Income can be more important than net worth. I’ll highlight a few reasons why you should focus on income rather than net worth. Additionally, I’ll highlight several legitimate income opportunities to back up the claim that you shouldn’t obsess over net worth.

Legitimate Income Opportunities to Achieve Financial Freedom

Do you ever wonder what matters most between the net worth and income? Let’s me give you a scenario.

- Jerry is a financial planner, and he earns $130,000 a year but has a net worth of $50,000.

- Daisy, on the other hand, is a nurse. She makes $85,000 a year but has a net worth of $180,000.

Between the two, who has more wealth- Jerry or Daisy? You thought right. Daisy, the nurse, has more wealth since her net worth is higher compared to that of Jerry.

Their personal financial planning is clearly different compared to each other.

Is Daisy better closer to financial freedom than Jerry though? Let’s evaluate.

Does net worth matter in financial freedom?

In the journey towards achieving financial freedom, you need to find ways to increase your cash flow.

Do you ever wonder why a guy who was lucky and won a jackpot, but a few years down the line, he becomes broke?

Net worth is good, but to maintain it, you need to create a passive income from it. That means that you risk your savings or your current net worth to create income-generating investments.

Back to our Example of Income vs Net Worth

According to our example above, Daisy saves much of her income to build her net worth. If she is keeping the money in a fixed account, then it may not guarantee her financial freedom.

Jerry, on the other hand, has a lower net worth because his liabilities are more than his assets.

If Jerry is living beyond his means or is spending a lot of his income on personal assets, then it may take longer before achieving financial freedom.

However, if Jerry acquired a business loan that he intends to repay in a given period, then during the period of the loan, he has more liability than assets.

But, the business will later be such a huge asset once it starts giving him extra income.

Therefore, anything that assures your constant cash flow is better than saving the little income that you are earning now while denying yourself some crucial things in life.

If you save and fail to invest, then you will never attain financial independence because net worth remains constant.

Evaluate your financial situation with these personal finance ratios.

High net worth at the moment will not guarantee financial freedom because it can diminish easily if it’s not growing. The solution is to find ways to increase your income.

Other Considerations in Income Versus Net Worth

Income is important in a variety of ways. Not just in its comparison to net worth. I’m obsessed with net worth. Frankly, I check it every day on Personal Capital.

However, I continue to focus on income over net worth. I’m younger, so I have runway for owning assets. I need to find ways to continually reinvest cash flow into income generating and/or capital appreciation assets.

Income can help you in the following ways:

- Diversify your income reliance from day job income (no one’s job is safe)

- Provide flexibility on the timing of receipt of income (if you own a website, every day is payday!)

- Obviously, accelerate your net worth by repaying debt or invest more

How to Focus on Income that Leads to Permanent Wealth

So, what are the options to increase your income? There are several ways to increase your income. I will focus on three excellent options.

Some of the most proven, legit income opportunities include:

- Creating a residual income opportunity

- Becoming an owner in a business

- Investing in income and capital appreciation assets

Create a Residual Income Opportunity

There are many passive income opportunities that you can invest in to give you residual income. Some residual income opportunities include:

Create a website

Another income-generating investment is creating a niche blog or website. A site is an excellent passive income investment. You can make money with a website in several ways.

Some of the ways to make money with a website include promoting products as an affiliate, selling your digital products and services, sell advertising space, offering premium content, offering workshops & live training and accepting donations among others.

If you start a niche website or blog, you can scale and automate it which will assure you a regular income albeit it takes time and hard work.

I believe everyone should start a blog. Many of us already document much of our lives and interests via social media.

With Bluehost, you can start a website at anytime for only $3.95/per month using my link.

[maxbutton id=”7″ ]

Start a YouTube channel or a Podcast

Another source of residual income is having a YouTube channel or running a podcast that attracts huge traffic of people. The idea is to pick something that you are passionate about and can showcase it to an online audience.

Having a YouTube channel or a podcast can help you build an audience and then you can monetize it through ads and affiliate marketing.

Create and sell courses

Do you have something that you can teach? It could be a new idea that you want to show people, related to career, sleeping habits, parenting, weight loss and educational subjects among others.

Why not create a course online and sell it via websites such as Udemy and Teachable.

All you need to do is create the course, and then you’re done. If you market your course online, you can get residual income on a regular basis.

Write a book

Today, it’s easier than ever before to self-publish a book using platforms like Kindle publishing. You can write fiction or a non-fiction ebook, get a professional editor, have it formatted and design a good cover.

Then upload it on Amazon, market it and start making some residual cash from it. Amazon’s Createspace can also help you turn your ebook into a physical book.

The important thing is to ensure that the topic that you write about is evergreen and people will be willing to spend their money on it.

Create an app

Apps are the in thing in today’s society. Almost everything can be accessed via an app to help you with specific functionalities. You can develop an app to offer a solution to any problems that you encounter in your day-to-day dealings.

You can then put it for sale and make some good money from your invention.

If you don’t possess the technical skills to make the app, you can hire somebody else to do it for you and then market it both online and offline.

Peer-to-peer lending

You can also lend money to people. Yes, there are lots of platforms that allow you to become a bank. This is where you loan your money to people, students or businesses for different purposes.

You get a chance to set the loan terms and then collect interest. The loan period can be long up to 10 or more years.

Many P2P lending platforms allow you to spread your investment by lending to several borrowers.

This kind of diversification lets you mitigate your risk.

Some of the most popular peer-to-peer lending platforms include Lending Club, Funding Circle, and Prosper.

Become a Business Owner

You don’t necessarily need to be frugal to achieve financial freedom. Starting a business is one of the best options to help you attain financial independence faster. That means that you will need to take on the risk of starting a business, but scale and automate it to bring fixed income later.

The business can guarantee you regular income that you can use to meet your needs. In this case, the net worth does not decrease.

You can also get an opportunity to sell the businesses, and your net worth will grow even more.

So, having a business investment is one way to improve your odds of financial freedom.

Think of businesses that can have a residual income business opportunity attached to them. There’s nothing better than owning a business with recurring revenue.

Valuable Metals

Valuable metals also increase in value over time because they are rare and expensive to find. You can invest in precious metals such as gold, silver, palladium and platinum and more. Investors buy rare metals to protect them against financial crises and inflation.

Possessing precious metals is an excellent way to diversify your investment portfolio and boost your net worth. This can actually be a business opportunity for residual income as you can collect the metals for very little startup costs.

Art and Antique items

Antique and vintage items also increase in value with time. Antiques are collectible items including artwork and furniture. They grow in value because of their quality, age, and rarity. Investing in such things is ideal because you can resell them later at a steep profit and attain financial independence.

You can create a full-time business online or in-person by finding old items for resale value. This is a proven, simple way to make money.

That might make sense why you can ALWAYS find an antique store in every city?

Goods will continue to have nostalgic value to them. These are some of the best antiques to flip for a profit.

Wine

Investing in wine is another alternative form of investment. Investing in fine wine is a lucrative investment.

So if you have the funds and the knowledge of wines, you can venture in this form of alternative investment to increase your net worth and eventually become financially independent (hopefully). Here are some tips for investing in wine.

Invest in Income + Capital Appreciation Assets

Investing in capital appreciation involves investing in items whose market price value goes up with time. The asset value can increase to an extent where it is more than the amount the investor initially paid when purchasing it.

Some of the causes of capital appreciation include general trend for an increase due to macroeconomic factors such as strong Federal Reserve, or GDP, a policy like that of low-interest rates, proximity to new developments including shopping centers and schools, etc.

Some of the income AND capital appreciation assets include real estates, land, buildings, dividend growth investing and more.

Real estate

Investing in real-estate is one of the oldest and probably still the most favorite type of passive income investment.

You can tap into the residual income in real estate in ways including building houses, flipping houses for a profit, and buying of REITs among others.

Anyone can invest in real estate as well. You don’t need to have significant sums, which is where real estate crowdfunding and REITs come into play.

[table id=6 /]

Dividend growth investing

One way to increase your revenue is by investing in dividend-paying stocks that can help you earn residual income. Dividend investing guarantees regular periodic dividend payments. The investor may also purchase additional shares of stock with the dividend reinvestment option.

These stocks charge no fees for electing in their dividend reinvestment plan.

A majority of companies that make dividend payouts are mature and stable companies. Therefore, the stock price is also likely to go up with time. Thus, it will not only create residual income for you but also increase your net worth.

Stock dividend investment is an ideal residual income investment that is less volatile and can guarantee constant revenues. Since dividend-paying stocks are less volatile, it makes this type of investment appealing to both novice and experienced investors.

To buy dividend-paying stocks, you need to open a brokerage account with an online broker. The next thing is to fund the account and research the companies that pay steady dividends. In today’s age, you can open a brokerage account and get free stock just by signing up.

A lot of online stockbrokers offer investors tools to screen companies that pay dividends. You can take advantage of this to create a steady income and achieve financial freedom. Financial freedom through dividend investing is possible.

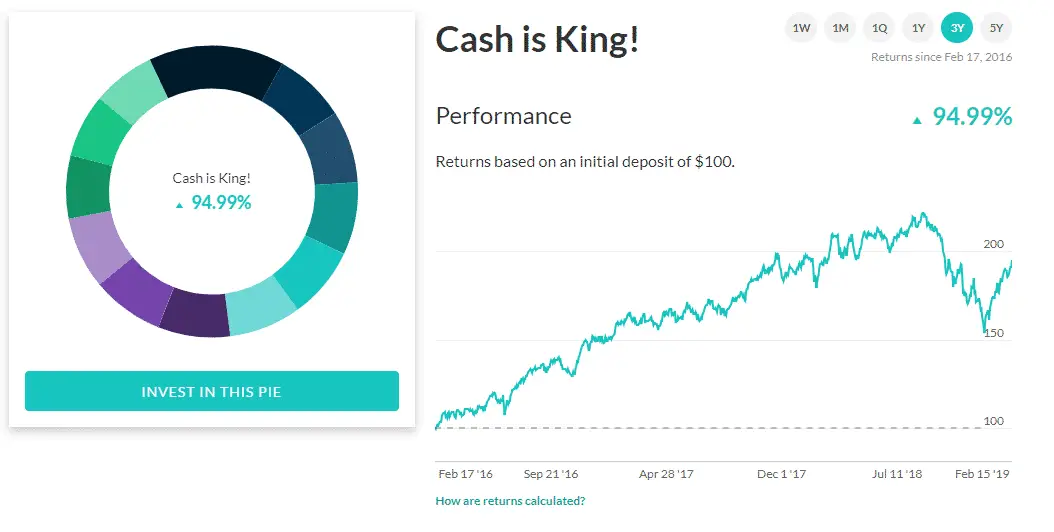

You can start investing completely free with M1 Finance. I created a dividend portfolio M1 Finance Pie that you can follow and investing in.

[maxbutton id=”1″ ]

You can download a sample of my dividend investing book if you’d like to learn more.

Conclusion on Income Opportunities

If you invest in a combination of capital appreciation and dividend or interest returns, you get a total return. Therefore, you don’t necessarily need to be a stingy saver or penny pincher to achieve financial freedom.

The best thing is to invest in something that will grow your net-worth and guarantee you constant cash flow.

What income opportunities will you pursue? Let me know in the comments below. I’d love to hear from you.

Related Resources

- Hire or get hired on these freelance platforms

- Best robo-advisors compared

- CrowdStreet review as a passive real estate income opportunity

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

No Comment