Dividend growth stocks that have a consistent track record of increasing dividends are typically viewed as the best of breed stocks. They command premium valuations. To increase your dividend for 50 consecutive years is an impressive feat that requires strong management, operational excellence, financial health and discipline. In order to build a successful dividend growth portfolio, you must have at least one of these Dividend Kings in your portfolio. Here is the ultimate list of stocks increasing dividends for 50 years.

Dividend Kings: A List of Stocks Increasing Dividends for 50 Years That Must Be In Your Dividend Growth Portfolio

Who should be crowned a Dividend King? Well…. a Dividend King is already an Aristocrat. The power of dividend investing is tremendous. Dividend investing is not sexy or the talk of the town. Investors in Dividend Kings or Dividend Aristocrats are rarely the same type of investors chasing the high flying valuations of FAANG stocks.

FAANG investing is a strategy whereby you invest in Facebook, Apple, Amazon, Netflix and Google. Dividend growth investors are usually the opposite. They love companies with a strong track record of success AND a strong track record of rewarding shareholders for their investment. You must have at least 3 of these Dividend Kings in your dividend growth portfolio.

When a company makes money, they usually have two options on that cash flow. They can reinvest the cash into the business or they can issue a dividend to their shareholders. A dividend is (of course) a share of the after-tax profit of a company. The stocks grouped in the FAANG index (with the exception of Apple) are reinvesting all of their cash flow back into the business.

My dividend calculator shows that I need to invest in reliable dividend stocks that have a high probability of increasing their dividends over time. If I do that consistently for 20 years, I will be living off dividends forever.

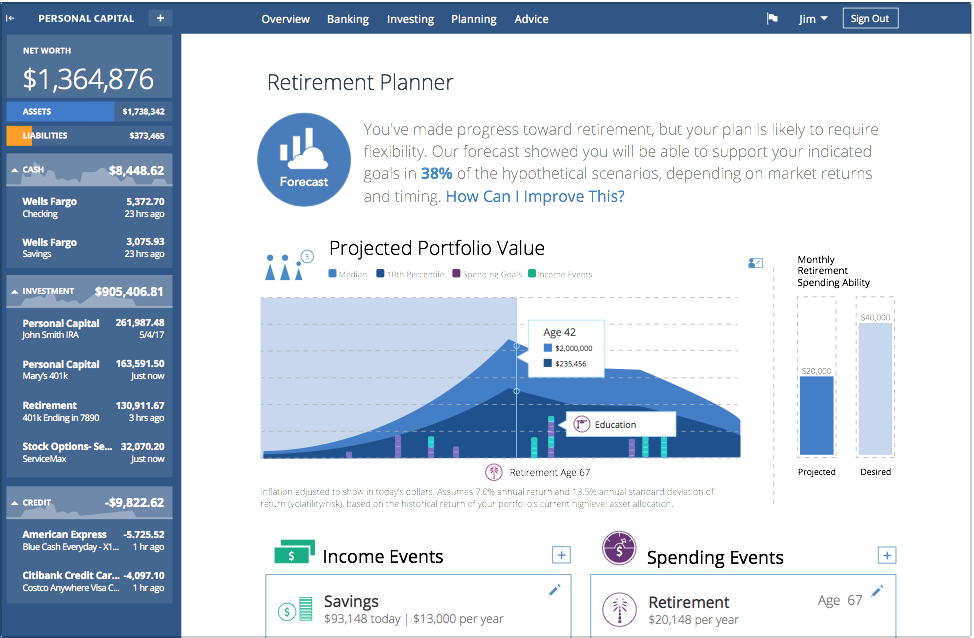

Personal Capital has a similar future value planning tools that tracks your current retirement savings. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. It is very easy to link all of your accounts and is highly secure.

Here is what the Retirement Planner dashboard looks like:

You can review our guide to building a dividend portfolio to help you make both basic and advanced dividend investing decisions.

How and when is a dividend issued?

Here is how and when a dividend is issued:

- Both the amount and timing of dividends are determined by the Board of Directors

- Dividends can happen on a monthly, quarterly or annual basis

- Most dividends are declared by large and established “blue chip” companies

- Dividends are often paid if a company is unable to reinvest its cash at a higher rate than shareholders

I loved the infographic that the Visual Capitalist put together that highlights the power of dividend investing. Jeff Desjardins touches on how a $10,000 investment in Coca-Cola in 1962 would have yielded more than $2 million by 2012 (50 years later). This is a classic example of the power of compound interest as well. You take the dividends received and reinvest to buy more stock, which produces more dividends. Rinse and repeat.

Dividend growth investing is not a get rich quick or overnight success story. Dividend investing is a story of taking a long-term view to ensure long-term financial success. This is what financial independence is all about.

What is a Dividend Aristocrat?

A Dividend Aristocrat is a stock that has increased dividends for 25 or more consecutive years. There are currently 53 different Dividend Aristocrats. In addition to dividend increases, a Dividend Aristocrat stock must be in the S&P 500 and meet certain minimum size and liquidity requirements as well.

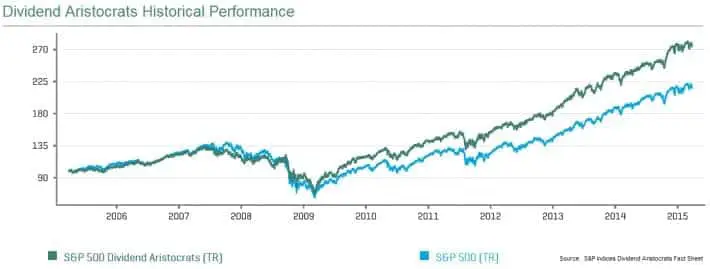

Like a Dividend King, Dividend Aristocrats often command premium valuations. This is for good measure because Dividend Aristocrats are often top-notch dividend growth stocks. Dividend Aristocrats are usually not the S&P 500 stocks with the highest dividend yield. This is because Dividend Aristocrat stocks continue to perform so great over the long-term (see below)! Dividend Aristocrats historical performance speaks for itself.

Performance speaks.

We think that these 5 Dividend Aristocrats are undervalued. What do you think?

For Dividend Kings…. these are stocks that are Dividend Aristocrats, but instead of increasing dividend for 25 years, these Dividend Kings have increased dividends for 50 CONSECUTIVE YEARS. That is some serious success (and shareholder returns). What if you are a passive investor and don’t like the idea of a managed dividend growth portfolio? I like to use Exchange Traded Funds (ETFs) as a form of passive investing (if you so desire) due to their extremely low expense ratios and opportunity to diversify.

However, I prefer to build a dividend growth portfolio on my own. Unless I am trying to find diversified international dividend growth. I own a couple of international dividend growth ETFs that have helped me diversify my portfolio through international exposure.

List of Dividend Aristocrat ETFs

Investing in an ETF focused on Dividend Aristocrats can be a great idea for an investor that has limited time to monitor their dividend growth portfolio. With a dividend growth ETF, you can essentially allocate a certain amount of income to the specific ETF on an ongoing basis each month and sleep VERY well at night knowing that your money is working for you. AND IT’S DIVERSIFIED! With a Dividend Aristocrat ETF or dividend growth ETF, you get the best of both worlds between residual income AND opportunity for growth over the long-term. Here is a list of Dividend Aristocrat ETFs for you to consider:

- ProShares S&P 500 Dividend Aristocrats (TICKER: NOBL)

- Expense Ratio: 0.35%

- SPDR S&P Global Dividend ETF (TICKER: WDIV)

- Expense Ratio: 0.40%

- ProShares S&P MidCap 400 Dividend Aristocrats ETF (TICKER: REGL)

- Expense Ratio: 0.40%

- SPDR S&P Dividend ETF (TICKER: SDY)

- Expense Ratio: 0.35%

Check with your broker to see the trading fees for each of these dividend ETFs. Oftentimes, brokerages have partnerships with ETFs that waive any trading fees for buying or selling an ETF. For example, Fidelity has a partnership with iShares and I currently can purchase a list of iShares ETFs completely commission-free. I love that. Do I only want to buy 1 share today and not erode my returns? Yes, please.

In addition, most of these Dividend Aristocrat ETFs are rated very highly by Morningstar. Morningstar provides independent investment research. Before investing, make sure to do a little homework on these ETFs by reading the prospectus. The prospectus will give you a good idea of the fees associated with the fund, the trading restrictions and more. Using ETFs is an easy way to increase your income without working more.

Why Invest in Dividend Kings?

Dividends or growth? Which is better? How about BOTH! Investing in Dividend Kings provides you stability and assurance in your portfolio while ensuring (hopefully, ensuring at least) some form of growth in the future.

With the stock market, our best indicator of future success is historical results. If you invest in the Dividend Kings, you obtain the ability to invest in earlier stage dividend growth stocks to complement the ‘old geezer’ Dividend King stocks that have a history of success. Use these with fractional shares investing for maximum compound interest.

Dividend Kings: A List of Stocks Increasing Dividends for 50 Years

The only way to invest in Dividend Kings is to know what stocks are the king of the castle! You do not get crowned king for no reason.

Kings of the castle.

Remember, being a king is hard. It comes with standards of excellence, honor and a big throne to sit on. Without further ado, here is our list of Dividend Kings. These dividend growth stocks that have increased dividends for at least 50 consecutive years (sorted by longest consecutive years of dividend growth).

Notice a trend with this dividend growth stocks? Solid brands? Products you use or stores you visit every day? Yes, these companies have outstanding reputations. These are true kings in all of the stock market investing, but more importantly in their industry.

Three Undervalued Dividend Kings to Buy Now

We’ve built our method for finding undervalued dividend growth stocks that combine both the promise of growth at a reasonable price. I like to call this the dGARP method or Dividend Growth at a Reasonable Price.

Using some of the methods that I outlined previously and a combination of our short-form dividend discount model (Gordon Growth Method). Out of the stocks increasing dividends for 50 years list above, these are undervalued stocks to buy now:

First Undervalued Dividend King to Buy Now: Target Corporation (Ticker Symbol: TGT)

We have owned Target Corporation (TGT) for nearly a year now. We have been buying this Dividend King growth stock since the ‘Amazon-Retail Apocalypse’ when everyone feared that Amazon’s acquisition of Whole Foods would DESTROY TARGET’S BUSINESS MODEL. Target is certainly undergoing a big change with a huge remodeling of their stores and how they do business.

For me, buying Target stock at a 5% dividend yield was a no-brainer. At current valuations, I think Target is still undervalued given the strong track record of dividend growth and the valuation relative to the peers (I’m talking about you Wal-Mart). Think about the capital stack opportunity and the risk/reward benefits.

Second Undervalued Dividend King to Buy Now: Dover Corporation (DOV)

Dover Corporation is an American conglomerate of industrial products. Dover is a classic example of a company that you probably use their products every single day, but you just don’t realize it. With a forward Price to Earnings ratio of ~16.50x, this Dividend King is a great buy. Dover pays out a dividend at a rate of 30.0% of their earnings, which is very modest.

There is still significant freeway for Dover to increase their dividend further even without increasing earnings. However, Dover has had a great track record of increasing earnings. Thus, leading to a great combination of dividend income and growth.

Third Undervalued Dividend King to Buy Now: Stanley Black & Decker, Inc. (SWK)

Stanley Black & Decker Inc. is a manufacturer of industrial tools and household hardware including security products. SWK is a classic examples of a company that you use their product every day and know it.

They have the most recognizable brand in home hardware and tools.

With a forward Price to Earnings ratio of ~17.10x, this Dividend King is a fantastic buy at current prices. SWK continues to expect Earnings Per Share (EPS) growth of 10-15% annually. SWK’s dividend payout ratio is extremely modest at 26.7%, so sleep well at night knowing that a dividend cut is not in the cards anytime soon.

Undervalued Dividend Kings in Your Dividend Growth Portfolio

Besides Target, the other two dividend growth stocks feature dividend yields below 2%. These are certainly not the high yield dividend stocks of the S&P 500.

This is because the stock continues to perform in light of strong continued earnings growth. Make sure to have these three Dividend Kings in your dividend growth portfolio.

Imagine being one of the early investors in a Dividend King. Right as they initiated their first dividend payment and were about to go on a torrid dividend increase streak? Well, I think this is something that can be done…

How? You need to be able to identify the companies that have shown some track record of dividend growth, current operational excellence, current strong management teams and a demonstrated discipline for financial health (i.e., balance sheet strength).

Unfortunately, there is no Dividend Kings ETF or fund. You can try to build your own mini-ETF through commission-free trading platforms.

We have been building our own dividend portfolio that you can track in our dividend growth investing section. You can use a commission-free trading platform such as Robinhood to create a Dividend Kings fund. Give it a try!

You can check out our Robinhood dividends guide and review for further information. If you want to

How Can You Find the Next Dividend Growth Aristocrat or King?

First, empower yourself with the tools you need to succeed. There are plenty of free tools out there that can help you find the next Dividend Aristocrat to build an effective dividend growth portfolio.

Here are 6 Powerful and FREE Dividend Growth Investing Tools

- Google Finance: Google Finance is currently undergoing some slight updates. However, this platform is just so simple and so easy to search current prices of stocks. I love this as a dividend growth investor. The charts are slick and awesome to use.

- Seeking Alpha: Ah, good old Seeking Alpha. This is such an amazing resource for all things relating to news, alerts and opinions. Add in each ticker symbol for stocks that you own. By downloading the app, you will receive instant alerts for the exact dividend growth stocks in your portfolio.

- Personal Capital: Personal Capital is a fantastic tool to monitor your investments. Their income report is the best for dividend investing. You can pull and see your dividend payments on the day they happen! There’s not a better feeling than getting a dividend payment and reinvesting it back into a dividend paying stock! Use this tool to monitor your investments and income!

- SEC Edgar Search: This is a boring one, but a powerful one. SEC Edgar’s search tool helps you find actual filings for public companies. Use this to your advantage for dividend growth investing. It is important to pull down a dividend growth stock’s 10-K (annual filing) to read through industry highlights, financial statements and more. In addition, you can find the official press releases for these companies under the SEC Edgar company search tool.

- Morningstar: As I mentioned above, Morningstar is a great independent research site. You can get some excellent ratings on stocks and ETFs. Also, they publish free content for you to read. There are a number of paid services, but their free tools are just as helpful! I use free articles on ETFs especially. Like Karen Wallace’s recent post on the 10 Funds That Are Better Than They Look.

- FINVIZ: FINVIZ is one the best stock market platforms for screening stocks through financial analysis, research and visualization. This information is disseminated through quotes, news, charts, maps, technical indicators, stock alerts and much more. Here is how to use the FINVIZ stock screener to boost your investment results. Also, you can use FINVIZ futures to understand market trends and identify a correction.

I use the above tools in my everyday research and analysis. Research is paramount here. Building a dividend growth portfolio is certainly passive in nature, but you cannot underestimate due diligence and research. In the end, you will be happy that you did your homework.

Criteria for Finding the Next Dividend Kings (Stocks Increasing Dividends for 50 Years)

Long live the King! I am on a mission to overthrow the current monarchy by finding the next Dividend Kings before they happen.

What would be better to happen?

Be the guy that invested in Coca-Cola in 1962 for $20,000 that turned into $2 million in 2012 (50 years later) or…

Be the guy that invested In Coca-Cola in 2002 for $2 million that turned into $2.5 million in 2062 (50 years later)? Get my drift… Coca-Cola could arguably see slower growth in the coming years than a stock that is on the cusp of becoming the next Dividend King.

If it were me, I would want to find the next dividend growth stock on the verge of a torrid streak of dividend growth. This is the most optimal way to get the most out of compound interest.

Let’s try to find the companies that we will be talking about in 50 years. The companies that have increased the dividend for 50 years when we are living in 2062. How can we identify the new Dividend Kings? Here are a set of questions to ask yourself as you review stocks:

- Shareholder Friendly: Has the company increased its dividend in the last 3+ years? (Yes or No)

- Financial Health: Does the Company have a modest dividend payout ratio? (Yes or No)

- Management Team: Was the current CEO hired internally? (Yes or No)

- Operational Excellence: Do they have a track record of revenue and earnings growth? (Yes or No) Has the company provided a long-term growth plan?(Yes or No)

- Business Model: Do you understand the business model? (Yes or No) Is there a significant moat around the company? (Yes or No)

Think of each ‘Yes’ answer as 1 point to your score. You certainly cannot have more than half of your questions answered as ‘No’ if a company is going to become a dividend growth stock for the long haul.

Once we’ve invested use a tool like Personal Capital and their Net Worth Calculator to monitor your asset growth. In addition, you can track your retirement progress through their awesome dashboard. It’s clearly one of the best platforms available to determine when you can retire.

Can you find the next high-quality stocks with consistent dividend growth?

We think we can find consistent dividend growth stocks that are on the verge of becoming the next Dividend Kings or Aristocrats. Check out our Lowe’s stock dividend analysis for a valuation of the Dividend King.

2 Comments