In order to live financially free you need to attain wealth and replace your income with assets that work for you. Financial freedom should be the ultimate goal for your personal finances. Living financially free is very fruitful. It allows you to live on your own terms and can lead to a very happy life. One our favorite mechanisms for building wealth over the long-term is through dividend growth investing. We seek to use all of our dividend income received from stocks to repurchase more shares of stocks. This is a great way to use compound interest in its finest form. With that being said, there are options out there that will automatically do this, such as a dividend reinvestment plan. Here is how you can attain wealth through a dividend reinvestment plan.

Attain Wealth Through a Dividend Reinvestment Plan

How do you attain wealth over time? Easy, compound interest. The hard part is doing that consistently with success over time. A dividend reinvestment plan can help you build wealth over time.

“The best time to plant a tree was 20 years ago. The second best time is today.”

Building wealth is a marathon and not a sprint. Wealth creation does not happen overnight. You need to continue to pour money into your investment accounts that will provide residual income and long-term capital appreciation. Every dollar received in gains should be reinvest back into your investment account.

I like looking at Dividend Kings to build an effective dividend growth portfolio. You can find a list of our Dividend Kings along with a couple of undervalued Dividend Kings here. Investing in dividend growth stocks is a proven way to create and attain wealth.

Try using Personal Capital to monitor your investment account balances. It’s completely free. I love the ease of use.

What is a dividend reinvestment plan (DRIP)?

A dividend reinvestment plan is an equity program offered by a select number of companies. An investor in the company does not receive cash for the dividend income, but instead repurchases additional equity in the company with the proceeds. Typically at a discounted price to the underlying market value of the stock price. A DRIP program is an effective way to build wealth through compound interest.

DRIP investing is truly a hands-free method to treat your equity investments like a savings account. Your dividend income automatically gets reinvested into the common stock (even if it is partial shares).

If you use a no-fee DRIP program to attain wealth you are in great shape. Try to find stocks that meet your investment ratios.

Benefits of a Dividend Reinvestment Plan (DRIP)

There are a number of benefits of that you need to consider:

- No time to think about what stock to buy with your dividend proceeds

- Typically, no commissions for reinvestment

- Partial shares can be acquired

- Long-term dollar cost averaging

I love DRIP programs through the ability to build a long-term dollar cost average for your investment. If I stock dips, I am automatically repurchasing shares at a lower cost.

Cons of a Dividend Reinvestment Plan (DRIP)

Additionally, there are a few downsides of dividend reinvestment plans:

- Limited ability to invest at your own discretion

- There can be fees associated with the dividend reinvestment plan

Overall, I think the benefits of a DRIP program outweigh the cons. A dividend reinvestment plan allows for you to build wealth on autopilot. There is no reason to overthink it over time. It is simple, easy and effective.

List of Companies That Provide a Dividend Reinvestment Plan

There are a number of companies that provide dividend reinvestment plans. However, I only will consider the companies that provide a free dividend reinvestment plans. I don’t want to pay for a service that I can potential do on my own.

We’ve provided a fantastic list of 289 different companies that offer no fee DRIP. I suggest you take a look at the list to see if you are invested in one of those DRIP stocks that are on the list and enroll in their dividend reinvestment program now.

You can also use a brokerage like M1 Finance that will automatically invest your money for free. They use Pies as portfolio. Here’s a few M1 Finance Pies to consider.

But how effective can dividend reinvestment be to building and creating wealth…

How does a Dividend Reinvestment Plan (DRIP) help attain wealth? Why can’t I just invest normally over the long-term?

“Never stop investing, never stop improving.”

Over a long period of time, compound interest is extremely powerful. As you continue to reinvest your dividends, this is the best opportunity to maximize total return since you are continually allocating your income to a particular stock over time.

As you buy the stock on even the slightest of dips or declines in share price, you maximize your return when the stock goes up. Here are a few smart investment techniques to turnaround your investment portfolio.

Wealth Building Characteristics

In order to create wealth through dividend growth investing and DRIP, you have to maintain the following characteristics:

- Setting goals. You need to set and monitor goals over for the short and long term. You need to be able to track your progress over time to ensure you are building wealth effectively. I like to use a variety of different programs to monitor my income and asset allocation.

- Discipline. There are no excuses. You need to continue your strategy no matter the scenario. If you have a high expense month, you still need to allocate the same amount to your monthly investment goals.

- Dividends. You want to invest in stocks that reward shareholders. Yes, growth stocks are great to have. However, they don’t provide the best combination of both income and earnings growth. Dividend Kings have a history of increasing dividends at least 50 years.

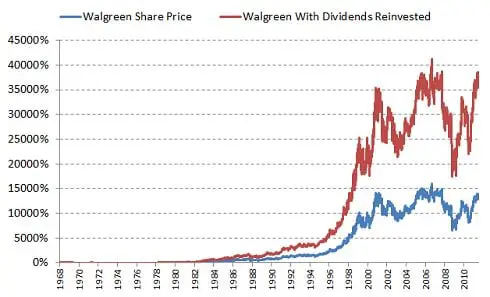

Here is a great story about a Chicagoan, Russ Gremel, who donated his $2 million of Walgreen’s stock after holding it 70 years. Russ invested $1,000 in Walgreen’s stock and reinvested the dividends.

Clear benefits from reinvesting dividends from Walgreen’s versus non reinvesting dividend.

This case study on Russ Gremel is a fantastic opportunity to review characteristics on creating wealth over a long period of time. Russ hit on all of the above topics of setting goals, discipline and dividends. Russ Gremel also hit on a few points that are important to me.

Important Characteristics to Remember in Dividend Growth Investing

- Invest in what you know. Do you understand the business model?

- Keep it simple. Keep buying a stock that you like over the long-term. Do not try to become a day trader.

- Invest in companies that have the following traits:

- Strong brand reputation

- Great management

- Conservative financial controls

- Demonstration of being shareholder friendly

I everyone to understand the above traits because it will allow you to find the next Walgreen’s opportunity. What if you can find the next Dividend King or Dividend Aristocrat before it happens?

Building wealth is easy if you stick to the plan.

Millionaire Mob’s Approach to Building Wealth Through Dividend Reinvestment Plans

I take a two pronged approach to investing in dividend reinvestment plans. For my after-tax dividend growth investment portfolio on Robinhood, I do not use dividend reinvestment plans. Robinhood is already commission-free on all stock trades, so I really don’t need to have a DRIP program incorporated into my portfolio.

This gives me the flexibility to buy other common stock at my own discretion.

For example, if I receive on a $10 dividend payout on Target Corporation, I can take that $10 and invest in a dividend stock that is less than $10. It allows me to use my compound interest on my own terms. You can view my Robinhood dividend growth portfolio here.

For my retirement investing accounts, it is pretty simple and straightforward. Dividend reinvestment plans all the way. My retirement accounts are a majority of my assets at the moment (besides real estate), so I want these to be optimized for wealth building as much as possible. Here are other wealth creation tips to help you plan you financial future.

Therefore, dividend reinvestment at all times is optimal. I’m looking to maximize my total return as much as possible.

I have a number of international dividend growth ETFs in my portfolio that will automatically reinvest in the stock, but are not necessarily a dividend reinvestment plan through a company.

I’m on a mission to try to find a formula that find the next Dividend Kings before they happen… How do you do so? You take case studies like Walgreen’s and Russ Gremel and learn from them. And so back to my point:

You never stop learning investing, you never stop improving.

Related Resources:

- Dividend Investing Starts with Profit Growth

- McDonald’s Stock Dividend Analysis

- Free Stock Calculator to Help You Invest Smarter

Prefer social media? You can find us on Twitter (@MillioniareMob2), Facebook (@MillionaireMob) or Instagram (@millionaire.mob). Give us your thoughts on dividend growth investing, passive income or even travel hacking.

Subscribe to our newsletter to find out what stocks we think are the next Dividend Kings (we do not send spam). Escalate Your Life.

1 Comment

Great article, thats for sharing./