Using a stock screener is crucial for any investor that wants to conduct fundamental analysis. I think that screening for stocks is even more important when building a dividend portfolio. Here are 5 dividend stock screeners to use to build a passive income portfolio.

8 Dividend Stock Screeners to Build a Passive Income Portfolio

Stock screeners are crucial. I love them. I can use a dividend stock screener to weed out a lot of junk in the stock market. I’ve given out my exact criteria I like to use for finding undervalued dividend stocks.

There are a number of different free and paid stock screeners out there to consider. There are only a few that are truly what you need to build a successful passive dividend income portfolio.

I’m all about working smarter and not harder. Our time is valuable, so we must be efficient. At the same time, we need to spend our time focusing on the important things. Like fundamental analysis and the evaluation of a company’s financial ratios.

If you want to invest your money effectively, you’ll need to know how to read financial statements.

Millionaire Mob wrote a dividend investing book to help people get started investing.

The book is titled Dividend Investing Your Way to Financial Freedom and features a number of resources to help you invest for financial freedom, including:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

If you want a sample of the book, you can download it here.

A tool like Personal Capital can help you manage your investment exposure for free. They have a great dashboard showing your exposure by industry type.

The best stock screeners out there provide you with accurate information, functionality and ease of use. There’s no reason to use a stock screener that won’t enable you to achieve success in the stock market.

Why you need to use a stock screener for every investment

A stock screener is a must-have tool for every investor’s toolbox. Why? The stock market has a lot of noise behind it. We simply don’t know what is good or bad simply by visiting financial news sites. We need to be able to strictly look at the numbers and ratios to determine if a stock is a fit for our risk tolerance.

Stock screeners provide the following benefits:

- Opportunity to remove the ‘noise’ of the stock market

- Ability to simplify your investment strategy

- Removes emotion and allows you to find stocks that fit your risk tolerance and strategy

- Saves you time to focus on the detailed tasks like fundamental and financial analysis

A stock scanner can make or break your portfolio. Thus, you need to find the best stock scanners to help you create your dividend portfolio. From there, you should then seek out financial statement analysis by reading the Company’s financial statements.

If you ever feel overwhelmed with financial statement analysis, use our guide on how to read financial statements to help you.

List of Dividend Stock Screeners to Use to Build a Dividend Portfolio

Investing is doable by anyone. Why? These brokerages will give you free stock just for signing up.

I use Robinhood (use our link to get free stock when signing up)! Dividend stock screeners are crucial. I don’t know what it was like to not have them.

Here is a list of the best dividend stock screeners to use to create a passive dividend income portfolio.

1. FINVIZ

FINVIZ is one of the most straightforward stock screeners out there. I love the interface and their charting is perfect for a person that likes to take a look at the bigger picture.

We created a guide on how to use FINVIZ to screen for stocks. FINVIZ is a free stock screener that can take your portfolio to the next level. Pair that with their simple and easy to understand charts to help guide your entry and exit opportunities in an investment.

2. Google Finance

Google Finance is by far one of the easiest and simple ways to screen for stocks. I used to love Google Finance a lot more before they changed the interface to following stocks rather than just a static page. It’s a little harder to follow (no pun intended).

The stock screener is still completely free, so that is a great plus. Check it out if you are just getting started.

3. GuruFocus

GuruFocus is such an amazing website. I love the concept as it helped me so much generate new investment ideas. You can learn a lot by just following along with the ‘gurus’ or institutional investors in the marketplace. I like using GuruFocus to be able to screen for value investments. Then, I compare these companies with the ones that I found in my dividend stock screening criteria.

You can view their gurus under the following categories:

- Buffett-Munger Criteria

- Undervalued Criteria

- Peter Lynch Criteria

- Magic Formula (Greenblatt)

- Ben Graham (Net-Net)

It’s a value investor’s dream. GuruFocus is not a free stock screener. However, it is well worth the price. If you are putting larger pools of capital to work, I highly suggest that you subscribe to the premium platform. Their charts and analysis are industry-leading.

The intuitive dashboard, research and highly sophisticated stock screeners will blow your mind. It’s helped me immensely with my portfolio level returns.

Want to try it out? Use my link and get a free month of premium.

4. DividendStocks.Cash

I love giving credit to the new guys in the market. I was able to be a beta-tester for this screener and give my input.

DividendStocks.Cash is a great website that allows you to screen specifically for dividend growth stocks only. I love the simplicity of the site and the focus on dividend investing. It makes my life much easier.

5. Dividend.com

Dividend.com is another resource specifically catered to dividend growth investors. What is not love about that? They have one of the most robust dividend (and investing in general) sites out there. You simply can’t go wrong with their dividend screeners and articles to help you become a better dividend growth investor.

6. Finbox

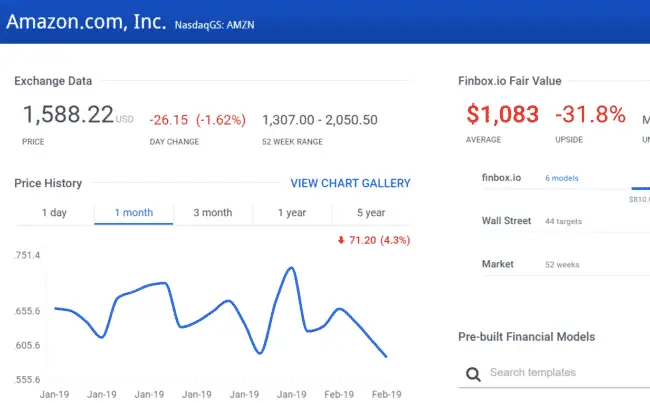

Finbox is an excellent tool for any investor. I’m actually obsessed. If I could rank these, this new tool would most likely be #1 for me. What’s better than models and screeners? This is one of the best tools that can position you for investing success from day one.

Finbox is so amazing that you get to use different plug-ins for excel, download financial models and more. They even have a live valuation monitor for each stock such as the below:

Here is how you can track Warren Buffett’s portfolio using Finbox.

7. CNBC

CNBC has a stock screener that you can use to filter down your dividend stock investment opportunities. It’s not my favorite screener of all, but it gets the job done. Plus, you’ll be able to read all of their articles to complement your screener. This can help get real-time data, which I’m not too concerned about intraday news.

8. Marketwatch

If you aren’t familiar with investing and are just getting started, MarketWatch can be a good option. I wouldn’t say that it has all the specialties a dividend investor is looking for, however.

The stock screener is pretty well organized and easy to navigate. You can filter investment opportunities using your selection of parameters such as price, volume, fundamentals, technical, and exchange and industry. MarketWatch provides key real-time data to help you narrow your search for the best investment.

Conclusion on Best Dividend Investing Stock Screeners

These dividend stock screeners can provide you with a distinct advantage over peers. Work smarter not harder. Start investing by weeding out the bad stocks that do not fit your investment criteria. From there, you will have a subset of stocks that fit your mold. Your job is not done from there.

You need to focus on how to read the true fundamentals and financial ratios to either kill the investment or conduct further due diligence. Even if you hit volatility in stocks, you can still find opportunities… Especially if you pair value investing with dividend investing.

In order to find the best dividend stock screener, choose the one that fits the following:

- Has accurate and reliable data (This is crucial! One small error can ruin an investment!)

- Specializes or has a unique perspective on dividend investing

- Has an intuitive dashboard and is not overly clunky (simplicity is key!)

My recommendation: Pair up Finbox with a free stock screener to hone in on your list. Then, try to use TradingView for charting.

You can use a tool like Motley Fool Stock Advisor to have additional investment opportunities sent to your email inbox.

Read more about the tool in my Motley Fool Stock Advisor Review.

What are the best dividend stock screeners in your opinion? Please let us know in the comment below. We’d love to hear from you.

Other Related Dividend Investing Resources:

- List of Dividend Kings to use for investing in dividend growth stocks

- How to use a 401(k) calculator to save on retirement fees

- How to build wealth through a DRIP program

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

No Comment