Volatile stocks can actually be a good thing for your portfolio. Why? Opportunity. Here we highlight why volatile stocks are awesome for your portfolio.

Why Volatile Stocks Can Be a Good Thing

The stock market has been going a bit crazy recently. The entire year of 2018 looked great with returns for the S&P running into the low double digits for the trailing one year that is until we reached October. I’ve been building a dividend portfolio that is best suited for the long-term. I don’t really react if the markets are up big or down one day or the other.

In October 2018 alone, the S&P dropped 5% with multiple days, up 2% and down 2% or more. It seemed like this volatility had become the new normal.

So what should we make of this recent volatility, is it time to get into cash or look for an opportunity to profit? Let’s start our analysis by taking a historical perspective.

What does normal stock market volatility look like?

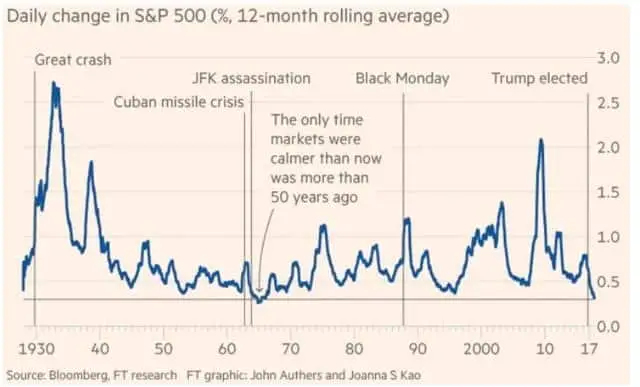

The below chart highlights the daily change of the S&P 500 as a 12-month rolling average. You can see the periods of prolonged volatility are centered on pretty recognizable events (the Great Depression, Black Monday, Trump election). As the callout notes, the only time markets were calmer than now was 50 years ago. We are in a period of relative calm.

Still while in the grand scheme of things this volatility may be minor, it’s hard to ignore the huge swings in the market day today. Stocks have volatility because you are lowest in the capital stack and there is significant buyer/seller interest.

What are volatile stocks?

Volatile stocks or the stock market as a whole, are usually stocks that have extreme movements on a daily basis. Volatility is usually gauged through an index or through options. There is historical and implied volatility.

Historical volatility is just a measure of the movements in stock price based on prior history or periods. While implied volatility is the metric that is priced into the stock that forecasts the volatility of a stock.

If you look at individual stocks, the most volatile stocks are typically highly speculative that have the following considerations:

- Limited earnings or profit, they purely trade off of speculation

- News or event-driven, they only increase in price based off of news or changes in forecasted performance

- Have limited liquidity, volatile stocks usually don’t have much day to day trading volume

Volatile stocks create a significant opportunity for traders since they enable traders to profit off of extreme movements. Extreme movements mean extreme profits. Traders love that.

Use a tool like M1 Finance to mitigate risk and stay diversified. You can read more about it in our M1 Finance Review. That is why it’s one of the best mobile investing apps out there.

So what do we make of volatility?

Recent market volatility may seem worrisome but it’s actually at times like this that professionals profit the most. When markets are calm and prices move in an orderly range it’s hard to make money on the upside or downside. But when volatility increases, the risk of each security decreases, and subsequently so does the reward if you are on the right side of the market.

Traders, in particular, look at these markets for opportunities to be on either, or both sides of a trade, as the individual positions move up and down throughout the day. For fundamental investors, these volatile days may be a great opportunity to grab a stock you believe trades well below its true value, based on an intraday swing.

That’s why it’s important you understand the important financial ratios of the stocks you follow vs their competition, so you are ready to act when volatility does move a position in your favor.

Investors and pundits may hate uncertainty but traders and those managing active funds love it. So what are some potential strategies to profit from volatile stocks?

What are some specific strategies to profit on volatility?

Traders and investors love volatile stocks. This presents a significant opportunity to exploit the stock market that happens as a result of overreaction. Thus, this creates a number of trading strategies solely off of volatile stocks.

These are common strategies on how to profit off of stock market volatility.

- Buying the VIX: In this strategy you are “buying volatility”, generally using VXX or VIX indexes. For a long while “sell volatility” was a popular trade until there was a surge in market turmoil in February that left funds with large losses.

- Trend following strategies: As markets move up and down these automated trends following strategies buy or sell stocks depending on the direction of the market. There are a few ways to measure how to specifically get in and out of your positions using trend following strategies including looking at moving averages and deviations away from previously followed “channels”. For example, if the stock has traded between the 50-day moving day average and 200-day moving average, and moves above or below this “channel” you buy or sell\. This is a great place to brush up on how to chart trade like a pro before diving in.

- Options strategies: Using a strategy called a long straddle. This strategy is the purchase of a long call and a long put. You would implement this if you think the market is going to experience some volatile movements up and down but aren’t sure which way. Here are some other stocks suited for writing covered calls.

There are other more complicated options strategies you could consider but that would require a further deep dive and maybe a few textbooks.

So there may be a chance to make some money and we have a few strategies to capitalize. But what if this volatility is the harbinger of an impending recession, and the entire market will be moving to the downside for the near future.

Does volatility tell us a recession is imminent?

A recession doesn’t seem to be imminent according to both market sentiment and economic fundamental data. We can look across the board are multiple indicators: unemployment rates, job quit rates, job openings, wage growth- all positive in Q4 of 2018.

Even the one indicator many individuals call the best indicator of a recession, the yield curve, is pointing towards continued growth. In the past when the yield curve inverts, that is when the 2-year rate rises above the 10-year rate, a recession is generally coming. This indicator has flashed prior to almost every previous recession in the 20th century, with only one false positive.

This is a bit intuitive as well, as one would think is short-term rates are paying more than long-term rates why would I risk my money in longer-dated, riskier assets.

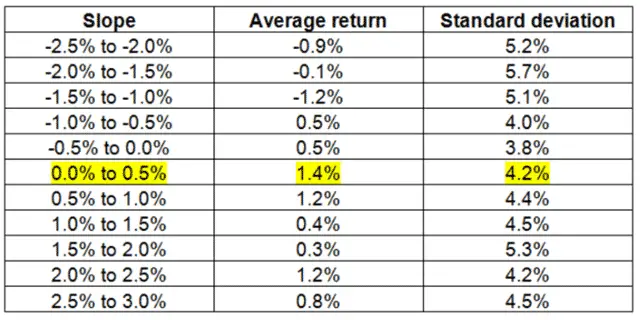

As the chart above shows even if the yield curve does invert over the next few months, we still have some time until a recession would be upon us. Also while we live in this time just before inversion, the average return per month has actually been extremely positive compared to other periods (chart below).

Conclusion on Volatile Stocks

So these volatile times might make a good opportunity to get in on stocks you like at favorable prices, if you are a fundamental investor and to make some money daily if you are a trader.

You can get free shares of stock using these apps to get started with investing.

The data tells us a recession isn’t coming over the next 12 months or so, so this a good time to pick your spots and make some money while there is some uncertainty in the air. Here are several investment techniques to help turn around your investment portfolio.

What do you think about volatility, do you disagree and think we are spiraling out of control with China tariffs, the debt ceiling etc., that the economic fundamentals don’t matter? Comment below.

See Related Investing Resources:

- 1-Minute Binary Options Trading Strategies

- Motley Fool Stock Advisor Review: Is It Worth It?

- Qplum Review: Reduce Risk During Volatility

Author Biography

The author currently writes about investing, personal finance and building your retirement portfolio over at www.investmentbasecamp.com. He’s not sure why but people seem to think he makes sense when he talks about investing. His Quora answers in finance received over 100,000 views the month of November alone.

He currently works in the Investment Consulting industry advising pension and 401k plans, worth over a collective $5B dollars in assets.

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

No Comment