I currently use Robinhood for my dividend growth portfolio. Building a dividend portfolio is easy through Robinhood brokerage as they offer commission-free trading on all stock purchases and sells. In addition, Robinhood now has commission-free options trading, which can be a great tool for risk mitigation. I will continue to update you on my Robinhood dividend income stock portfolio, so you can follow along.

Robinhood Dividend Income Update – June 2018

It was another solid quarter for our Robinhood dividend portfolio. If you don’t know Robinhood, check out our Robinhood app review for further information about the platform and how I intend to use it.

With our dividend portfolio, we will oftentimes use covered calls which is great through Robinhood. Robinhood has NO commissions for options trading. I love that. So many brokerages make you pay outrageous fees for options. Options can be helpful for boosting you income in your dividend income portfolio. The best stocks for writing covered calls are the following:

- Stocks that pay a dividend

- In addition, write covered calls on stocks that have suppressed valuations that haven’t yet unlocked value

- For example, General Motors was highly undervalued and the stock took significant time before it started to increase in share price. People just did not believe that General Motors was actually growing or generating strong cash flow. During that time, the stock was stuck in a trading pattern of about $36-$40 for a number of years. That’s a lot of covered call writing! The stock eventually increased by about 15-20% after earnings calls.

- Write a covered call on a stock in between any significant events. We don’t want increased volatility. In fact, we’d prefer for volatility to be high but expected to decrease. Thus, leading to a decrease in the extrinsic value of the option and you earning more money!

Here is more detail on the best stocks for covered call writing.

If you sign up for Robinhood, we both receive a free share of stock!

Building wealth through dividends is an effective strategy that is proven and reliable. Dividend provide a stable return and are a key component to the overall total return of the stock market.

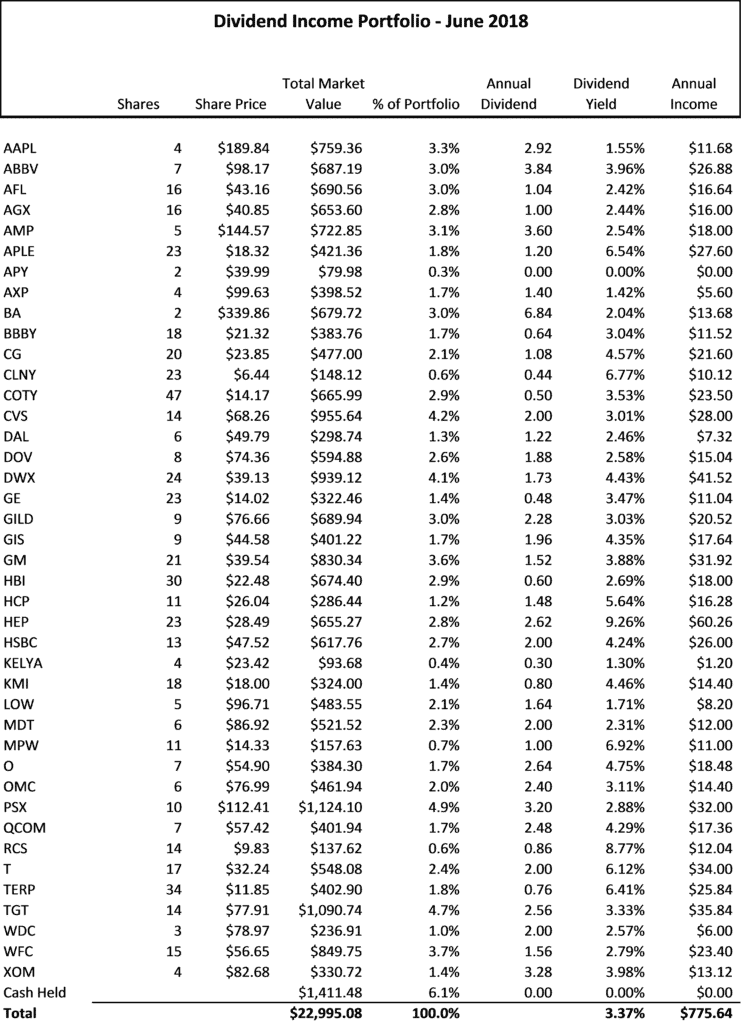

Robinhood Dividend Portfolio Snapshot

Please note our dividend portfolio only includes our dividend growth portfolio through Robinhood. We have a number of other investment accounts including a Roth IRA, 401(k), Health Savings Plan and an investment account focused on index investing.

We are only showing our dividend growth stock portfolio since this is a fund that is focused solely on achieving financial freedom.

I continually put more and more money to my other investment accounts, but I view these accounts as retirement accounts.

I am unable to really live off of them until a certain age. Retirement accounts are assets, for sure. However, they just are adders to my financial independence and net worth considerations.

From the last quarter’s Robinhood dividend portfolio update, I increased my portfolio value and dividend income by $4,800 and $775.64, respectively.

I’ve been able to track my dividend income with Personal Capital for completely free. I love when my dividends show up.

Due to some contributions during the quarter, I was sitting on a decent amount of cash as it made up the top position in the dividend portfolio. I was eager to put that capital to work, so using FINVIZ and GuruFocus I ended up acquiring more AGX and GIS stock.

You can use FINVIZ futures to help understand market trends. This gives me a broader macro view of the market.

I’ve loved the insider buying at General Mills and the fact that they are re-positioning the company for growth while cleaning up the balance sheet. The yield is pretty good too.

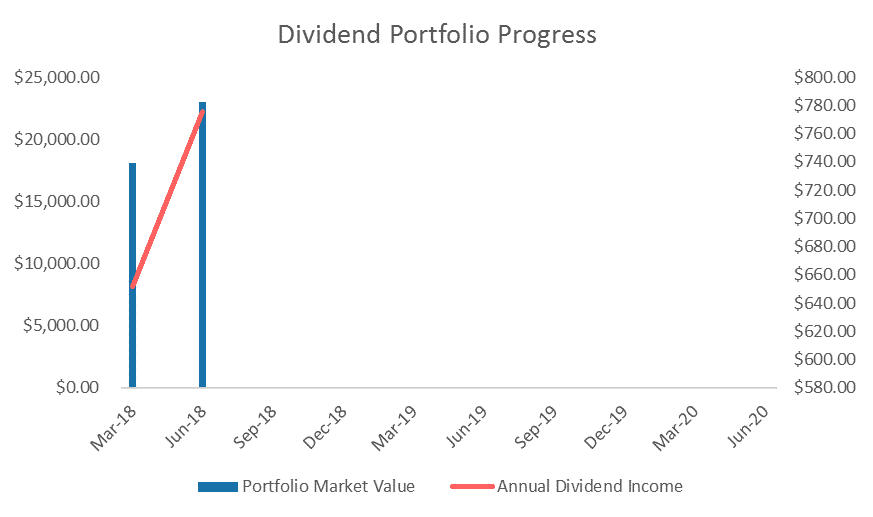

Robinhood Dividend Income Portfolio Summary Chart

We plan to continue to track the market value of our dividend stock holdings as well as the annual income of our dividend growth stock portfolio throughout time. Our ultimate goal at Millionaire Mob is to help you build wealth through dividend income. We believe you can do it, so we will be transparent in our holdings. This will lead to better learning and we all are able to win.

Here’s what is takes to live off dividends. I’ll be investing and following these steps along the way to show my progress, which will hopefully help you as well.

See Related: M1 Finance vs Robinhood: What is Better?

Resources to Start Investing for Passive Income

Investing for passive income is achievable. In addition, it is possible to live off dividends forever.

Here are a few dividend growth investing resources to help you increase your income:

- Building a Dividend Portfolio Infographic

- Ultimate Guide to Building a Successful Dividend Portfolio

- List of Dividend Kings for Dividend Growth Investing

- Free Downloadable Dividend Discount Model

- List of No-Fee Dividend Reinvestment Plan Stocks

Dividend growth investing opens the door the following considerations that are not commonly found with other passive income ideas:

- Obtain unlimited upside potential by investing in high-quality dividend stocks

- Realize the benefits of monthly or quarterly income from you Robinhood dividend income portfolio

- As Albert Einstein once said, “Compound interest is the eighth wonder of the world.” Dividend investing is the best way to capture compound interest over the long haul and maximize your total return.

What is your favorite Robinhood dividend income stock? Let me know in the comments below. I’d love to hear from you!

All of our other wealth management resources can help you improve your financial positions. The good news is they are nearly all completely free.

Millionaire Mob is an early retirement blog focused on passive income, personal finance, dividend growth investing and travel hacking. With both a million rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

Escalate Your Life.

7 Comments

MMob –

Nice job, almost to the $1k mark going forward on those divvies, keep it up!

-Lanny

Thanks Lanny!

Your story, vision and efforts are very inspiring!!

Am I able to transfer dividend payouts directly into my Roth IRA? I have Robinhood and Fidelity

Yeah, you will just have to withdraw it out of your non-Roth account when you receive the dividend payment then make contributions into your Roth IRA.

Hello. Loved the article. It aligns with a Robinhood DRIP strategy I started in March of this year.

I’ve been primarily collecting ETF’s with monthly dividend payouts. Do you have any thoughts around using ETF’s as the basis of a portfolio, or focusing on monthly payouts vs. annual?

Thanks.

I think you should either use ETFs-only or build a portfolio for scratch. I like building it from scratch with a blend of monthly and quarterly dividend payers.