Passive income is an important part of becoming financially free. In order to build wealth effectively, you must surround yourself with as many different sources of income as possible. A platform that we recently came across is Wunder Capital. Let’s discuss our Wunder Capital review and the opportunity as a passive income idea.

Wunder Capital Review: Is this a Passive Income Idea?

Passive income opportunities can be scarce. However, passive income ideas are always evolving. With emerging technologies, this can lead to great passive income opportunities on a risk-adjusted basis.

One platform that is highly intriguing is Wunder Capital. With passive income, you can generate additional income that can be reinvested to capitalize on compound interest.

If you pair passive income with online jobs (such as freelancing), you can increase your income significantly over time.

Wunder Capital has a solid platform

What is Wunder Capital?

Wunder Capital (The Wunder Company) develops, manages and operates solar investment funds by leveraging a partnership network of solar developers and installers while using a proprietary underwriting framework.

Wunder actively manages their entire process, which includes sourcing of commercial solar opportunities, the underwriting contracting and construction of each project. Once a project is fully installed and operationally, Wunder manages the ongoing operation and maintenance, bills the energy customer and distributes proceeds to investors.

Wunder acts like a peer-to-peer lending platform, but instead investors help finance the development of solar projects. If you are a solar developer, you apply on the portal to obtain financing. As an investor, you create an account on the platform to invest in solar opportunities by said developers.

Wunder is addressing a very underserved market in my opinion. There is a huge gap in project financing for smaller-mid size solar projects. In addition, there are not enough financing vehicles out there for small developers since transaction costs are very high to get a deal done.

You may see that solar is hitting record numbers, but the smaller projects have not been able to be financed as easily. Big money is chasing the large utility-scale solar projects.

Wunder was recently featured in The Wall Street Journal highlighting “A Ray of Sunshine for the Solar Market”, the article highlights how Wunder Capital is addressing the gap in the project financing market.

Wunder Capital Review

Our Wunder Capital review will hit on the platform itself and the opportunity from a passive income perspective. Let’s break down Wunder Capital’s portal for ease of use and intuitiveness. The create an account section is very simple and easy to use.

There’s a number of other platforms out there similar to Wunder. Here are some of Wunder Capital competitors:

- Mosaic

- CoPower

In my opinion, these platforms are not as simple and easy to use as Wunder. These also don’t offer the flexibility in type of investment and investment return as Wunder.

In addition, I love how transparent Wunder is with the performance and projects being funded.

Check out the 2017 Year in Review for Wunder Capital. It’s great to see where my money is going and the fact that it is actually helping get solar projects in the ground. Investment returns and an environmental impact. It doesn’t get much better than that.

Wunder Capital Review: Can this be added as a passive income idea?

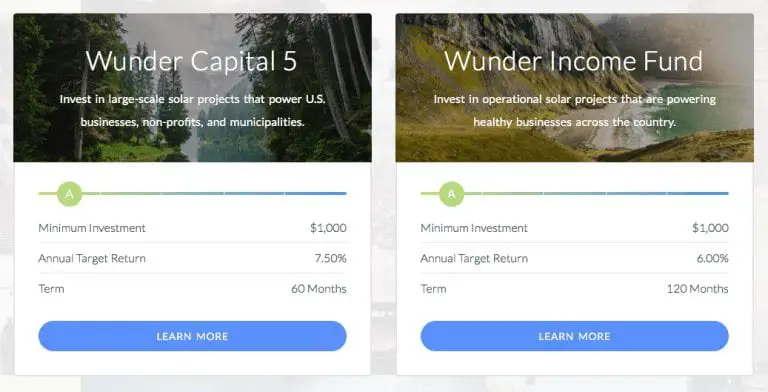

There are several different funds that you can invest in on the Wunder platform. I love the diversified ‘menu’ of risk profiles and investment parameters. Keep in mind these are all targeted investment returns and are subject to change based on actual performance.

Here is a comparison of Wunder Capital 5 and Wunder Capital Income Fund

1. The Wunder Capital 5 Fund

This fund finances and manages a diversified portfolio of commercial-scale solar projects that service stable businesses, municipalities, non-profits, and community solar developments across the United States.

Each solar loan is secured by the assets of the respective solar system, and each system is developed by one of Wunder’s trusted solar partners. Wunder Capital 5 provides investors with targeted monthly cashflows of 7.50% annually for 5 years.

2. The Wunder Income Fund

This fund finances and manages a diversified portfolio of commercial solar projects that service stable businesses, municipalities, and non-profits across the United States. Borrowers enjoy monthly electricity savings and help the environment. The Wunder Income Fund provides investors with targeted monthly cashflows of 6% annually for 10 years.

3. The Wunder Term Fund

This fund finances and manages a diversified portfolio of commercial-scale solar projects that service strong businesses, municipalites, non-profits, and community solar developments across the United States.

This full-amortized fund provides targeted monthly cashflows of 8.5% annually for 7 years, while aiding in the fight against climate change by significantly reducing carbon energy pollution. Each solar loan is secured by the assets of the solar system, and each system is installed by one of Wunder’s trusted solar development partners.

You aren’t the lowest on the capital stack with this fund.

4. The Wunder Bridge Fund

This fund finances and manages a diversified portfolio of short-term loans that allow leading solar installers and developers to cover the upfront costs of new solar development (namely, hardware procurement).

Traditionally, these borrowers have floated development costs off of their own balance sheets, which significantly constrains their ability to book new business. Bridge loans allow borrowers to grow their businesses beyond a leveraged balance sheet or distributor credit limit.

The Passive Income Opportunity

I love the flexibility in the different fund types. I believe this is a great passive income idea as you are able to generate strong monthly cash flow yields for a predetermined amount of time. This is truly passive income investing at its finest.

Depending on your investment horizon and goals in investing, you may want to think about allocating a certain percentage to the income fund or term fund. This is a great way to invest in stable income-producing assets. This will look good in my Personal Capital dashboard.

Investors have become much more familiar with solar as an asset class. The energy production is predictable and costs to maintain the facilities are minimal. There are plenty of parallels between investing in solar projects and investing in real estate.

The one difference is with solar the assets most likely do not have much of a terminal value such as real estate. With real estate, your property appreciates in value over time and you can likely sell that property for a certain amount.

How does solar project financing work?

With solar, there is a finite life of cash flows. That is what makes Wunder Capital such a great platform to use. You don’t have to worry about the management of operations, selling or accounting. You just get to check in with the performance from time to time and collect your monthly cash flows. That sounds and smells like a passive income idea to me.

Wunder is a medium to accumulate wealth and will help you build your personal balance sheet. One personal financial ratio that I like to look at is a measure of “Passive Income divided by your Current Income (aka day job income).

You want to do everything in your power to increase that personal financial ratio to 100% over time. Meaning that you earn the same amount of passive income as your current day job income. This can lead to significant wealth accumulation over time and create a stable personal financial statement.

We can add Wunder to the list of our passive income ideas.

Is Wunder Capital right for me?

With the platform, there is a verification step for accreditation. To use Wunder Capital you must be an accredited investor. This certain limits a number of people in their ability to invest on the platform.

I believe this will change over time, but for now you must be an accredited investor.

See Related: Fundrise Review

What is an accredited investor?

“Accredited Investor” is a term used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and therefore have a reduced need for the protection provided by certain government filings. The SEC defines an individual Accredited Investor as anyone who:

- Has earned income in excess of $200,000 for the past two years individually, or $300,000 with a spouse, with the expectation of earning the same this year.

- Has assets in excess of $1 million, excluding the value of a primary residence.

If you’re accredited based on income, you can upload a W2, 1040, or any other government or company form containing salary for the past 2 years.

If you’re accredited based on assets, you can upload a statement from a financial institution or asset appraisals.

Overall Wunder Capital Review

Wunder is a great platform for those seeking an opportunity for yield and impact investing. The impact investing universe is growing fast. This is a great opportunity to invest for the greater good of our climate and society. Climate change is real and the platform of Wunder allows retail investors to get involved with changing the way we consume and generate power.

I think everyone should carve out a portion of their investable assets in impact investing. There is a need for capital in the impact investing universe that combines the best of both worlds… Investing for financial return and social good.

Invest in solar projects. Do well and do good.

Have you tried Wunder before? Did our Wunder Capital review help you make a decision to try the platform out? Let us know in the comments below. We’d love to hear from you!

I hope our Wunder Capital review helped you.

With both a million rewards points and a million dollar net worth you can live a happier lifestyle. Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve the financially free lifestyle that you’ve always wanted.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

2 Comments

Millionaire Mob, thanks so much for the post.Really thank you! Great.

Millionaire Mob, thanks! And thanks for sharing your great posts every week!