Are you looking for your next significant investment? Maybe you’ve recently come into some extra money and want to make it grow. Currency trading could be the right move for you to make.

Currency trading on the world’s foreign exchange market is one of the simplest ways for individuals to break into the world of investments. It’s relatively easy to learn, has less risk than many other forms of investment, and practically anyone can do it successfully.

What Exactly Is Currency Trading and How Does It Work?

Currency trading by individuals takes place 24-hours a day online at the foreign exchange market. Also, currency trading takes place at financial centers around the world, so the market is always open for traders. New York, Tokyo, Sydney, and London are a few of the main hubs. If you’re in search of a form of investment that you can micromanage on your own time, in between work and sleeping, trading currency may be right for you.

There are three main “lots” involved with currency trading. Each lot is made up of the base currency of your choice. There is the standard lot, which is 100,000 units of currency. The mini lot, which is 10,000 units of your chosen money. And last but not least, the micro lot, which is 1,000 units of base currency.

The Forex

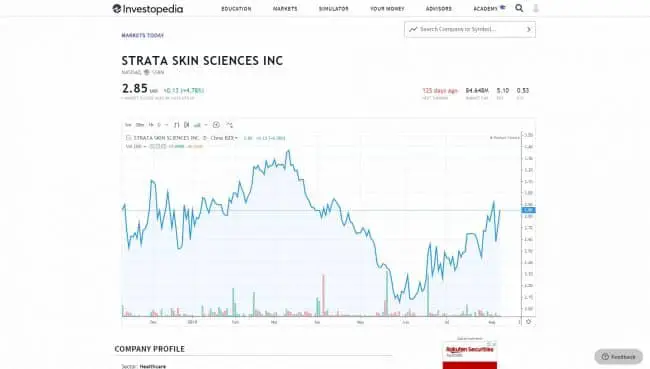

As mentioned above, currency trading takes place on the Foreign Exchange Market, also known as the Forex market, or FX for short. It is the largest market for investing in the world and continually grows every year. Several trillion dollars worth of trading currency is completed daily on the Forex market.

Image CC by 4.0, by Raksha Shanbhag, via Wikimedia Commons

Until recently most of the currency trading taking place on the FX was done by professionals. Now, with the rise of online currency trading platforms, just about anyone who is interested in trading currency can get involved.

The Forex market appears as somewhat complicated at first glance due to the level of various players and operations taking place. To give you a better idea of how trading on the Forex market works let’s take a look at the major players who’re involved.

Central banks

The central banks of the world are by far the most crucial players of trading currency on the FX. Any actions by the world’s central banks directly influence the economy of their nations. They control the market operations and set the interest rates which dictate the rise and fall of currency rates.

Other banks

Banks are one of the most significant players involved with currency trading. The livelihood of big banks depends in large part on their trading currencies on the Forex market. These banks help FX investors with their transactions as well as partake in speculative currency trading themselves.

Corporations

Large corporations and global firms that deal with importing and exporting rely on the Forex market to aid in the process of transferring goods and services.

Professional investors

To grow various funds, professional investors are a frequent participant in currency trading. Hedge fund managers are also known to partake in speculative currency trading as well.

Individual traders

In today’s world of currency trading, individual traders have become one of the biggest proponents of the FX.

The major currency pairs

Currency trading is the act of purchasing and selling one primary currency for another. These traded currencies are currency pairs. Three letters represent each type of money that is available for trade on the Forex market. The first two letters are an abbreviation of the country from which the currency originates. The third letter represents the official name of the money.

Image CC by 2.0, by Images Money, via Flickr

There are quite a few currency pairs available for trading on the Forex market. However, most professional investors and individual traders stick with the most liquid currency pairs. The four “major” currency pairs, and the three “commodity” pairs.

The top four major currency pairs

- The euro and the U.S. dollar (EUR/USD)

- The U.S. dollar and the Japanese yen (USD/JPY)

- The British pound and the U.S. dollar (GBP/USD)

- The U.S. dollar and the Swiss franc (USD/CHF)

The top three commodity currency pairs

- The AUS dollar and the U.S. dollar (AUD/USD)

- The U.S. dollar and the Canadian dollar (USD/CAD)

- The New Zealand dollar and the U.S. dollar (NZD/USD)

Only a small amount of all currency trading on the Forex market consists of currency pairs outside of these primary seven currency pairs. However, there are slightly over two dozen combinations that traders can invest in using just these seven currencies.

Understanding pips

To be successful at currency trading on the FX, one must first understand all of the basics. Pips are one of the essential pieces of information that you’ll want to learn regarding currency trading. A pip, or percentage in point, is the smallest FX trading measurement. A single pip typically accounts for one-hundredth of one percent.

Because individual traders tend to focus on micro lots for currency trading, it’s crucial to understand that one pip is roughly a ten cent move in the value of currencies. Trading in micro lots makes currency trading much less risky in the case that the trader fails to reach their desired goals.

When dealing with mini lots, a single pip equals one dollar. In a standard lot, one pip equates to ten dollars worth of currency. Certain money types move up to 100 pips at a time per trade. This investing makes losses extremely manageable for experienced traders.

Currency trading lingo

If you’re interested in getting into currency trading, you need to be familiar with the regular currency trading lingo. Here is a handful of the most critical currency trading vocabulary for you to get to know before trying your hand on the FX.

Nicknames for popular currency

- Aussie: the main nickname for the Australian dollar

- Buck, and greenback: are both nicknames for the U.S. dollar

- Cable, pound, and sterling: the nicknames for the GBP

- Kiwi: the main nickname for the New Zealand dollar

- Swissie: the primary nickname for the Swiss franc

- Little dollar, and loonie: nicknames for the Canadian dollar

Typical FX measurement lingo

- Figure: a term which indicates a round number, 1.4 for example

- Yard: a word which represents one billion units of currency

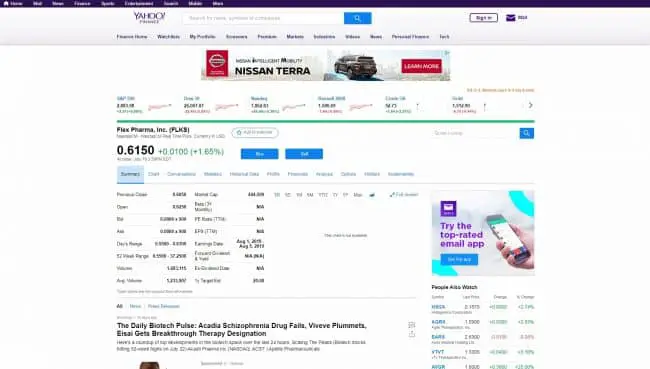

Making Money with Currency Trading

To become successful in currency trading, you must attain a certain amount of knowledge as well as exert enough willpower and have a bit of luck. With enough determination, you’ll gradually build enough experience. Generating profits from the majority of your trades will eventually become second nature.

Image CC by 2.0, by Pictures of Money, via Flickr

The best way to start currency trading is with small amounts of money. There are even demo accounts that allow you to practice trading on the FX. Watch the Forex and financial news reporting daily. Study global trends in the world’s economy and practice as many trades as possible.

Common roadblocks

There are a few common roadblocks along the way as you start with FX trading. Investing too much before learning the ropes, for instance, will shut you down before you even get going. Likewise, a common fear of losses is crippling to many individual traders as well, possibly because they are solely responsible for their financial losses. Their trading funds are also much more limited in comparison to professional investors or bankers.

On the other hand, greed is something to look out for as well. When you begin to understand the ins and outs of trading on the FX, it’s all too easy to become a bit sure of yourself and even greedy. The best way to prevent unnecessary losses due to this sort of behavior is to make yourself a hard and fast rule about how many pips you deal with each day.

Keep in mind that with any trading, whether it be stock trading, commodity trading, or trading on the FX, there will always be risk involved with such activities. You should also be fully aware of the fact that between 75 percent and 80 percent of individual traders who invest in FX currency trading end up losing money at some point or another.

So, Is Currency Trading Right for You?

That answer is entirely up to you, and factors such as your personal preferences and current life circumstances. If you feel comfortable with calculated risks, are overly confident in your ability to gauge the economics of countries around the world, and have a bit of cash to spare, Forex trading could be just the thing for you.

Don’t forget that you can always start off with FX trading risk-free by opening a demo account. Remember to study the fluctuations of the major currency pairs. Also, take full advantage of live trading on a demo account until you’re comfortable with your level of understanding.

Do you have experience with currency trading on the Forex market? Good or bad, we’d love to hear all about it in the comments section below! If not, then what are you waiting for? Get out there and learn the basics so that you can get to work building profits through FX currency trading.

Good luck!

You’re new to the world of Forex trading. You are just starting out in the Forex market. You’re learning new terms and how they relate to buying and selling in the marketplace. And, a new word pops into the picture to further confuse you. The Commodity Channel Index, or CCI. What is it? How are you going to use it as a trader?

These are all questions that beginners ask about. It may seem overwhelming at first, but luckily it’s much easier to understand than you probably think!

What is the Commodity Channel Index

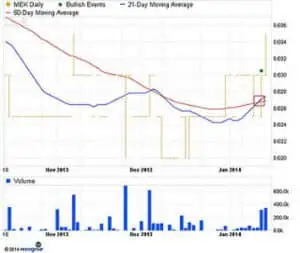

The Commodity Channel Index, or CCI, is an indicator providing technical analysis of trends in the Forex market. This indicator belongs to the oscillator group of Forex indicators. The index oscillates between levels of +/-100, with modifications to +/-200, and has a lookback period of 14-days. When CCI rises or dips below the 100 (or 200) level, this indicates over buying or selling is occurring.

The CCI is a standard indicator for Forex traders, meaning they don’t have to download it on different platforms. It comes standard on different trading platforms. The oscillator measures momentum in the Forex market. In trading, momentum refers to a security’s price. It indicates whether the rising or falling of that price will continue in the same direction. The Commodity Channel Index calculates and depicts the rate at which prices are rising or falling. And, it indicates if that price will continue to rise or fall, for a set period.

How to Use the Commodity Channel Index

The commodity price index relies on a basic formula, shown in the picture below.

CCI measures relations between prices and Moving Averages (MA), and the deviations in those prices. The first step in using the CCI is to set the time interval for calculating averages.

In most trading platforms, the Commodity Channel Index comes standard. It eliminates the need to calculate the MA manually. Traders can use the tool to help determine deviations in the price of an asset. It can help traders see if prices will fall or rise, given recent trends. The calculations rely on a time interval set. It gives specific parameters traders can use safely. They can use this information to decide if it is time to buy, sell, or wait on an investment decision.

The CCI will provide more buy and sell signals for active traders. Traders can also use the CCI to measure the strength of a market trend. The indicator can also warn traders of extreme market conditions which are taking place in the Forex marketplace.

The Commodity Channel Index isn’t an exact answer to trading questions. It doesn’t provide a 100 percent guide of when assets are overbuying or overselling (OB/OS). Instead, it provides traders with information about trends. These trends circulate depending on the time frame traders choose to input in the indicator formula. The CCI is a tool, not a precise science. It is ideal for traders who want to learn fundamental market trends and to make the right decision moving forward.

Problems with the Commodity Channel Index

There are also problems with the Commodity Channel Index worth noting. Traders who rely solely on CCI charts, and don’t use other indicators, will be at a disadvantage. Some issues with the commodity channel indicator may include:

- False signal readings, since they are predictions, not exact fluctuations

- Buy and sell signals can be too high/low (depending on +/- 100 or 200 settings)

- It can over or underestimate profits and losses

- It utilizes a time frame, set by the trader, rather than exact timing parameters

- Beginner and novice traders might not know how to read indicators, causing false readings and errors properly

Like any indicator, the Commodity Channel Index is just that — an indicator. It is not going to provide 100 percent accuracy and can make incorrect predictions like other trading tools. And, it also varies given external market conditions that the indicator doesn’t account for in Forex. So, as a trader, it’s important to understand there are flaws in the system.

Benefits of the Index, in Spite of Its Flaws

The above section details some of the issues with the Commodity Channel Index. Don’t move so quickly in throwing it aside when choosing indicators and tools to help you as a trader. There are also many benefits to consider, that the CCI presents to traders. In addition to indicating trends, it also allows traders to set the parameters. Doing this can provide a big picture or small picture depiction of market trends in the Forex marketplace.

It is also a great supporting tool. Like other graphs, charts, and calculators, it supports traders in the decision-making process. It helps them visualize buying and selling patterns, for a set period. Traders can also rely on this tool to identify a divergence in the charts. The indicator also helps determine overbuying and overselling that’s occurring with specific assets. It’s also an excellent tool for calculating moving averages and other Forex strategies traders develop.

As long as traders use it wisely, and as a helping tool, they’re going to benefit from the CCI. It can also provide invaluable insight into other trends in the market. And, when traders use it with other indicators, they have a larger picture to help them make wise decisions.

Pivot points also work well with the CCI. The reason for this is because both methods rely on turning points in market trends. Adding moving averages will further enhance the benefits of these three tools. There’s no shortage of ways to use CCI and Forex indicators. As long as traders correctly read them and know their limits, they can benefit from these tools greatly.

Basic Rules of the Commodity Channel Index

When using the CCI, traders must understand the basic rules as it relates to buy and sell indicators. The Commodity Channel Index serves as a baseline of recent fluctuations in the market. So, it will provide current over and under buying or selling of assets. These are some factors to keep in mind when using the buy and sell indicators the CCI presents.

Buy indicators

The Commodity Channel Index provides traders details about buying a specific asset. For example, if the CCI indicator dips below -100, and begins curving upwards, this is a positive indicator. This indication means the price levels are steadying out for a specific asset. If a bullish divergence occurs, this is also a buy indicator. A bullish divergence occurs when an upward movement in CCI occurs. This divergence happens while prices of an asset remain the same or move downward on the indicator graphs.

Again, this information isn’t a 100 percent guarantee that people should jump in and buy an asset. However, the trends indicate that the asset is moving in an upward direction, and may result in positive gains.

Sell indicators

There are also sell indicators a trader should familiarize themselves with when dealing with the Commodity Channel Index The first sell indicator is if the CCI crosses above 100, and begins to take a downward curve. In this case, it may be an indication that the price of the asset is going to continue to drop.

A second sell indicator is when a bearish divergence is visible in the Commodity Channel Index graph. A bearish divergence occurs when the price between the CCI and actual price movement, are on a downward trend. The downward shift in the CCI and the cost of the asset increasing or moving sideways is a contrary indicator. It possibly means a trader should sell the asset, rather than hold onto it.

Benefits of Utilizing the Commodity Channel Index as a Trader

As the name implies, the commodity channel indicator is an indicator. It indicates to traders whether they should buy, sell, or hold onto an asset. It provides traders with details about previous market trends, given a period the trader enters into the CCI formula. The CCI can also produce insightful information about fluctuations in overbuying and overselling in the Forex market. It is, however, an indicator, and shouldn’t be the sole source a trader utilizes, to make their decisions.

Bearing this in mind, traders can significantly benefit from reliance on the commodity channel indicator. It is one of the many tools a trader should keep in their arsenal of trading indicators and calculators. It comes standard on most trading platforms. And, it is a tool investment professional, as well as traders with more experience, rely upon for trend indications. So, as a beginner trader, you can also depend on it as a tool for predicting market trends. This information helps you make insightful decisions, given recent trends for specific assets you’re comparing. As long as traders use it accordingly, the CCI provides invaluable details. It serves as a guide of when and how traders should act when dealing with specific assets.

Understanding the basics of the CCI is the starting point for incorporating it into your trading toolbox. These are a few of the reasons to use the CCI. You can rely on the data points as a guide for buying and selling assets in Forex.

Featured Image: CC by 2.0, by Adam Greene, via Flickr

If you’ve been looking for funding options for bad credit, you’ve probably come across Fortiva MasterCard. According to their website, this MasterCard is what you need. They say it will help you improve your credit or access funds without any hassle despite your less-than-perfect credit. But is it worth it? Only a Fortiva credit card review can answer that question.

You see, service providers will go to great lengths to market their products and make them as attractive as possible to their target audience. Fortiva is no different.

So don’t just take their word for it. Go through a Fortiva credit card review or two to understand what you’re getting yourself into. You’ll be glad you did.

Build credit to save money over the long-term.

About Fortiva Credit Card

Fortiva is a product of Atlanticus (a holding company that invests in financial services) that bills itself as a less-than-prime card. What this means is that they offer credit cards to people with subpar credit.

However, the Bank of Missouri issues the Fortiva credit cards. Therefore, if you decide to take the MasterCard, you’ll get the card from the Bank of Missouri, but you’ll work with Atlanticus to manage it.

The Fortiva credit card is one of the three products you can get from Fortiva. The other two are the personal financing loans and retail credit lines. But we’re not going to cover those in this Fortiva credit card review.

Who is the Fortiva credit card for?

The Fortiva credit card is most suitable for individuals who have a bad credit history. Lenders shy away from lending to individuals with subprime credit for obvious reasons, which is why products like Fortiva MasterCard exist.

However, if your issue is that you have zero credit history, we wouldn’t recommend Fortiva credit card. You’d be better off building your credit to a level that allows you to take advantage of better options.

Payments

Fortiva also offers hassle-free payment methods. The first option you have is to make payments through their account management platform that’s accessible through the app or online.

You can also set up autopay, which allows Fortiva to debit the amount from your bank account. In addition to this, you can use pay-by-phone, online payment services, and check or certified money order through the mail.

Online account management

In this day and age, no one has the time to stand at a bank when they need to make payments or get account statements. Fortiva offers its users a hassle-free online account management experience.

From their online platform, you can access your statements, make payments, receive alerts, and so much more. And the best part? You can also access the platform on your phone through their app that’s on both the Apple Store and Google Play Store.

No security deposit required

In some cases, credit card issuers protect themselves by providing secured credit cards to people with bad credit. A secured credit card requires you to pay a cash security deposit as a down payment before you start using the card.

The downpayment is often equal to your credit limit. If you don’t pay your credit, the credit card issuer can get back their money by taking your deposit.

However, if you manage to make all payments and close your account, you get to keep your deposit.

Fortiva credit card is different; they don’t require any security deposit. As soon as you’ve qualified for the card and received it, you can start spending — a feature that sets it apart from other bad credit funding options.

Fraud liability

Fortiva credit card also provides $0 fraud liability, which means you won’t be responsible for any charges incurred on the card due to fraudulent activities.

However, while this seems like an impressive feature, it’s not. The majority of credit card issuers thoroughly protect their customers from fraud. Besides, credit card issuers can only hold you accountable for $50 of fraudulent activities regardless of the charges incurred.

Annual Percentage Rates (APR)

APR is a yearly representation of your interest rate. In most cases, credit card issuers offer a grace period for your first purchases. If you buy something and pay the amount due at the end of the month, you won’t be required to pay any interest.

However, if you decide to carry it forward, you have to pay interest on the outstanding balance. It’s this interest rate that makes some credit cards unbearable. When it’s too high, you’ll get even deeper into debt within no time.

Therefore, it’s crucial to choose a credit card with a favorable APR. Unfortunately, Fortiva is not one of them. This credit card has an APR of 29.99 percent that can easily go up to 36 percent.

With such an APR, missing only one payment is all it takes to get into an even worse financial situation. So think about this before you decide to get a Fortiva credit card.

Fees

Apart from the APR, it’s also essential to know the costs you’ll incur while using the credit card.

Fortiva doesn’t hold back when it comes to charging their credit card customers. If you thought this credit card was the answer to your financial problems, the fees may change your mind.

In the first year, you’ll be required to pay an annual fee of up to $175, and up to $49 for the subsequent years. And that’s not all. You’ll also have to pay transaction fees, program fees, maintenance fees, and balance transfer fees.

To add salt to injury, if you delay payment or it bounces, you’ll be required to pay a $36 fee. And let’s not forget the costs you incur if you request cash advances.

Fortiva is marketed as an excellent choice for people who have bad credit and can’t afford security deposits. However, this credit card has a way of draining all your accounts dry.

How to apply

So how do you apply for the Fortiva credit card and hopefully improve your credit? Unfortunately, you can’t just apply for this MasterCard.

The company must approve your request first. Once your application is approved, you’ll receive an invitation email. Go to the Fortiva website and respond to the offer to get the card.

How We Reviewed

So far, you’ve probably noticed several advantages and disadvantages of the Fortiva credit card. But chances are you’re still not sure whether or not it’s the best option for you.

Lucky for you, we’re here to help. We scoured the internet for expert and user reviews to help you make a more informed decision. What’s more, we analyzed this MasterCard’s features and compared it to some of the top options in the market to find out if it’s really the best deal on the table.

We have no doubt you’ll be confident in your decision after reading this Fortiva credit card review. Are you ready? We’re going to jump right in.

Fortiva Credit Card Review: Our Take

After extensive research, we managed to come with several pros and cons of the Fortiva credit card we think you should know. Here’s what we found.

What we like

One of the benefits of Fortiva credit card is the fact that it doesn’t require any security. This feature is excellent if you’re trying to pick yourself up from rock bottom.

We also love that they offer credit to people with bad credit, which is hard to come by.

Another noteworthy benefit is that Fortiva gives you access to Free VantageScore 3.0. This feature allows you to keep track of how your credit score is doing and see what other credit issuers see when they look at your information.

Besides, Fortiva reports to credit bureaus like Experian, Equifax, and Transunion. Therefore, if you maintain good credit habits, you may end up improving your credit score by a lot.

What we didn’t like

One of the downsides of using the Fortiva credit card is that you won’t enjoy any rewards. Most credit card offer rewards for purchases made, which you can use to pay off some bills or get more stuff.

Fortiva credit card fees are also quite high compared to other credit cards. For instance, their late payment fee of $38 is very high. Although the Fortiva late fees fall within the maximum credit card fee range of $28 to $39, it’s still on the higher side compared to most credit card providers.

Furthermore, the majority of financial institutions only charge up to $39 when you’ve been late for two or more months in 6 months.

And this is just the late fees. The annual fees are on a different level. Considering some financial institutions don’t charge annual fees for credit cards, this is enough reason to stay away from Fortiva credit card.

We also don’t like that there are no card limit increases or upgrades with Fortiva.

Fortiva Credit Card Review: How Does It Stack up to the Competition?

If you’re not impressed with Fortiva credit card, you’re probably wondering if there are other alternatives you should consider. The answer is yes.

Here are some excellent Fortiva credit card alternatives.

Capital One Secured MasterCard

Capital One Secured MasterCard is an excellent choice for people with poor credit. Unlike Fortiva, this card does not include annual fees. However, they require you to pay a deposit of either $49, $99, or $200, to get your initial $200.

If you decide to close the account and you don’t have any pending payments, the deposit will be refunded back to you.

Another thing that makes Capital One a better alternative is that you get a limit increment if you make your payments on time for five months consistently.

This card has an APR of 24.99 percent, which is still high. But compared to Fortiva, it’s more affordable.

Discover it Secured

Similar to Credit One Secured MasterCard, Discover it Secured requires you to pay a deposit before they allow you to use the card. You’re required to pay $200 upfront.

Discover credit card does not include annual fees. Also, you get to earn two percent back on gas station and restaurant expenditures, and up to $1,000 each for every quarter. How amazing is that?

And that’s not all. If you manage to make all your payments on time, the company will start considering you for an unsecured credit card. Discover offers an APR of 24.74 percent, which is a good deal compared to Fortiva.

Nonetheless, you still need to be careful about carrying balances forward.

Indigo Platinum MasterCard

Indigo Platinum MasterCard is quite similar to Fortiva credit card. However, several things make this card stand out.

For starters, it has a lower initial annual fee compared to Fortiva. They require you to pay $75 in the first year. However, the cost for subsequent years is quite high ($99).

Indigo also has a lower APR of 24.90 percent, but their late payment fees go up to $39.

So, when it comes to choosing between Indigo and Fortiva, your primary concern should be which one is most affordable because they basically offer the same things.

Fortiva Credit Card Review: Yay or Nay

Based on our findings, we wouldn’t recommend Fortiva credit card. The card has some outrageous fees that we believe would only pull you deeper into financial troubles, which is definitely not what you want.

Think about it. If you already have bad credit, taking a credit card you can barely manage to maintain will only make your credit worse. It’s really not worth it.

Not to mention, customers have complained about poor customer service. So apart from accumulating even more debt, you won’t enjoy using the card. Why put yourself through that? Don’t use this card unless you don’t have any other choice.

Have you used the Fortiva credit card before? Would you recommend it? Please share your experience with us in the comments section. It’s always a joy to hear from our readers.

It’s a question few know the answer to, but many ponder: What’s the difference between a credit union and a bank? On the surface, both types of organizations seem to do the same thing. You give them your money and, when you need it again, they give it back.

Both credit unions and banks also offer other perks and services. You can turn to either institution when you find yourself in need of a mortgage or auto loan. You can also earn interest on any money you have tucked away in a savings account.

So, with all these similarities, what really is the difference between a credit union and a bank?

What Is a Credit Union?

Choosing which bank to trust with your money is never easy. But you also need to ask yourself one other question: Why not “bank” with a credit union instead?

Before you can decide which establishment is right for you, you first need to learn the difference between a credit union and a bank.

So, when you bank with a credit union, you’re not just a customer. That’s right. You’re also a co-owner. And that doesn’t just mean you get the privilege of a fancy title, either.

Because there are no shareholders expecting dividends and returns on their investments, all proceeds go right back into the credit union. That also means that all members have the right to vote on how this money is reinvested back into the credit union.

Most of the time, that translates into lower fees, higher interest on savings accounts, and other valuable benefits.

Credit Unions are Cooperative

Are you wondering how a credit union operates without an owner or investors? It’s actually quite simple.

You see, credit unions do have investors (just not in the same sense as a traditional bank). By investing their own money, normally in the form of a minimum savings account deposit, a credit union’s members act as the investors.

If you like, you can invest more than just your money into your chosen credit union. Members can run for appointment to the board of directors of their credit union, giving them even greater say over how the union invests its earnings.

Whether you invest a little or a lot, in the end, a credit union is built on cooperation.

image via Pexels

Credit Unions are an Identity

One other significant difference between a credit union and a bank is that most credit unions only serve certain people. On the other hand, banks will take almost anyone as a customer.

While credit unions offer an opportunity for all members to own a share of their banking institution, that doesn’t mean just anyone can join. Instead, most credit unions have a certain set of membership criteria that must be met.

For example, some credit unions only accept members who live within a certain area. Others, though, may only accept members who work within a specific profession.

In many cases, these limitations actually benefit credit union members by narrowing the scope of the union and how it invests its resources. When everyone shares a common interest, earnings and other resources can be used more effectively.

The Birth of the Co-op and the First Credit Union

To really understand the difference between a credit union and a bank, we need to take a step back in time to the very first credit union. For that, we need to visit the end of the 19th Century.

During the late-1800s, the cooperative movement was all the rage in Europe. This movement started when a group of gentlemen opened a cooperative store in Rochdale, England.

The store sold normal things like butter, milk, and eggs. But one key fact made it different than any other store of the time: instead of one owner, the store was owned by a “cooperative” of co-owners.

And this trend didn’t end with grocers and other retail stores. In 1864, the first modern credit union opened in Cologne, Germany.

image via Pexels

It wouldn’t take long for this idea to jump across the pond, either. In 1909, a credit union opened stateside in New Hampshire. Then, 10 years later, Massachusetts formally recognized credit unions and wrote legislation providing a framework for them to operate.

Shortly after, credit unions gained considerable favor when the Great Depression destroyed the trust most citizens had in traditional banks. While banks collapsed under the recession, credit unions remained relatively untouched by the economic collapse, and people turned to them in droves.

Today, the National Credit Union Administration oversees one hundred million credit union accounts within the United States. That adds up to one account for almost a third of the country’s residents!

What You Really Need to Know About the Difference Between a Credit Union and a Bank

Clearly, credit unions and banks share very little when it comes to their histories and guiding principles. In modern times, though, what is the practical difference between a credit union and a bank?

Ultimately, it boils down to how profits are created and used. However, the subtle differences between being a customer and a member can also have a major impact on your banking experience and long-term financial goals.

If you’re unsure which of these financial institutions is right for you, here are the factors to consider before making a decision:

Show Me the Money

Have you heard the saying, “Follow the money?” You probably have at some point in your life.

When it comes to understanding the difference between a credit union and a bank, you need to follow the money. Or, more specifically, how the money is handled. After all, these two institutions manage your money and make money for themselves in vastly different ways.

Let’s start with traditional banks:

Traditional banks are privately-held, for-profit ventures. In other words, banks exist almost exclusively to make a profit for their owner or shareholders. But how do they accomplish this goal?

Most of these earnings come from financial services, both for individuals and for businesses, offered by the bank.

Anytime you pay a fee or are charged interest by your bank, this money goes into the bank’s earnings. From overdraft fees to paying interest on a credit card, there are countless ways banks profit from their customers.

Now, let’s turn our attention to credit unions:

Since credit unions don’t strive to make a profit in the first place, there’s little motivation to charge high fees for basic services.

Of course, credit unions still need to bring in some earnings. If they don’t, there’s no way to pay the employees or cover the cost of their building. With that said, credit unions don’t feel the same pressure to maximize earnings from an owner or shareholder.

While no two institutions are alike, it’s easy to see why credit unions seem to care more about their customers than most banks.

image via Pexels

Jump in the Deep End

The next key difference between a credit union and a bank has to do with how your money gets managed.

At a traditional bank, your money effectively becomes the bank’s money. When you deposit money into a checking or other type of account, the bank turns around and invests that money themselves (in most cases, making a profit). When you later withdraw your money, it comes from a pooled reserve the bank keeps on hand.

If you paid attention during class when learning about the Great Depression, you might remember something called a “run.” So, what is a run? And what happens if there’s a run on your bank?

Since banks invest the money deposited by their customers, banks don’t technically have access to all of this money at once.

If most of the bank’s customers attempt to withdraw all their money at once, a bank run occurs. When this happens, the bank in question often closes down — whether the customers actually get their money is another question entirely.

A bank run might seem like something that only happened in the early 20th Century. But, in fact, this has recently occurred in both Greece and Venezuela.

Service with a Smile

Another major difference between a credit union and a bank is the quality of service. Since credit unions aren’t driven by profitability, many credit unions spend more on their employees than some banks.

In fact, according to a 2018 study of banking customers, 92 percent of credit union members said they were “very satisfied” with their experience.

Of course, many banks offer acceptable customer service. And some credit unions likely offer some pretty terrible service. But, in general, credit unions tend to reign supreme in this regard.

image via Pexels

Location, Location, Location

During your time learning about the difference between a credit union and a bank, you might think things are looking pretty strong in the credit unions’ favor. But there is one key area where banks come out ahead.

When you do business with a traditional bank, especially a regional or national chain, you’ll likely find branches all over the place. It’s not always that easy when you bank with a credit union.

Many credit unions have a very limited number of branches (some even only have one!). That isn’t a big deal when you’re home, but it can definitely turn traveling into a logistical nightmare.

Some credit unions have banded together to offer an extended network to their members. If your chosen credit union is a member of a shared branching network, you can visit any participating branch around the country.

Still, this isn’t as convenient as a national banking chain like Wells Fargo.

Choose the Financial Solution That’s Right for You

So which is better for you, a credit union or a bank?

When looking at the difference between a credit union and a bank, it may seem like credit unions are always the best choice. But if you travel often or like the flexibility of being able to find a branch almost anywhere, a large bank might be better.

That being said, many people prefer the approachability of a credit union to a traditional bank.

Whether you need a mortgage, to invest, or simple day-to-day banking, many credit unions offer more than a regular bank. In the end, though, the choice is entirely up to you.

Do you currently use a traditional bank or a credit union? Let us know your experiences in the comments below!

What’s the first thing that comes to mind when you think about retirement? If you’re a teenager or in your early 20s, you probably think you’re too young to think about that. And if you’re in your 50s, it’s more clear that you need to start thinking about retirement. According to the best retirement books, you’re never too young to think about retirement and the good news is, it’s never too late to start!

Thinking about retirement can be scary, especially if you haven’t taken the necessary steps to finance your life after retiring. But imagining the worst-case scenario won’t help you one bit.

How about reading the best retirement books to learn how to build a happy and financially secure life after retirement?

Image via Pixabay

How to Choose the Best Retirement Books

There are a plethora of retirement books on the market today, which makes identifying the best retirement books a challenge. However, if you know what to look for, finding one for your needs will be a walk in the park. So let’s find out some of the things you should consider.

It doesn’t have to be boring

The majority of people believe retirement books are filled with investment jargon and endless pages of boring stuff you won’t understand without a degree in finance. But that’s not the case.

Many retirement books employ an engaging and fun tone that keeps you turning the pages while learning important stuff. So don’t waste your time on a book that puts you to sleep within the first pages. At that rate, you’ll retire before finishing the book, and we wouldn’t want that!

How close are you to retirement?

Apart from choosing an exciting book, it’s also essential to consider how close you are to retirement. Young adults have the luxury of time and can, therefore, take advantage of compound interest and take more risks.

Older investors, on the other hand, can’t afford to risk their money in risky investments. They have to take calculated risks to ensure their money is safe in the long run.

For this reason, make sure you choose the best retirement books that address where you are in life. And avoid books that provide a one-size-fits-all approach because they’ll most probably not work.

Spotting scams

An honest retirement book will tell you that retirement planning is a long and intense process that requires discipline and patience. However, not all retirement books are reliable or honest.

Some investment “gurus” will try to sell you on the idea that it’s possible to retire in only five years and become the next Bill Gates without doing much. Be wary of such books because they’ll only mislead you and waste your time.

Relevance

It’s also crucial to rely on up-to-date investment advice. If your grandparents read the investment book you’re considering, there’s a high chance you won’t benefit a lot from the book because it contains outdated information.

Go for recent books that take into account current changes in the market, using technology for savvy investments, and other factors that may affect your financial security.

How We Reviewed

We’re big on having a happy and financially secure retirement. And we’d like you to enjoy a similar experience in your retirement as well.

We, therefore, scoured the internet in search of the best retirement books to get you started on your path to financial freedom. We considered the best sellers, the top-rated books by readers, and the most recommended books by finance experts. And we didn’t stop there.

We also took the time to find out what each book has to offer to know if they would be helpful in your retirement journey.

Top 10 Life-Changing Retirement Books

After a thorough evaluation, we managed to come up with 10 of the best retirement books for the money. Whether you’re a young adult or approaching retirement, we’re confident you’ll find the lessons in these books life-changing. So let’s dive right in.

1. How to Retire with Enough Money

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/How-Retire-Enough-Money-Know/dp/0761186131/” ]

Most people in their pre-retirement stage have poor saving and spending habits. In fact, the majority of people live from paycheck to paycheck. And the sad part is, they don’t know how it happens.

And that’s why we love this book. In this book, Teresa Ghilarducci, an economics professor and retirements savings specialist, explores the different reasons why people have a hard time saving and breaking bad spending habits.

She also gives you a simple guide on how to take control of your finances and plan for retirement without losing your hard-earned money on expensive financial planning services.

If you want to retire with enough money, this is the book to get. Buyers rated it 4.1 out of 5.0 stars.

2. How To Retire Happy, Wild, and Free

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Years-Before-You-Retire-Retirement/dp/144056972X/” ]

Retirement seems like a magical time. You don’t have to wake up at insane hours of the morning to go to work, raise any kids, or stay up all night responding to work emails.

But the magic disappears very fast, and you may begin feeling like your life no longer has a purpose.

It’s for this reason that many people dread retirement. If you’re sailing in the same boat, you’ll love this Ernie J. Zelinski book.

Unlike most authors who focus mainly on saving and investments for retirement, Ernie drops some wisdom on equally important stuff like how to follow your dreams and live to the fullest in your retirement.

He also teaches you how to invest your money intelligently, so that you won’t need millions to secure your future.

Amazon buyers can’t stop raving about this book. They rated it 4.3 out of 5.0 stars.

3. The 5 Years Before You Retire: Retirement Planning When You Need It the Most

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Years-Before-You-Retire-Retirement/dp/144056972X/” ]

Five years before retirement is, without a doubt, the ultimate crunch time. You’ve got five years to get it right, or you’re screwed.

Emily Guy Birken is the author that comes just in time. She gives you practical advice that you can implement in only five years to secure a happy and secure life after retirement.

The author explains how to make wise family, medical, and financial decisions as you approach retirement. She also emphasizes the importance of taking advantage of real estate and 401K retirement plans at this stage of your life.

If you’re currently dreading your retirement because you’re not well prepared, this book will give you the confidence you need. Buyers have attested to its effectiveness. They gave it a rating of 4.3 out of 5.0 stars.

4. How to Retire Happy, Fourth Edition: The 12 Most Important Decisions You Must Make Before You Retire

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/How-Retire-Happy-Fourth-Important/dp/0071800697/” ]

They say experience is the best teacher, and Stan Hinden uses his own to share the approach that worked for him in creating a happy retirement life.

This book is easy to understand and offers practical tips on financial planning for retirement and other important information like how to maintain emotional and mental health.

Amazon buyers believe this is one of the best retirement books you can read. They rated it 4.2 out of 5.0 stars.

5. The Total Money Makeover: A Proven Plan for Financial Fitness

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Total-Money-Makeover-Classic-Financial/dp/1595555277/” ]

If you’re looking at your credit card and student loans and thinking there’s no way you’re ever going to achieve financial freedom, this is the book for you. It’s written by Dave Ramsey, one of the most recognized names in investing and finance.

Dave emphasizes one thing, stop bad spending habits, pay off your debts, and start saving for the future.

He teaches you practical steps to getting out of debt and gaining financial freedom. And the best part is that there’s no finance jargon involved and you don’t need you to be an expert to do it.

If you want to get out of debt before thinking about your retirement goals, you’ll find this book very informative and useful. Buyers gave it a rating of 4.7 out of 5.0 stars.

6. Women’s Worth: Finding Your Financial Confidence

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Womens-Worth-Financial-Confidence-Hardcover/dp/B010CLS8AK/” ]

Women have it harder than men when it comes to attaining financial freedom. From the challenges of having to leave work to raise their kids to getting lower salaries compared to men, the journey can seem impossible.

Eleanor Blayney comes to your rescue with incredible tips that help women take control of their finances and catch up with their retirement goals.

She maintains an empathetic tone while encouraging you to go for your goals because it’s within your power to do it.

If you’re a woman who’s currently overwhelmed by your finances and don’t know how to build a happy life in retirement, you won’t want to put this book down. Buyers say it’s a page-turner. They rated it 5.0 out of 5.0 stars.

7. Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Your-Money-Life-Transforming-Relationship/dp/0143115766/” ]

If you’re looking for a fun and engaging read that will inspire you to make a difference, Your Money or Your Life by Vicki Robin will live up to your expectations.

This book offers broad-based financial advice and is, without a doubt, a fantastic read. It focuses on helping the reader to adjust their priorities by focusing their energy on what matters most, investing money in appreciating assets.

We also love that the book has charts, photos, and graphs that help drive the points home even more clearly.

It’s comprehensive and a perfect companion for a new investor. Amazon customers rated it 4.3 out of 5.0 stars.

8. The Smartest Retirement Book You’ll Ever Read

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Smartest-Retirement-Book-Youll-Dreams/dp/0399536345/” ]

We’ve all come across books with such titles. They talk a big game but fail to deliver. But this book is different. It lives up to its title.

Daniel R. Solin uses simple language to explain different ways to live a happy retirement life.

From teaching you how to avoid common investment scams to guiding you on how to ensure your money lives longer than your lifetime, this author drops some gems of advice you’ll always remember.

It’s among the best retirement books for beginners who know nothing about retirement planning. It will help you evaluate and understand suggestions given by your financial planners.

Amazon buyers can’t stop raving about this book. They rated it 4.2 out of 5.0 stars.

9. Winning at Retirement: A Guide to Health, Wealth, and Purpose in the Best Years of Your Life

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Winning-Retirement-Health-Wealth-Purpose-ebook/dp/B07HL7VZFH/” ]

This book is among the best retirement books that take a modern approach when it comes to retirement planning. Patrick Foley and Kristin Hillsley teach you how to take advantage of technology, TED talks, and other resources at your fingertips to plan for your retirement.

The authors are entertaining, inspirational, and practical, and what makes them stand out is that they touch on other areas of retirement, such as health and ways to make the most of your retirement years.

You won’t be dreading retirement after reading this book. Amazon gave it a rating of 4.2 out of 5.0 stars.

10. How to Make Your Money Last: The Indispensable Retirement Guide

Image via Amazon

[maxbutton id=”8″ url=”https://www.amazon.com/Make-Your-Money-Last-Indispensable/dp/1476743770/” ]

For most people, trying to make money last longer in retirement is like eating soup with a fork — impossible. If you feel the same, this book by Jane Bryant Quinn will give you hope for the days to come.

Jane takes a different approach. She teaches you how to keep your pot overflowing in retirement. From investing, taking advantage of social security, and lessons on how to grow your money, this book will give you confidence in your retirement years.

Amazon buyers recommend it as one of the best retirement books. They gave it a rating of 4.7 out of 5.0 stars.

The Time Is Now

Image via Pixabay

Retirement seems so far, especially when you’re starting your career. But it’s at this time that you should be thinking about retirement planning. When you start early, you’re in a better position to take significant risks, and more likely to make a fortune.

But as we said, it’s never too late to start. So don’t waste any more time, get one of the best investment books on this list and build a great retirement life.

Have you read any of these retirement books? Were they helpful, and would you recommend them? Please share your thoughts and views in the comments section below. We’d love to hear from you.

Featured Image via Pixabay

When it comes to managing your finances, you have to understand the question, “what is the opportunity cost of an investment?” This consideration allows you to assess the attractiveness of an investment better.

So what is the opportunity cost of an investment? Opportunity cost is simply the required sacrifice in achieving some gain. For example, a part-time student worker faces the decision of whether to work or study. If the student worker chooses to study, they must forego the benefits of working for this time. So the opportunity cost of studying is the amount of lost wages they could have earned while working for this time.

As another example, imagine you’re making the decision between purchasing two different drinks. The opportunity cost is the lost opportunity at whichever drink you do not pick.

The opportunity cost of an investment works the same way. It represents the value of other investment options available. Investing today is a complex minefield that requires careful decision making. So, there are many additional factors we must consider in determining the opportunity cost of an investment.

What Is The Opportunity Cost Of An Investment?

Opportunity cost is the benefit that an investor or business doesn’t acquire when choosing one investment over another. You usually won’t find the opportunity cost of an investment in the financial reports. However, it’s still crucial to know so you can make better decisions when presented with multiple options.

Ask yourself if your money and time would be better off somewhere else. International finance can be extremely volatile, and you need to keep constantly aware of emerging trends. So, it’s essential to not only examine individual investment decisions based on their own merits but also to consider alternatives to the opportunity in question as well.

This perspective entails a higher degree of risk due to the dynamic nature of markets. It can be difficult to compare investment options, so the risk is an inherent factor in opportunity cost.

Opportunity cost vs. risk

While these terms closely relate, risk and opportunity cost feature key differences. Risk is “the potential drawback from a business or investment decision.” On the other hand, opportunity cost covers the gain and disadvantages you can reap from an investment. So risk involves an element of surprise, while opportunity cost features aspects of sacrifice.

Image by pixabay

Looking at investments

When comparing your potential investments, you have to factor in its profitability. By looking at the option that will give you the highest return, you should be successful. However, this isn’t all you should keep in mind.

As a business-minded person with a set amount of money, you must choose between investing your funds in a new venture or buying new equipment. Whichever option you choose, the potential profit you miss by not investing in the other choice is the opportunity cost. And this idea is essential when considering an investment.

Image by pixabay

Examples of opportunity cost

What is the opportunity cost of investment? To make this principle easy to comprehend, you have to apply it in real life. Think of a building owner who decides to invest $10,000 by building a convenience store on the second floor of his building. The opportunity cost of this business decision is that he will no longer get income by renting this space out for as office space.

This concept isn’t only applicable to investments. It also applies to business decisions. Let’s say a farmer chooses to plant mango seedlings on a particular patch of land. As a result, the space and money spent on seedlings can no longer serve to grow other crops such as tomatoes or coconuts. The opportunity cost of growing mangoes on a finite piece of land is that the other crops cannot grow simultaneously.

Another example is someone with $10,000 in savings. Suppose this person can either invest their money in a car coating company or use the money to get their graduate degree. If this person uses their money to invest in the car coating company, their opportunity cost is the lifetime earnings and benefits of completing their advanced degree.

Positive Or Negative Opportunity Cost

Opportunity cost can either be positive or negative. For example, a farmer may make more money by selling mangoes compared to planting cucumbers or tomatoes. The opposite can also happen. There are a lot of factors in the market during the planting season that could make mangoes more or less valuable.

While many people only think of money when considering what is the opportunity cost of an investment, you need to consider additional resources. These resources include labor, time, and the required workload of managing the investment.

For instance, the farmer can choose to plant one crop over the other, but he might spend more on labor during planting and harvesting times, depending on the crop. The opportunity cost of the labor-intensive crop isn’t just financial; it also includes the time and money he spends for people working in the field.

Applications of opportunity cost

In assessing the attractiveness of an investment, you must consider all its possible outcomes. Any responsible investor would consider these negative and positive effects during the decision-making process.

Although no one truly knows what the future holds, you have to realize the opportunity cost of an investment so you can weigh the expected results of the available options.

While the examples listed above make sense to building owners and farmers, it can also have equal importance in regards to investments. If you know what is the opportunity cost of an investment, you can apply it to all areas of investments that involve the use of resources. Whether it’s investing in your inventory stock or thinking about your storage space, learning how to assess your options is important.

Why Opportunity Cost Is Important

Image by pixabay

Understanding the basics of “what is the opportunity cost of an investment” is similar to mastering trade-offs, one of the foundations of economics. This knowledge is not only valuable in business and investing, but also in your daily life.

Once you make a particular choice, you say goodbye to other options. So you need to factor in opportunity cost when making any decision.

How To Calculate Opportunity Cost

There is no single mathematical formula used to calculate what the opportunity cost of an investment is. However, you can still approach this problem using mathematics.

Measuring opportunity cost leads to better decision making. To know this, you have to note what you are sacrificing. Will it be a change in your lifestyle or finances?

Factors to consider in calculating the opportunity cost

To know the opportunity costs, you have to consider the three factors of time, money, and sweat equity.

Money

Image by pixabay

In terms of money, the opportunity cost is rather straightforward. Ask yourself what else you would do with the funds you are about to spend on your decision. The alternative use of your money is the opportunity cost of an investment.

A farmer who spends $5,000 on tractors owns the equipment but will lose the use of their capital. That same money could hire a part-time employee during the busy season or even open a new store. So these options represent the opportunity cost of buying the tractors.

Sweat equity

Image by pixabay

If you invest your time in your own business, you have to factor in the effort required to make a business work. That effort can either lead to a successful business venture or be a missed opportunity by dedicating your time working for another company.

Time

Image by pixabay

Money and effort are not the only commodities you have to keep in mind. You also have to factor in time. In determining the opportunity cost, time is sometimes more valuable than money. When making an investment decision, think of the time required or saved by a particular investment opportunity.

The formula for calculating the opportunity cost

Image by pixabay

Dollars cannot account for all aspects of value. And you can find out the opportunity cost in terms of satisfaction or even time. To determine your opportunity cost, use the ratio of what you are sacrificing and gaining.

This method will allow you to evaluate the ratio between two or more choices to estimate opportunity costs.

Examples of opportunity cost of an investment

You can figure out the opportunity cost by factoring in what you sacrifice over what you gain. In the investment example mentioned above, a person is sacrificing either the benefits of possessing a graduate degree or the profit they can make by investing in a car coating company.

Here’s another example. Vin has $$ worth of stocks in a food company, which he can sell for around $30,000. He initially wanted to wait six months before selling his shares since the stock price is likely to increase. However, imagine he decides to sell his stock now. To calculate its opportunity cost, you need to estimate the stock’s value in six months.

Suppose the stock value increased to $$$ in six months. Now, it is possible to determine the opportunity. In this case, the opportunity cost is the difference between the current and future value of the stock. So, the opportunity cost is $5,000 in this example.

Investing Is Now Easier

Investors always face options on where to put their money to receive the most significant return. In today’s business landscape, calculating the opportunity cost of an investment is a required step in assessing a business or investment decision.

Opportunity costs exist everywhere and are both big and small. This concept doesn’t just apply when answering the question, “What is the opportunity cost of an investment?” — it applies to many major decisions throughout your life.

Think about what would have happened if Steve Jobs did not start Apple and decided to stay at IBM. Then, important technological investments may not have come to pass or come in a timely fashion. So be sure to consider opportunity cost as you face your next decision.

Do you have your own experience that relates to calculating what is the opportunity cost of an investment? We’d love to read about it in the comments below!

Do you want to learn travel hacking 101? Believe it or not, you can save money while traveling! That’s right, and you do not have to pay top dollar for lodging or your flight. I don’t know about you, but that means more traveling for my family. And there is no better way to make some memories.

And even better, there are so many ways to save money and get upgraded.

What is travel hacking, though? And how can you make it happen?

What Does Travel Hacking 101 Entail

Image source: Pexels

Travel hacking 101 means being able to find the best deals for every trip you take. Whether it is for a flight, hotel, cruise, train, or rental property.

There are some great tricks into finding the best value for your trip. Sometimes, it may require you to do a lot of research and possibly yelling at your computer screen, but it’s worth the time.

Travel hacking 101 is used for so much

There are people who may think travel hacks are only for flights or hotels, but it can be for so much more.

Saving as much money as possible for everything you use or do on vacation is crucial.

Packing

Did you know if you pack less and wash while you are away, you can save a ton of money? That’s right; airlines charge you an arm and leg for an extra bag. However, carry-on bags are usually free, so that may be a great choice if you are only going on a trip for a few days.

Besides, the less you carry around with you, the better it is for your stress level. You will not struggle as much to carry your bags. Also, finding your luggage at the baggage claim area is a major pain. I hate standing around watching the carousel of luggage go around and around, only to realize my luggage is not there.

Also, carry-on bags that are simple and small to hold your personal care items. This can make finding your things incredibly easier, and you will not throw away as much because it will be the perfect size for the trip.

Eating

Depending on where you are staying and what type of storage you have, will depend on how you can save money.

If you are staying in a hotel, try to find deals that include breakfast and free parking. Also, if your hotel has a stove and refrigerator then shopping at the grocery store and buying food will save you a lot of money.

Food and lodging eats, no pun intended, up a significant portion of travel budgets. You could use that extra money towards shopping or other activities you may want to try.

Or if you are staying in a campground, try to save your leftovers for the next day. You could also borrow a friends camping supplies instead of buying everything new.

Wifi overseas

During vacation, you will still need to stay in touch with the world unless that is why you are a vacation. Having a portable wifi device can save you a bunch of money. Not only is finding a hotspot a pain the rear but it can be almost impossible in some places.

You can simply carry around a small device to make getting wifi so much easier, and it should cost you a lot less than those long-distance calls if you are traveling overseas.

Shopping

Now, I love to shop, like really who doesn’t, but I’m not going to lie, I have purchased a lot of things on vacation that I never use.

So, to save a little money, think twice about buying that fur coat if you live in Florida.

Lodging

When booking a place to stay, you may find great deals online. You can also take those online results to your local travel agent, and they may be able to find you even more discounts.

There are many websites out there but depending on if you are looking for a hotel, cabin, vacation home, or going a little rugged staying in a tent, will determine which website is best. Expedia, for example, often gives their members a percentage off of the lodging.

And if you know someone who works for a hotel chain like Hilton hotels, then you could check with them and see if they can add you to their friends and family account. Oftentimes, hotels give large discounts to their employees.

Flights

You may have heard that booking your flight on certain days of the week will save you money. You may have even heard to fly out on certain days, but this is not always 100 percent true. I have booked many flights online on a Friday and rechecked to find the same price on the following Tuesday. Weekend flights are usually more expensive, though. So, if it is possible to fly during the week, that is the best route to take.

This is also something you can take to your local travel agent and see if they are able to find a better discount.

Local transportation

I have found with all my international traveling that using the local bus, is much cheaper than the taxis. If you do not mind being crowded with complete strangers, then traveling this way is the cheapest.

Also, if you are able to walk to your destination, then that can be a relief for your wallet. Now, we know not every place you travel will have clean, safe local transportation, but it is worth a shot.

The Major Need for Travel Hacks

Almost everyone loves to travel and save money. If you are able to get enough taken off of that flight to afford an upgraded hotel room, then all that research was worth it.

I am a mother of five kids, and when we fly internationally we spend around $2,000 for just the airfare. We try to find every discount we can with transportation to our vacation home. We make sure to wait to eat until we get to our place, instead of buying the overpriced food on our flight. By doing simple things like that, we are able to save enough money to do some sightseeing.

Types of travel hacks

One of the best travel hacks is Google maps offline. I have been stranded on the side of the road many times because my phone has lost signal. If you download the map before you start your journey, it will make your day less chaotic, for sure.

My husband’s favorite item to take everywhere he goes, is a pen. I know right, why is a pen such a big deal? Well, he travels internationally at least twice a year, and the flight attendants always have forms for you to fill out but never any pens!

Another great travel hack is baby powder. Baby powder can be used for more things other than your baby’s bottom. You never know how long your layover will be, and using a little baby powder to freshen up may make you feel a lot better.

Also, don’t forget that purchasing your tickets to some places in advance can save you some money. Not only could you save money on the tickets, but you also do not have to wait in the long line to get in.

We also think having a reusable water bottle is terrific. Not only does it help the environment, but you don’t have to constantly buy bottles of water.

Finally, don’t forget to do an internet search of all of the free places to visit in the town you are going to. For example, my family was recently in Asheville, North Carolina and there are roughly 50 free waterfalls to visit in the area. Also, free botanical gardens, tons of hiking trails, and more.

How to Find the Best Travel Hacks

Of course, doing a lot of research will find you the best deals.

Many credit card companies give travel bonuses and money back if you meet the requirements on time. You may not like all those emails about promotions until it is time to use them, but they are great. Most airlines have deals, even free flights, so try to have an open mind when you sign up for their advertisements.

Also, adding companies to your social media will help you know when a big deal may be going down. Yes, the deals may not come every day, but you do not want to miss a big one.

The traveler in the YouTube video below finds many benefits of using Ebates for all her purchases online. Please take a moment and let her explain how it works. Plus, she has a few other travels tricks up her sleeves that may help you on your next trip.

Benefits of Knowing Some Travel Hacking 101

The benefits of knowing travel hacks is saving money! The more money you save, the more trips you can take. If you have saved tons of money, then you will not feel bad about how much money you spend while shopping.

My mother has worked hard her entire life. Her biggest regret is not traveling enough, and always worrying about her credit score. We are not saying to stop paying your bills. Just to remember it is okay to do something for yourself every now and again.

My family and I love to travel, but with five kids, it can be very costly. So, every dollar we save on one trip goes towards our next trip.

Travel hacking 101 can take some time to learn, but it is worth the time you spend learning it. There are so many surprising ways to save money while you travel. Please do not stress too much when you start your next vacation. Remember, it takes time to learn all the tricks.

What is the best travel hack you have used? Please let us know in the comment section below.

Are you wondering how to read a 10-K effectively? Warren Buffet is famed for being one of the world’s wealthiest men and the single most successful investor of the 20th century.

However, the one thing that always stands out is his ability to spend five to six hours a day reading. What’s more, 10-K reports top his list.

So how do you go about finding worthwhile investments? Perusing 10-K reports should be one of those items to check. At a glance, they can seem bulky, but knowing what to look for is a great start to learn how to read a 10-K.

What Is the 10-K Report?

Image source: Pexels

A 10-K is an annual filing that public traded companies are required to submit to the U.S. Securities and Exchange Commission (SEC).

It offers a detailed picture of the company’s activities, subsidiaries, and the risks it faces, as well as the operating and financial results for the fiscal year.

The 10-K report has to be filed within 60 days after the end of the fiscal year. You can find a company’s 10-K report by using the SEC’S EDGAR database. But some companies post their 10-K reports on their websites.

Difference between an annual report and a 10-K

A 10-K has more detailed information than the annual report. An annual report is more for shareholders to view. It does have information related to the company and financial reports.

And while it is designed to report fiscal happenings, the main purpose is to encourage more investing.

The 10-K is an official report for the SEC in a standard format. It also has a letter from the CEO or chairperson and illustrations. Plus, it does have more information, but it isn’t designed to impress. It’s only meant to report, and it hits areas you won’t find in an annual report.

Some companies can file the 10-K as its annual report while others may provide both the 10-K report and an annual report to the SEC.

How to Read a 10-K: Breaking It All Down

Image source: Pexels

To help you learn how to read a 10-K effectively, you have to understand that, as mentioned, these reports follow a strict format that’s determined by the SEC. It also helps to know how to spot financial monkey business, but that’s for another time.

All information is presented in 4 main categories that are broken down into 15 subheadings.

Let’s look at the four key areas that a 10-K report covers.

How to read a 10-K: company overview

An efficient way to tackle a 10-K report is by reading the business description. It provides a fundamental analysis of the company’s economic purpose, products or services, some sense of its history and the competitive conditions it operates in.

In this section, you’ll also find the risk factors, which involves an explanation about significant risks that apply to the company and its securities. The company should address the risks and not how it applies to them. Each risk is titled in bold, then its description follows.

This section also includes the unresolved staff comments where the company explains the comments received from the SEC staff on reports filed previously that have not yet been resolved.

A red flag most investors look for here is if the SEC has raised questions about the company’s unresolved statements.

The company overview section goes on to cover properties and legal proceedings that add to the overall picture.

How to read a 10-K: business discussion

In the business discussion, you’ll find out the company’s stock price and performance as well as the number of shareholders within the company. You will also read about certain financial information about the company for the last five years.

In addition, this is where you’ll read about the management discussion and analysis. Management provides the company’s perspective about business results for the past year.

You’ll also get to pick the brain of the current CEO and get a sense of the direction the business is going.

Information about the company’s operation and financial results are in this section. You will be able to find out its capital resources, liquidity, and how the company views its key business risks and what it’s doing to address these issues.

The disclosure about market risk here refers to risk related to interest rates, foreign currency exchange rates, commodity prices, market exposure, as well as stock price risk.

You’ll also get audited financial statements, exhibits, and disclosure about the disagreements, changes in company accountants and accounting procedures.

How to read a 10-K: involved parties

This section provides background information and experience of the company’s director and executive officers. It also offers insights into the company’s code of ethics and qualifications for its committees of the board.

You’ll also find a detailed discloses the company’s compensation policies and pay levels of the top executive officers. Similarly, you’ll get information about shares covered by equity compensation plans and whether each company director is independent.

This section also requires companies to disclose the number of fees they pay to their accounting firms for various tasks. Most companies provide a separate document for this step, called a proxy statement.

How to read a 10-K: full financial statements