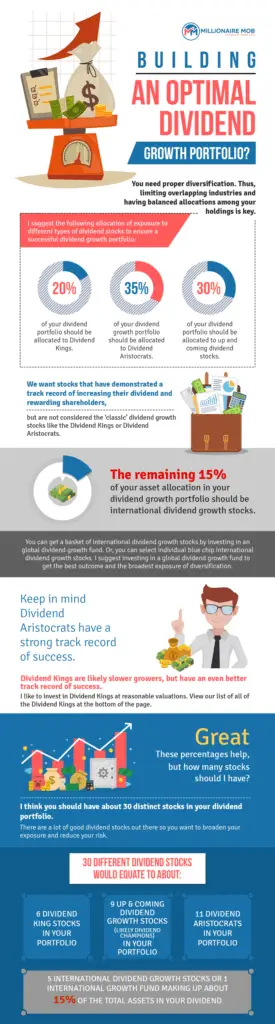

Our dividend portfolio infographic will help you invest in dividend stocks at the most optimal level. Investing isn’t always fun, but our infographic will hopefully help you get started with dividend growth investing.

How to Build a Dividend Portfolio Infographic

Our infographic for building a dividend portfolio hopefully helped you consider the important composition for an optimal portfolio. My goal of living off dividends forever is within reach based on the outline and case studies I created in our living off dividends post.

If you want to see what it will take to live off dividend forever, try my dividend calculator that allows you to sensitize your dividend investing goals.

Why dividend investing is powerful

Dividend investing is the best way to capture the best total return in the stock market because you are taking advantage of the ‘compound interest snowball.’

With every dividend income check received, you should reinvest that income back into your dividend portfolio. I’ve been able to build my net worth from negatives to over $400,000 using a combination of dividend growth investing and pre-tax retirement contributions. Personal Capital has been instrumental in helping me do so. This is why I named it one of my favorite dividend income trackers.

This helps you capture compound interest in its most optimal form. By investing in dividend stocks, we are investing in businesses not making bets on stock prices. We are not traders either. Dividend investors seek to grow alongside the business as a part owner in the company.

To be a dividend investor, I suggest using a zero-commission fee trading platform like Robinhood. That way you can reinvest even the smallest amount of dividend income into stocks without any transaction costs.

To find these dividend stocks, set up a stock screener. You can review our infographic on screening for dividend stocks to learn more. Here is my simple criteria for finding undervalued dividend stocks.

- Invest in stocks that pay a dividend… Duh!

- Screen for companies with a market capitalization of over $10bln. We want companies with scale and a size advantage.

- Find stocks to invest in with a P/E ratio less than 20x.

- Additionally, I want to invest in companies that are growing their Earnings Per Share (“EPS”), so screen for EPS growth next year of greater than 5%.

- Long-term growth is important, so filter companies that are growing their EPS over the long-term.

- Don’t overpay for growth, so screen for companies with a Price to Earnings Growth (“PEG”) of less than 1.

- Finally, I want dividend safety over the long-term. Screen for companies with a payout ratio of less than 50%. This gives us a margin of safety. If EPS doesn’t grow, there is still sufficient dividend coverage. I don’t mind looking for Dividend Kings when possible.

Run a few of these stocks through our dividend discount model to check valuation at a high level.

Investing in Dividend Stocks Infographic Conclusion

Building a dividend portfolio should be fun. One of the most important points to consider with dividend growth investing is ensuring that you are investing in the right stocks from the onset. If you are not strategic with your investment strategy from the get go, you can have your portfolio turn sideways in a hurry.

Not every stock in your dividend growth portfolio will be a winner and that’s okay.

A critical component to dividend growth investing is that you only need to invest in 7 to 8 outstanding businesses out of 10. Some businesses simply do not execute on their plan or there are uncontrollable risks inherent in the industry or business. A dividend growth investor has to realize that.

For example, in a portfolio of 10 stocks, you can do quite well if only 5 beat the stock market, 3 track or slight underperform the stock market and 2 underperform the stock market.

Consider buying one of these best dividend investing books to help you expand your knowledge.

What will a do with our dividend portfolio infographic? Has this helped you with your goals in dividend growth investing? Please leave a comment or question below. We’d love to hear from you!

Millionaire Mob is an early retirement blog focused on passive income, personal finance, dividend growth investing and travel hacking. With both a million rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel tips, dividend growth stocks, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

Escalate Your Life.

No Comment