Often times, wealth creation tips remain the same but still; only a few people hack these simple principles for money management. Your wealth planning should be fun and exciting, so use this guide to help you achieve financial freedom.

13 Wealth Creation Tips You Need to Know

Increasingly, the gap between the rich and the poor continues to widen. Wealthy people continue to accumulate more wealth while the poor seem to become poorer.

There is no magic to guarantee yourself riches; you need to make it happen by following the wealth creation ideas.

I have come up with a list of surefire wealth creation tips from the millionaires that will help you achieve financial freedom. I learned a few tips from Tony Montana about managing money.

What is wealth creation?

Wealth creation is the process of developing your net worth through long-term asset ownership. Building wealth takes time and positioning.

If you position yourself in the most positive manner for creating new wealth early on, you will hardly notice that you are building a massive amount of wealth over time. Positioning is a core pillar in wealth creation.

Wealth creation is achieved by developing a number of controllable revenue streams that you own and dictate. There are several core strategies to wealth creation that I will highlight below.

In our post, I will highlight the core components of wealth creation, including:

- Planning for wealth creation

- Wealth creation strategies

- Wealth creation tips

I am a Personal Capital addict and I can’t stop checking my net worth calculations and income. This has helped me with the wealth planning process more strategically. Personal Capital has freed up my time significantly.

How to start the wealth planning process

Starting the wealth planning process is somewhat straightforward and is the clear foundation of Millionaire Mob. I strive to focus on these four core pillars of wealth planning to achieve financial freedom. Some of them are more difficult than others. However, for the most part, any person should be able to start doing these four today.

There are several approaches to accumulating and creating wealth, which include the following:

- Increase the income you already have: Stay focused on your career or business that you own to increase your income over time. How can you be more efficient? Check out my post on how to increase your income without working more.

- Add a second or multiple other sources of income: I use Fiverr and Freelancer to earn side gigs and develop relationships where I can add additional income. These platforms help me work from anywhere and I’ve landed a few clients that I continue to work with for many months!

- Invest for income and long-term capital appreciation: I’ve built a Robinhood dividend portfolio that enables me to increase my income and hit my wealth goals for early retirement. Check out my infographic on how to build a dividend portfolio if you want to get started. Then, use one of these amazing investing apps to start building wealth.

- Budgeting effectively to live financially free: Becoming debt-free is paramount, but you also must budget effectively. I used SoFi to refinance my student loans, which allowed for me to completely repay my student debt. Thereafter, I now monitor my credit score with Credit Sesame to ensure I am in good standing with all of my other accounts. Credit Sesame helped me boost my credit score to 812. Here are some other creative ways to repay student loans.

These four pillars for wealth planning are essentially if you want to create wealth and live financially free. I’ve aligned myself with the appropriate wealth building tools to ensure financial success. These tools help, but you must execute on your strategy. So, what are those wealth creation strategies?

Wealth creation strategies

Wealth creation strategies are a core piece to build wealth through positioning. How are wealth creation strategies different than wealth planning? With wealth creation strategies, you are solely focused on the step beyond the planning process. Wealth creation strategies are the actual act of creating wealth. These are the paramount and proven acts of wealth creation.

The core wealth creation strategy to consider is this….. Become an owner.

By becoming an owner, you are able to grow your wealth while the underlying business/investment/entity grows. Yes, you can increase your income over time.

But, by becoming an owner, you enable yourself to increase your income AND your net worth over time. In fact, you can grow both of these much more quickly than if you were working for someone else. Here are some wealth creation strategies to consider in becoming an owner. Look at these millionaire farmers. They were very passionate about their business and focused on growth, which led them to a lot of success.

How can you become an owner in something?

Becoming an owner is, in fact, a lot easier than you think. There are several ways to become an owner in something to create wealth.

- Investments: By investing in stocks, you are a partial owner of the company. You take your hard earned cash and buy a share of the company. You do not maintain control (unless you own 51%). Actually, you can invest in private companies too. This is much harder and requires much more capital. Our guide can show you how to invest money wisely.

- Real Estate / Hard Assets: By owning real estate, you own the property and all the potential capital appreciation. By using someone else’s money (usually a mortgage), you can enhance your return and reduce your risk. If you are renting the property, you earn the income from the property and the capital appreciation.

- Start a company: I love this wealth creation strategy. While this wealth creation strategy does not come without risks, it offers some of the best upside and the best flexibility. Some form of this must be in your wealth creation plans. By starting a company, you can select an industry with low barriers to entry and low startup costs (think blogging!). Or, if you have more capital to work with you can start something completely new that is a software tool online. The world is your oyster.

These are core, fundamental wealth creation strategies that every person needs to consider. All of these don’t take too much money to do. You can either save early on to participate in investments then move down the list as you get more comfortable with risk.

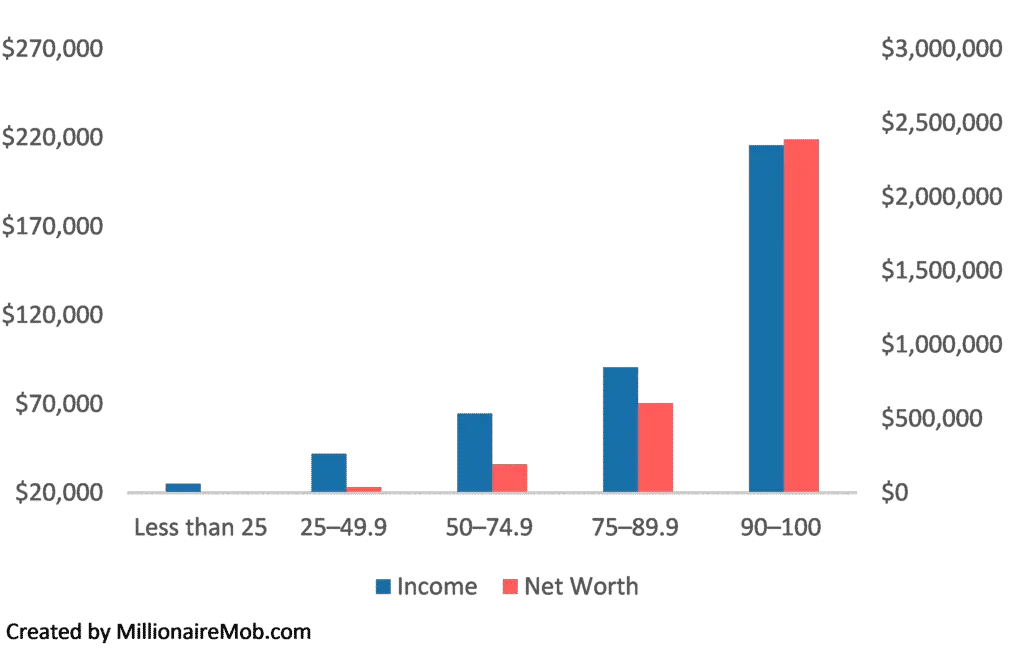

Here is a chart I created that illustrates the net worth and income graphed by percentile. The top percentile has about 10x their net worth in income. If you want to perform like the top percentiles then your net worth should be 10x your income.

List of Wealth Creation Tips

Wealth creation entails so much more than just having a core strategy as well. You know what is the most important way to create wealth over the long-term. What wealth creation tips can you learn to ensure you approach the wealth planning process appropriately?

There are several tips and tricks to wealth creation that can help you maintain your path to financial freedom. So, here are the 13 proven wealth creation tips that you should know:

- Wealth is a mindset

One wealth creation strategy that is incredibly true is that building massive wealth starts with your perspective on wealth. There is a saying that goes” your attitude determines your altitude”. A big difference between the poor and the rich is their mindset. If you believe that you can accumulate wealth and get rich, success is 99% assured. But if you believe you won’t, chances are you won’t.

Make your wealth building habitual. Use Wealthsimple or other robo advisors to help you achieve your goals while you focus on personal growth. Here is a comparison of robo-advisors to consider for investing.

- Don’t flow with the prevailing financial tide

Another common principle that most successful people employ is that they go against the prevailing financial tide. Warren Buffet in one of his numerous quotes on financial freedom says, “A good investor has the opposite temperament to that prevailing in the market”.

While people are panicking, the rich take advantage and implement what people fear to do. When the stock market price drops, the rich buy the shares.

A majority of rich people are risk takers and act on impulse. Most filthy rich individuals made several investments in stock markets and didn’t panic or sell when their investment seemed lost. The rich find opportunities in challenging situations. Ensure you are not overpaying in retirement fees by using a 401K fee calculator.

- Wealth creation takes time

This is a very important wealth creation tip. If you want to accumulate wealth, you need to cultivate patience.

The Richest Man in Babylon is a popular financial freedom book and the author George Clason says in one of the chapters that, “ This is the process by which wealth is accumulated; first in small sums, then in larger ones, as a man learns and becomes more capable”.

Often times, the largest financial leap happens at the end of the path.

Wealthy individuals start accumulating wealth early and wait. The most important factor in accumulating wealth is getting started. You need to start somewhere and have clear goals of where you want to go. When you follow something that promises quick riches, in most cases, it ends up being just a scam.

Warren Buffet, one richest men in the world has a net worth of over $77 billion. But its worth to know that he actually never had more than $3 billion when at the age 59. As a matter of fact, at age 60, he was able to more than double what he had accumulated by age 59. Accept delayed gratification. This is where you make a sacrifice now for a better life later. Work hard now to create a better tomorrow.

I love that wealth creation doesn’t happen overnight. You gotta work for it! Also, compound interest takes time to see the best results. This is one of those wealth creation tips that you should write on a piece of paper next to your computer.

- Make the wealth creation process fun

There are many opportunities in the market environment to build wealth today. If you can match up your talents and skills and pursue what you love to do, you will accumulate plenty of riches. You can actually accumulate more wealth while you pursue your passion than when you are doing things just for revenue purposes.

Don’t just work to make money, do what you love and build wealth by having fun. Turn your hobby into a money-making opportunity. If you combine your interests, and talents, you will attract money.

- Set specific goals

To become financially independent, you need to make smart money moves. A top secret about financial independence is that it just doesn’t happen. Often times, it’s planned. It starts with the creation of a detailed plan with specific goals and a willingness to commit to the plan. Create a series of steps that will help you achieve your specific personal financial goals.

Use different personal financial ratios to assess your financial position. Some of the goals that you can set in different aspects include increasing your net income, create a budget to control your expenditure, clear your debts, develop a savings pattern, create investment strategies among others.

Well, they may sound cliché but they can start you off on your financial independence journey. Tony Robbins said, “Setting goals is the first step into turning the invisible into the visible”.

- Let money work for you

If you are working to get money, then you will never be rich. If you’re exchanging your time for money, you will never become wealthy. Another Millionaires wealth creation strategy is making passive investments. You can save a lot by taking advantage of coupons, not buying unnecessary items and by being frugal among others. But don’t just save money, invest your savings.

Let money work for you while you are asleep or away pursuing other things. But if you don’t invest what you save, then you will not achieve much. Massive wealth is an indication that you don’t work, you own. It includes being an owner of multiple streams of income, investments, stocks, royalties, businesses among others.

I cannot stress this enough.

- Read financial literature

There is a lot that you can learn from the financial books and materials. A number of financial experts have written eBooks, podcasts, blogs and more to teach and train people wealth creation strategies and wealth creation tips. Invest in yourself by reading and implementing the different strategies that you can gather from different sources.

I love the book Millionaire Next Door. This is a great read for someone looking to pursue financial freedom.

- Get a millionaire mentor

If you get a millionaire mentor, you will be fully committed to following their steps. It is important to have someone to look up to in your wealth creation and financial independence journey. A mentor can offer you guidance and direction, knowledge and expertise, support and network, experience and advice, hold you accountable and help you realize your goals and dreams. When searching for a mentor, you need to get someone who is preferably ten years ahead of you. Consider these financial planning quotes to keep you motivated.

Go through all of their existing materials including blogs, podcasts, seminars so that you can acquire everything you need to be like them. You can obtain massive wealth creation ideas from a millionaire mentor. Here’s how to become a millionaire teacher.

- Avoid accumulating debt

Debt can really ruin you as it weighs down your earning capacity down. Don’t get into the debt trap. A golden rule is to live within your means. Borrow when necessary and pay off your debts as soon as possible. Avoid funding expensive lifestyle with debts and reduce unnecessary expenses by budgeting. Manage your credit spend and maintain a good credit history. Try to live mortgage free to free up flexibility in the long-term.

- Diversify

It is important to accept that things can really take a drastic turn in the future. What will happen if they do? Create a safety net by making different investments. That can hedge you against the risk of losing everything when one asset-class crash. Diversify your income sources and your investments.

Create different sources of income. The economy and the job market are very unstable and you need to prepare for the unexpected. You can face a job loss, what will happen if this unfortunate thing happens?

If you have a full-time job, you can create a side business or a part-time business. Try to venture into entrepreneurship, peer to peer lending and real estate among others. You can also have some money invested in the stock, market, fixed income, real estates, currency, and commodity trading among others. Take advantage of strong markets wherever possible but don’t just go for a single investment.

Don’t just stick to one investment, create multiple streams of income. Diversify your income with freelancing, use these freelance websites to start making money online now.

- Avoid procrastination

If you belong to the class of I will start tomorrow, then you will never be rich. Procrastination is a dream killer and you need to avoid it like plague. Do what you set out to do and don’t hold it for until later.

Chances are high that if you fail to start immediately, your zeal will drop with time. So, it’s important to start now and pursue those principles as soon as possible.

- Ensure your wealth

It is vital to have insurance coverage as your wealth grows. If you amass a lot of wealth and then fail to ensure it, then it defeats the whole purpose of having it. The world is full of uncertainty and the unpredicted can happen.

It is therefore important to take a cover to protect your accumulated wealth from unexpected occurrences.

- Ignore the Joneses

A huge undoing when it comes to wealth creation process is in comparison. Avoid competing with other people on spending money matters. Stick to your goals and avoid trying to keep up with friends and neighbors. The only person that knows your financial situation is yourself. No need to assess your situation relative to others.

Play your own hand that you are dealt with, not someone else’s.

Conclusion for wealth planning

Wealth creation process is not a one size fits all approach. It can take time but in the long run, you will reap massive benefits.

I hope that this article has offered you some great insights on wealth creation strategies. Align yourself with the best tools for financial success. Our wealth management resources features plenty of tools that will position you for success.

I suggest that you write each one of these wealth creation tips on a piece of paper and follow them throughout your daily routine.

These wealth creation tips can be used as a checklist for your money management every single day. Try completing all of them each day and you will be amazed at the financial success you will start seeing.

Here are several ways to increasing your net worth.

What wealth creation tips do you like? Are you participating in wealth planning? Let us know in the comments below. I’d love to hear from you.

Millionaire Mob is an early retirement blog focused on passive income, personal finance, dividend growth investing and travel hacking. With both a million rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

1 Comment

Help me to get a reach of people