The capital stack is an important consideration for making investment decisions. Based on where you are in the capital stack will determine your returns. The lower you are on the capital stack the higher the risk and thus a higher return.

Capital Stack Guide: 5 Capital Structure Analysis Tips for Investing

Investing should be a staple for everyone goals to achieve financial freedom. Investing your money can be stressful, but it shouldn’t. I created an ebook on investing for financial freedom. I love investing in outstanding businesses at attractive valuations.

My ebook titled Dividend Investing Your Way to Financial Freedom highlights how I invest in stocks at great valuations but also pay out attractive dividends.

If you want to start investing and don’t know how to download the free sample of my investing guide.

My portfolio has exposure to a variety of components of the capital structure. I have some senior debt exposure through bonds and mezzanine capital through my private equity investments. Also, I have significant equity exposure through my investment portfolios as everyone does.

I use Personal Capital to manage my net worth, my cash flow and any liabilities. It’s completely free and the dashboard has a killer interface.

Not everyone knows how to invest their money in various parts of the capital structure.

Use my guide for investment tips to help you create a plan for investing and stick with it.

What is the definition of the capital stack?

The capital stack is a description of where investors sit in priority of ownership of the assets or underlying company. Equity and debt investors usually participate in the ownership of an asset at various levels.

Lenders typically have lower risk as they lend against the collateral of the asset and are not the end owners of the asset or business.

Lenders are typically the highest in the capital stack of an asset or business. Meaning lenders have the highest priority in the event of a liquidation. Conversely, common equity holders are usually the lowest part of the capital stack.

There are several free apps out there that give free stocks just for signing up. I’ve been using Robinhood. They will give you a free share of stock with my link just for signing up. Use these apps to start investing your money effectively.

Think of the capital stack in the same way as capital structure. When people say capital stack, they refer to the priority of the capital structure. The capital structure reflects debt and/or equity investments that mirror the assets of any particular balance sheet.

The capital stack/capital structure is a very important component of the diligence aspects of any investment.

Why is the capital stack important?

Aligning with the concept of risk and exposure, the capital stack/capital structure outlines the legal rights and obligations to certain assets and income for a business or real asset.

Imagine if you didn’t conduct due diligence on your investment and you had no clue your rights to your assets in an event of bankruptcy and liquidation? If you don’t understand it, you could lose everything in a hurry.

People that invest in common stocks rarely understand that they are the lowest priority in any capital stack. Therefore, if there are any new liabilities that appear ahead of you, make sure you understand them.

I’m writing this because I want to pass along the knowledge with investing your money, so you can be smarter with your investment decisions. I’ve seen countless individuals not realize what risk they are truly taking on with investing. This guide will help you in the following areas of investing money:

- Peer-to-peer lending such as Lending Club,

- Real estate,

- Crowdfunding real estate,

- Common equity,

- Private equity,

- Bonds, and

- So much more.

I use tools like Motley Fool Stock Advisor to generate new investment ideas. If I’m investing significant sums of money, I don’t mind paying a subscription fee to have ideas generated and sent to me. Let’s get into the crux of the capital stack.

Components of the Capital Stack

There are several components of the capital stack. Some that you understand, but also some that you didn’t realize were a part of it. Let’s evaluate the components of the capital structure, so you can understand your risk tolerance.

These different tranches of structured capital are the main determinants of the capital structure.

Capital Structure for Businesses

The main determinants of the capital structure for a business starts with the income statement. With the capital stack and a liquidation scenario, taxes come first. You must pay the tax man. Then, come employee wages.

Thereafter, comes all the investors involved in the capital structure of the business.

Types of Capital for Businesses

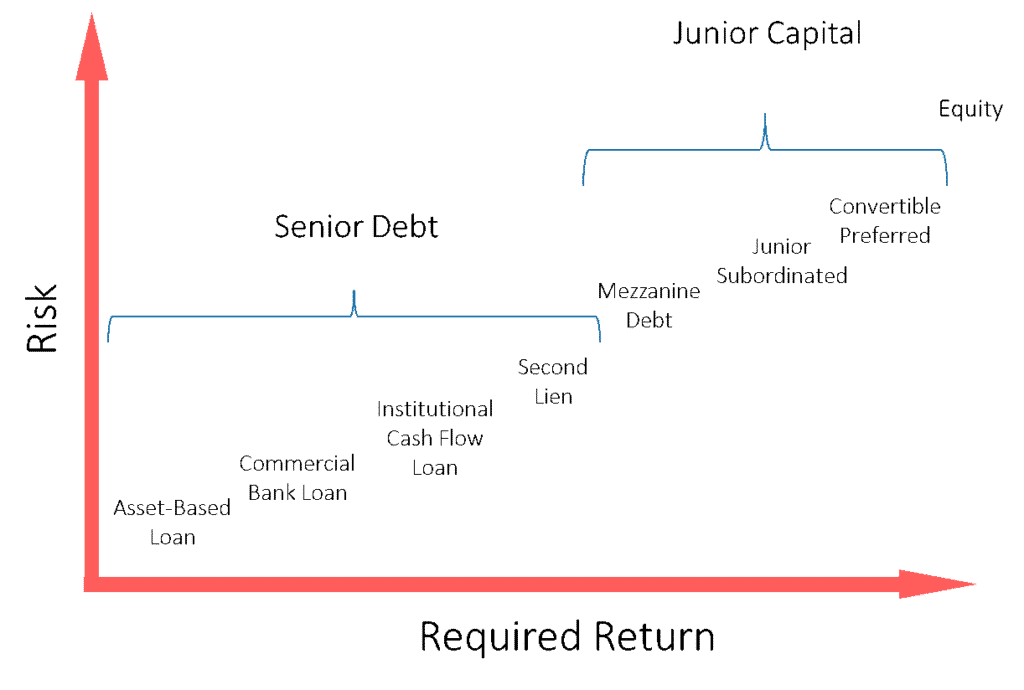

Here are the various types of capital for businesses. Let’s break it down between Senior Debt and Junior Capital.

Senior Debt Capital Stack

- Asset-Based Loan

- Commercial Bank Loan

- Institutional Cash Flow Loan

- Second Lien

Junior Capital

- Mezzanine Debt

- Junior Subordinated

- Convertible Preferred

Then, I won’t label it as Junior Capital… Comes common equity.

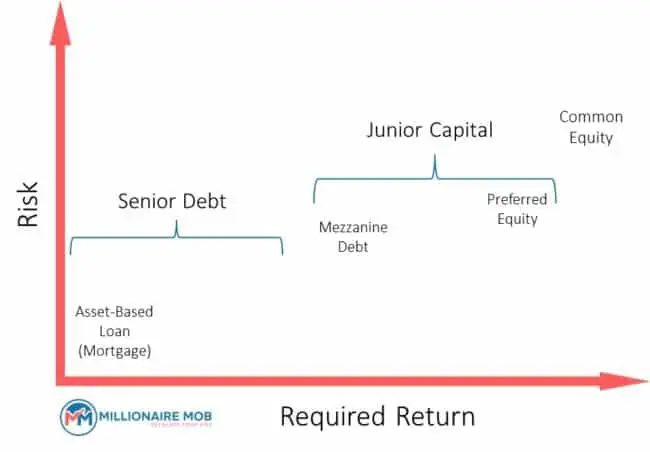

Capital Structure for Real Assets

In addition, capital structures for real assets such as commercial real estate, energy projects, infrastructure and other real asset classes have slightly different capital structures. Remember taxes will always come before the invested capital.

Let’s look at real estate as an example since it is the most common for investors.

Types of Capital for Real Assets

Let’s break down the various capital for real assets, which include real estate, energy assets, infrastructure and more. It’s slightly different than the capital stack for a company.

Senior Debt:

- Mortgage Loan

- Mortgage Loan #2 (sometimes there are just two tranches of senior debt)

Junior Capital:

- Mezzanine Debt

- Preferred Equity

Then, common equity. The reason why you don’t see as many tranches within the capital structure for real assets is that they simply don’t have the balance sheets and flexibility that operating businesses have with capital.

Assets don’t have much in terms of working capital, overhead, etc. They run on their own.

Plus, the cost of capital spread between equity and asset-based loans can be a lot tighter than in company level investing.

It definitely depends on the asset class.

For example, the spread of returns for equity and debt in a biofuels energy project would be much more different than the spreads for a straightforward real estate investment.

In fact, with riskier real assets, debt sometimes isn’t even an option.

You can diversify your risk by using a platform like Fundrise for investing in commercial real estate. Read more about the platform in our Fundrise review.

Tips for Conducting Capital Structure Analysis

In order to do capital structure analysis, you need to use fundamental analysis and use key investment ratios to find opportunities. Imagine through your analysis, you can invest in the top portfolio of the capital structure but get equity-like returns.

Here are my favorite financial ratios and formulas for investing.

1. Understand the Credibility of the Assets

If you can understand the true value of assets held on a balance sheet you can make an evaluation of the collateral. If any of the assets become impaired, the capital stack could crumble…

It all starts with the assets. It simply doesn’t matter if you are senior or junior in the capital stack. If you are senior and the assets held on the balance sheet are overvalued or worthless, you can lose everything.

If the senior investors are losing, well, everyone below them is too. Follow the Gurus like Warren Buffett by using a tool like GuruFocus. The GuruFocus premium subscription is definitely worth it.

2. Verify the Earnings Quality

When conducting capital structure analysis and the various spot that you will sit on the capital stack, you must understand the underlying quality of earnings. If you are looking at a business, make sure any addbacks or adjustments to earnings are truly one-time in nature.

Companies frequently adjust earnings to meet expectations or to position their earnings better. You must be able to call their bluff. If a company says they are making $1 million, but really that is truly $10,000 of quality earnings… You have a huge problem.

3. Is There an Optimal Debt-Equity Relationship?

Large businesses or assets can have very complex capital structures. In order to analyze the capital structure, you must know what the true relationship is with the amount of debt and equity in the business or asset.

For instance, historically, Apple was generating outstanding cash flow and had significant cash on their balance sheet. In fact, Apple had so much in cash they became an investing institution. At the same time, Apple had no debt on the balance sheet. You can use debt to lower your cost of capital that can be used for growth initiatives or even to reward shareholders.

If you can raise debt at 3% and buy back a stock that has a return on equity of 15%, it’s simple math. You come out ahead immediately.

See… Debt is not a bad thing after all. However, this can happen on the converse. Some businesses or assets will raise debt/equity and its use is sub-optimal.

As investors, we need to simply find and opinionate on the best solutions possible.

4. Working Capital is Very Important

Furthering the point on the assets, short-term assets/liabilities (i.e., working capital) are crucial. Working capital reflects the timing of assets and liabilities and what it takes to run the business on a day-to-day basis. Working capital plays an important part in the capital stack and capital structure analysis.

Can a business or asset afford the short-term liabilities based on the short-term assets held on the balance sheet? If it can’t then there are huge problems.

You can use a tool like FINVIZ to screen for businesses with favorable working capital positions.

5. What’s Your Risk? What’s Your return?

Let’s go back to basics with investing. You simply don’t need to take more risk relative to your return than you need be. Wherever you are coming in on the capital stack ensure you are getting compensated for it.

Actually, the best success in investing reflects people that invest with little risk but extremely high reward. Investopedia can be a tool that will help you find the best trade opportunities for low-risk, high-return.

Our main goal in investing is to maximize our risk-adjusted return. Try to invest at the senior level, but recognize equity-like returns. Or, find equity opportunities that are so attractive there’s simply no room for downside.

Here is how I like to find undervalued stocks in the stock market.

Conclusion on Understanding the Capital Stack

Let’s start investing money smarter. Take don’t extra risk without the reward. It doesn’t matter if you are looking at your retirement accounts or not. You must diversify. Use these calculators to ensure you have proper allocations.

I hope that this guide to the stack of capital in businesses and assets helps you become a better investor. Investing money is important and you should have diversification in not only industries and geographies, but also in terms of levels of any particular capital structure.

In addition to capital structure, there is a component of investing at various stages of growth cycles for companies.

However, it all comes down to risk tolerance. Your investing strategy should be completely personal to your level of risk tolerance. Develop a plan upfront and follow it through. If you diversify your holdings you will naturally limit risk.

If investing on your own is not for you, there are tools like Wealthsimple or M1 Finance that will automatically invest your money.

What do you think about the capital stack? Let us know in the comments below. We’d love to hear from you!

Related Investing Money Resources

Use the resources about how to invest your money to start making money work for you:

- The most common robo-advisors compared

- 5 steps to live off dividends forever

- How to start investing your money

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

No Comment