Titan Invest is an investing platform that enables you to invest like a hedge fund. Our Titan Invest review will highlight everything you need to know about the platform including an overview of the company, investment strategy, pricing, security and more.

Titan Invest Review 2019: Invest Like A Hedge Fund

The rise of financial technological innovation from robo-advisors and different investing apps have allowed for anyone to start making money in the stock market while saving time.

Investing with robo-advisors and other investing apps can help you build wealth, but are all of them right for you?

Hedge funds are often viewed as an investment product that is not available to retail investors. Until now.

Here we will evaluate the feasibility of using Titan Invest to start investing like a hedge fund.

Overview of Titan Invest

In a world with so many investment services and robo-advisors, it can be hard to understand how each option differs and which one is best suited for you.

In my view, Titan, a hedge fund-like investing platform backed by Y Combinator, seems to stand out from the crowd.

While most modern robo-advisors and investment products offer a passive, index-tracking approach, Titan is an active advisor that offers hedge fund style investing that seeks to outperform the market over the long term.

Titan Invest’s Investment Strategy

First of all, let’s talk about Titan’s strategy. Titan invests you in a basket of 20 high-conviction stocks that are vetted by leading long-term hedge funds. According to their website, they believe these portfolio companies are typically high-quality businesses that have strong competitive advantages and long growth runways.

Titan identifies these stocks via their proprietary algorithm, which analyzes thousands of hedge fund filings known as “13Fs.” Per their website, these filings can offer a wealth of valuable information to investors but are also filled with pitfalls that can render them misleading to the casual onlooker.

By analyzing and comparing thousands of filings every quarter, they believe their algorithm is able to filter through the noise and identify strong picks.

On top of the core portfolio, Titan offers you personalized downside protection via a portfolio hedge tailored to your individual risk profile and investment goals.

The hedge dynamically adjusts to different market conditions, which seeks to offer protection to investors from market risk, especially in protracted bear markets, like the one witnessed in 2007-08.

This entire strategy is designed to offer investors attractive returns over a long-term time horizon (say, several years or more).

By focusing on businesses that they believe have attractive fundamental drivers and taking a concentrated approach that isn’t “over-diversified,” Titan believes its strategy offers investors a way to sustainably grow wealth over the long run.

The portfolio itself is relatively low turnover and is rebalanced once every quarter.

See Related: How to Conduct Evidence-Base Investing

Titan’s Returns

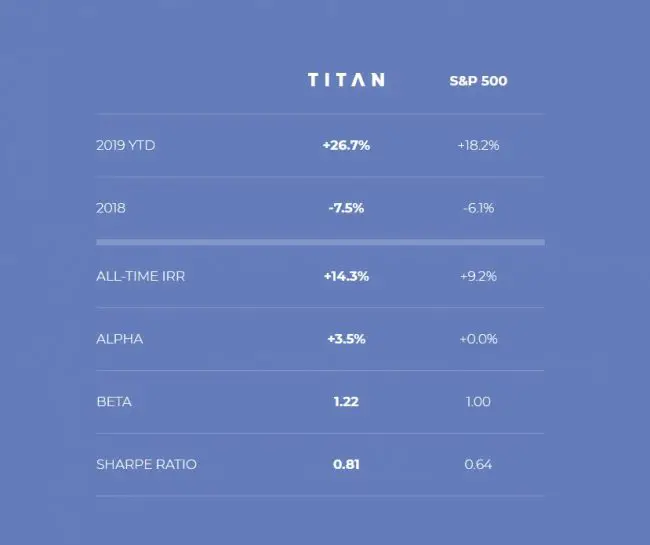

While past results should never be taken to be indicative of future performance, Titan seems to have done well so far. As of April 30, 2019, a hypothetical client with an Aggressive risk profile who joined Titan on January 1st, 2019, would have been up 26.7% YTD versus 18.2% for the S&P 500 over the same period.

What’s more, it was able to achieve those returns with a Sharpe ratio that was higher than the S&P 500’s – meaning it was able to offer better returns than the S&P 500 for each unit of risk taken.

You can track Titan’s performance here. See the end of this post and Titan’s website for full performance disclosures.

Quick Explainer: What’s a Hedge Fund?

Some of you may be wondering what exactly a hedge fund is. If you’ve seen the show Billions on Showtime, you may have a good sense. In essence, hedge funds are investment vehicles designed for high net worth (read: extremely wealthy) individuals or institutional investors like pension funds.

Hedge funds typically have minimum investments in the millions of dollars as well as “lock-up periods” (during which you can’t withdraw your funds) for one year or more.

In return, hedge funds offer their investors the opportunity to earn attractive returns that exceed the level of risk they take (or in other words, attractive “risk-adjusted returns”). They do this via their namesake element – “hedging” – which enables them to have positive exposure to both upturns and downturns in the market.

While even the most robust hedging can’t eliminate volatility in its entirety, top hedge funds, on a multi-year basis, tend to do quite well for their investors.

Titan’s founders themselves used to work as investors at hedge funds before leaving to start Titan.

In an interview with Bloomberg, the founders revealed they grew tired of helping to make the already-wealthy wealthier, and sought to design a system that could offer the everyday investor the ability to invest like top hedge funds.

See Related: How to Start Investing Your Money

How Titan Works

The signup process is very simple: just download the app from the iOS or Android app store, then complete a brief signup process right on your phone.

As soon as you fund your account, you’ll be granted access to the app, where you can see your individual portfolio holdings as well as all of Titan’s in-house investment research.

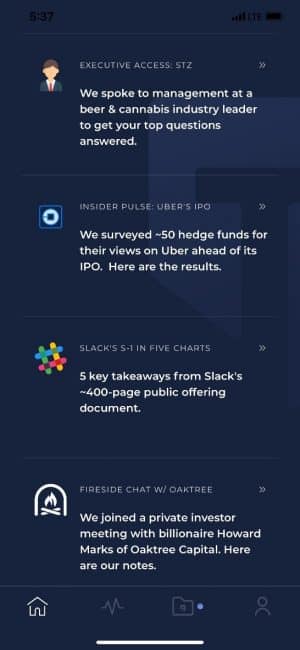

The app’s home screen features a scrolling timeline of Titan’s latest investment research.

The app’s home screen features a scrolling timeline of Titan’s latest investment research.

The first thing you see on the home screen is an overview of your portfolio’s performance, followed by a constantly updating feed of Titan’s investment research.

Their research covers all sorts of topics, from their portfolio companies and upcoming IPOs to market analysis and investment strategy. The format of the research also varies widely – from deep dive reports and videos to podcasts and interviews.

Scrolling through the feed, I saw a pre-IPO analysis of Uber based on a proprietary survey Titan conducted across 50 hedge fund investors. There were also notes from a private meeting with Howard Marks (a veteran hedge fund investor), as well as a transcript from a conversation with executives at a market-leading beverage business.

This material all seemed exclusive to Titan clients and was presented in a straightforward, jargon-free fashion. While the analysis seemed very thorough and typical of the research hedge funds often conduct, it did not strike me as unapproachable.

This all seemed to check out with Titan’s mission of creating a world of more informed investors. The research is not just aimed at providing updates and insights, but also at helping clients become better investors.

According to Titan, it’s important for all investors to have some understanding as to what they’re invested in and why, as they believe investor behavior can dramatically influence their realized returns.

To top it off, if you have any individual questions, you can chat directly with Titan’s research team of former hedge fund analysts inside the app. This struck me as a level of transparency and access that typically isn’t available at traditional hedge funds or robo-advisors.

Screenshots from Titan’s research library, which includes videos, interviews, and podcasts.

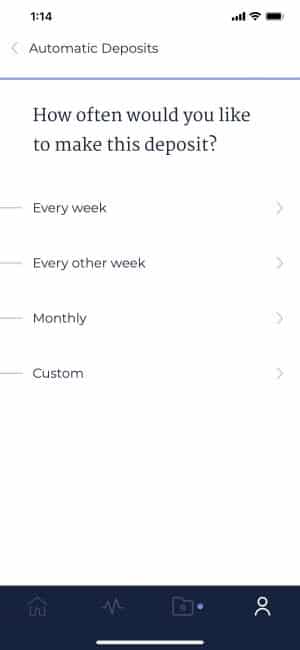

Managing your funds inside the app is also quite simple – you can make transfers into and out of your account at any time with just a few taps. Recurring deposits are available for people who want to get in the habit of regularly saving and investing. And unlike traditional hedge funds, which can have lengthy lock-up periods of up to one year or more, Titan lets you withdraw from your account at any time.

The recurring deposits feature allows you to make regular contributions to your account over custom time intervals.

Pricing

You may be wondering how much all of this costs… Traditional hedge funds often have complex fee structures, often referred to as “2 & 20” – meaning 2% of assets under management and 20% of performance. Titan’s fee is much simpler, at a flat 1% annually.

Lower fees may be available elsewhere; for example, traditional robo-advisors often charge 0.25-0.50%. However, Titan believes its higher fee is justified by its differentiated features (e.g. concentrated portfolio of stocks vetted by hedge funds, personalized hedge security, investor education through detailed reports and videos).

Another thing unique to Titan’s pricing is their referral program, which can allow you to effectively reduce your fees to 0% just by referring friends. Under their current program, each referral you make reduces the advisory fee for both you and your friend by 0.25%, for life, on this first financial product.

That means after just 3 or 4 successful referrals, you can invest with Titan for no advisory fees, for life, on this first financial product.

From what I can tell, no other active investment advisor comes close to this when it comes to pricing (to say nothing of traditional hedge funds).

See Related: Best Value Investing Books to Read

Security – Is Titan Invest Safe?

Titan security measures seem very robust, with all data and financial information in the app encrypted using 256-bit SSL encryption. In addition, all funds are held not by Titan, but rather in individual accounts in your own name via the leading financial custodian Apex Clearing (which you may have seen in your account statements if you’ve ever had an account with Robinhood or M1 Finance).

What this means is that while Titan directs the investment activity in your account, your funds are held safely and independently of Titan.

All Titan accounts also come with up to $500,000 of SIPC insurance.

How Titan Compares to Other Investment Platforms

At this point, you may be wondering how Titan fits in in the broader landscape of investing platforms. With a plethora of options available to the everyday consumer, ranging from other investment apps to mutual funds and ETFs – it can be hard to understand what services might work best for you.

The key thing to understand about Titan is that it’s an active investment manager, much like the hedge funds it tracks. Titan actively selects stocks based on its proprietary algorithm, which is designed to construct what it believes to be a “best-of-the-best” long-term equity portfolio.

Beyond that, they don’t aim to track any single index, factor, or even fund.

This is similar to the behavior of traditional human investment advisors, but with a state-of-the-art algorithm, a fully digital interface, a more attractive fee structure, as well as a fully-fledged research platform attached.

“According to Titan’s founders, simplifying the consumer investment process and democratizing access to elite investment strategies are the primary aims of Titan’s mission.”

While Robinhood and M1 Finance look similar to Titan in terms of their front-end interface, from an investment perspective they are also totally different. These types of firms are not investment advisors, but rather brokerage houses that let you diligence and manage all of your trading decisions yourself.

Similarly, robo-advisors like Wealthfront and Betterment are very different from a strategy perspective and are geared towards investors who are seeking more passive options that look to track the market rather than outperform it.

When it comes down to it, as a long-term oriented investment platform, Titan seems best suited for people looking to grow their wealth for the long haul. This includes people who are saving up for retirement or just building their nest egg.

Titan has announced plans to launch IRAs this summer, which would make it a more comprehensive platform for those planning on investing for retirement.

Pros and Cons

- Pros

- Simple, hands-off approach

- Access to curated investment research (videos, podcasts, deep dives, etc.)

- Generous referral program

- Cons

- Not suitable for active traders and shorter-term investors

- Currently only invests in US-listed stocks

See Related: How to Invest Your Money (Including Tips to Live By)

Conclusion on Titan Invest Review

Titan gives people a hedge fund-like investment option over time or an opportunity for those who simply lack the confidence to manage a stock portfolio themselves. It’s a completely hands-off approach to investing a nest egg for years down the line (compared to the multitude of merely index-tracking offerings out there).

I believe that the research they publish is a particularly unique aspect of Titan compared to other investment services.

Although I think their current offering differentiates itself from the market, something I hope to see in the future is that they offer more options to invest in bonds, options, and other asset classes.

What do you think of this Titan Invest review? Let us know in the comments below. We’d love to hear from you.

Related Resources

- M1 Finance Review: Complete Free Automated Investing

- Free Dividend Calculator to Help You Plan for Investing

- Fundrise Review: Seamless Commercial Real Estate Investing

This article is a paid partnership with Titan Invest (“Titan”). All opinions are our own. This is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services. Titan uses a proprietary algorithmic strategy in selecting recommendations to advisory clients. Please see Titan’s website (https://www.titanvest.com/) and the Program Brochure (available on the website) for more information. Certain investments are not suitable for all investors. Before investing, consider your investment objectives and Titan’s fees. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested. Titan’s registration as an SEC-registered investment adviser does not imply a certain level of skill or training and no inference to the contrary should be made.

Nothing here should be considered as an offer, solicitation of an offer, or advice to buy or sell securities. The above content is for illustrative purposes only to demonstrate products, services, and information available from Titan. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections, are hypothetical in nature and may not reflect actual future performance.

All Titan performance results include the use of a personalized hedge for a hypothetical client with an “Aggressive” risk profile; clients with “Moderate” or “Conservative” risk profiles would have experienced lower returns. Please visit https://support.titanvest.com/investment-process/hedging for full disclosures on our hedging process. 2019 YTD results are from 1/1/19 through 4/30/19. 2018 results are from Titan’s launch date of 2/20/18 through 12/31/18. Performance results are net of fees and include dividends and other adjustments. All-Time figures represent the performance of a hypothetical account created on 2/20/18 using Titan’s investment process for an aggressive portfolio, not an actual account. See Titan’s website for full performance disclosures.

No Comment