Using credits cards as a form of passive income is a fantastic idea. It requires no required upfront costs with fantastic benefits that reap benefits throughout your everyday life. From my Chase Ultimate Rewards points, I’ve been able to take trips to Macchu Picchu and places around the world. I like to use credit card churning to build a huge travel rewards portfolio. I complement my credit card churning with credit card manufactured spending, which allows me to travel the world for virtually no cost. In my opinion, credit card churning qualifies for passive income as you pair it with credit card manufactured spending you can earn more money than it costs to do the manufactured spending. I will highlight the best credit cards to churn.

Best Credit Cards to Churn: Travel the World With Travel Hacking

Over time, I will highlight some of the top credit cards to get right now. There are several cards that are keys to have in your portfolio. The credit cards that I highlight below are important to have in your portfolio because they are subject to the Chase 5/24 Rule.

Chase Ultimate Rewards offers some of the most dynamic, beneficial travel rewards points. I believe you should prioritize the top Chase cards as you begin you credit card churning expedition.

What is credit card churning? How do I use credit cards to travel the world?

Credit card churning is a strategy that allows you to earn massive signup bonuses for credit cards after hitting the first 90 days of spending for the credit card.The more credit cards that you open the more signup bonuses you can earn.

However, you need to make sure that you follow some disciplined rules before getting committed to credit card churning such as paying off your balance in full each month or making sure you hit the minimum spending requirement. This is one of the many mistakes you want to avoid in churning credit cards.

Read my credit card churning guide to learn more.

What is the minimum spending requirement for a credit card?

The minimum spending requirement is the “Spend $3,000 in the first 90 days to receive 50,000 bonus points” language. You need to be able to hit the minimum spend to get the bonus.

If you aren’t hitting the minimum spending requirement, you are giving away free money. If you don’t think that you can hit the minimum spending requirement, then you can partake in credit card manufactured spending.

How do I do credit card manufactured spending?

Credit card manufactured spending is the act of ‘artificially’ spending money on your credit card to hit the minimum spending requirement and thus generating the signup bonus. There are a number of bank accounts that allow credit card funding. Doctor of Credit has a fantastic list of bank accounts that allow credit card funding. There are a number of other ways that you can do credit card manufactured spending in 2018.

Additionally, credit card manufactured spending accelerates your ability to use credit cards for other reasons. For example, you can manufacture spending on a credit card that offers only 1x value and then move to a credit card that offers 3x points on restaurants. It is a way to optimize your bonus points.

I like to think of credit card churning as a way to increase your income or assets. Points are indeed assets as they have cash value. Think of your rewards points like a portfolio that you want to diversify, so you have a variety of options.

Once I build up a lot of points, I like to use these 5 tools to help me book award travel. Credit card manufactured spending allows you to hit your minimum spending easily!

What are the best credit cards to churn?

We like to pair our these top credit cards with manufactured spending to hit the minimum spending requirement quickly and efficiently.

This allows for us to the bonus points much more quickly. No more waiting for 3 months to see the bonus hit your account! In fact, with manufactured spending you should be able to get all three cards and hit the minimum spending requirement in that same month!

Things to Look for in the Best Credit Cards to Churn

The best credit cards to churn usually have several distinct features and qualities to consider. You need to look for several things that make up a great credit card for churning. Think of your credit cards like an investment portfolio. You should develop a credit card churning strategy and plan before you get started. I made several mistakes early when getting involved in credit card churning.

For instance, I applied for the American Express Hilton Honors credit card because the bonus upfront looked huge! However, I quickly learned that redemption values for Hilton properties are awful. My bonus was barely worth much compared to the alternatives.

Here are some qualities that make up the best credit cards to churn:

- Are the points flexible? Can you transfer to other travel rewards partners?

- Can you eventually downgrade your card to a no annual fee credit card?

- Does the bank track how many credit cards you have applied for like the Chase 5/24 rule? Prioritize credit cards that have rule restrictions on applications. If you are passed the Chase 5/24 rule, then prioritize cards that are not part of the 5/24 if you want Chase cards. Here is a list of Chase credit cards not subject to 5/24.

- Does the credit card allow for manufactured spending?

These are some considerations for the best cards for churning. However, there is other considerations. This is why I like to use a credit card flowchart to decide where to go next.

I use the Reddit churning community to interact and stay up to date on the best information related to credit card churning. Here is a guide on how to use Reddit churning to better your travel hacking skills.

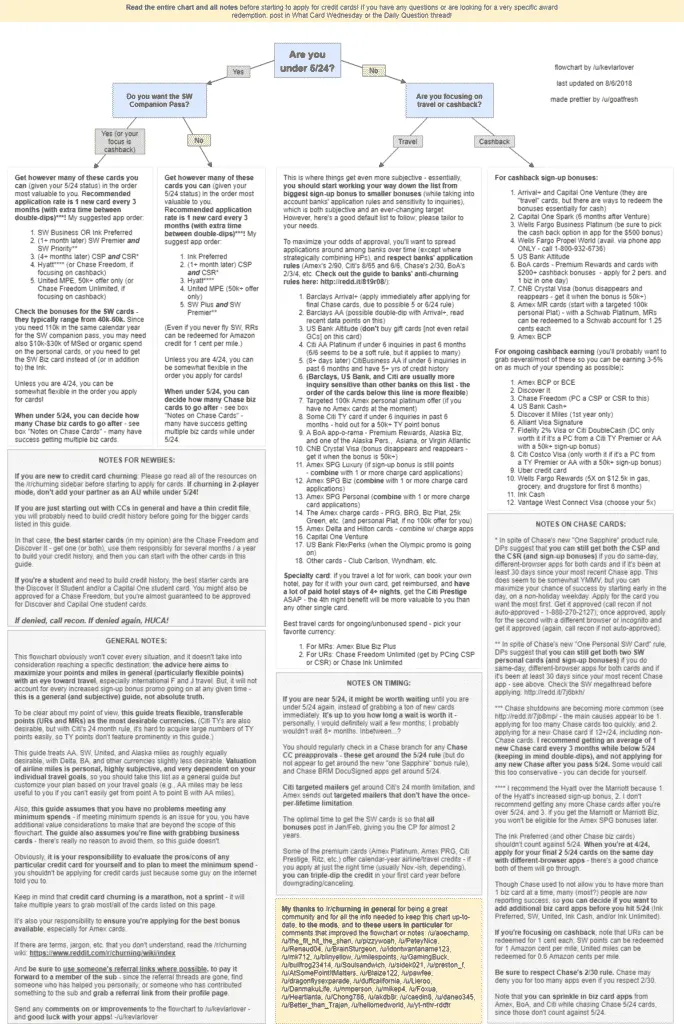

Credit Card Decision Flowchart

This is a credit card decision flowchart from the Reddit churning community. Review it based on the needs of your churning experience. I always seek to maximize my travel rewards.

Traveling is the best way to gain wisdom and open your eyes to new experiences. Just click on the image to learn more about the decision flowchart.

Let’s get into our list of the best credit cards for churning.

List of the Best Credit Cards to Churn

Here is our list of the best cards for churning. My list of cards for churning includes my considerations above on points flexibility, upfront bonus and lucrative travel rewards.

Chase Ink Business Preferred

Bonus 80,0000 Chase Ultimate Rewards Points: The 80,000 signup bonus of Chase’s valuable Ultimate Rewards points is one of the best offers out there, and this card gets 3 points per dollar on the first $150,000 spent on travel, shipping, social media advertising and internet / cable / phone services, making it one of the best cards out there for Business Owners.

Apply using your social security number and as a sole proprietor to get approved!

Chase Sapphire Reserve

Bonus 50,0000 Chase Ultimate Rewards Points: This is one of the top premium cards out there since you earn 3x on all travel and dining and have access to great perks like a $300 travel credit each year, 50% more value when you redeem points for travel through Chase Ultimate Rewards.

You get elite travel benefits like Global Entry application fee rebate, Priority Pass Select and special rental car privileges. With the Priority Pass, I have gone on 3 trips and have already reaped over $150 worth of meals at the airport for free. Also, if you travel with friends they get to enjoy the benefits too!

Chase Sapphire Preferred

Current Bonus 50,0000 Chase Ultimate Rewards Points: Great travel benefits, 2x points on travel & dining, a 50,000 point sign up bonus, and no annual fee first year make this one of my favorite cards. If you do not have a Chase Sapphire card in the last 2 years, you can apply for BOTH the Sapphire Preferred and the Sapphire Reserve on the same day!

Chase Freedom & Chase Freedom Unlimited

The Chase Freedom and Freedom Unlimited credit cards are fantastic for churning. With the Chase Freedom credit card, you receive quarterly access to 5% cash back categories. If you combine your Chase Freedom card with the Chase Sapphire suite, you can unlock unbelievable amounts of Chase Ultimate Rewards points. Check out my Chase Freedom review for more information.

I used my Chase Freedom card from college to build up a fantastic credit score. The bonuses are very limited, but not hard to hit. If you are in college or have a limited credit history, this may be a good place to start building up your credit.

It is very easy to apply and get the card right away.

Conclusion on Best Credit Cards to Churn

These three cards would give you an outstanding portfolio of Chase cards to use going forward as a credit card churner. Track your credit cards with our free tracker to help you stay organized.

With over 180,000 UR points that can be redeemed for ~$2,700 WORTH OF TRAVEL! Chase Ultimate Rewards points offer best in class redemption with the opportunity to transfer to travel partners, redeem for cash or book for travel through the Ultimate Rewards Portal.

There is a reason the Chase cards are the best credit cards to churn. They allow you to go anywhere in the world while participating in an amazing travel experience.

What do you think the best credit cards to churn are? Please let us know your thoughts in the comments below. I’d love to hear from you.

There are several ways to get rid of holiday debt with balance transfer credit cards. This is a great way to attack your debt quickly and avoiding paying interest on an outstanding balance.

If you are a big coffee drinker, consider these best credit cards for coffee lovers.

At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. Join our community to achieve both. With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle.

Subscribe to our newsletter to find out the best travel hacks, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

Escalate Your Life.

4 Comments

As far as Chase cards, I currently only have a Freedom and Freedom Unlimited. I might try a couple of the cards you mentioned next year.

Also, I didn’t know you could apply for both a Chase Sapphire Preferred card and a Chase Sapphire Reserve card.

Yeah, you actually can! You have to do it on the same day aka “double dip”

If you don’t own a business is it still possible to apply for the Chase Ink Business Preferred?

Yeah totally. Just apply using your SSN and input business revenue of $0. There’s still a good chance you’ll get accepted if you have good credit. Good luck!