After reviewing the many opportunities out there and my goal of living off dividends forever, I became intrigued with how I can help others achieve their goals too. This led me to create a free downloadable dividend calculator model to help you achieve goals similar to mine.

Free Dividend Calculator: Achieve Your Retirement Goals

Investing your money should be exciting. Not overwhelming.

By being a dividend growth investor, I am always finding ways to quantify my financial future. There is no better way to plan for your financial future than using good ‘ole financial modeling. The devil is in the details.

Building a dividend portfolio should be fun and exciting. You get to earn income AND make progress towards early retirement.

I’m a big fan of quantitative analysis to determine an outcome.

You really never know an answer until you run the numbers. We already gave you a free dividend discount model to download. Now it’s time to get moving on securing your financial future!

I love dividends so much that I wrote a book titled: Dividend Investing Your Way to Financial Freedom. The book was named #1 new release in the Amazon stock market investing category!

Can You Use an Investment Calculator to Plan for Retirement?

An investment calculator can help you achieve your retirement goals without a doubt. Can you earn a passive income from investing? Absolutely. Living off dividends is possible. I’ve highlighted in a post how to live off dividends.

I’ve been contributing the max amount to my 401(k) and IRA since I graduated college. I always had this urgency to plan my financial future in the right way. I needed to make my savings and investing habitual. I’ve been tracking my net worth and portfolio with Personal Capital for free.

However, I had a revelation. I can’t touch my 401(k) money or my IRA until I’m 59.5 years old. What do I do until then? I knew I had to build something that would give me income and residual value. There is nothing better to do that than dividend growth investing.

So, I developed a five-step plan to live off dividends while building a portfolio on Robinhood. If you sign up, we both receive a share of free stock. Robinhood is just one of the top investment apps to use to build wealth through dividends.

My five-step plan will help you obtain living off dividends in 20 years. They are aggressive, but this would allow me to achieve a six-figure income and a millionaire dollar portfolio at the end of 20 years.

Just follow these five steps to living off dividends:

1. Contribute $200 per month to your dividend portfolio your first year

Set up an automatic contribution of $200 per month to your dividend growth portfolio. That should be an easy start. If you want to contribute more, even better! Make your contributions automated as much as possible. We want to save our time for other sources of passive income.

2. Increase your monthly contributions by 25% per year

This sounds like a lot but can be done so long as you increase your income from other sources along the way. As long as you are a good saver, you should be able to do this for the first 10 years. After that, the annual increases get much more difficult, but they are certainly attainable. I’ve been saving at least 30% of my after-tax income each year.

3. Any dividend income you receive should be reinvested into your dividend growth portfolio

Once you receive dividend income, use this to buy more stock in your portfolio. Rather than a dividend reinvestment plan, I like to invest at my own discretion.

A dividend reinvestment plan will automatically buy shares in that specific stock. Without the dividend reinvestment plan, I can invest in a stock when it declines in value or I can invest in a different dividend stock in my portfolio.

4. Invest in quality stocks that enable you to achieve a 6% growth rate in your equity value

This point shouldn’t be hard to do. You will have some winners and some losers, but just make sure you have 6-8 winners out of every 10 stocks.

5. Repeat steps 1-4 as you go over time

Continue with your plan and it will all work out. I like building a hand-selected version of dividend stocks as opposed to index investing. This allows me to focus on specific yields and invest in companies at attractive valuations.

There’s plenty of reasons on why to become a dividend growth investor. By year 20, you have achieved a ~$100,000 annual passive income and an aggregate portfolio value of over $3 million.

In our dividend calculator, we do not price out this case study. We price out a more realistic approach of achieving $1.2 million by year 20.

If you prefer automated investing, you can stop here. Try using Wealthsimple and they will automatically allocate your savings.

Use a Dividend Investing Calculator to Plan for Living Off Dividends

By creating my dividend growth investing case studies, it led me to believe that you should be able to play with the assumptions on your own.

What do you need to do to achieve your financial goals? Not everyone’s financial goals are the same.

Here are some considerations to determine your living off dividends goals:

- How much can you contribute right away?

- When do you want to live off dividends (i.e., 10 years, 15 years, 20 years, etc.)?

- How fast can you increase your contributions?

- Are you going to reinvest all of your dividend income?

A dividend retirement calculator can help you determine all of these. In addition, with the proper inputs, you can sense your information to set upside, downside, and base case scenarios for living off dividends.

With our dividend calculator, you can determine how much money you could make by investing in dividend growth stocks.

The dividend investing calculator is a great way to realize the importance of a ‘savings snowball’ and how you need you to realize compound interest as early as possible. Compound interest is the best way to maximize the total return of over the long-term.

With compound interest, you don’t need to worry about the market as much. Just continue to reinvest your dividends. Over time you will do fantastic.

Maximize your returns further by investing in dividend growth stocks at reasonable valuations.

Use dividend income tracking software to know when your dividend stocks will pay their dividends.

Use GuruFocus to find stocks that experts are investing in. I like to follow some of the expert investors that share the same common goals as me, which is investing in high-quality businesses at attractive valuations.

Here is a guide to understanding your capital stack risk.

How to use the dividend reinvestment calculator

Here are a set of instructions on how to use the dividend calculator to calculate what you need to do to live off dividends.

To use the dividend calculator, follow these simple instructions.

- Input your monthly contributions to your portfolio.

- Input your assumed annual increases in contributions.

- The assumed annual dividend income yield on your portfolio. Here is why you should not solely use annual dividend yield when investing.

- Input your assumed annual increase in the portfolio value (i.e., capital appreciation).

It is as easy as to use the dividend investing calculator. Try plugging a forecast or evaluate new Dividend Kings to put in your portfolio.

How to Use a Dividend Reinvestment Calculator Video

I show you exactly how to use our dividend calculator in the video below. This should help you set your goals and even tweak the model to suit your personal needs.

Why You Must Reinvest Your Dividends in the Calculator

Think of our calculator like a dividend reinvestment calculator because we take all dividend income and assume that the contributions are fully reinvested. This is really the best way to capture the benefits of compound interest as you are dollar cost averaging your portfolio over time.

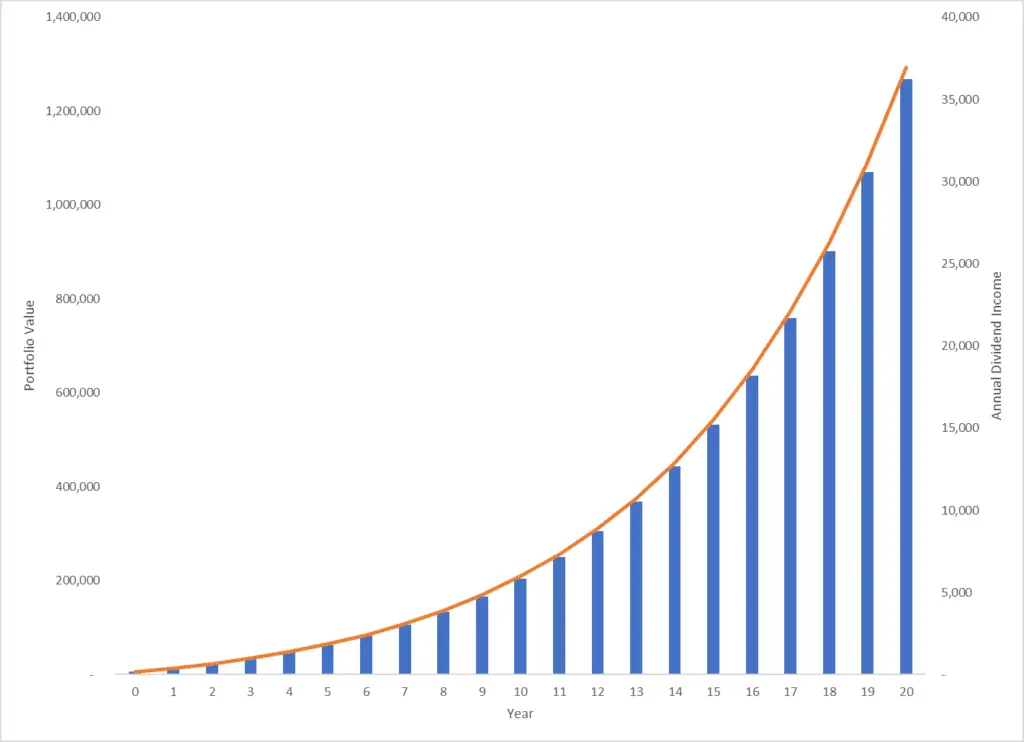

Included in the dividend calculator is an output chart that really summarizes the benefits of dividend investing for passive income. This really shows the power of compound interest.

The calculator can even be changed for individual stocks if you want to see how dividend reinvestment calculates over time as you make contributions for a specific Dividend Stock Reinvestment Plan (DRIP).

I suggest only participating in Dividend Reinvestment Plans that completely no-fee. Here is a list of no-free DRIP stocks.

Alternatively, M1 Finance will allow you to reinvest your dividends and the app is completely free. Here are some handcrafted M1 Finance Pies to consider.

These pies offer some great opportunities for fractional share investing, which is one of my favorite ways to take advantage of compound interest.

Benefits of Compound Interest from Reinvestment

Our video above highlights the benefits of compound interest. I love using it to my advantage by investing early on and let reinvestment plus time work magic. Compound interest is our friend. Our calculator clearly proves out the benefits of compound interest and why it’s important to start investing early and often.

How do you maximize your compound interest to the highest extent possible?

It’s easy.

You want the highest frequency of reinvestment possible. Daily compound interest is much better than annual. You can read why compound interest is better suited for daily reinvestment in your post about compound interest.

When you are constantly reinvesting, you are putting yourself in a better position for future capital appreciation. Compound interest really works its magic when you combine automate contributions plus dividends. However, you want to be able to reinvest those dividends as fast as possible.

You can do that by using fractional share investing or dividend reinvestment. That means that no matter the amount of money, it will automatically be reinvested.

Check out the platforms that offer fractional share investing in our post.

Want to see compound interest from your own perspective? Let’s visualize how dividend reinvestment works in the context of compound interest.

Chart of Dividend Investing Calculator Output

This chart of our dividend reinvestment calculator is impressive. Compound interest is no joke. Here are a couple of highlights on how compound interest works its magic with reinvesting your dividends in the calculator:

- In year 14 to year 20, your portfolio value triples from $400,000 to over $1.2 million. Meanwhile, it takes you 14 years to get from $0 to $400,000.

- If you hold your dividend yield the same over time, you will earn an annual dividend income of over $35,000 per year by year 20.

Think of a high-yield savings account that also has upside from capital appreciation.

Sounds kind of nice right? There’s only so many investments that offer this type of attributes. When you build a dividend portfolio, the best part is each stock has a different dividend payment date.

If you have monthly dividend stocks, even better. However, think about your risk tolerance first. There’s plenty of monthly dividend stocks out there that are not worth investing in.

The best part is that anyone can get started… There are plenty of brokerages that will give you free stocks just for signing up.

Here’s a list of 6+ ways to get free stocks.

What are some of your favorite highlights from the dividend investing calculator output?

Download and Use Our Dividend Investing Calculator

Below is a snapshot of our dividend reinvestment calculator. This is completely free to use and try on your own time. Schedule out your financial plan for living off dividends.

The dividend investing calculator is very simple to use and input your own assumptions. It literally only takes 5 minutes!

Once you click download for the dividend investing calculator, check your inbox for the model in excel form. You can certainly change your assumptions in the dividend investment calculator to evaluate if you want to reinvest your dividends or not.

If you turn off dividend reinvestment, you will see that the benefits of compound interest drastically decrease.

Expand your knowledge by building a library of these top dividend investing books. Continue learning and continue investing.

Conclusion on Dividend Reinvestment Calculator

A dividend retirement calculator can give you the true answers to what it will take to live solely off dividends. In addition, a dividend calculator can be used as a financial roadmap for your financial planning. The dividend investing calculator model provides you with actionable steps to take to achieve financial freedom.

Our dividend portfolio infographic can help you create an optimal portfolio.

I suggest that you use the dividend calculator conservatively, so you know you can beat your goals and get to the endpoint that you need to achieve.

Dividend investing does have risks, so please evaluate accordingly. However, if you use the dividend retirement calculator effectively, you too can retire off dividend income!

Like our dividend reinvesting calculator? Check out my free dividend discount model to help you value dividend stocks.

Happy investing! If you have any questions or comments regarding our model, please leave a comment below.

Related Resources

- Try our free stock calculator to invest wiser

- Invest passively with these top robo-advisors

- How to use a 401(k) fee calculator to save money on retirement

Millionaire Mob is an early retirement blog focused on passive income, personal finance, dividend growth investing and travel hacking. With both a million rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel tips, dividend growth stocks, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Join our community of over 5,000 mobsters seeking financial freedom. What are you waiting for?

8 Comments

Wow, right down my alley! Just discovered your site, I too am an avid dividend investor, thank you for posting this, and for offering your dividend calculator.

Great! Glad you like it and happy that I was able to help.

I would love your opinion on my google sheets stock screener, if you’re interested in seeing it, please email me.

I will have to read your book! Are you investing in single dividend funds that you like? I’ve been maxing out all my retirement accounts, but am investing in index funds (VTSAX, VTFIAX).

I only own a dividend fund that is for international stocks. I mainly pick stocks individually and remain diversified. I also own low-cost index funds.

Love the post. I’ve been experimenting with a few of my dividend based selections, and have been leering towards buying more of these rather than sheer growth based funds…

Yeah, that’s a great approach. You can pair growth with some dividend-based stocks at attractive valuations.

Great stuff, I really appreciate you guys posting this. I will escalate my life!