I currently use Robinhood for my dividend growth portfolio. Building a dividend portfolio is easy through Robinhood brokerage as they offer commission-free trading on all stock purchases and sells. In addition, Robinhood now has commission-free options trading, which can be a great tool for risk mitigation. I will update you on my Robinhood dividend growth stock portfolio.

Robinhood Dividend Growth Stock Portfolio Update – March 2018

One of our goals at Millionaire Mob is to reinvest our passive income streams into a dividend growth portfolio to ensure we are on a path to financial freedom. Our freelancing income is a good example of an income stream that we enjoy reinvesting into our Robinhood dividend growth portfolio.

I love checking my Personal Capital account to see freelance income AND dividend income. Make your money work for you while you sleep.

I love dividends so much I wrote a book about it. It’s titled Dividend Investing Your Way to Financial Freedom. Living off dividends and receiving passive income through dividends is feasible.

I wrote a 5-step plan on how to live off dividends that will surely help you realize your full investing potential.

You can read about why I wrote a dividend investing book if you’d like to hear my goals and ambitions from writing it.

How to Build a Dividend Growth Stock Portfolio

We recently created a guide to building a dividend growth portfolio, which will help you make better decisions regarding your investments. We believe that an dividend investor should have a balance mix between the ‘dividend dinosaurs’ aka the Dividend Kings and Dividend Aristocrats. A dividend investor should also not avoid the up and coming dividend growth stocks of the future such as Dividend Champions.

We are firm believers in trying to find the next Dividend Kings and trying to invest in dividend growth stocks early in their growth cycle.

Building wealth through dividends is an effective strategy that is proven and reliable. Dividends provide a stable return and are a key component to the overall total return of the stock market.

What is a dividend?

If you are relatively new to this and just learning, you may be wondering what is a dividend? A dividend is a cash payment made by a company to reward shareholders. When a company generates earnings, they have two options to do with the cash flow.

The first thing that a company can do is reinvest the cash flow back into the business to fund growth initiatives or expand their operations. The second is a company can pay a cash dividend to existing shareholders as a form of appreciation for their ownership.

In regard to investing in public stocks, I like to invest in companies that do both with their cash flow. I like companies that do not pay a significant amount of cash in the form of dividends. I invest in companies that pay a dividend, but are ALSO focused on reinvesting cash flow back into the business. Check out our review of Robinhood dividends to hear more.

Build wealth through dividends.

Interesting Travel Tips Bonus

I personally took the above photo while walking down the street in Chicago, Illinois. I believe this was on Memorial Day when they decided to hold a giant American flag up in the middle of the plaza. The flag was one of the biggest I had seen. That was probably because the wind put it in perspective.

There were a few giant gusts of wind blowing through the plaza. No shit, it’s the Windy City! I loved the lighting with the photo as the sun was gleaming off the historic building in the background. Another reason why I love taking my own travel photography when I’m going to new places.

Awesome times, now back to some boring dividend investing…

See Related: M1 Finance vs Robinhood: What is Better?

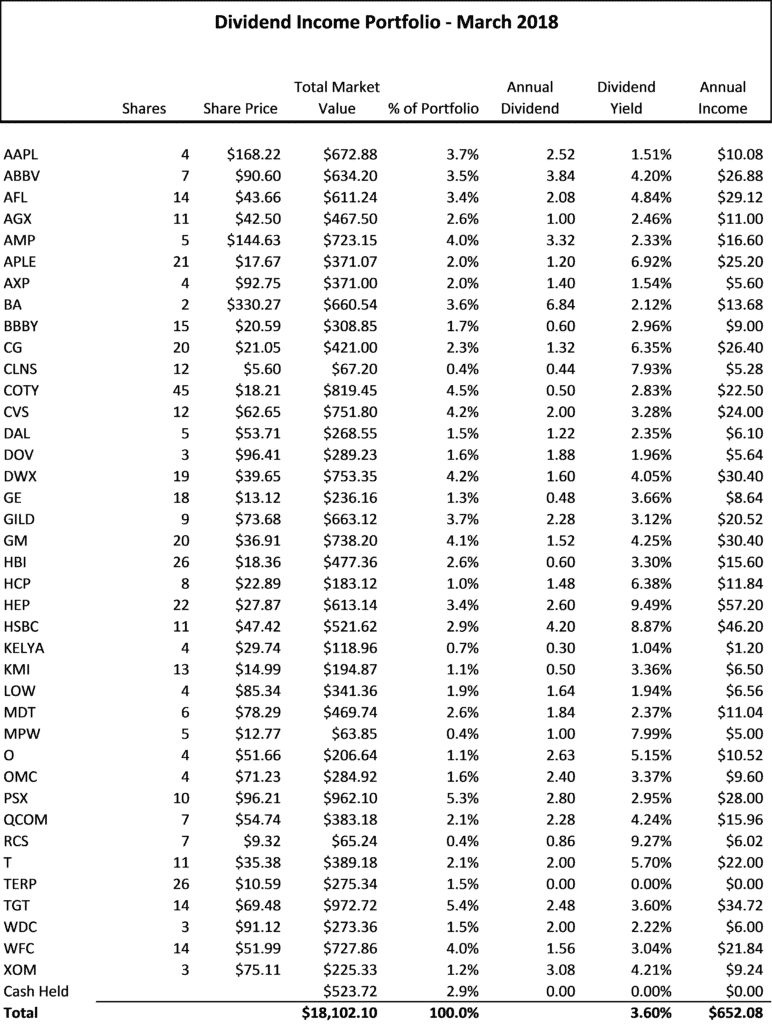

Dividend Growth Stock Portfolio Snapshot

Please note our dividend portfolio only includes our dividend growth portfolio through Robinhood. We have a number of other investment accounts including a Roth IRA, 401(k), Health Savings Plan and an investment account focused on index investing. We are only showing our dividend growth stock portfolio since this is a fund that is focused solely on achieving financial freedom.

I continually put more and more money to my other investment accounts, but I view these accounts as retirement accounts. I am unable to really live off of them until a certain age. Retirement accounts are assets, for sure. However, they just are adders to my financial independence and net worth considerations.

Here is a summary snapshot of our dividend growth holdings.

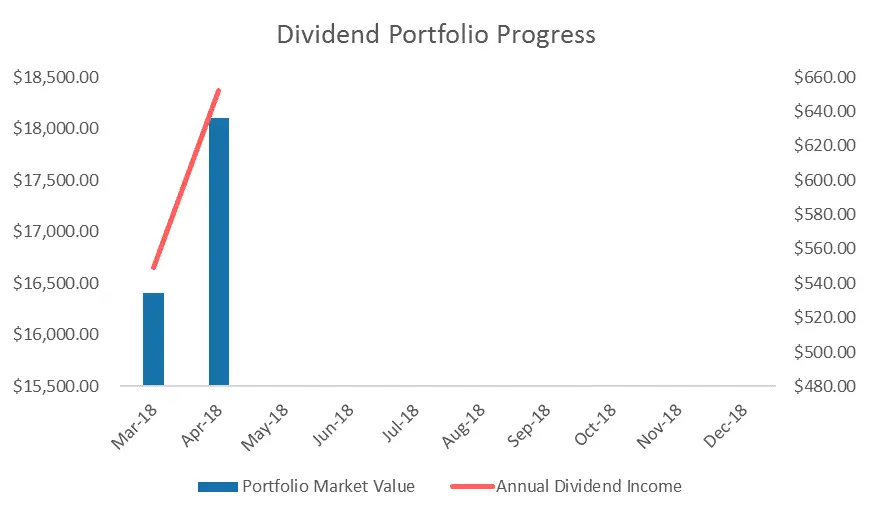

Dividend Growth Stock Portfolio Summary Chart

We plan to continue to track the market value of our dividend stock holdings as well as the annual income of our dividend growth stock portfolio throughout time. Our ultimate goal at Millionaire Mob is to help you build wealth through dividend income. We believe you can do it, so we will be transparent in our holdings. This will lead to better learning and we all are able to win.

Here is a summary chart of our dividend growth stock portfolio. As always you are welcome to compare our holdings to the prior month, here is our post on our dividend portfolio for February. I can’t tell you how many times I hear that dividend investing is only for retirees.

That is just not true. Good investing is boring. I am so glad to be past my old days of day trading options. From here on out, I will only use options as a form to generate additional income (selling puts) or hedging my portfolio (covered calls). Using options in your portfolio is a great way to mitigate risk and potentially increase your income.

We were able to increase our holdings and annual income.

How does your dividend portfolio look? You never know a stock until you own it.

If you want to build wealth through dividends too, try using our dividend reinvestment calculator to see what it will take to live off dividends forever.

Or, try running some of your favorite stocks through my free dividend discount model.

Conclusion on Building Wealth through Dividends

We bought a number of stable, undervalued Dividend Aristocrats during the month of March, which include Medtronic (Ticker: MDT), Lowe’s (Ticker: LOW), Omnicom (Ticker: OMC) and ExxonMobil (Ticker: XOM).

While the recent volatility in the stock market is a cause for concern, I am not investing in stocks to have them go up 15% in one month. I am taking a long-term view with this portfolio and will continue to do so.

In addition, I think now is a great time to focus on how to increase your income so you can be a strong buyer when the market pulls back. I am actually slightly bearish on the market and may look to hedge on a small scale. I’ve been looking for a number of different ways to increase my income.

I won a couple new freelancing clients in April, so I look forward to writing about how much I’ve poured into my dividend portfolio from side hustles during the month.

We love using FINVIZ futures to monitor the direction of the overall market, reduce risk and increase investment returns. Check out our analysis on how to use FINVIZ futures to understand market trends.

Here is a quote to leave you with (I’m sure you have read before), but don’t forget quotes like these when markets experience volatility:

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

-Warren Buffett

What are your thoughts on building wealth through dividend income? Do you think a dividend growth portfolio is a great way to achieve financial freedom? Building a dividend portfolio is easy and straightforward. Do not get caught up in the get rich quick trading schemes out there. Let us know in the comments below. We’d love to hear from you.

Disclosure: This does not constitute as investment advice.

Related Resources:

- Dividend Investing Starts with Profit Growth

- McDonald’s Stock Dividend Analysis

- Free Stock Calculator to Help You Invest Smarter

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

Escalate Your Life.

No Comment