Fundrise is a reliable real estate crowdfunding platform for both accredited and non-accredited investors. My Fundrise review will feature a deep dive of the platform and how you can use it to earn additional income while building long-term wealth.

Fundrise Review: Seamless Commercial Real Estate Investing

I’m a big fan of real estate investing. There are so many parallels to dividend investing. I love the added income plus an opportunity to realize the upside of capital appreciation.

There are other reasons why you should consider commercial real estate in your asset allocation, which include:

- Isolated from stock market volatility

- Ability to invest in targeted markets that may be less susceptible to recessionary conditions

- Multiple investment strategies to tailor to your risk tolerance

Investing in commercial real estate comes with risks, so you should always do your own due diligence when you think sourcing new investment opportunities.

Using a platform like Fundrise can help you navigate the various risks associated with real estate.

Fundrise Overview

Fundrise is a reputable and reliable real estate investing platform that began in 2010 in Washington DC. The platform started as an idea of two brothers Ben and Dan Miller who became one of the pioneers of real estate crowdfunding in the US.

Besides providing investors with affordable real estate offerings, the company also enabled Washington D.C. residents to invest in real estate development projects that the brothers were building in the area.

In 2015, Fundrise became the first to launch the world’s first eREIT. The eREIT would make investing in commercial real estate accessible to ordinary people.

Fundrise REIT (real estate investment trust) was launched with an initial offering of $50 million which was according to Regulation A+.

Fundrise became the first company to take commercial real estate online, and it created true equity ownership in local properties.

- Early 2016, Fundrise company opened a second eREIT. Then in December 2016, the Fundrise Growth eREIT came to be the second ever issuer to raise $50 million according to Regulation A+.

- Around June 2017, Fundrise announced the launching of their eFund. This was a diversified portfolio of “for-sale housing” which spread across the major US cities.

- Later, in conjunction with the eFund launch, the company also introduced a goal-based investing as well as an advisory service.

- Recently, Fundrise announced that it had acquired thirty residential properties in the Washington, DC area which is in anticipation of the Amazon’s HQ2 announcement.

- Then, Fundrise has established the HQ2 DC eFund and targets to invest as much as $50M in residential properties in entire Washington, DC.

- Currently, Fundrise performance is strong, and according to the information in their site, they have invested in $2.5 billion of real estate.

Let’s look at some helpful terms before we delve into how Fundrise works:

eREIT Definition

REIT (real estate investment trust), is an entity that owns real estate property and just like with stocks, you can buy and sell shares at any time through a broker. An eREIT is an electronic real estate investment trust that works similarly to the traditional REITs except that you don’t need a broker because shares are not publicly traded.

eFund Definition

An eFund is a diversified fund that consists of residential real estate projects such as single-family homes, condos, and apartment complexes and more.

To avoid double taxation, these types of funds are structured as partnerships and not as corporations, and they’re sold through Fundrise exclusively.

[maxbutton id=”2″ url=”https://millionairemob.com/fundrise” ]

Now, let’s dig into how to get started:

How Fundrise Works

A majority of Fundrise reviews have explained how to get started with Fundrise. If you want to invest in commercial real estate, then you should consider investing through Fundrise. This is because Fundrise is one of the best investing apps.

Not only is it one of the best private real estate crowdfunding platforms, but it also has a lower minimum initial investment. You can either start with a starter portfolio plan or invest in the core portfolio plans.

Starter Portfolio Plan

With as little as $500, you can invest in the Starter Portfolio. This plan offers you a diversified mix of eREITS and eFunds with underlying real estate projects spread throughout the US. When you invest in this portfolio, you will receive quarterly dividends returns.

Moreover, you also profit from the appreciating value of the assets.

You can buy the shares directly from Fundrise company. All you need to do is open a free account on the Fundrise app or website. Fundrise investments are not subject to the volatility of the market since they are long-term.

On the flip side, it’s harder to sell their shares since they’re not publicly traded in a secondary market. Fundrise serves 50 states across the US.

You don’t have to meet an accredited investor qualification requirements to participate in Fundrise eREITS since the platform fits both accredited and non-accredited investors.

Shares of eREITs are bought exclusively online, and Fundrise members get alerted when there is an addition of new assets to the eREITs.

Other Core Portfolio Plans

You can also invest $1000 initial minimum investment to get the upgraded Core Portfolio plans. At this point, you can choose from their three plans which include:

1. Supplemental Income

You can get a steady income stream with this plan since it has more focus on dividends. These investments will be income-oriented first. They will likely invest at an oriented cap rate off of operating income.

2. Balanced Investing

The plan presents a more diversified portfolio which helps in greater wealth-building. Balance investing with Fundrise is exactly how it sounds, it’s a blend between income and growth.

This can be a great way for an investor to realize increased cash flow from their investments while recognizing long-term capital appreciation.

3. Long-Term Growth

This portfolio is designed for potentially superior returns over the long term.

Since Fundrise investments consist of the eREITs and eFunds, your asset allocation depends on whether you are looking for growth, income or a mix of both. If you are unsure which one is right for you, you can use the Fundrise three-step questionnaire that helps one determine how they should invest.

Whichever plan you pick, your money will be invested in an allocated assortment of eREITs and eFunds consisting of private real estate assets located across the U.S. Fundrise will custom the specific allocation based on your personal investment needs.

Besides the individual placements, Fundrise also offers both growth eREITS and an income eREIT for beginners. The two eREITs have similar goals but a slightly different set-up.

An income eREIT offers investors a low-volatility income stream of attractive regular cash distributions which come from the commercial real estate investments. Income eREIT focuses on debt as an investment and pays returns during its investment term.

Fundrise Growth eREIT, on the other hand, focuses mainly on assuming equity ownership of the commercial real estate assets. Unlike income eREIT that focuses on debt, growth eREIT has a higher potential of accruing higher value over time.

Contrary to dividends that are paid quarterly, returns of this kind of investments are paid out towards the end of the investment period. Having some form of commercial real estate investments is crucial to investing your money and wealth.

Fundrise Features

Here are some of the core features of Fundrise.

- Low Minimum investment: Fundrise minimum investment is as little as $500.

- Moderate Annual fees: The company charges an 0.85% annual asset management fee and account fees are 1% per year.

- Invests in Self-Directed IRA: You can invest in Fundrise with pre-tax dollars and use it for retirement planning. The self-directed IRAs can only be used for eREIT offerings.

- Investment Options: Fundrise offers only commercial real estate investment options, and the offering types include debt, equity, and preferred equity.

Fundrise Pricing and Charges

Fundrise charges an annual asset management fee of 0.85%. In addition, it charges a 0.15% annual investment advisory fee which may be waived under specific circumstances. In total, it adds up to 1% annual pricing model which is up to 40% more cost-efficient compared with many other publicly available investments.

Nonetheless, Fundrise can charge up to 2% as other miscellaneous fees. Thus overall, you can expect to pay as much as 3% on fees.

Fundrise also requires a one-time 1-2% commencing fee charge and $5,000 ending cost for real estate companies

How Fundrise Allocate Assets

Fundrise eREITs spreads its investment in multiple properties to help diversify and streamline the investment returns. Currently, Fundrise provides three options of eREIT funds an investor can select from.

Use the Fundrise questionnaire. If still unsure of the fund to invest in, you should consider Fundrise as it incorporates a questionnaire which resembles the robo advisor.

How to Redeem Your Fundrise Shares

Real estate is an intrinsically long-term illiquid investment. eREITs and eFunds are also illiquid assets. Therefore, if you want to redeem them, you’ll have to follow a redemption plan to allow your funds to become liquid every quarter which is subject to certain limitations.

You’ll need first to submit a redemption request when redeeming your shares from your Fundrise portfolio. The process is simple and can be done from your account settings on the site.

You may obtain liquidity every month after a 60-day waiting period. Submitting the redemption request is also subject to certain limitations.

However, if you submit a redemption request, your redemption value may be subject to a penalty of up to 3%.

Fundrise Returns

You can earn returns primarily in two ways. First, you can receive quarterly dividends. Secondly, you can get returns from appreciation in the value of the shares. The returns are from the individual real estate assets in your portfolio including the interest, rental income collected as well as potential appreciation in the property’s value.

As an investor, you are entitled to a pro-rata portion of any returns. Investors receive dividends distributions in the middle of the month following the end of each quarter, for example, mid-April for dividends received during the first quarter.

Investors also earn additional periodic cash distributions when they sell specific underlying assets. The shares value is also typically re-calculated on a semi-annual or a quarterly basis.

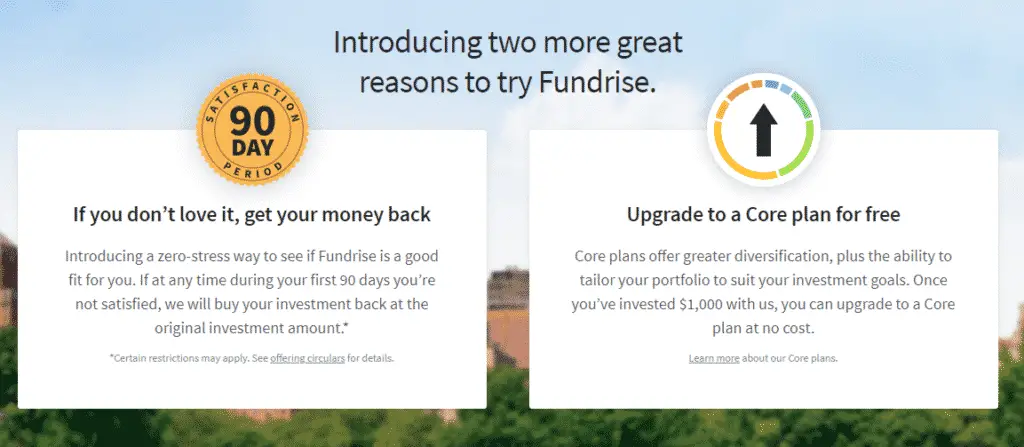

Also, Fundrise offers investors a 90-day money back guarantee.

If you are for any reason unsatisfied with their service, Fundrise will repurchase your investment at the original investment amount.

The annual returns of each deal are quoted as gross and not net of the yearly servicing fees.

Fundrise Competitors

Groundfloor and RealtyMogul platforms are also real estate crowdfunding platforms for non-accredited investors. With Groundfloor, you can get started with as low as $10, unlike Fundrise which requires at least $500.

Instead of investing in specific portfolio plans like Fundrise, Groundfloor releases several graded residential and single Family properties that you can pick from.

Crowdstreet mainly focuses on commercial real estate properties. Crowdstreet is for accredited investors, although they do offer an option for non-accredited investors as well just like Fundrise.

Minimum investment for Crowdstreet is much higher compared to Fundrise or Groundfloor since it starts at $10,000.

To sum up, this Fundrise review, let’s look into the advantages and the disadvantages of Fundrise platform.

Pros and Cons of Fundrise

Let’s take a look at the various advantages of Fundrise.

Advantages of Fundrise

- Low Minimum

Fundrise has a lower minimum investment, and you can start investments with as low as $500.

- Low Fees

The platform charges only a 0.85% asset management fee per year.

- Commercial Real Estate Access

Fundrise invests in commercial real estate which is basically a high-dollar investment, but which Fundrise allows you to invest with little cash.

- Passive Investment

Fundrise investments are passive, and you don’t have to be a hands-on investor to get involved in it.

- No Accreditation

This platform is open to any investor in the United States, regardless of their income or net worth.

- Diversification

Fundrise eREITs have a collection of several properties that diversify your returns, unlike other private REITs.

- Expert Management

Investors receive expert management by a team of experienced real estate professionals.

- 90-Day Money-back Guarantee

If at any time during your first 90 days as an investor you’re not satisfied with your investment, Fundrise will repurchase your investment at the original investment amount. However, this offer is subject to certain limitations.

- Quarterly Redemptions and Distributions

Fundrise eREIT offers investors a quarterly redemption plan to provide periodic liquidity although, distributions are not guaranteed.

- You can Invest through an IRA

You can potentially invest in Fundrise through an IRA if you open a self-directed IRA.

- The Platform has a Simple User Interface

Fundrise platform allows you to search through and filter different offers to find the most potentially profitable deals that meet your personalized criteria.

- The Account is Free

Opening a Fundrise account is free, and you can browse the website first before you commit any money.

- Most Fundrise Investments offer Rolling Maturity Dates

Many Fundrise investment options allow you to cash out part or all of your investment every few years and so you can access your funds periodically.

Disadvantages of Fundrise

There are only a couple of core disadvantages of Fundrise.

- Fundrise Investment is illiquid until maturity

Fundrise eREITs are not traded in the secondary market, and once you invest, you should remain committed to the investment for the entire period. You cannot sell your investment to others in a public or secondary market.

However, it offers the investors a quarterly redemption program whereby investors can redeem their shares, though subject to some limitations.

- Tax Implications

Distributions are taxable as an ordinary income. You can minimize your tax burden for electing in a more growth-oriented strategy.

[maxbutton id=”2″ url=”https://millionairemob.com/fundrise” ]

Conclusion on Fundrise Review

Fundrise is an ideal platform for real estate crowdfunding. By investing in commercial real estate, you open the door to a diversified asset class that provides both income and growth.

If you are still unsure of real estate investing, consider these real estate investing books.

Commercial real estate has some key advantages that you should be aware of:

- Isolated from stock market volatility.

- Ability to focus on market-based diversification.

- Earn income and capital appreciation.

- Reduce tenant risk in multi-tenant commercial real estate properties.

I hope this Fundrise review has offered you useful information. Fundrise is one of the elite real estate crowdfunding platforms that can tailor to both accredited and non-accredited investors.

Start your journey with Fundrise and start building sustainable wealth.

What do you think about Fundrise? Share your opinion in the comments section.

Related Resources

- Best Robo-Advisors Compared

- M1 Finance Review: A Completely Free Investing Platform

- Ultimate Guide to Fractional Shares Investing

- Finbox Review: A Powerful, Affordable Stock Screener

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter, Instagram, and YouTube.

No Comment