I use FINVIZ for all my investment screeners whether I am searching for dividend growth stocks or retirement account investments. You can use a stock screener to find a new investment or build an entire portfolio from scratch. Before you set up a screener ensure you have a well-thought out strategy of what type of investing fits you best. Here is how to use FINVIZ stock screener effectively!

How To Use FINVIZ Stock Screener (And Increase Your Investment Returns!)

The FINVIZ stock screener can boost your investment returns instantly. FINVIZ allows you to find any type of stock no matter the situation.

I will highlight why you need to be using a stock screener to make investment decisions, which is why FINVIZ is the perfect option to help you build a successful investment portfolio. I love investing so much that I wrote a book titled Dividend Investing Your Way to Financial Freedom. You can read why I wrote a dividend investing book to learn more about it.

Personal Capital has a future value planning tools that tracks your current retirement savings. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. It is very easy to link all of your accounts and is highly secure.

What is FINVIZ?

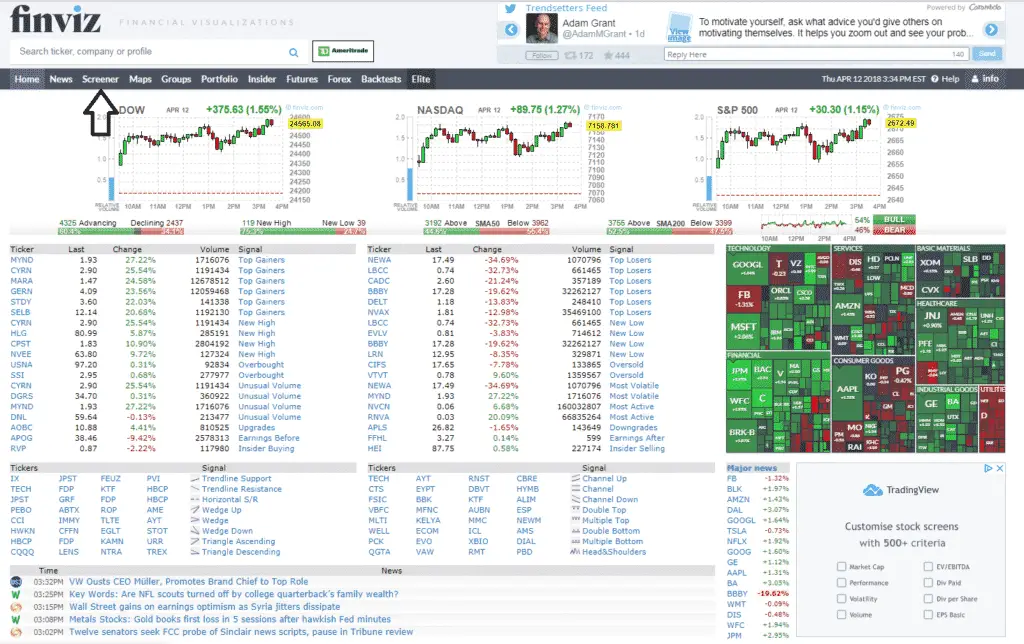

FINVIZ is short for ‘Financial Visualization.’ FINVIZ is one the best stock market platforms for screening stocks through financial analysis, research and visualization. This information is disseminated through quotes, news, charts, maps, technical indicators, stock alerts and much more.

By using FINVIZ, you can boost your investment returns.

All of your analysis can be decided in one centralized tool to make conscious investment decisions. Their stock screener platform is best-of-breed and is completely free to use. Through the free stock screener, you can evaluate public stocks by identifying a set of distinct criteria in the following categories:

- Descriptive: The descriptive criteria includes things such as dividend yield, IPO date, average volume, market capitalization, sector, etc.

- Fundamental: Fundamental criteria includes key valuation themes such as price to earnings ratio, dividend payout ratio, current ratio, PEG ratio, etc.

- Technical: Finally, the technical criteria is for eliminating stocks based on technical charts such as the 200-day moving average, RSI, beta, 52 week high/low, etc.

FINVIZ does so much more than just screen stocks. You can use the platform to create a portfolio to monitor, review heat maps and get the latest news. Try testing out FINVIZ Elite, which is a great option for any investor to gain an edge in a competitive stock market.

Why using a stock screener can boost investment returns?

“Risk comes from not knowing what you are doing.”

-Warren Buffett

Before you start investing, you must have a distinct strategy that you know works or fits the exact criteria of your investment goals. Through these three sets of disparate categories, an investor can eliminate a number of different publicly traded stocks. By eliminating stocks an investor can hone in on a select few companies to research further. Once you have your list of stocks, you can do further due diligence on stocks that meet your personal criteria.

A strategy that Millionaire Mob uses is the dGARP strategy. dGARP means Dividend Growth at a Reasonable Price, which seeks out dividend growth stocks at undervalued prices. We believe that you can find undervalued dividend stocks in any environment.

Follow our steps to invest in undervalued by using the FINVIZ stock screener.

Here is How To Use FINVIZ Stock Screener

We look for as many ways to build a successful dividend portfolio as possible. Using the FINVIZ stock screener is a core theme to building a dividend portfolio. This is just my strategy, so follow these steps on how to use FINVIZ stock screener at your own discretion to fit your needs as an investor. We believe that our criteria for investing in undervalued dividend growth stocks is a proven strategy. We’ve increased our investment returns by over 20% during the past year from using the FINVIZ screener.

In addition, try out the charts offered on the FINVIZ website. They are some of the prettiest in the industry and can be extremely helpful for determining an entry point for a new investment. Building a dividend portfolio is simple. Just follow our tutorial on how to find undervalued dividend growth stocks.

I also love the FINVIZ futures toolbar that allows for me to make actionable decisions before the markets open and after they close. Here is how to use the FINVIZ futures tool to understand market trends.

Millionaire Mob’s FINVIZ Screener Tutorial (including criteria for finding undervalued dividend growth stocks!)

I hope to provide you with a FINVIZ screener tutorial that will enable you to be an expert at screening stocks. There are only three steps so this should be easy enough for a caveman to do it. By following these steps you will be spending less time trying to find stocks. Additionally, you will stay more disciplined in your investment strategy by sticking with the criteria you are comfortable with. No one knows you better than yourself. If you prefer a visual representation of our dividend stock screener criteria, I’ve created an infographic for screening dividend stocks.

Let’s get started on selecting FINVIZ stock screener criteria, so follow these steps…

Step One: Go to the Homepage and Click on FINVIZ Screener

First step of using the FINVIZ screener is by going to the homepage and clicking the ‘screener’ tab at the top of the page. There are plenty of ways to screen for stocks, but there is only one way to screen via FINVIZ screener, so pay attention!

Click the screener tab on the FINVIZ homepage.

Let’s move onto step two on how to use FINVIZ stock screener. This is where you will start building your criteria in your screener.

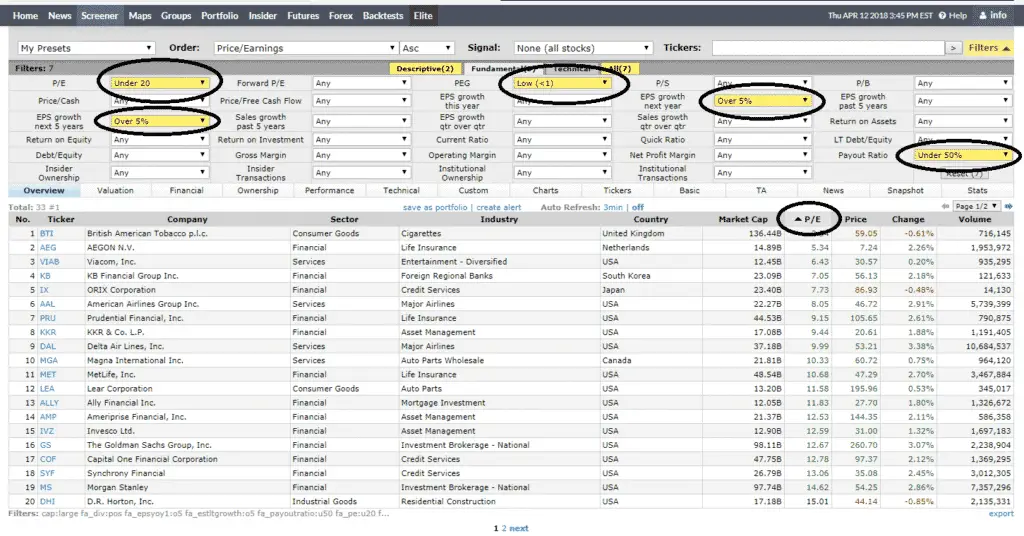

Step Two: On the screener page, select your FINVIZ stock screener criteria

Once you have navigated to the screener page you will need to get into the fun stuff for identifying undervalued stocks. There are plenty of criterion to choose from. Find out what is most important in your investment strategy.

Our favorite FINVIZ stock screener criteria is as follows to find undervalued dividend growth stocks:

- Dividend yield stocks greater than 0%.

- Market Capitalization of over $10bln.

- Input P/E ratio less than 20x.

- EPS growth next year of greater than 5%.

- Input EPS growth next 5 years of greater than 5%.

- Select a Price to Earnings Growth (“PEG”) of less than 1.

- PEG formula is typically used with Growth at a Reasonable Price (GARP) investors. I love this post from Tim Connolly, CFA on the CFA Institute blog about ‘Is it Overvalued?’ Hard to determine if a stock is overvalued by only looking at their P/E ratio. You have to look at growth too!

- Use a payout ratio of less than 50%.

Here is what it should look like on the stock screener page. I like to sort my output by P/E (Price to Earnings Ratio) to ensure I can identified junk or undervalued companies early.

Take a look at the circled criteria for identifying undervalued dividend stocks.

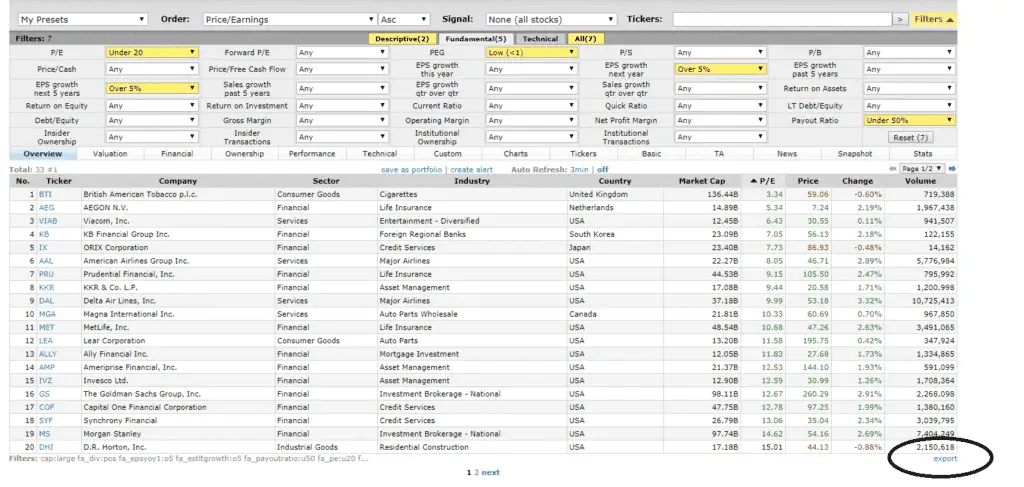

Using the set of criteria identified above, I now have over 33 different stocks that fit my FINVIZ stock screener criteria. That is a lot better than a list of over 7,157 different stocks to choose from that are publicly traded! From here, you should be able to eliminate a handful of stocks that have a bit too much risk. However, given the size of these companies, most of them have some sort of competitive advantage.

If you want a visual depiction of how we look for stocks. Check out my dividend stock screener infographic.

Step Third: Digest the result from your stock screener

There is a bit of a science to understand the output of your criteria. You need to evaluate qualitative considerations. We don’t have enough time to read 33 different annual reports and investor presentations. However, we can pick three or four stocks from our screener to look into further during night time reading!

I suggest you go to a stock’s investor relations page to review the documents available related to the company. These documents would include the 10-K (annual report), investor presentations and 10-Q (quarterly reports). In these documents, they will include pertinent qualitative and quantitative information.

I always suggest you review businesses that fit the mold of the following qualitative criteria before investing:

- Do you understand the business model?

- Does the stock have a strong management team?

- Do you understand the future of the business?

- Does the business have an economic moat? Are there barriers to entry in the industry?

The above qualitative criteria will help you narrow your list a bit further. Not only that. These will be businesses that YOU are comfortable with. That’s the most important part. I’d like to invest in a business that I’m happy owning and I know I contribute to their value (aka I’m a CUSTOMER).

If you’d like to save down your list, I suggest that you export your stocks. This way you can track them over-time OR use them as a checklist as you continue to evaluate the prospects of a potential investment. You can do so by clicking the export button in the bottom right corner.

Use the export button to save down your result into Excel.

In order to export the results from your stock screener, you must be part of FINVIZ Elite. Run some of your own forecasted investments through our dividend calculator to find out when you can achieve your retirement goals.

Now you know how to use FINVIZ stock screener, are you ready to get ELITE?

See Related: Alternatives to Yahoo! Finance

What is FINVIZ Elite?

FINVIZ Elite is used by thousands of traders around the world to make better decisions. FINVIZ Elite includes real-time stock quotes, advanced visualizations (these charts are awesome!), backtesting strategies and a bunch more!

Here are all of the features included in FINVIZ Elite:

- Advanced Charts

- Intraday charts

- Overlays and indicators

- Drawing tools

- Performance comparison charts

- Real-Time and Premarket Data

- Homepage and maps

- Charts and stock quotes

- Stock Screener

- Backtests, which includes profitability research on technicals

- 100 technical indicators

- 16 years of historical data

- Compare with SPY benchmark

- Correlations

- Find correlated/inversely correlated stocks

- Diversify risk

- Alternate your positions

- Proprietary correlation algorithms

- Advanced screener! Use the existing free FINVIZ screener to export data and use more custom filters

- Data export

- Advanced charts

- Customized filters

- Statistics view

In addition, FINVIZ provides an ad-free layout when you subscribe to Elite. Here is a summary of the FINVIZ Elite features compared to the free version of FINVIZ:

These elite features are used by both professional and beginner traders.

The best part about FINVIZ Elite is that you can cancel anytime! Also, if you are not satisfied with their product, FINVIZ guarantees a full refund within the first 30-days of subscribing.

That is a great offer and is so much better than anything I’ve seen out there.

Why you need FINVIZ Elite

With something as efficient as a stock screener anyone can become an investor these days, but not everyone can make decisions at the split second. With FINVIZ Elite you are able to make quicker decisions and discover actionable trades/investments at the very second. Signing up for Elite has boosted my investment returns and has helped me find investments faster than ever before.

By using the FINVIZ stock screener, I can automate my investment selection process. This saves me significant time to focus on the important points in investing such as the qualitative analysis or reading through annual reports to understand the business model. This is the most proven way to favorable returns. Here is how to conduct an evidence-based investing strategy.

Remember using a screener is not an end-all solution. You can always tweak multiples, operating metrics and more to hone in on select companies. I suggest that you narrow your search down to 30-50 stocks to evaluate. You don’t want to be too specific otherwise your sample size will eliminate too many potential investments. You might be missing out on an opportunity!

Using tools like FINVIZ help you generate new investment ideas. You simply can’t have enough information. We need to work smarter not harder. Motley Fool Stock Advisor is another tool that will send you investment ideas directly to your inbox.

You can read my Motley Fool Stock Advisor review to learn more and see if it is the right fit for you.

Use a dividend income tracker to help you follow your dividend payments, so you can deploy more capital and let compound interest work it’s magic.

Now you are an expert. Do you think you know how to use FINVIZ stock screener? You definitely know how to use FINVIZ stock screener. Let us know how we can help in the comments below. We’d love to hear from you.

At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. Join our community to achieve both.

With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle. Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

Escalate Your Life.

No Comment