Dividend investing should be fun, exciting and a long-term goal. Good investing is boring. You need to have a plan and prepare for every scenario. You can hit your wealth goals by building a dividend portfolio for the long-term. There is nothing better satisfying than achieving a lifelong goal of financial freedom. You can do so by building a dividend portfolio for the long-term.

Ultimate Guide to Building a Dividend Portfolio

Building a dividend portfolio is one of our favorite ways to increase your income. In addition, it is one of our favorite ways for wealth creation due to the ability to realize long-term total return as companies increase their earnings.

If you want to learn how to invest your money, you should start with retirement accounts and move to taxable accounts such as a dividend portfolio.

Besides being an entrepreneur and creating your own company, building a dividend portfolio is the only way to create wealth through income AND capital appreciation.

At Millionaire Mob, we are focused on increasing our income to help others reach their financial goals. This is the ultimate way to build wealth. We believe that becoming a millionaire is possible for anyone at any income level.

Stay motivated by reviewing these financial planning quotes and build wealth.

Personal Capital has a similar future value planning tools that tracks your current retirement savings. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time.

It is very easy to link all of your accounts and is highly secure.

Building Wealth Through Dividends

The way that we strongly advise building wealth through dividends is by taking all of your dividend income and reinvesting it back into dividend-paying stocks. This can be done through a dividend reinvestment plan.

You can review how to attain wealth through a dividend reinvestment plan at Millionaire Mob.

Alternatively, you can build wealth through dividends by doing it on your own. In this way, you essentially take the dividend income you receive and just invest in existing stocks in your portfolio or invest in new companies.

In order to reinvest dividend proceeds at your own discretion, you must pair up with a brokerage that offers the lowest commission trading.

There are a number of different brokerages out there that offer small commission trading. The brokerage that I use for my dividend growth strategy is Robinhood.

Robinhood offers commission-free trading on all stocks and options. This is perfect for building a dividend portfolio. If I receive a $5 dividend payment, I can reinvest this directly into a $5 stock. You can review my Robinhood dividend guide for further information (link below).

I’ve built a Robinhood Dividend Growth Portfolio that you can monitor over time and track my progress to replace a significant portion of my income through dividend investing.

While stock prices vary in value over time, I am less concerned about the day to day movements on my underlying stock holdings. I am only concerned about acquiring stable dividend-paying stocks at reasonable valuations. In prior sections at Millionaire Mob, you will notice that I call this the dGARP strategy or Dividend Growth at a Reasonable Price.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.”

– Robert G. Allen

Dividend Definition

For those that need some context and are just learning the ropes on dividend growth investing. What is a dividend?

A dividend is a cash payment made by a company to shareholders as a reward for being shareholders. When a company generates earnings (for simplicity purposes is equal to all revenues minus expenses), those earnings turns into cash.

That cash can either be reinvested into the business or paid out to shareholders.

Dividend Stock Examples

A stock that is a good example of reinvesting their cash back into the business is Twitter (Ticker: TWTR). TWTR has had some trouble making money, but more recently they posted their first profitable quarter. That took long! TWTR will reinvest any cash generated from their earnings back into growth in the company.

This is because TWTR believes that reinvesting the cash back into the business can provide a higher return on equity. TWTR is still a growth company that has lofty projections to achieve. The only way they will do so is by reinvesting and reinventing.

A stock like McDonald’s (Ticker: MCD) or Coca-Cola (Ticker: KO) does not need to reinvest ALL of their cash back into the business. They have sizeable moats and defensible value over their peers. Thus, they can reward shareholders for all the prior success they had from reinvesting their cash flow back in the business many years ago.

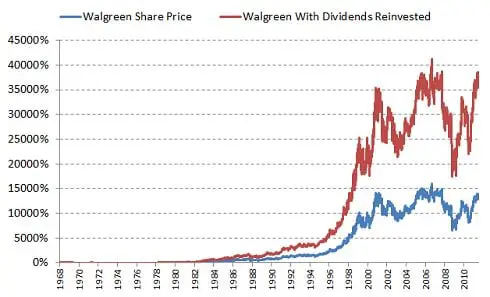

Dividends are an essential component to total return over time. Total return is your return received from capital appreciation in the underlying price plus the income received over time. Dividends are so important to total return that since 1930 dividend comprised of 40% of the total returns in the U.S. stock market.

That is pretty powerful.

Dividends must be a part of your wealth building strategy. One of my favorite examples is Walgreen’s over time with dividends reinvested compared to just the share price returns. It is pretty impressive the return differential from reinvesting the dividends.

Compound interest should be top of mind with anyone seeking financial freedom. Building wealth through creating a dividend portfolio works. Just look at the data.

Building wealth through dividend is proven.

A dividend portfolio is a proven method for building wealth and income over time. Not only should you seek out building a dividend stock portfolio, but think of ways that you can build an effective dividend growth portfolio. Dividend growth is a core theme to increase your income over time.

How does Robinhood pay dividends?

Back to my Robinhood Dividend Growth Portfolio… I oftentimes get questions about how does Robinhood pay dividends?

Robinhood pays you your dividends automatically by using a clearing firm. A clearing firm just handles the settlements and transactions with stocks to ensure that they happen efficiently. This is a great way for brokerages to ensure the cash transfers are organized. With technology in modern times, clearing firms are pretty automated to allow for automatic dividend payments and transfers nearly instantaneously.

Robinhood pays out dividends just like any other brokerage firm does.

Robinhood currently does not support a Dividend Reinvestment Plan (DRIP). A Robinhood DRIP option would be nice to have but it is not essential as you can invest in stocks commission-free already.

In my retirement accounts, I elect to have a few of my stocks, dividend growth funds and (of course) index investments in a DRIP.

I will definitely be on the lookout for a Robinhood DRIP option and will elect for certain stocks to automatically reinvest. I like doing this for stocks that I am pretty cautious about their future. This allows me to dollar cost average lower without having to do any additional work.

I use M1 Finance for my automated passive portfolio and Robinhood for my active investments. The best part is that both are completely free to use. No gimmicks.

Read more about M1 Finance in our review of the platform.

These apps will automatically invest your money in fractional shares if you want to speed up the benefits of compound interest.

Let’s be clear. I don’t buy stocks that I think are going down. If they might go down, I am totally fine buying additional shares. I am always looking at acquiring shares for the long term.

There are plenty of brokerages that will give you free stock just for signing up. No one has an excuse for investing now. Here is a list of brokerages that give free stocks.

How to Build a Successful Dividend Growth Portfolio

If you are building a dividend growth portfolio on your own, you need to understand how to build an optimal portfolio to ensure success. With an optimal portfolio comes a repeatable plan for you to set aside money each month to continue building the size and income of your dividend portfolio.

Building wealth is easier than you think.

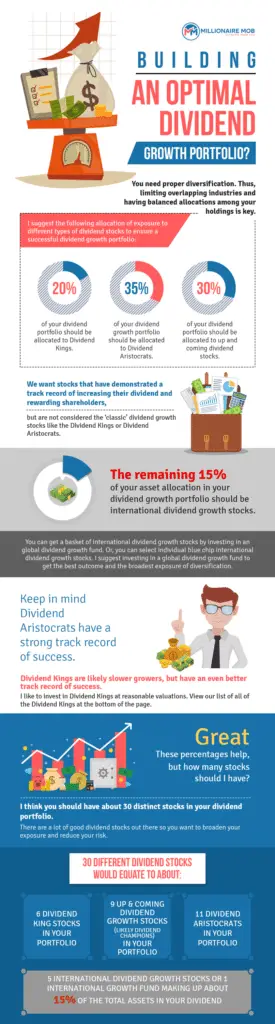

What makes up an optimal dividend growth portfolio? You need proper diversification. Thus, limiting overlapping industries and having balanced allocations among your holdings is key.

I suggest the following allocation of exposure to different types of dividend stocks to ensure a successful dividend growth portfolio:

- 20% of your dividend portfolio should be allocated to Dividend Kings

- 35% of your dividend growth portfolio should be allocated to Dividend Aristocrats

- 30% of your dividend portfolio should be allocated to up and coming dividend stocks. We want stocks that have demonstrated a track record of increasing their dividend and rewarding shareholders, but are not considered the ‘classic’ dividend growth stocks like the Dividend Kings or Dividend Aristocrats.

- The remaining 15% of your asset allocation in your dividend growth portfolio should be international dividend growth stocks. You can get a basket of international dividend growth stocks by investing in an global dividend growth fund. Or, you can select individual blue-chip international dividend growth stocks. I suggest investing in a global dividend growth fund to get the best outcome and the broadest exposure of diversification.

Keep in mind Dividend Aristocrats have a strong track record of success. Dividend Kings are likely slower growers, but have an even better track record of success.

I usually like to invest in Dividend Kings only at reasonable valuations. View our list of all of the Dividend Kings at the bottom of the page.

See Related: Best Investing Apps to Use Today

How Many Stocks Should I Have in My Dividend Portfolio?

Great. These percentages help, but how many stocks should I have? I think you should have about 30 distinct stocks in your dividend portfolio. There are a lot of good dividend stocks out there so you want to broaden your exposure and reduce your risk.

30 different dividend stocks would equate to about:

- 6 Dividend King stocks in your portfolio

- 11 Dividend Aristocrats in your portfolio

- 9 up and coming dividend growth stocks (likely Dividend Champions) in your portfolio

- 5 international dividend growth stocks or 1 international growth fund making up about 15% of the total assets in your dividend

This should give you enough stocks in your dividend portfolio to earn some solid income. In addition, you get paid to wait until prices increase over the long-term.

If you’d want to tweak your allocation for building your dividend portfolio, if you can tolerate more risk then have less Dividend King stocks in your portfolio and some new dividend growth stocks.

I love using various tools to generate new investment ideas. This is key to success in investing, you need to set up alerts on companies that meet your criteria.

You can use a newsletter like Motley Fool Stock Advisor to generate new investment ideas quickly.

You can read more about my Motley Fool Stock Advisor review to see if it is a fit.

Building a Dividend Stock Portfolio Infographic

A dividend growth portfolio is as easy as following an infographic. Follow our steps with an easy to understand infographic on how to build an optimal dividend growth portfolio.

Share this Infographic On Your Site

A dividend growth portfolio is the sole way to maximize your total return over the long-term. By building a dividend growth portfolio, you increase your income without doing anything.

A company continues to increase their earnings, which in turn they reward shareholders more. In addition, a dividend growth portfolio is a great way to combat inflation. Our dividend growth portfolio infographic should help you get started to building a successful portfolio.

The goal with our dividend growth portfolio is to hold onto it for life. We are long-term investors and not traders. By finding the right dividend growth stocks off the bat, you shouldn’t have to do much (OR ANY) work at all thereafter.

Are dividends passive income?

Yes. Of course. Passive income oftentimes gets a bad reputation. Everyone says that there is no such thing as passive income. However, I think dividends are one of the best forms of passive income.

You do some upfront research, but reap long-term benefits for limited ongoing work. Everyone must understand that passive income takes time. However, passive income is PASSIVE. This is not going to supplant your hours spend during a day job.

Do you need to monitor your dividend portfolio on an ongoing basis? Absolutely.

Is information oftentimes spoon-fed to you? YES. Nowadays there are so many tools that will allow for you to get actionable news and alerts for your portfolio that you do not need to do any additional work to monitor and build your dividend portfolio. It is so easy.

Building a dividend portfolio can also be fun too. There is nothing better than watching your dividend payouts come into your account. Investing for passive income is achievable, but it comes with due diligence and some risks.

You need to follow a strategic plan to achieve it and execute. If you can execute over a long period of time, you open the door to the possibility of living off dividends forever.

See Related: Best Real Estate Crowdfunding for Passive Income

Is dividend investing a good idea?

Without a doubt. Do I have to put in significant time to build a successful dividend growth portfolio? Yes, the more time the better.

The end goal is to continue reinvesting proceeds and other passive income streams into your dividend portfolio over time and to increase your dividend income to a point where you can live off of it without working! This will likely take years for most people. If executed well, this will be extremely rewarding.

It is entirely possible to live off of dividends and become completely independent from a day job by building a dividend portfolio. Stay focused on your goals.

Set a number for your targeted monthly dividend income and with each month you will become closer to reaching your goal of living off of dividend income.

You can use REITs plus businesses to have diversified yield and income. I like REITs because there are so many variations including hotels, hospitals, senior living and more. Here’s how you can invest in hotels.

However, there is an alternative to investing in building a dividend growth portfolio on your own…

Those are dividend growth funds…

What are dividend growth funds?

Dividend growth funds offer diversification and simplification in the building a growth portfolio process. Dividend growth funds provide you the ease of investing in a low-cost exchange traded fund. This is called passive investing.

Passive investing requires no research at all since you are invested in a fund that is either actively managed or tracks an index such as the Dividend Achievers Index. This type of investing allows you to focus on increasing your personal income and focus on the important things in life.

You can set aside a predetermined amount of money each month and purchase these dividend growth funds regardless of price. You are fully diversified and ready to go.

A dividend growth fund is a pre-built dividend portfolio. No building a dividend portfolio here…

List of Dividend Growth Funds

A majority of these dividend growth funds are dividend growth exchange traded funds (ETFs) since these are easily accessible for investors and have low expense ratios.

- Vanguard Dividend Appreciation ETF (Ticker: VIG)

- Vanguard Dividend Appreciation Index Fund (Ticker: VDIAX)

- WisdomTree U.S. Quality Dividend Growth Fund (Ticker: DGRW)

- iShares International Dividend Growth ETF (Ticker: IGRO)

- iShares Core Dividend Growth ETF (Ticker: DGRO)

- SPDR S&P Dividend ETF (Ticker: SDY)

- PowerShares High Yield Equity Dividend Achievers Portfolio ETF (Ticker: PEY)

- DIVIDEND ARISTOCRATS ETF (Ticker: NOBL)

- PowerShares Dividend Achievers Portfolio ETF (Ticker: PFM)

- PowerShares S&P 500 High Dividend Low Volatility ETF (Ticker: SPHD)

Most brokerages offer commission-free trading on ETFs, so double check to see if one of these dividend growth funds is on the list. You can drop a few of these funds in your Roth IRA, which is a big win since you won’t have to pay taxes on your dividends.

You can contribute over $35,000 to your Roth IRA by doing a mega backdoor Roth IRA. Here is my guide on the mega backdoor Roth IRA and how to execute it.

A couple of downsides from investing in dividend growth funds include:

- One downside is that you have to pay someone to managed the dividend growth fund. You don’t see this come out of your investment returns since it is embedded in the underlying fund assets, but it is still a fund expense. This is called an expense ratio. Try to find dividend growth funds with extremely low expense ratios.

- These funds have oftentimes been scrutinized for underperforming the dividend growth rates of the underlying holdings

Will you include a dividend growth fund when you build a dividend portfolio?

Millionaire Mob Guides to Dividend Growth Investing

Millionaire Mob features a number of different guides and resources that will help you become a dividend growth investor. Regardless of your economic status or even if you’d like to be a passive investor or an actively managed dividend growth investors.

Not many other money bloggers are participating in dividend growth investing. I want to help you find your way to investing for passive income.

Let’s build wealth together. I am confident that my guides for building a dividend portfolio will boost your investment returns and help you achieve your financial goals.

Helpful Guides to Dividend Growth Investing and How to Build a Dividend Portfolio

You can review a set of our guides to dividend growth investing here. I hope these guides help you build a better dividend portfolio.

- Do Not Use Annual Dividend Yield When Investing

- How to Forecast Dividend Growth Rate

- Investing in Dividend Kings: High-Quality Dividend Growth Stocks

- Attain Wealth Through a Dividend Reinvestment Plan

- Finding Undervalued Dividend Growth Stocks

- Dividend Kings: A List of Stocks Increasing Dividends for 50 Years That Must Be In Your Dividend Growth Portfolio

- How to Use the Dividend Discount Model to Build a Dividend Portfolio

- How to Use FINVIZ Stock Screener

- Robinhood Dividends Guide and Review

- Free Downloadable Dividend Discount Model Calculator

- How to Use FINVIZ Futures to Understand Stock Market Trends

- Best Stocks for Writing Covered Calls

- Investing for Passive Income: 5 Steps for Living Off Dividends

- Guide to Selling Weekly Put Options for Income

- Downloadable Dividend Calculator

- Undervalued Dividend Growth Stocks Infographic

- 11 Best Forex Trading Books You Must Read

- Motley Fool Stock Advisor Review: Is It Worth It?

- TradingView Review: Learn to Chart Like a Pro

- How to Invest Money: 13+ Investment Tips to Get Started

- Why Volatile Stocks are a Good Thing

- Capital Stack Guide: Tips for Conducting Capital Structure Analysis

- Guide on How to Read Financial Statements

- How to Start Investing: A Guide to Invest Easy and Profitably

- Top Dividend Income Tracking Software You Must Use

- Best Dividend Investing Books to Consider

Dividend Growth Investing Lists for Building a Dividend Portfolio

Here is a set of growing dividend growth investing lists to help you make better conscious decisions when building a dividend growth portfolio.

- List of Dividend Kings to Consider for Dividend Growth Investing

- List of No Fee Dividend Reinvestment Plan Stocks

Robinhood Dividend Growth Portfolio Updates

You can monitor the progress of our Robinhood dividend growth portfolio over time. We hope to help you achieve financial freedom by building a successful dividend growth portfolio.

- First update on our dividend portfolio: Robinhood Dividend Growth Portfolio Update – December 2017

- Second Update:Robinhood Passive Dividend Income Portfolio – January 2018

- Robinhood Dividend Growth Portfolio – February 2018

- Robinhood Dividend Growth Stock Portfolio Update – March 2018

- Our Latest: Robinhood Dividend Income Portfolio Update – June 2018

Are you going to build a dividend portfolio? Let us know how we can help you build a dividend portfolio to achieve your financial goals. Follow us along our path to achieve sustainable dividend income over the long-term and achieve everlasting financial freedom.

What are you waiting for? Join the mob of thousands at Millionaire Mob. Escalate Your Life.