M1 Finance is an excellent platform for investing. It’s completely free and offers “Pies” that help you allocate your money in the stock and bond market. Here are some best M1 Finance Pies to help you invest your money.

7 Best (And Creative) M1 Finance Pie Examples to Help You Invest Smarter

The best M1 Finance is one that achieves your risk tolerance and financial planning goals. I created a dividend investing book that will show you exactly how to build a portfolio.

The book is called Dividend Investing Your Way to Financial Freedom. You can download a sample of the book below if you’d like to try the first few chapters out:

I’m a dividend growth investor with a fundamental focus. If you are a new or expert, investor, M1 Finance can be a platform that will help you build wealth in an automated manner.

It’s a great way to invest your money.

In the bel0w article, I’ll show you how to create powerful M1 Finance Pies that have both fundamental and qualitative macro focuses.

You can use these created Pies to invest smarter.

What is M1 Finance?

Based in Chicago, M1 Finance is an online investing platform that offers the commission-free robo-advising paired with individual stock investing. The platform will conduct automated features including rebalancing, recurring deposits, and tax efficiency.

You can elect to self-direct your entire portfolio along with the automated features. You can elect to have your entire (or partial) portfolio be automated…

And this is all FREE of charge.

You can open an account and start investing for as little as $100 (or $500 for a retirement account). There are no commissions on investing.

M1 Finance Investment Pies

Here is where the whole crux of my post comes into play. M1 Finance features ‘Pies’, which you can think of your own basket of strategy for investing completely automated.

You can either create your own pie from scratch or choose from pre-built Pies in certain categories such as:

- General Investing – Pick investment ala carte as you wish.

- Plan for Retirement – Invest in a pre-determined Pie that allocates your assets for retirement.

- Responsible Investing – This is a pre-built Pie that invests in impact-oriented companies that make a lasting difference in our future

- Income Earners (hey, dividend investors!) – Ability to increase your passive income by solely focused on income-focused investments

- Hedge Fund Followers – Follow hedge fund investments… Mimic the smart money completely automated

- Industry or Sector Based Pies – Target specific industries or sub-industries to take advantage of broader economic trends

- Just Stocks and Bond Allocations – Focus on stocks and bonds only, this would be similar to a 401(k) or ETF investing strategy

While all the above Pies are great, you can actual invest in multiple M1 Finance Pies within your account. Thus, opening the door for maximum creativity in your investing strategy.

I’m going to show you exactly how to create M1 Finance investment pies as examples that are creative and can suit your investing needs.

Read more about M1 Finance in my review of the platform.

Why I Love M1 Finance: An Alternative to Motif Investing and ETF Investing

M1 Finance provides an opportunity to replace ETFs on your own. It’s a great alternative to Motif Investing and ETF investing. Why?

Well, ETFs have been a race to the bottom in fees and there have been massive flows of capital into these funds. Not the underlying stocks.

Motif Investing is good and creative, but it doesn’t feel like you really own anything.

The below M1 Finance Pie examples will be a good starting point for you while you start your investing strategy.

Why Investing Pies are Good

Investing pies are a great way to allow the investor to explore their creativity in the stock market.

You can create an M1 Finance Pie based on a number of factors, including:

- Fundamentals

- Industry Specific

- Expert Based Investment Pies

- Qualitative Themes Such as Clean Energy or ‘Sin Stocks’

- Target Income-Oriented Stocks

The world is your oyster with M1 Finance Pies. All completely free…

I’ll show you some amazing ways that you can get creative with M1 Finance Pies. Plus, I’ll share every single one with you. You can copy each and every one.

[maxbutton id=”1″ ]

How I Use Screeners to Build Customized M1 Finance Pies

I love Finbox Premium. It’s been a tool that has opened Pandora’s box for my investing goals. Traditional stock screeners have limited information and exportable content for excel modeling.

Finbox solves that.

Similar to M1 Finance, Finbox has pre-built screeners that you can use to generate new Pie ideas. Here is an example of one that I will replicate as a M1 Finance Pie.

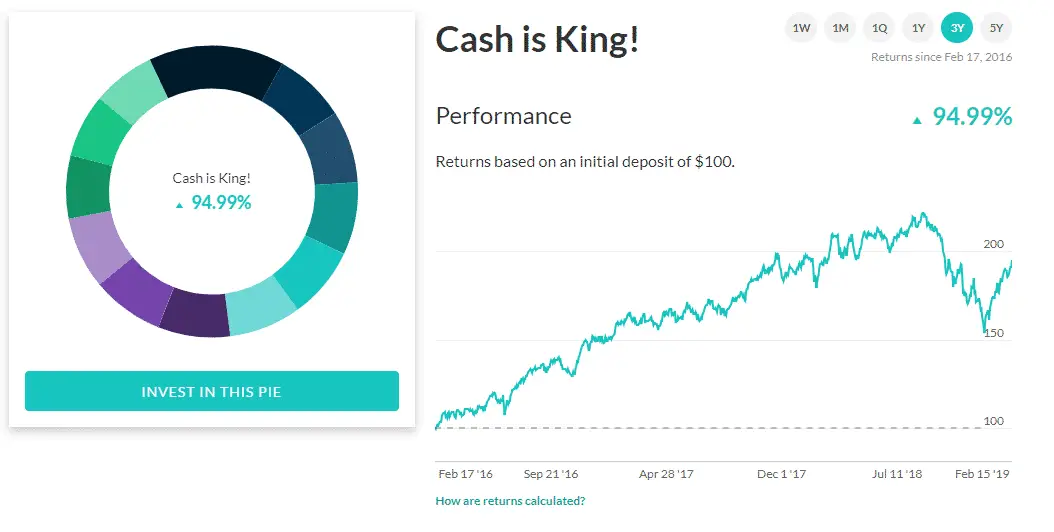

Finbox has a screener titled ‘Cash is King!’, which finds stocks that are generating significant free cash flow.

If you use Finbox plus M1 Finance together, you’re opening your eyes to a new way to invest.

List of 7 M1 Finance Pies That Show the Power of the Pie

I won’t claim these are the best M1 Finance Pies out there. Why because there are so many ways to make a M1 Finance Pie. However, these should help you realize how you can use M1 Finance to your advantage as an investor.

The possibilities are endless. Here is how I make these different Pies based on criteria.

I’ve been using Finbox Premium to screen for a variety of stocks based on strategy.

1. The Public Exposure to Private Companies Pie

I wrote about this M1 Finance Pie in my review of the platform. The Public Exposure to Private Companies Pie would give you diversified equal weighting exposure to some of the largest, most reputable private equity firms in the world, including:

- BlackRock Inc.

- Brookfield Asset Management

- The Blackstone Group

- The Carlyle Group

- Apollo Global Management

- Oaktree Capital Group

Public Exposure to Private Companies Pie would kick off a nice yield of ~5.37% and would feature no fees at all. M1 Finance would automatically reinvest your dividends as fractional shares.

2. Cash is King! Pie

Using the Finbox pre-built screener ‘Cash is King!’, I replicate it with allocating certain percentages to the top free cash flow generating companies.

There are other stock screeners out there of course, but I’m in love with the simplicity and power of Finbox for such a low cost.

The criteria for Cash is King! Pie is as follows:

- Cash to Total Capital = Greater than 10%

- Current Ratio = Great than 1.5x

- Debt to Total Capital = Less than 10%

- Return on Assets = Greater than 10%

- Levered Free Cash Flow Margin = Greater than 10%

You can view the Cash is King! Pie here. I did equal weighting for each stock within the Pie. You can do a market cap weighting on yours if you’d like.

By using the screener and the Pie together, you get the following list of stocks:

| Ticker | Name | Market Capitalization |

| CHKP | Check Point Software Technologies Ltd. | 18,761 |

| UTHR | United Therapeutics Corporation | 5,214 |

| EVR | Evercore Partners Inc | 3,978 |

| LPX | Louisiana-Pacific Corporation | 3,782 |

| LITE | Lumentum Holdings Inc. | 3,550 |

| YELP | Yelp Inc. | 3,318 |

| ORBK | Orbotech Ltd. | 3,056 |

| CCMP | Cabot Microelectronics Corporation | 2,889 |

| RMR | The RMR Group Inc. | 2,302 |

| AEIS | Advanced Energy Industries, Inc. | 1,969 |

| MMI | Marcus & Millichap, Inc. | 1,540 |

| WDR | Waddell & Reed Financial, Inc. | 1,363 |

| EGOV | NIC Inc. | 1,158 |

3. Millionaire Mob Finding Undervalued Dividend Growth Stocks Pie

As I noted in my finding undervalued dividend growth stocks criteria, I like to invest in value-oriented dividend stocks that have a high likelihood of increasing their dividends in the future.

I built an infographic to help you understand how to screen for undervalued stocks.

- Dividend Yield = Greater than 0%

- Market Capitalization = Great than $10bln

- P/E ratio = Less than 20x

- EPS growth next 5 years = Greater than 5%

- Price to Earnings Growth (“PEG”) = Less than 1x

- Dividend Coverage Ratio = Greater than 2x Coverage

This is a great way to show why I don’t invest for dividend yield. I’m not looking to reach for income with dividend investing.

If you want growth and dividends, invest in stocks that have a high likelihood of continued dividend growth. I’m not investing in stocks based on what they used to pay in dividends.

I’m investing for the future. Ensure you are tracking your dividend income by using these software products.

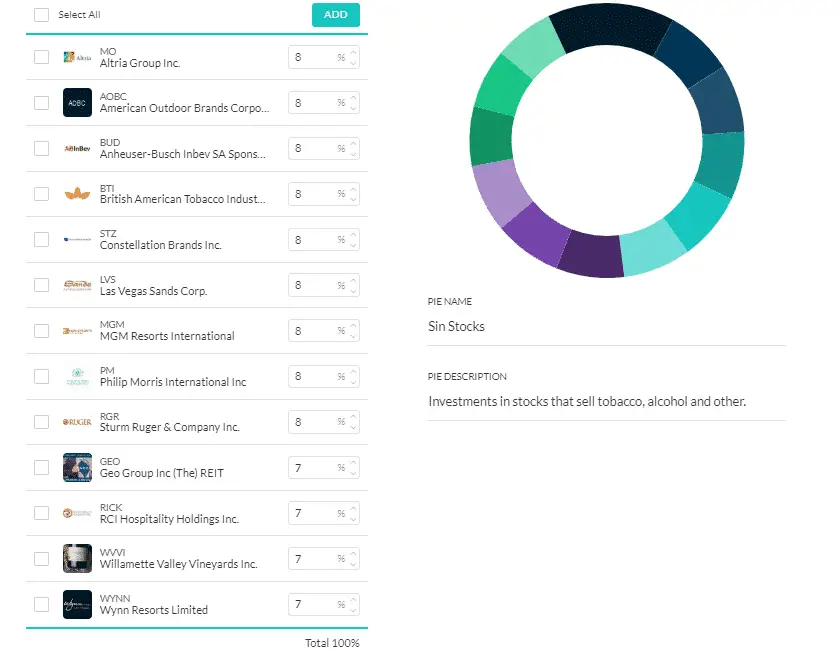

4. Sin Stocks Pie

Ah, Sin Stocks! Everyone loves them because they are often recessionary proof, they’ve actually grown significantly over the years. This one is a much more qualitative approach as opposed to some of the more quantitative analysis that I conducted above.

Sin Stocks are referred to as stocks that deal in guns, alcohol, tobacco, gambling and other sin-related products or services. This is only a portfolio of true-sin type companies. Someone could make a case for fast food or streaming services as sin stocks, but we want the real dirty stuff.

Again, equal weighting among the companies listed here. Some are a lot larger than others, so you may want to consider a weighting based on market capitalization. This portfolio sports a decent yield of 3.3%.

You can view the Sin Stocks Pie here.

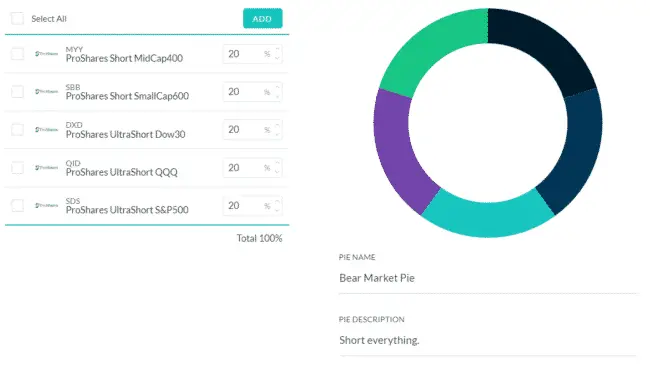

5. Bear Market Pie

Who says that M1 Finance doesn’t allow for you to take short positions or make fundamental bets? With this Bear Market Pie you can short the entire market including:

- S&P 500

- Dow 30

- Nasdaq

- Mid Cap 400

- Small Cap 600

If you are bearish on the market, this Pie might be for you. There are probably better ways to be short than using UltraShort ETFs, however. You can view the Bear Market Pie here.

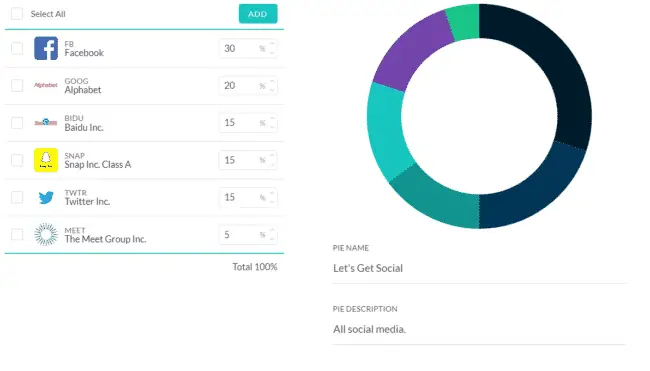

6. Let’s Get Social Pie

Social media has taken over our lives. Phone usage is way up. People can’t stop checking their social media accounts. Our lives have shifted from human interaction to virtual interaction.

Do you think there is a significant runway for further social media growth? If so, this M1 Finance Pie is for you.

For this Social Media Pie, I input a weighting since there are a couple of large stocks and a few small stocks. Here are some of the social media stocks that I’ve included:

- Alphabet (gotta have exposure to YouTube!)

- Baidu

- Snap Inc.

- The Meet Group

You can view the Social Media Pie on M1 Finance here.

7. Bottom Hunter + Dividends Pie

Let’s get back to some more of the fundamentals. I’m going back to using my Finbox Premium account to create an M1 Finance Pie based on valuation and fundamentals of the stock.

I used Finbox’s pre-built Bottom Hunter Screener then layered on Dividend Yield and a Market Capitalization threshold.

Similar to my finding undervalued dividend growth stocks criteria. However, this time I’m looking for stocks that are the real bottom feeders.

Stocks that are close to their 52 week low and have grown revenue.

This is one of my favorite M1 Finance Pie examples because it allows for you to find stocks that have pretty good fundamentals and might just be misunderstood at the moment.

Below is the additional criteria for finding stocks that meet the Bottom Hunter + Dividend strategy:

- Near 52 Week Low

- Debt to Total Capital = 0%

- EV / Fwd EBITDA = Less than 15x

- EV / Fwd Revenue = Less than 3x

- Revenue Compound Annual Growth Rate = Greater than 5%

- EBITDA Margin = Greater than 0%

- Dividend Yield = Greater than 0%

- Market Capitalization = Greater than $150 million

Here is a list of all the Bottom Hunter + Dividend stocks:

| Ticker | Name | Market Capitalization |

| BUD | Anheuser-Busch InBev SA/NV | 149,609 |

| NTDOY | Nintendo Co., Ltd. | 32,607 |

| GNTX | Gentex Corporation | 5,337 |

| THO | Thor Industries, Inc. | 3,772 |

| GSH | Guangshen Railway Company Limited | 3,269 |

| SHOO | Steven Madden, Ltd. | 3,009 |

| CCMP | Cabot Microelectronics Corporation | 2,889 |

| UNF | Unifirst Corporation | 2,828 |

| MC | Moelis & Company | 2,671 |

| FANH | Fanhua Inc. | 1,688 |

| WMK | Weis Markets, Inc. | 1,421 |

| KNSL | Kinsale Capital Group, Inc. | 1,283 |

| EGOV | NIC Inc. | 1,158 |

| NCI | Navigant Consulting, Inc. | 1,157 |

| YRD | Yirendai Ltd. | 747 |

| AGX | Argan, Inc. | 737 |

| JOUT | Johnson Outdoors Inc. | 658 |

| MPX | Marine Products Corporation | 485 |

| PETS | PetMed Express, Inc. | 483 |

| WHG | Westwood Holdings Group Inc | 346 |

| ITIC | Investors Title Company | 321 |

| TSBK | Timberland Bancorp, Inc. | 237 |

| SAMG | Silvercrest Asset Management Group Inc. | 206 |

| ESCA | Escalade, Incorporated | 172 |

I’m sharing this M1 Finance Pie example that pairs together with my undervalued dividend stocks criteria exclusively with my subscribers in the newsletter.

Some more fundamental investment pies require you to know how to read financial statements and conduct fundamental analysis.

Subscribe now to get the best tools for investing success like the above.

Conclusion on Best M1 Finance Pie Examples

I hope this shows you the power of M1 Finance and how you can use it to stay creative in the stock market, but also invest somewhat passively. In my opinion, it’s the perfect blend of being able to invest based on fundamentals and completely passive.

You’ll likely have to change your allocations over time to certain stocks as they change in price over time. Use my calculator to help you plan for your investing goals.

Like I was saying, I’ve seen a lot of people compare Robinhood to M1 Finance. I don’t think it’s a matter of having one or the other.

I believe people should have both. They are completely complementary to each other.

You can build a portfolio on Robinhood for a particular handbuilt market strategy and then have a broader trend based focus on M1 Finance.

Did you know that you can invest in multiple M1 Finance Pies within one portfolio? You could allocate your capital to all of the above Pies at once…

[maxbutton id=”1″ ]

Are you creating an M1 Finance Pie and want my opinion? Please feel free to comment below. I’d also love to create an M1 Finance Pie for anyone that has a specific strategy in mind.

Related Resources

- Best Robo Advisors Compared

- Our Motley Fool Stock Advisor Review

- Ultimate Guide to Building a Dividend Portfolio

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best personal finance tips, travel hacking tips, dividend growth investing, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

No Comment