Are you looking to invest in cheaper stocks this year? We’ve got you covered with the best penny stocks you’ll want to keep an eye on. Maybe you’re a veteran trader already — you’ve had your luck in forex, indices, and even commodities. And, now, you’re looking for something different to help grow your money. Or, maybe, you’re just a newbie who can’t wait to get started in the game.

Well, trading penny stocks isn’t something you want to go into blindly. It takes learning and mastering a few tricks to even make it as a penny stock trader. Do you know how to interpret the charts? How well can you analyze a stock technically and fundamentally? Have you even used a demo account yet? Also, depending on the weight of your wallet, you might want to pay for a couple of tools, including reliable stock screeners.

Reading expert books might come in handy, too, as is taking training courses. And yes, this can be daunting! The good news is that we’ve done the hard part and prepared a list of the best penny stocks you should be watching this year. It’s just that we don’t want you settling for every “Tom, Dick, and Harry” you bump into. But before we dive in…

What Are Penny Stocks?

Also called OTC stocks, cent stocks, or small-cap stocks, penny stocks aren’t your average stocks. These are securities that, while exchanged publicly, are usually cheaper with a small market capitalization. In fact, they’re priced below £1 in the United Kingdom and go for less than $5 in the United States.

Which makes penny stocks a riskier investment. A small move in the market can either fetch huge returns or subtract a decent portion from your investment, in equal measures.

Did you also know that…

Penny stocks are often issued by companies that are relatively small and new — businesses that are yet to establish a successful performance track record. And that doesn’t change the fact that penny stocks could be a sign a company is approaching bankruptcy.

Ever wondered why a stock priced up to $10 might fall under the OTC-stock category? That usually happens when its market capitalization is pretty low ($250 to $300 million). You should also know that most penny stocks are exchanged over the counter, even though some might be listed on large exchanges, such as the New York Stock Exchange (NYSE).

The history of penny stocks

We get it: You might be here for the best penny stocks to help grow your money. But it doesn’t hurt to dig a little into their background, right? Penny stocks have been around for a long time — since the inception of the stock market. It’s just that these probably traded differently.

The OTC stocks are even responsible for the 1929 stock market crash, according to the federal government. That was long before the Securities Exchange Act was created in 1934. This act would redefine the penny stocks to what they’ve partially come to be: The unlisted equity securities trading below $5.

The Great Depression would complete the definition to include those OTC stocks that trade on the exchanges. You should also know that before the age of the internet, you could only trade your best penny stocks over the phone. With the internet, however, new investors entered the market, exploding the entire penny stock idea.

Why Penny Stocks?

Even with the risk tied to trading penny stocks, many investors see these as a way of making quick money. And you know what? They could be right. Some of the best penny stocks available have high growth potential and can yield incredible profits. You only need to jump in early enough, rather than when the trend is about to reverse.

Even so, you want to know what you’re getting into before investing your hard-earned dollars. Get acquainted with the pros and cons and measure both sides. Do your research on each company you’re going to be a shareholder in, and diversify your stocks to manage risks.

The pros

Here are some of the pros associated with trading OTC stocks:

- A small move upwards can bring substantial gains, probably because of the lower price

- Penny stocks can be a means for small companies to gain access to marketplace listing

- These stocks help fund growing businesses

The cons

And here are the reasons you might want to trade penny stocks cautiously:

- OTC stocks tend to lack follow-up history

- There are no minimum standards set to trade these stocks, probably because they mainly exchange hands over the counter

- Small-cap stocks often have low liquidity

- Information related to these stocks might not be available to the public

How We Reviewed

So how did we review our best penny stocks? Firstly, we combed through dozens of expert websites for reliable OTC stock information, including PennyStocks. Then we followed through with the latest news, which helped shed some light on the small-cap stocks with higher growth potential.

Penny stock experts were next in line: Thanks to them, we added reliable predictions on our list of the best penny stocks you want to watch. And yes, we considered different sectors, just so you can have your pick. Last but not least, we factored in tips from real investors who’ve crushed it in this type of trading.

The Best Penny Stocks to Buy This Year

Finally, here are the best of the best penny stocks you can’t wait to add to your trading portfolio. We’ve listed them in no particular order.

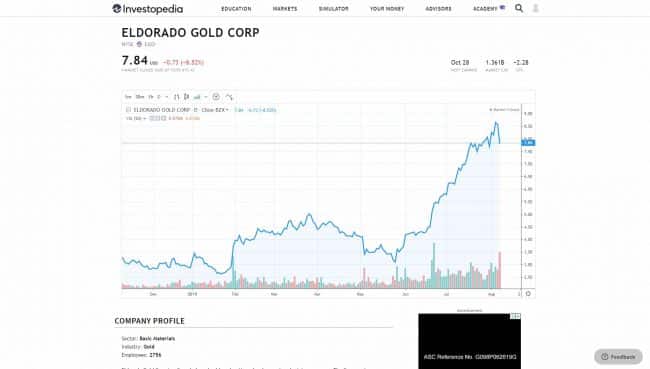

Eldorado Gold (EGO)

Shares of this gold penny stock have been on the rise since the end of May. In fact, the price has more than doubled in the last 40 days. Which makes us wonder if Eldorado Gold could just be one of those rare stocks that tends to withstand difficult economic times. But despite the market’s stormy condition, this stock’s price has not lost its momentum.

So, why did price even soar? Well, all this came about following the company’s announcement in its gold-production surge in the second quarter of 2019. After which, investors, being who they are, couldn’t sleep on their job, sending the price north.

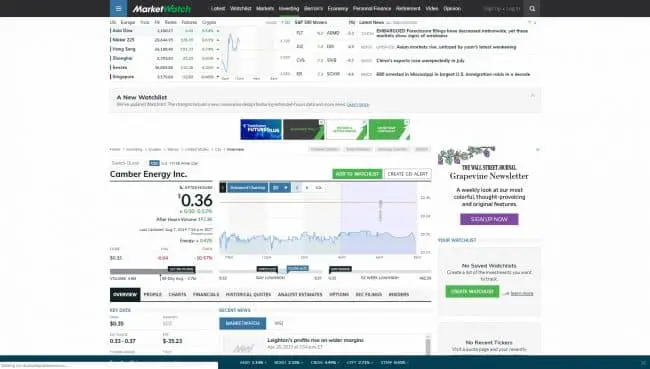

Camber Energy (CEI)

Another one of our best penny stocks to watch is Camber Energy. Based on the company’s announcement that it was nearing a key acquisition, prices have rallied over the last few weeks. On July 8, Camber made known its plans to acquire Lineal Industries. And, this is no small deal. In fact, according to experts, it should only boost the company’s revenues.

It’s no wonder investors have raised their eyebrows since the stock at one point escalated in price by over $6.50 in 24 hours. And, even though the price has tested lows of under $6 during this time, it is still interesting to know how Camber is going to perform going forward. Definitely, a stock you want to keep an eye on.

FuelCell Energy (FCEL)

You don’t want to skip FuelCell Energy when assessing the best penny stocks to help grow your money this year. But if you’re still thinking this stock has had a bumpy year, you need to rethink it. In case you’d no idea, things made a remarkable turnaround in late June, when the company landed a major project with Drax Power Station, one of U.K.’s largest renewable energy generators.

And yes, this alone has skyrocketed share prices to higher highs. Not only has price rallied by 37 percent, but also the trading volume has towered to a record peak. Which leaves us with the question: Will FuelCell’s price keep rising, considering it has since doubled?

Biocept (BIOC)

Sure, the current recession might have compromised the earning potential for several companies, but the defensive health sector could, apparently, survive the “tsunami.” Even with an extensive global portfolio of 33 patents, Biocept recently announced a potential launch of a liquid biopsy test for lung cancer.

Got no idea what Biocept’s cancer assays do? Well, these allow for cancer patients to qualify for targeted therapy, all in an endeavor to identify resistance mechanisms. This oncology diagnostics firm is witnessing some pretty strong sales, as a result. It is one of the best penny stocks you don’t want to overlook, especially if you’re a risk-averse investor.

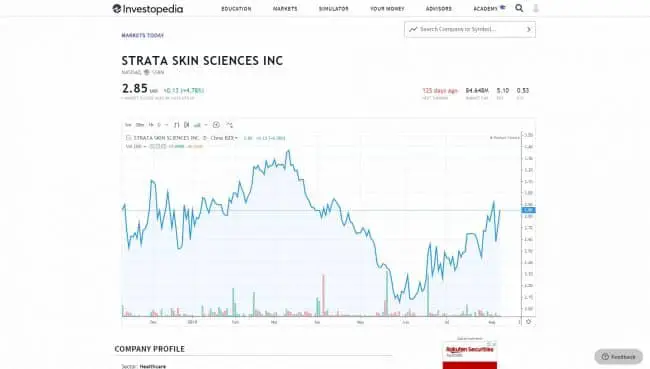

STRATA Skin Sciences (SSKN)

You probably already know that prices for this dermatological service company have nosedived over the last few months. However, that’s not to say the price has stagnated downwards. After the fall, STRATA has gained a cool 12 percent. Yes, this might not be much of an increase, but there are signs the ascend could linger on for some time.

STRATA’s average 5-year sales rate is standing at a whopping 137 percent. We’re not even talking about the promising balance sheet. Without a doubt, you want to add STRATA to your best penny stocks basket.

CVR Partners (UAN)

CVR Partners couldn’t be more promising in the near future. But this nitrogen fertilizer company has reported a 68 percent growth in earnings per share (EPS) in 2019. And the estimated 28 percent increase for 2020 only adds to the already decent score. Yes, we know: Analysts have forecast a negative outlook with regards to fertilizers. We, however, are thinking they might be basing their evaluation on these two things: trade disputes and declining global demand.

You probably are also asking yourself questions on the CVR low prices, in June. Wonder no more! The company has recorded a 10 percent increase over the last several days, which has seen prices ascend to $3.99. This ascent is believed to have been initiated by Moody’s positive sentiments towards CVR Partners. Among other things, investors are also hopeful that the upcoming meeting between the U.S. and China chiefs is going to be fruitful.

Avino Silver & Gold Mines (ASM)

If you’re looking to invest in precious metals, this penny stock could well fit the bill. Of course, silver has been revolving around the $15.50 resistance level, but Alvino is proof that this metal is about to trend upwards. The company has, in fact, gained an impressive 30 percent over the last few months.

As silver endeavors to catch up with gold, commentators are hopeful that it’s going to double its value, effortlessly, over the next six months. That probably means Alvino is showing signs that its share prices are just about to soar, despite the company recording a massive drop (56 percent) over the last year.

Encana Corporation (ECA)

Even though it’s currently trading just over the $5 mark, this fuel producer deserves to sit on our list. It is still one of the best penny stocks you want to watch. Don’t be fooled with the higher debt and unfriendly balance sheet — which has probably contributed to the current lower price. But we have a reason to believe Encana might catapult to $7 pretty soon.

Oil prices tend to rise just before a recession. So, if you don’t mind investing just over $5 a share in the energy sphere, this stock might well offer a perfect entry point. Note that it can be tempting to think Encana is currently oversold due to its six quarters of upbeat earnings in a row.

Rekor Systems (REKR)

This security firm has got some terrific clients, including the Nokia Corporation and the U.S. Defense Department. Not only has Rekor managed to increase its clientele, but also more customers are scheduled to use the company’s software. Just recently, the price skyrocketed to $1.12 — that’s about a 62 percent rise.

And, while Rekor lost some of the gains, it has more than redeemed itself, recording escalations of up to 117 percent in the last few months. Even though this company sits in our best penny stocks category, it’s currently showing signs of being overbought, which can be a red flag. You want to trade cautiously!

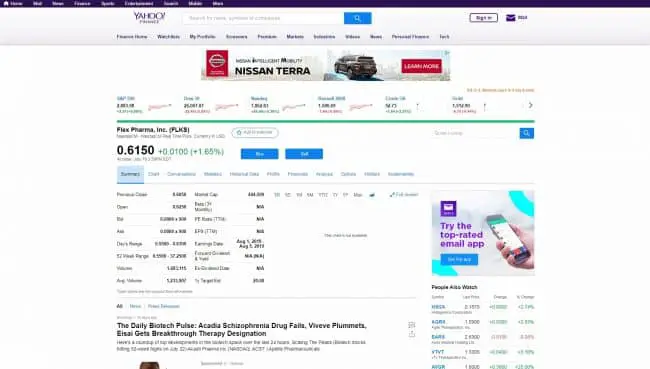

Flex Pharma (FLKS)

The potential merger for Flex Pharma with Salarius Pharmaceuticals, an oncology firm, is one watch. Well, Flex Pharma is a Boston-based biotech firm, whose share prices are currently sitting below 50 cents. The company, in fact, has recorded a loss in the first quarter of 2019.

However, the potential merger has got analysts thinking positively; they are hopeful it’s going to be a success and push the share prices up. Also, just so you know, Flex has risen over 45 percent in the last few weeks. And no, this wasn’t news-based, as is often the case with such spikes in price.

Partake in This Profit-Making Wave

There you have it — some of the best penny stocks you want to watch. Even so, like with forex, indices, commodities, etc., trading stocks can be risky. You should be doing it cautiously and investing what you’re comfortable losing.

You also want to do your homework on the various penny stocks you’re looking to invest in before taking the next step. Equally noteworthy, if you’re a newbie, you should consider taking training classes, reading books, and mastering a few tricks. You want to get started on the right foot.

Above all, you don’t want to skip using the demo account — you need some experience with virtual money before risking your hard-earned cash. It’s just that money, like time, is precious. Losing huge sums of it in unexpected ways can be especially devastating. We don’t want that for you.

Remember: This is not investment advice. You want to do your research before even giving these stocks a shot — and, ultimately, beat the penny stock promoters at their own game. What penny stocks do you recommend? Let us know in the comments below.

No Comment