The key to unlocking the potential millionaire in you is mastering the best money hacks from millionaires. Following a path that has led to a successful outcome is one way towards being successful. What money hacks do you use?

8 Best Money Hacks From Millionaires That Will Awe You

It all comes down to establishing a few money habits that have resulted in the accumulation of massive wealth. Thomas C, Corley on his research on hundreds of self-made millionaires emphasizes the money habits of millionaires and the subsequent results. He wrote in “change your habits, change your life” that habits are the cause of wealth, poverty, good relationships, bad relationships, good health, bad health, happiness, or sadness. Learn more about the habits of millionaires and how billionaires become so rich.

Money hacking your way to financial freedom.

Follow these 8 Money Hacks from Millionaires

Here are our favorite money hacks from millionaires. Some of these may be money management tips or some are just plain common sense. You will be surprised at how many millionaires use simple concepts to achieve their personal finance goals. Let’s dig into some of the surprisingly best money hacks from millionaires that you can adapt to build your own or to maintain the millionaire lifestyle.

1. One of the most important money hacks. Live below your means.

Majority of people adjust their spending habits to match their earnings. The moment they get a pay rise, they instantly begin to make lavish holiday bookings or they start looking for a bigger home, they itch to buy a stylish motorcade they have always admired. That is a grave financial attitude, to say the least. Living well is important but not at the expense of your future. Enjoy and save.

How about you save the raise. Invest the extra dollars in retirement or a brokerage account and the compounding effect will result in huge amounts of money coming back to you later.

A millionaire is not wasteful. Here are a few quick money hacks from millionaires:

- Set long-term goals & have a vision.

- Prioritize goals.

- Distinguish between needs and wants.

- Shop with a list.

If you are prone to surplus buying or you are a shopaholic, then here is the brutal reality: you are beckoning a financial disaster. Living within one’s means is easier said than done. Only a few can implement this simple cash hack.

How about you live below your means?

It is prudent to budget for whatever items that you need and avoid the unwanted expenses. Most wealthy individuals live a relatively frugal lifestyle or way below their means. This creates for them the extra cash to save and invest and thus making their bank accounts fatter.

Frugal living does not mean denying yourself the finest things in life.

So, what does it really mean?

- It means having smarter money management plans.

- Plan your expenditure. Do you really need that shoe? Is that new gym suit really necessary? Being a spendthrift is a fatal financial disease. The cure for it is to have a well laid out plan.

- Map out your monthly and weekly expenses.

First, you need to track how you spend your money. This will give you a clear picture of where your money is going to ensure that you keep your spending in check. Purchase only that which you need and cut the unnecessary wants.

Consider the fixed and the variable expenses at your home such as:

- Housing expenses

- Healthcare expenses

- Debt repayments

- Transportation expenses

- Personal living expenses

- Childcare expenses

Prioritize those expenses and put the most important items at the top of the list.

Then, create a budget to work with.

Before you attain that million, you must have that single dollar.

It also means smarter money spending hacks.

Stretch your finances to fit in with your budget.

Learn how to get the best deals on everything that you purchase. Take advantage of the shopping thrift stores, clearance stocks, yard sales, barter boards and other best saving tips to hack free money. Find coupons and rebates in addition to the sales to achieve the very best price on your groceries. Try stockpiling items when you can get them at an unbeatable price. Use these automated cashback apps to save money on routine purchases.

It also includes knowing when not to shop. When the item is in high demand, the prices are likely to be hiked. Hold off on a purchase when the item is in season. Try buying the things you may need when they aren’t in season.

It means harnessing your creativity to cut on excessive spending.

Learn a few money-saving hacks through research on ways to do with what you have and how to employ the DIY hacks.

If you always find someone to fix that ride for you, sew a patch on your pair of shorts, then it’s time to try and do it yourself and save a few coins. Reuse items like the grocery bags and avoid purchasing new ones on every visit to the grocery store. Wash in cold water to cut the electric bills. Eat at home, eat healthy food and do plenty of exercises.

Find other money-saving hacks and seize every little opportunity that you get to accumulate savings.

2. Have multiple streams of income

The little secret of most self-made millionaires is having more than one source of income. In most cases, they have over three sources of income. Creating multiple sources of income means receiving more earnings and thus gives you more chances to save and invest.

What other ways can you implement to make more bucks?

Think of investments and any other money making ideas to make extra money.

There are numerous investments that you can get a hold of such as the stock market, forex market etc. Perhaps, you can invest in the real estate industry. You may have a skill that you can utilize to create a part-time job. You can try numerous freelancing jobs available online and learn how you can become a digital nomad. You can also create passive income.

There are numerous ways to create passive income to build real wealth.

Start a business. It is necessary to create a feasible business plan for how to run your business. A business plan is a detailed description of all that you want to do in terms of marketing, finances, etc.

Find as many easy money making hacks to increase your sources of income. Having more than one source helps to ensure that when one fails the other one will cover your expenses. Earning opportunities are endless. Just figure out any hack to get money and implement it.

Also, it is important to know the differences between passive and nonpassive income.

3. Invest your Savings

Saving is not enough if you are not investing what you have saved.

If savings is a bit strenuous, try creating an automatic saving plan. This can be achieved through your employers’ direct deposit or a recurring transfer from your bank account. Then invest what you have saved. Invest every coin you get. Investing will compound your money into a lump sum amount. Ask for advice from financial planning experts. DIY is good but you may miss an important aspect. Do not be afraid to seek financial advice.

The millionaires who invest in stocks tend to hold their investments for decades and allow their dividends re-invest over time. Saving in certificates of deposit (CDs) and money markets is short-term but cannot be underrated though you might not make enough in returns.

According to Janet Bodnar, the editor of Kiplinger’s personal finance blog, investors should put safety first when they want to make investments and build a strong base for their personal finance.

Bodnar also says that picking stocks should not be an impulse decision but one should carry out a thorough stock analysis before they invest. Novice investors should exercise caution and patience to build a solid fund foundation.

Here are a few investment hacks you can consider:

o Safe Investments

Investors should consider their risk tolerance when making investments. There are numerous safe investments like federal treasury bills and bonds for the risk-averse. These investments may have lower returns but the risk is also relatively low or none at all. Invest in I bonds, Treasury inflation-protected securities (TIPS) bonds, municipal bonds.

They can only be sold after 12 months after purchase but they come in handy after that period. Invest in fixed and immediate annuities. This will help you accumulate wealth with time. There are numerous US Treasury securities that you can include in your portfolio.

If you feel overwhelmed with investing, consider using a robo-advisor like M1 Finance. Here are several robo-advisors compared if you want to evaluate others.

o Retirement investments

Saving for retirement is another yielding money hack. If you are employed, ensure that you are saving in the retirement plans available like the 401(K). It is also imperative to save and plan for your own retirement plans where possible. Make retirement savings a priority and not an after-thought.

The internal revenue service offers a tax incentive to attract more savings into the retirement funds. Start as early as possible possibly after college or earlier but if you are a bit old and has not started, don’t panic. You can still save; it’s never too late to start. You need to be financially secure in your old age and so the retirement fund will secure your future. Millionaires have their retirement years taken care of from as early as possible.

Ensure that you are not overpaying in retirement fees by using a tool look Blooom. Here are some other retirement fee calculators to consider.

o Faith-based and socially responsible investments.

Another way to ensure full satisfaction even as you create another source of income is investing in faith-based and socially responsible investments. It helps to ensure that your money is going to the investments that you are most concerned about and that gives you more fulfillment.

Investing is the best way to save and manage money to attain your financial goals. Find out the best investments options to consider. I’m a big fan of impact investing, which combines investing for profit and good. Swell Investing is a great platform to consider to get started in socially responsible investments.

o Dividend growth investing for income and capital appreciation

At Millionaire Mob, we’ve been building a dividend portfolio for several months. This is a great way to earn residual income in addition to your retirement accounts. This is one of the best ways to increase your income while also participating in the growth of the stock market. Follow along as we build an optimal dividend portfolio.

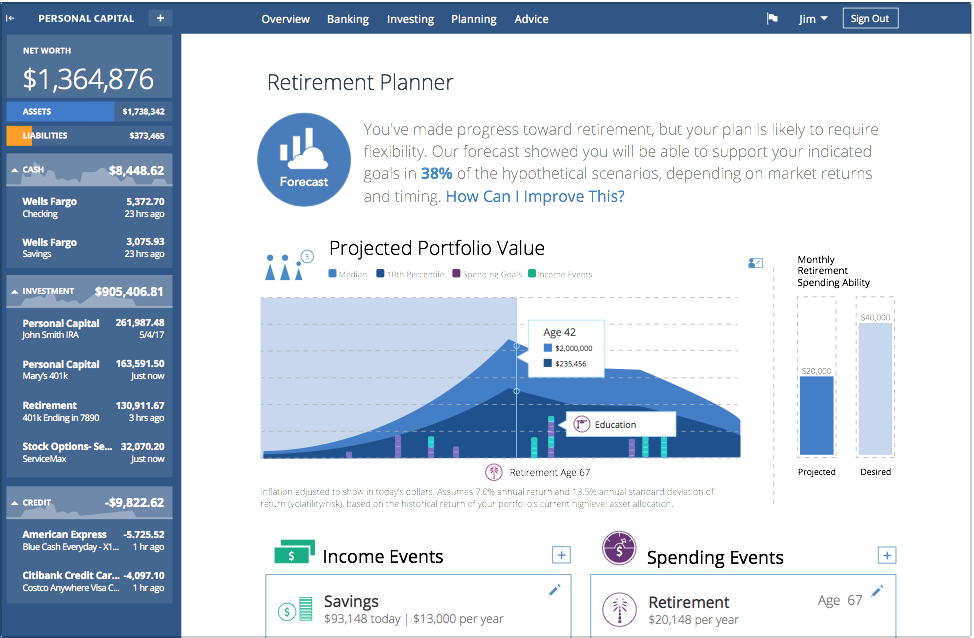

With the Personal Capital Retirement Planner, we’ve been able to manage our money efficiently. I love the intuitive dashboard and tracking. I highly suggest that you sign up for Personal Capital if you’d like to improve your investment portfolio. I love seeing a dividend payment come in Personal Capital.

Here is what the Retirement Planner dashboard looks like:

4. Borrow what you can afford to repay

There is a huge difference between good and bad debt.

Bad debt is when you obtain money from a loan without proper management and repayment plan in place. This kind of debt can really ruin your prospective earnings very fast.

Borrow a loan with a good plan on how you are going to use and repay it. Find the loans that you can obtain at the lowest interest rates. Ensure that your FICO score is excellent or at least good to obtain lower interest rates on your loans such as mortgage and car loan. Carry low debt loads.

Repay it as soon as possible. If things don’t go as planned, you can negotiate with the lenders to make a repayments rescheduling if you are having trouble with your current loan repayment schedule. You can also get lower interest rates and a temporary delay of payments from the lender. Getting out of debt is a crucial money hack for you to reach a stable state of financial freedom.

5. Think Insurance

Insurance is also essential. Having coverage like life insurance can provide for your spouse and children in the event of your untimely death. Insure your wealth as well. The wealth that you have taken a lot of time building needs to be protected.

A tragedy occurs at the most unexpected time. Be prepared for anything. Ensure your job too. A job loss can occur. In case of job loss, you can get unemployment benefits that will sustain you during that period.

Find health insurance to cover your expenses when you get sick or injured. Get car insurance to cover you when you get involved in an accident. Get homeowners insurance for fire tragedies at your home. Disability insurance to help you in the event of an accident.

Find different forms of insurance and coverage’s that can act as a safety net to cover the expenses in the event of any unexpected occurrences. Millionaires tend to use these 401k alternatives to ensure they have the maximum amount of money saved.

Here’s how to determine how much life insurance you actually need.

6. Create an emergency fund

Majority of financial experts advice one to set aside at least between 3 to 6 months of their living expense amounts as an emergency fund. Make a habit of depositing money into your account for an emergency weekly, bi-weekly or monthly.

Nobody knows what might happen the next minute or in the future. “Better safe than sorry” a saying goes. Creating an emergency fund ensure that you are able to cater for the unexpected happenings without straining your pre-estimated budget. It is necessary to prepare for that car break down, job loss or an emergency home repair.

7. Spend your time wisely

There is an old adage that says “time is money”. How you spend your time determines the outcome or the eventual turn of events. Use your time wisely.

You can use any extra time you have to harness your skills or to learn a new skill. The new skill bagged can help you to create new earning opportunities or to optimize the already existing ones. So, keep learning. Education has no end. Read widely and gather as much information as possible from all available sources including the internet, journals, Books etc.

Evaluate if you should use freelance websites for income or build passive income sources.

8. Spend your money on experiences, not things

This is one last key takeaway. The most important things in life are not possessions but sweet memorable experiences. There’s more to life than money hacks. Let’s be real.

Spend your funds on that which makes you happy. Invest in relationships. It creates a more lasting effect than possessions. When you spend on material possessions, the happiness they provide quickly fades away. This is because people are quick to be used to possessions. What was once exciting becomes ordinary in no time.

People keep raising the bar. With new purchases come new expectations. Human beings are insatiable. The copycats and Joneses are also lurking behind closely and this keeps us on our toes.

If someone gets what we have, we look for better. The biggest enemy of happiness is an adaptation. A comparison is a major enemy of progress.

There is power in experiences. They deliver longer lasting happiness than any possession. They become a valued part of you or of your identity. You are not what you own but an accumulation of what impact you have made. Create the best impact wherever you go and stay. That way, you will find even more fulfillment than you can get with possession of any amount of material wealth.

Here are our favorite quotes about financial freedom to inspire you.

Bottom Line for Money Hacks to Achieve Financial Freedom

The best money hacks from millionaires are surprisingly everyday simple habits that the majority of people ignore or are not keen on following. I hope this article has given you some valuable insights. Let’s start money hacking our way to financial freedom. Combine our money hacks with travel hacking through credit card manufactured spending and you will be living the good life in no time.

Check out these other wealth management resources that will help you build wealth, understand your personal financial ratios and track your personal financial statement.

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

No Comment