We evaluate the viability of Lowe’s as a stock dividend investment. Let’s dive into our Lowe’s stock dividend analysis.

Lowe’s Stock Dividend Analysis (LOW): A Dividend King Worth Buying

Dividend investing is a great way to earn income and residual value for investing. We believe in investing in undervalued dividend growth stocks to ensure you can take advantage of total return.

Much of this is included in our dividend investing book to help people get started investing for income and value.

The book is titled Dividend Investing Your Way to Financial Freedom and features a number of resources to help you invest for financial freedom, including:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

If you want a sample of the book, you can download it here.

Lowe’s Companies Inc (NYSE: LOW) is the world’s second largest home improvement retailer. It was founded in 1946, North Wilkesboro, North Carolina. Currently, it has an employee base of around 310,000 people.

It serves 17 million customers a week in the United States, Canada and Mexico via a retail chain of almost 2400 stores. The company offers a diverse range of products (hand tools to sinks to tiles) and installation services.

Lowe’s has been a Dividend King for years, which signifies it’s the strong track record of success and devotion to rewarding shareholders.

Review our list of other Dividend Kings for investing.

Business Analysis of Lowe’s (NYSE: LOW)

The key element in Lowe’s growth has been consistency in customer services and strong geographical coverage of its stores.

It is second only to Home Depot and the new CEO, Marvin Ellison, a veteran of Home Depot and J.C. Penney’s is focusing on chipping away their lead by strategic initiatives.

The Amazon Proof Nature

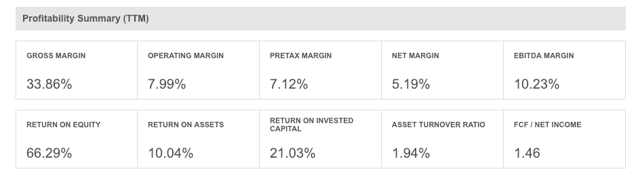

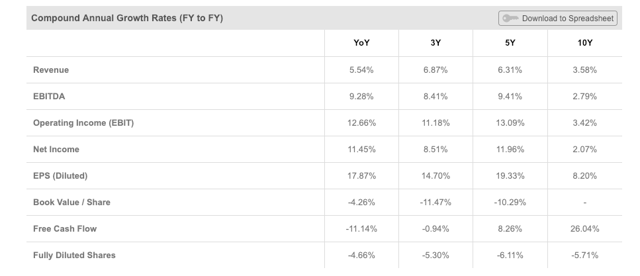

Many retail companies are losing to Amazon, one after another. Due to its strong service base and discounted prices, Lowe’s has been able to stand strong during the Amazon onslaught. Its Amazon proof nature can be assessed from its flourishing results in sales, earnings, cash flows etc.For reference have a look at the charts-

Source: https://seekingalpha.com/symbol/LOW/growth

Insight: The Company has shown strong growth in all parameters. The year on year performance has been particularly impressive.

Financial Analysis:For Fiscal year 2018, its sales revenue touched $68.619 billion, marking a 5.5% increase than the previous year. Earnings for the same period were reported to be $3.436 billion.

Lowe’s ranked 40 under FORTUNE 500 list of largest United States corporations in the terms of total revenue.

Five year comparison of Lowe’s financials-

| Year | Revenue * | Net Income* | Total assets* | Price per share* |

| 2018 | 68,619 | 3,436 | 35,219 | 96.71 |

| 2017 | 65,017 | 3,064 | 34,408 | 77.66 |

| 2016 | 59,074 | 2,534 | 31,266 | 71.22 |

| 2015 | 56,223 | 2,682 | 31,721 | 67.59 |

| 2014 | 53,417 | 2,270 | 32,732 | 47.84 |

*All figures are in million US$.

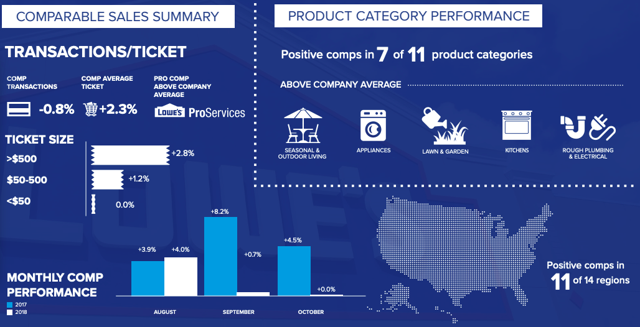

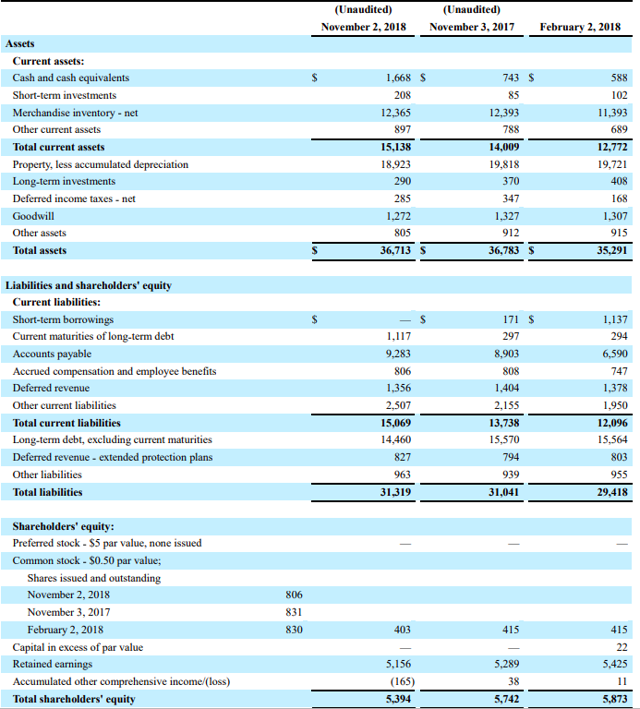

The Q3 2018 results have also been strong especially when compared to the same quarter in 2017. The results below paint a picture of a stable and growing company.

Source: Lowes Companies – Investor Relations Home

- As is visible from the table above, LOW’s financials have been on a strong and steady upward surge. The market has rewarded the financial performance; at a current price of almost $94, the stock price has almost doubled in the last 5 years.

Source: https://seekingalpha.com/symbol/LOW/analysis-and-news

Dividend Growth: Stock Analysis for Lowe’s (Ticker: LOW)

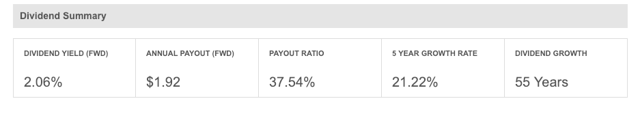

Lowe’s a dream stock for dividend investors. The company has declared a cash dividend every single quarter since it became public in 1961. That is a 57 year record of uninterrupted cash flows to its investors.

The company has also awarded its investors with 57 years of straight dividend growth. This ensures its place in the hall of fame of Dividend Aristocrats. Actually, Lowe’s is a Dividend King! There are only around 25 such dividend kings in the entire S&P universe.

Source: https://seekingalpha.com/symbol/LOW/dividends/scorecard

Look at the majestic 10-year dividend growth chart to understand the dividend history of Lowe’s.

Insight: The Company’s current dividend yield is at 2% which is lower than the average dividend aristocrat yield of 2.7%.

But the company needs to pay out only 38% (approx.) of its earning to maintain its dividend growth as compared to almost 58% for Home Depot.

This leaves it with a stronger cash arsenal for future growth and expansion.

See Related: Best Value Investing Books to Read Now

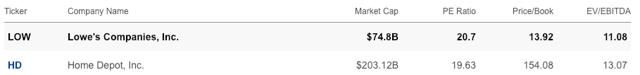

Competitor Analysis

In spite of the improvements, Lowe’s has a long way to go to match its industry peer and main competitor – Home Depot. Home Depot stands out against LOW in almost all financial and operating parameters.

- Lowe’s first 3 quarters of 2018 saw operating profit hit 8.2% of sales, as compared to 10% for 2017 first 3 quarters. Home Depot in comparison was at 14.8% this year versus 14.9% previous year. Profit growth is essential for dividend growth investments.

- Home Depot’s 2019 guidance points to a 5.3% expected growth in sales versus 2% for Lowe’s.

But the company’s valuation metrics are in line with Home Depot’s suggesting that the industry number 2 is on a strong footing and poised to take market share from both the leader and smaller incumbents in the coming years.

Source: https://seekingalpha.com/symbol/LOW/peers

Balance Sheet Profile

Source: Lowe’s

- The balance sheet has improved considerably. The company holds $1.67 billion in cash and cash equivalents which is more than enough to pay current maturities of long term debt (which stand at $1.12 billion).

- The long-term debt is at $14.4 billion versus $15.6 billion in the previous year. The company is paying off its debt and deleveraging its balance sheet which is a good sign as the economy is expected to slowdown in 2020.

- The Company has also not entered into major capital expansion. Its fixed investments remain constant and it has been able to rationalize inventory levels at a higher sales level.

If you need help with how to conduct fundamental analysis, use our guide on how to read financial statements.

Investment Highlights of Lowe’s Companies

Here are some of the core investment highlights of Lowe’s Companies (NYSE: LOW).

- Dividend growth is consistent at LOWE’S Companies Inc. This makes it a steady source of cash for investors looking for stable earnings.

- It is a strong number 2 in the home improvement industry. But under new management, the company has been aggressively rationalizing expansion into any non-core areas. The focus is to garner a bigger share of the professional’s market which currently Home Depot dominates.

- The new management is not afraid to shut down non-operating stores and scrap vanity projects. It closed 47 stores in the US and Canada by end of Q3 2018. It is exiting retail operations in Mexico and has exited Alacrity Renovation Services and Iris Smart Home Businesses.

- Lowe’s Amazon-proof nature makes it an attractive bet in an era where the whole industry market cap dives whenever Amazon announces its intention to enter the industry. You could add Lowe’s and other Dividend Kings to an M1 Finance Pie.

Our Conclusion on Lowe’s Stock Dividend

Lowe’s Companies Inc. is a highly recommended stock by Millionaire Mob. We suggest a long position for at least a 3-5 year horizon.

The company scores strongly on growth, value and dividend parameters. This Dividend King promises safe and steady growth making it a great for a new investor just starting out their investment goals.

The new CEO has been aggressive in cost-cutting from day one and we can expect shareholders to be rewarded further.

The Company scores highly on Warren Buffet’s parameter of strong earning visibility, amazing brand recall and a long-term business which has weathered the online storm. In fact, the company’s Q3 2018 saw a 12% increase in online sales.

The best strategy would be to buy on dips and accumulate heavily if any major bad news is received on the economic front. Continue to reinvest your dividends to take advantage of compound interest.

With almost 60 years of operating history as a listed company, it has shown time and again that it can stand the test of time. Run the stock through our stock calculator to see what return expectations are realistic.

Use these other dividend stock screeners to find new investment opportunities.

What do you think of our Low’s stock dividend analysis? Please let me know in the comments below.

Other Related Dividend Investing Resources:

- Do not use annual dividend yield when investing

- How to use a 401(k) calculator to save on retirement fees

- How to build wealth through a DRIP program

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

No Comment