Raising your credit score can some times seem like a black box. Actually, it’s pretty straightforward. You just need to stay organized and in control of the situation. Here’s how to raise your credit score by 200 points.

How to Raise Your Credit Score by 200 Points (A Case Study)

Your credit score is an essential barometer of your personal financial situation. Your credit report is a scorecard that indicates the reliability of your credit tendencies. This score impacts a number of decisions that current and new borrowers make based on your application.

Having a great credit score will save you money, make it easier to obtain financing and generally give you better well-being about your finances.

You will be surprised at how flexible banks are when your credit score is not just good, but great. Imagine if you want to start a business, but a bank doesn’t trust your reputation. Your dreams could be squashed.

With great credit and some capital in hand, you too can finance the purchase of a business to start building wealth.

What’s my credibility with building credit?

I repaid over $60,000 of student loans in less than 5 years while contributing the max amount to my 401(k) and Roth IRA.

If you think you need to improve your student loan position, follow my guide to clearing debt fast.

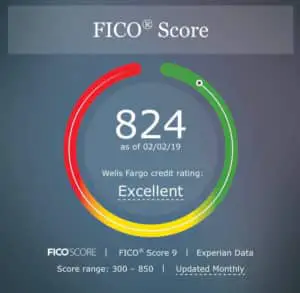

Additionally, I took my credit score from the mid-600’s to a nearly perfect 820 credit score during that timeframe.

For a point in time, I obsessed over my credit score. Checking it daily and finding out how I can increase my credit score through hours of reading and dissecting the credit scoring process.

What I learned is that student loan repayment wasn’t the biggest factor in building my credit score.

How to Build Credit

Building your credit score takes time, but there are definitely actionable items that you can do to increase your credit score now. Let’s walk through a few highlights before we get into how to build credit exactly. In this section, we will hit on the following:

- First, why building your credit is so important

- Secondly, why a poor credit score hurts your personal finances

- Third, the exact factors to target to raise your credit score 200 points or more

I’ve been monitoring my accounts by using Personal Capital. It’s a completely free tracking tool that links all of your accounts. Then, calculates your cash flow and net worth.

Before we get into our steps to increase your credit score by 200 points. Let’s highlight a few important considerations.

Why is building credit important?

If you have a credit score of 600 or below, you are considered a subprime candidate from financial institutions. If you are a subprime candidate, you are likely to be turned down by a vast majority of companies and institutions that can hand out loans or other financial products.

They turn you down because, like a subprime candidate, the institution will think that you have a record of not adhere to loan schedules and make payments.

As a result, you get rejected more frequently for credit cards and loans, have fewer choices and become subject to higher interest rates. The impact of a low credit score can also jeopardize your chances of leasing an apartment or even getting a job!

A Poor Credit Scores Impact on Personal Finance

A poor credit score can severely impact not only your personal finances but also your life. I would consider a poor credit score of 700 or below.

In order to build credit, you need to open credit accounts early in your life and show lenders that you are reliable with paying your debt on time.

Here are the main key points on how a poor credit score can impact your life:

- Poor credit can prohibit your ability to obtain a mortgage. A poor credit score will also lead to a higher interest rate on all of your loans. With long-term debt like a mortgage, this can result in a lot of money over time.

- A poor credit score will also limit your interest rate on a car loan if you want to purchase a car.

- In addition, you may not qualify for a student loan.

- Some companies pull credit reports when you are applying for a job. A poor credit score can impact your ability to obtain a job!

Take the necessary steps to avoid a poor credit score now.

At the end of the day, a bad credit score = higher interest rate.

This means more money you are paying the bank for the same (or worse) product.

A good credit score will allow you to have unbelievable financial flexibility over time.

So, how do you do that?

You need to hit on the most important factors of your credit score first.

Most Important Factors That Influence Your Credit Score

If we want to build credit, we need to improve on the highest priority factors to your credit report. What are the most important factors?

- Your payment history (35%)

- Level of debt/credit utilization (30%)

- The age of credit (15%)

- Your mix of credit aka credit diversity (10%)

- Credit inquiries (10%)

A few things stand out by looking at that breakdown of credit score factors.

- 80% of your total credit score comes from age of credit, credit utilization and your payment history. If you hit on these three important factors for your credit score, you can ignore the rest.

- The most important weighting to your credit score, payment history, can’t be changed. Unless there is an error, of course. You’re going to have to improve going forward if that’s hurting your score right now. If you have delinquencies, there’s a chance the creditor removes it. Why would they though? They were just put through hell trying to get money back from you…

Let’s start with the most important steps to boosting your credit score by 200 points or more.

Follow These Steps to Raise Your Credit Score by 200 Points

You can raise your credit score by 200 points in just a matter of months. You can even do it in less than a month if you really work hard at it.

Follow these exact steps to raise your credit score by 200 points (or more!).

1. Check Your Credit Score and Dissect It

One thing we have going for us in this process is that free credit score tracking isn’t hard to come by these days. In fact, there’s plenty of options to choose from that can accurately track your credit score and provide the exact roadmap for improvement.

Start out by checking your credit score for free. Don’t pay for it! There are a couple of great platforms to check your credit score instantly.

- Credit Sesame: Use my link and get your credit score completely free AND free identity theft insurance

How are you going to know what you need to improve if you don’t have a copy of the report itself? It sounds cliche. But, this is the most important part.

Your credit score is simply a formula. Find out your weak points first.

Then, improve your credit score weaknesses as soon as possible. The next step is one very easy way to increase your credit score immediately that people don’t realize.

2. Decrease Your Credit Utilization

Credit Utilization = 30% Determining Factor

One of the most important factors for determining your credit score is your revolving credit utilization, which some people estimate is about 30% of the determinant in your credit score. In order to have a low credit utilization, you need to have a number of different accounts.

I actually have about 10 different credit cards along with a mortgage and I repaid all of my student loans. I never carry a balance on my revolving credit lines.

This is a great way to build an outstanding reputation with your credit provider.

Make sure you don’t close your accounts to increase your age of credit accounts as well.

How do you decrease your credit utilization?

- Open more revolving lines of credit! This may sound counterintuitive, but it works. Let’s look at an example.

- You own one credit card that has a credit limit of $3,000. You spend $750 dollars on that card each month. At any given point in time during the month, your credit utilization can be 25%!

- Remember the credit score is simply a formula. A score is not going to be tailored to each individual. Now you open a new credit card that has the same limit of $3,000, which means your total credit limit is $6,000. You still only spend $750 dollars per month on your credit cards. Thus, your credit utilization is 12.5%!

- Simply ask for a larger line of credit with your credit cards. You’d be surprised. A number of different banks have options through their online portal to increase your line of credit. If not, simply call them on the phone and ask to have your line of credit increased. They will likely increase it for you.

I suggest that you do this step second because you will get slightly dinged for opening a new account. That only accounts for 10%.

At the same time, don’t go wild and open a bunch of new accounts. Start with one.

However, this step will boost your credit score and position you for success.

See Related: A Guide to University Account Service Problems & Solutions

3. Pay Off Your Low Balances Immediately

If you have bills in collection, this is a very important next step.

If you’re looking to raise your credit score 200 points, you need to pay the creditors who will delete their filings on your report after repayment.

When you look for any creditor that is delinquent, you will need to call each one and ask if they will close/remove your account from your credit score if you pay in full. If you have a lot of accounts like this, you won’t get all removed from your credit report. It’s worth the try.

If you are struggling with ways to raise money to pay off your delinquent accounts, here are some resources to help.

To motivate you, it’s the 21st century.

The world is your oyster to start making extra now.

- Jobs That Pay Cash Daily

- Things to Do When You Need Money Now

- Best Freelance Websites to Earn Online Income

If you don’t have any delinquent accounts in collection, I still believe it’s a prudent strategy to eliminate the additional burden on you going forward.

Eliminate a few accounts that are right in reach for you.

4. Eliminate the Hard Inquiries on Your Credit Report

Okay, we can’t just eliminate hard inquiries. All we can do is wait. You can prioritize this step in raising your credit score by 200 points if you know that you have several hard inquiries on your credit report that are about to expire.

Best practice is to create a timeline of all your hard inquiries and when they occurred. You can do this by using my credit card tracker. I created a section that includes hard inquiries.

It takes a second to download and get started.

How long do hard inquiries stay on your credit report?

Well, they stay on there for 24 months (or two years). However, they will impact your score for 12 months (1 year).

Take a look at your credit report to see when these hit your score. From there, see when they expire in order.

Make a judgment call whether you should open a new account to improve your utilization or wait until a hard inquiry rolls off your credit report.

5. Never Miss a Payment and Prepay Your Debt as Often as Possible

Alright, you have some actionable steps to raise credit score by 200 points or more. Now, I need to leave you with some parting wisdom.

Your historical credit history is the most important factor in your credit history. It becomes engrained in your credit DNA. You can’t really reverse history. How can you ensure you are safe going forward? You change your mindset about money and make better decisions that will position you for timely repayment.

You can do this by tracking all your accounts via my credit card tracking spreadsheet. Or, you can build your own. Regardless, start earning income the right way to achieve financial freedom.

If you’d like my help on how to raise a credit score by 200 points, please feel free to reach out to me. I’d love to see what I can do to help.

You will be amazed at the end results of boosting your credit score by over 200 points.

Conclusion on Raising Your Credit Score by 200 Points

Take a step back from your credit report. It’s only a formula. The formula is public and can be easily dissected. Pinpoint your weaknesses to raise your credit score by 200 points.

A few things to remember about your credit score, include:

- There’s no need to close a credit card account.

- While your credit score is formulaic, it’s highly dependent on your history. The order I mentioned above should be re-prioritized depending on your credit history.

Remember a low credit score means high-interest rates.

What do high-interest rates mean? More money going to banks and less money in your pocket. That means less wealth that you can build over time.

It’s not a good cycle, but it’s the way of the world. A credit score is simply the best barometer of credit history at the moment.

Once you’ve boosted your credit report by 200 points, you can then work on refinancing debts to lower interest rates with SoFi or Credible. These will save you significant sums of money.

We know the formula. Let’s beat it together.

Do you know how to raise your credit score by 200 points now? Let us know in the comments below if you have any questions or comments. I’d love to hear them.

No Comment