Credit card manufactured spending (MS) can be highly lucrative and an excellent form of passive income. People manufacture credit card spending to generate income or generate significant rewards points at no cost.

Credit card churning contributes to building up massive rewards points, but credit card MS takes your rewards travel and benefits to a whole new level. In addition, credit card MS does not come without risk though, so I will give you a primer that you can use as a baseline for your future involvement.

Manufactured Spending Guide: Accumulate Credit Card Points

Manufacturing credit card spend is a great way to earn significant rewards points without spending additional money. In addition, with manufactured spending you can earn passive income if traveling is not your cup of tea.

At Millionaire Mob, we are manufacturing credit card points to enable us to travel more and maximize our benefits with credit card churning. I like to think of manufactured spending as a subset of travel hacking.

If credit card travel hacking isn’t for you, here are some travel hacking tips without a credit card.

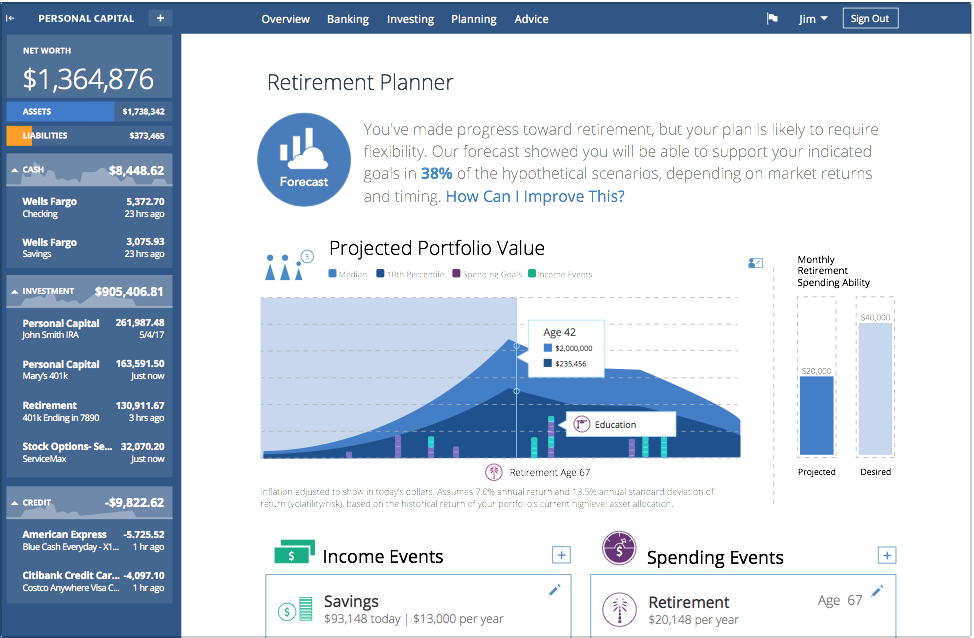

Personal Capital has a fantastic tool to monitor your manufactured CC spend effectively. This is a free tool that enables you to manage your cards effectively. It is very easy to link all of your accounts and is highly secure.

Here is what the Retirement Planner dashboard looks like:

What is manufacturing credit card spending?

In layman terms, credit card manufactured spending (“MS”) is using ‘artificial spending’ to turn credit card spending into cash, which you then use to pay off your credit card leading to $0 in net spend. Your primary goals in doing this are for:

- Meet the minimum spending requirements to meet the signup bonus without buying extra items. I like to accelerate the timing of my minimum spending requirements, so I can properly allocate other spending to more optimal rewards earning. For example, airlines rewards credit cards typically earn 1x points on restaurants unless you purchase from the airline. I like to manufacture spending on these cards, so I can use my Chase Sapphire Reserve to earn 3x on dining.

- Generate significant rewards points without actually buying anything. There are instances where you can actually profit from manufacturing credit card spending such as using cash back rewards to capture a spread. Particularly, you can do this with the quarterly Chase Freedom 5% cash back rewards.

A majority of people use credit card MS just for the first step. MS is not a prerequisite to credit card churning. If you’re just trying to meet the minimum spend on a credit card, there are many ways to do so without resorting to manufactured spending. For example, there are sites that allow you to pay your rent or mortgage with a credit card such as Plastiq.

This is not credit card MS, but this does help you accelerate your spending to hit the minimum spending requirement. You will likely incur some fees with this, but to me it can be worth it if you are going to hit a $750 travel bonus from it. In general, I would advise to just keep your MS activities separate from whatever bills you have.

Credit card MS can be time-consuming. A lot of research is needed along with some experimentation in order to get started. In addition, credit card MS is changing every day, so stay up to date and stay nimble.

You don’t need to participate in credit card churning to be doing credit card MS. Credit card churning is the process of opening a number of credit cards to receive the bonus and then canceling the card down the road.

I know a lot of people that have just one credit card and end up manufacturing spend. It works the other way too, if you like credit card churning you don’t need to manufacture credit card spending. It’s all a personal preference.

My Free Travel Hacking Spreadsheet Template

Well the first tool that is a must-have is my travel hacking spreadsheet that is completely free to download. My travel hacking spreadsheet includes:

- Credit card churning tracker

- Manufactured spending tracking

- Hard pull credit inquiries

Rule #1: Do Not Withdraw Cash from a Credit Card

You should never do this because it will result in cash advance fees. Bank will charge interest on withdrawals starting on the day you withdraw AND you will not get any miles from the transaction.

The primary goal of credit card MS is to find ways to get cash without a transaction being considered a cash advance. There are a number of methods to do this, but please remember that if you make a mistake you should pay off your entire balance immediately.

How do you avoid this? Simply secure message your bank and reduce the cash advance limit to $0, which will effectively make all cash advance transactions to be declined. If they don’t allow the limit to be set at $0? Then, tell them to put it to the minimum amount possible (usually $10).

Other Rules to Manufacturing Credit Card Spending

There are a few rules to live by when you are participating in credit card MS.

- No method is 100% safe and risk free. While you likely will not lose money, it might end up being tied up for multiple days or even weeks. This means you should never invest more money than you can afford to live without when participating in credit card MS. If you’re going to MS $2,000, make sure you have at least $4,000 available in your bank account. I like to rule by a 2x coverage ratio just in case something goes wrong and you don’t see that money back before your credit card bill is due.

- Start credit card MS in small increments. Start with $50 to $100 to test the waters and experiment, so you understand how the process works and the steps that you need to take. There is a difference between reading and learning and actually applying it to real life (I learned that from school).

- MS credit cards varies based on different corporate policies, registers, store policies, or even customer service agents. Each time something different can happen. Make sure you avoid interaction with your bank about your spending habits.

Do you have additional rules to manufacturing credit card spending? Credit card MS is ever changing. You must continue to be creative and think of new ways to manufacture credit card spending.

Methods for Manufacturing Credit Card Spending

Here are some methods of consideration for manufacturing credit card spending. Some methods are more scalable than others, so be strategic in your planning.

1. Funding bank accounts with a credit card

Funding bank accounts is the easiest manufactured spending method out available. It is fast and safe. You can only do this so often so choose your spots wisely. Here is how the process works:

- Research banks that allow you do to the initial funding

- Doctor of Credit has a pretty comprehensive list of bank accounts that can be funded with a credit card, including the limits and which credit cards have been reported to treat these as a cash advance.

- Once the funding is complete and you have your new checking account. Go to your bank and set up that checking account as a payment option.

- Once you have your payment option set up, pay off the entire balance of the credit card.

- Close the newly opened account. If the bank asks why, just cite that it was too inconvenient.

Certain banks will want to charge you an early termination fee. Try to get that waived if possible. If not, do not close the bank account and try to call back in later with a different rep and close the account.

Most times they will just close it and forget to mention the fees associated with it. Use this method wisely as it is one of the only ways for free manufactured spending. Other methods cost nominal amounts of money.

You will need to hook up your routing number to repay your spend. Here’s how routing numbers work, so you don’t need to continually update it.

2. Buying virtual gift cards

Another popular manufactured spending method is to buy Visa, Mastercard or Amex gift cards. There are two steps: find a place to buy a gift card, then find a way to liquidate it.

While most gift cards have activation fees, these can be offset by buying them at a store that qualifies for a category bonus on your credit card (e.g. such as a location offering the Chase Freedom 5% cash back categories). One-time promotions can make the deal even better. Often times, around Christmas, Simon Mall offers discounts on gift cards.

Even if your credit card does not have any category bonus, some places sell gift cards with low activation fees that should easily be offset by whatever rewards you’ll get from the transaction.

Simon malls are a popular example as most of them sell $500 Visa gift cards with a $3.95 activation fee. That equates to less than 1%, so if you are getting 3x points or even 2% cash back you are instantly coming out ahead.

Here are a few popular ways to liquidate gift cards with a PIN:

- Buy money orders. Some grocery stores will allow you to buy a money order using a debit card (in your case, a Visa gift card) for a nominal fee, which you can then deposit in your bank account. Not all grocery stores will allow this and you need to do research or find data points reflecting what grocery stores will work. Not all grocery stores will allow this and you’ll need to do some online research then field testing to find one that will work. Please not that some banks do not like frequent money order deposits. Do not deposit money orders in to your personal bank account. I like to set up a separate account.

- Load your gift cards onto reloadable prepaid cards such as Amex Serve.

If you receive a money order or check from manufactured spending, you can cash the check instantly. Here are some instant check cashing options to consider.

On the contrary, a number of large banks offer online check cashing through their mobile apps. However, if you want to consider cashing a check without a bank, consider these places that cash checks.

3. Reloadable Prepaid Cards

Certain reloadable prepaid cards can be loaded with a credit card directly online, and these can usually be liquidated more easily than gift cards. Again, back to the point on research for data points. You will likely need to use different forums to confirm information from individuals.

4. Other Manufacturing Credit Card Spending Methods

There are a bunch of other ways to manufacture credit card points. Stay on the lookout. They are constantly changing and you likely do not hear of the best ones. People have found ways to do this with extreme scale. Just keep reading on the topic in your free time.

Stay creative with travel hacking. Manufacturing miles and points can be a great way to earn income or travel the world for little to no cost.

Once you rack up significant points, use these tools to book award travel. If you need instant responses for your travel hacking, credit card churning or manufactured spending, use the Reddit churning community to your advantage.

You can review our Reddit churning guide on how to use it for travel hacking success.

Is manufactured spending illegal?

No, it is not illegal. Credit card MS is basically a loophole and will most likely go under the radar if done on a smaller scale and in small chunks. Try to stay vigilant by reading the terms and conditions of your credit cards.

Conclusion on Manufactured Spending

You can easily manufacture credit card points if you continue to do what works well. That is one reason why I like the option of buying virtual gift cards with my credit card. If you don’t like traveling, manufactured spending can be a solution to earn some passive income because you can redeem travel points for cash. Or, use cash back credit cards to scale your credit card manufactured spending activities.

This gives me the flexibility to use the gift card for other things in case my conversion to money order option goes away. If you need some ideas for churning, here are some of the best credit cards to churn.

You can learn a lot about travel hacking just by enjoying travel experiences. Here are a few travel hacks from my trip to Japan.

At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. Join our community to achieve both. With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for? Escalate Your Life.

1 Comment

Thanks for explaining this all. I know a lot of people who buy gift cards ahead of time to use for Disneyland. It sounds like it’s the same concept. Same with Starbucks gift cards.