Tax-efficient investing can take your portfolio (and finances) to the next level. In this article, we get into the importance of building a tax-advantage portfolio.

Why Tax-Efficient Investing is Extremely Powerful

A lot of the blogosphere writes about how to invest money. Some of it is good advice. Much of it is not. One topic we hear little about in personal finance is tax-efficient investing. That’s what I want us to explore in today’s post.

Compound interest is an amazing thing. If you do it under a tax-efficient structure and continually invest, your wealth will compound quickly.

Using a tool like Personal Capital is essential for investing your money. The software is completely free and allows you to track your dividends, forecast your retirement, cash flow and so much more.

First, let’s talk about taxes for a minute.

Types of taxes

Generally speaking, people have an aversion to paying taxes. We pay federal, state, and local income taxes. There’s sales tax on items purchased, tax on gasoline, carbon tax, and property tax. There are the gift and estate taxes. There are a hotel tax and even a tax called the sin tax, which taxes things like cigarettes and alcohol.

We pay taxes on a lot of things. These taxes pay for the services the government provides.

Most of us try to reduce or eliminate as many of these taxes as we can. There’s nothing wrong with that if we do it legally and play by the rules.

If we can reduce the amount of tax we pay, it puts money into our pockets. And let’s face it, most of us feel we can do better with our money than the public entities to whom we pay our taxes.

Investing and taxes

I’m assuming that almost everyone reading this article has an investment portfolio.

You might be investing via your employer-sponsored retirement plan. Maybe you own rental properties. You might have a traditional or Roth IRA. Or even a mega backdoor Roth IRA.

Perhaps you’re investing for your kids’ college education in a 529 plan. Most of you probably have individual investment accounts or, if married, a joint account with your spouse.

It’s hard enough to decide the types of investments to own. When we add the burden of trying to make those investments tax efficient, the problem seems even more significant.

But if you will take the time to learn about and focus on making your portfolio as tax efficient as possible, it will increase your returns.

We’ll talk about tax-efficient investing by covering three major areas.

- The types of taxes paid on various investments

- Investments that offer tax efficiency and how ways to invest in them

- Asset location – placing your various investments in the accounts that provide the most favorable tax treatment

Types of investment taxes

These are the various forms of investment taxes that you need to know, which include capital gains and dividend taxes.

Capital gains

Investors pay capital gains taxes on investments like stocks, bonds, real estate, and other property sold at a profit

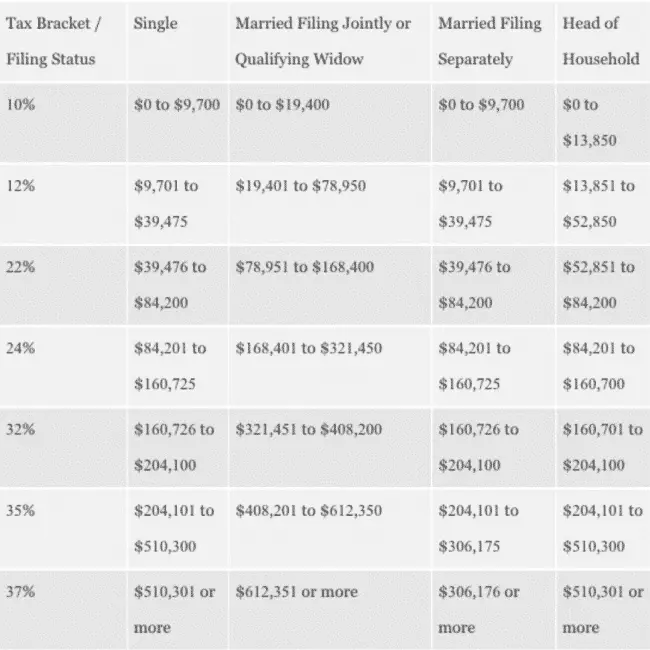

The tax rate on the profits depends on the holding period of the investments. If held less than one year, the tax rates come from the ordinary income tax rates table.

Here are those rates:

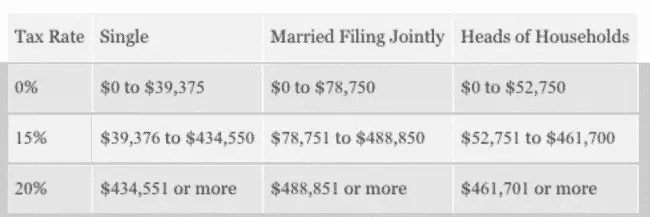

If the holding period is one year or more, the tax rate comes from the capital gains tax table as follows:

Let’s look at an example.

We will assume that you’ve owned a stock, ETF or mutual fund, sold it and have a gain of $50,000 after selling. We’ll also assume that you’re married, filing a joint tax return with a combined income of $150,000.

If held less than one year, here is the tax you would pay.

Short-term gain taxes:

First $19,400 10% $1,940

Next $59,550 12% $7,146

Next $71,050 22% $15,631

$150,000 16.5% $24,717

Long-term gain taxes

Income Tax Rate Tax

$150,000 15% $22,500

Tax savings if gains are long-term – $2,217

Tax saving tip #1

Before selling an asset (stocks, bonds, etc.), look at how long you’ve held the investment. Calculate the tax rates both ways to see which one makes the most sense.

In the example above, if your income were $100,000 instead of $150,000, the tax would be $13,717 instead of $24,717. The blended tax rate would be 13.7% instead of 15% for the capital gains tax.

Note: These examples are meant to represent a simple example of the impact of taxes on sales of investments. It does not account for any other deductions or adjustments, which could alter the tax rate. It is meant to show the difference in tax rates at ordinary income vs. capital gains. Before deciding what to do, take into consideration your total tax picture.

Tax saving tip #2

There is another way to lower the tax bill on sales of investments. The IRS allows us to offset any gains from investment sales against any losses from sales.

Another name for this strategy is tax-loss harvesting. The plan involves selling securities you own that have capital losses to offset securities you’ve sold that have capital gains.

For example, if you had $50,000 in capital gains and lost $25,000 from selling other investments, your net capital gain is $25,000.

The allocation of losses against gains works as follows:

- Short term losses against short term gains

- Long term losses against long term gains

- You can deduct any excess losses against the opposite gain

Let’s say you sold securities with the following gains:

- Long term gains – $5,000

- Long term losses – $3,000

- Net long-term gain – $2,000

And these losses:

- Short term gain – $3,000

- Short term loss – $5,000

- Net short-term loss – $2,000

The $2,000 net long term gain is used to offset the $2,000 net short term loss resulting in zero tax due on these transactions.

You can deduct any excess gains against ordinary income up to $3,000. Any losses not used during the current tax year can be carried over into subsequent years

Use tax loss harvesting to manage capital gains and losses during each year. You can use a tool like Betterment or M1 Finance in your automated investing goals. They will tax-loss harvest for you. With no work to do on your end.

Here is a comparison of the various robo-advisors that are the best in business.

Dividend taxes

You also pay tax on dividends you receive from stocks, mutual funds, and ETFs. The tax rate depends on whether the dividends are considered qualified or non-qualified.

Qualified dividends come from publicly traded stocks of U.S. companies listed on major U.S. stock exchanges. Investors who own these stocks and receive dividends benefit from the favorable tax treatment of those dividends.

The tax-rate for qualified dividends is the same as the capital gains tax rates (15% or 20%). Investors must meet the holding period criteria to qualify for favorable tax treatment.

That is, they must have owned the stock for 61 days of a 121 time-frame. The stock cannot be part of an ESOP plan or issued by a tax-exempt organization.

If I’m going to build a dividend portfolio, you should only seek to own the stocks for the long-term. If your plan is to invest for dividend income, you can’t also be a trader at the same time.

If you receive dividends from companies that don’t meet these criteria, you will lose the favorable tax rates and pay ordinary income taxes on the dividend income.

Here is where Personal Capital comes in the clutch. You can easily monitor all my dividend income and dividend reinvestment.

Here are several other ways to track your dividends.

Tax Tip #3

Be sure the companies, funds, or ETFs you invest are companies that pay qualified dividends. If not, you need to make adjustments to your return expectations because on an after-tax basis the returns will look much different.

Use a stock calculator to ensure you are calculating your returns appropriately.

Tax efficient investments

These are some of the most tax-efficient investment opportunities out there that are readily available for retail investors.

Tax-free bonds

Unlike stocks, which represent ownership interests in companies, bonds are loans to the issuing entity. Since it’s a loan and not an ownership interest, they issuing entity pays interest at a set rate to their investors (bondholders).

Typically for individual bonds, that payment frequency is semi-annual. Corporations, along with federal, state, and local governments can issue bonds (loans) to raise money.

Municipal bonds are issued by the state, county and local government. Like other bond investments, they pay investors regular interest payments. Bonds issued by municipalities are free from federal income tax. If you invest in a bond within your state of residence, it will likely be both federally, and state tax-free.

Let’s say you live in Michigan and invest $100,000 in a bond issued by the State of Michigan paying 3% interest (one can hope, right?). Let’s assume your federal tax rate is 24%. The state tax rate in Michigan is 4.25% for a total of 28.25%.

To match the after-tax yield of this State of Michigan bond, you would need to buy a taxable bond paying 4.18% (3% / 71.75% =4.18%). If you had a blended federal rate of 32%, the taxable equivalent yield to match it becomes 4.9%.

As you can see, there’s an advantage to invest in tax-free municipal bonds, especially if you’re in one of the higher tax brackets.

Ways to invest in tax-free bonds

Investors can buy individual bonds issued by states, cities, towns, and counties through a broker. They come in 5,000 increments. You own the bonds directly and get the face value of the bond back when it matures. There are several things to consider when buying individual bonds that are outside the scope of this article.

Let’s say you invest $100,000 into a bond and pay face value for it ($100k); you will get that original principal back when the bond matures. Assuming the bond matures in five years, that’s when you get your money back. If it’s a ten-year bond, it’s ten years.

To get a properly diversified portfolio requires a hefty initial investment when buying municipal bonds. As part of a balanced asset allocation strategy, that may not be feasible.

The other way to invest in tax-free bonds is through a mutual fund or ETF. Rather than owning the bonds yourself, investors own shares of the mutual fund which in turn buys the bonds themselves.

Like any mutual fund, the minimum investment required is smaller and offers a broadly diversified portfolio to reduce the risk of bonds defaulting.

Like any mutual fund investment, the value of your shares will go up and down during the time you hold the shares. Unlike holding individual bonds to maturity, when you sell shares of bond mutual funds, you could get more or less than you paid for them.

The dividends paid on bond funds and ETFs that invest in municipal bonds are federally tax-free. The portion of the bonds the fund owns in your state may be state tax-free as well.

If you’re a high-income earner in one of the higher tax brackets, consider adding tax-free bonds or funds to your portfolio.

Annuities

Annuities are a controversial investment. There are numerous types of annuities to purchase. We’re going to stick with the basics. Annuities are complicated and there are numerous types to consider.

For the purpose of this post, we’re going to talk about deferred annuities.

Like an IRA, money invested in a deferred annuity delays taxes until withdrawals begin. Withdrawals are taxed at ordinary income rates, just like an IRA. For this discussion, we are going to assume that the annuity is funded with after-taxes dollars.

Deferred annuities come in three basic types:

- Fixed – In a fixed annuity, the issuing insurance company offers a fixed rate of return. Typically, they guarantee the first year and a minimum rate. Each year, they will declare a new one-year rate. Fixed annuities are the safest of the bunch., The assets of the issuing company back them. It’s important to choose a highly rated, financially secure company for your annuity.

- Fixed index – In a fixed index annuity, the company ties your rate to some sort of index. Many use the S & P 500. Rather than get what the index returns, you will get a percentage, called the cap or participation rate, that will be less than what the index returns. They usually come with a minimum guaranteed return as well. Be sure you understand the crediting methods before investing.

- Variable annuities – Variable annuities have investments that are more like mutual funds. Called sub-accounts, you can choose from a menu of funds that mirror funds available outside the annuity. Returns in variable annuities come from the returns of the underlying sub-accounts chosen. One of the main criticisms of variable annuities is their high expenses. Underlying expenses can be from 3% – 5%. The higher fees come from some of the additional features offered (guaranteed income, death benefit, etc.).

Tax advantages of annuities

As mentioned, earnings grow tax-deferred as long as they remain inside the annuity. Withdrawals may have favorable tax treatment. There are two ways to withdraw money from annuities.

- General withdrawals – With this type of withdrawal, you would request an amount of money come out of the annuity-like any other investment. Taxes are such that earnings come out first. This type of withdrawal is taxable at ordinary income rates. Withdrawal penalties may apply as well.

- Annuitization – When an annuity is “annuitized” the total account value converts to a lifetime income. There may be other annuitization options as well. You could withdraw over ten years, add a survivor benefit, etc. When annuitized, the IRS offers a tax advantage. The IRS considers part of the payment return of principle and does not tax it. The remaining portion gets taxed at ordinary income rates.

Almost all annuities have early withdrawal penalties. The penalty period ranges from 5 – 8 years and can be quite high. Be sure you don’t need this money until after the surrender period expires.

Like IRAs, withdrawals before age 59 1/2 come with an additional 10% penalty. There is a lot to consider when investing in annuities. Be sure to analyze all aspects of the annuity chosen carefully.

Asset location

I believe diversification is important when investing. It can help manage risk by not having concentrated positions in any one security or asset class. There are differing views on the topic for sure. Millionaire Mob believes in dividend investing to create a passive income. I agree. He also believes in diversification within that strategy.

Another form of diversification is asset location. Asset location is the process of deciding which investments go into which type of account. Most people have both taxable and tax-deferred investment accounts. Let’s take a look at how this might work.

Interest rates on taxable fixed income investments get taxed at ordinary income rates. That could be as high as 37% plus the additional net investment income tax of 3.8%. If possible, it’s best to put these investments in a tax-deferred account like a traditional or Roth IRA. Earnings grow in these account tax-deferred. Taxes on those earnings are at ordinary income rates when withdrawn. Delaying the tax by placing them in these accounts can save a lot of money over time.

Real estate investment trusts (REITs) distribute income every year in the form of dividends. Unlike qualified stock dividends, tax rates on income from REITs are at the higher ordinary income rates.

You can invest in REITs through the stock market or e-REITs via real estate crowdfunding platforms.

Placing these investments in tax-deferred accounts will save money on taxes every year as well.

Capital assets like stocks, ETFs and mutual funds should be in taxable investment accounts (individual, joint, trust, etc.). Why?

Most companies owned in funds or outright throw off qualified dividends. That means you get the favorable dividend tax rate of either 15% or 20%. If you hold these investments for more than one year and sell them, your tax rates are at the lower capital gains rates.

The downside to asset location

The only downside to the asset location strategy comes how you view your portfolio. If you choose your asset allocation by looking at all accounts as one portfolio, the asset location decisions are fairly easy.

On the other hand, if you manage your portfolio based on the bucket strategy (each account tied to a specific goal) asset location may be more difficult.

Whichever way you manage your investments, have them located by accounts in the most tax-efficient ways can increase returns.

Final thoughts on Tax-Efficient Investing

Like many subjects regarding investments, there are a lot of things to consider. Minimizing taxes is one decision among many smart investment techniques. We’ve only scratched the surface in this post.

I hope you learned something you didn’t know. At the very least, I hope I may have motivated you to take a second look at tax efficient investing if it isn’t something you’ve reviewed in a while. We welcome your thoughts on the topic.

What are you going to do to meet your tax-efficient investing goals? Let me know in the comments below.

Related Resources

- M1 Finance Review: A Completely Free Automated Investing Platform

- A Guide on How to Start Investing: Make Investing Easy

- The Ultimate Guide to Fractional Shares Investing

Author Bio

I started Money with a Purpose to help people “keep it real” when it comes to their money and their lives. Financial success comes through planning. You must also align your plan with who you are and what you value. Doing this is THE key to making your money work for you.

My focus on Money with a Purpose has evolved since inception in late 2017. When I began the blog, I wrote about all things retirement. My readers have caused me to rethink that approach. As a result, my writing now focuses on three primary areas – Personal Finance, Overcoming Adversity, and Lifestyle

1 Comment

This article kicks arse!