Caught up in the rat race, the humans of this world have often been identified to be exuberating similar forms of behavior when it comes to competing with each other. Millions of people wake up every day, go to work in a monotonous routine. What each individual works for is a better future, a better financial life. For this, people save and invest with the intention to build up wealth for their future. You can gain financial freedom if you stick to a plan used by millionaires.

However, very few, in fact only a handful of these individuals are able to achieve success in building up their wealth. These people eventually become what we term as “Millionaires or Billionaires”. Why? Because the stashes of their wealth can be quantified in millions and billions.

Gain Financial Freedom By Learning the Saving Habits of Millionaires

Becoming financially free is a lot easier than you think. By gaining financial freedom you are able to live completely without a day job and without the requirements of a 9-5 job. In order to gain financial freedom, you must focus on the saving habits of millionaires or even billionaires. Financial independence is important. You can read an outline on why financial freedom is important to learn more.

At Millionaire Mob, we are focused on building a number of different sources of income to gain financial freedom. This is why we take all of our income from our passive income streams and reinvest into building a dividend portfolio.

Can becoming a millionaire just be luck?

Contrary to the belief, there are no shortcuts for achieving the millionaire status. Majority of these successful individuals are labeled as being “simply being lucky”. But could this be the only reason? That fate found these people and they became wealthy instantly.

It may be hard to believe but, it has been proven that these individuals follow particular investing and spending patterns that make them successful. We are not saying that every individual who follows these habits will end up becoming a millionaire, but we can definitely learn more about our finances from the experiences of these people.

Use money management tips from millionaires as a guide to your financial future

Habits that helped millionaires achieve their dream

It took Thomas Corley 5 years to interview and gather data about certain habits that millionaires/billionaires followed. He interviewed and carried out investigations to assess whether the self-made rich followed similar patterns or not.

His conclusions have been summed in a Business Insider research: In 5 years of studying rich people, I found self-made millionaires have 7 habits that help them build wealth. These self-made rich individuals are least likely to take risks when investing.

To dig a little deeper, we found it helpful to share some of the common daily habits of these individuals that we can incorporate in our lives. These money hacks are followed by EVERY millionaire.

How did billionaires get so rich?

These are more than just money management tips… These are leadership skills that can be leveraged into your money management goals. Leadership skills take up a big component in money management tips. If you can lead a team, you can lead your money.

Here are 6 points to identify how billionaires got so rich…

- Bring discipline to your life: It has been observed that self-made entrepreneurs depend upon themselves for self-sufficiency. Therefore, they lead a disciplined life where they do not compromise on their (quality of) sleep. They wake up early, follow schedules, indulge in physical activities and work on their body and mind for relaxation.

- Follow minimalism: The most common trait found in these rich individuals is that they choose to live very simple lives for very lower costs. They wear simple clothes, live in average houses and take lesser vacations. They minimize their expenses and still lead comfortable lives. Read more about minimalism here.

- Set goals and devise plans to achieve them: It can be said that they are good planners. They set their goals and create their lists to do things to reach that status.

- Eager to learn: One astonishing piece of evidence found that the rich and the smart do not consider themselves intelligent. They read, learn more and always eager to follow in the footsteps of other successful people. They give knowledge, great importance and read to exercise their minds.

- Socializing for a purpose: Although they care about their families & friends as much as we do, these people believe in meeting and interacting with others to learn from them. Many of the millionaires/billionaires before 30 have often been noticed to be surrounded by the rich classes for inspiration. As the saying goes “The wealthy learn from the wealthy”. In fact, choosing and following idols is a key characteristic among young millionaire/billionaires.

- They love what they do: This is where the majority of us lack. Not a lot of people are able to find their true passions. People work for earning a livelihood and to get through the daily difficulties of life. But how many of us are actually proud to say that we love our jobs and we wake up enthusiastic to get to work? Tony Montana loved what he did, but was he right? Here are 7 money management tips I learned from Tony Montana.

Simple values go a long way in gaining financial freedom

Some of the simple values they share are that they set their goals early in life, live very simple and minimalistic lives; they choose like-minded friends & partners. Read How to Become a Billionaire at Forbes. Living within your boundaries means you can gain financial freedom more quickly.

Essential money management tips from the rich themselves

There is a lot to learn from the rich and their money management habits. What money management tips can you live by? Here are four money management tips to live by:

- Automate Savings: Belonging to the era of technology, the majority of the millionaires/billionaires suggest using digital options of transferring money. Once the cash comes into your pocket, it is difficult to let go of it for a savings account. To save more, transfer a proportion directly into the savings account before withdrawing it. Or find the best deals so you don’t overpay unnecessarily.

- Diversify Income: Never depend upon one source of income for all your expenses. The experts’ advice individuals to look for opportunities to earn from multiple sources. Also, the individuals should only use one income for their expenses and save the others. Through our passive income streams, we can build different sources of income to be invested into our dividend growth portfolio. With Millionaire Mob, you can gain financial freedom much more quickly by focusing on your different sources of income.

- Alternate between Saving & Investing: Saving one proportion of income and investing another proportion of the income can become difficult at times. Therefore, what is suggested is that you spend some months saving proportions of your income and direct the rest of the months towards investing for long-terms. These apps will give you free stocks just for signing up. There’s no excuse for building your wealth.

- Follow the 20:30:50 Rule Religiously: Many multi-billionaires have admitted having stuck to the general savings rule for all their lives. The rule states that no matter what figure your income is in, you divide it into proportions 20:30:50. Where you save 20% of it without any questions, keep 50% part of all your major expenses that cannot be minimized. Also, you can be wise with the 30% that is left. You can spend it on more expenses and make your life comfortable, or you can further save a proportion of it. Learn more about your finances and money saving tips.

Once you’ve followed millionaires you’re able to replicate the process over and over again to achieve success. What about successes and failures? We’ve analyzed Tony Montana and 7 money management tips from the movie Scarface. We had fun with this one.

There is no single mantra to becoming a millionaire or even a billionaire

Each individual is different and works differently to achieve what they desire. Therefore, there is no general rule that applies to all. However, what can guarantee success is hard work, self-confidence and focus. Through determination, one can find possibilities to earn what they desire. The only rule is that you continue to work, after failure to gain success one day.

How do you handle money or what are you doing to gain financial freedom? You can gain financial freedom if you stick to the plan and execute. Also, make sure to have patience in your financial freedom journey.

Gaining financial freedom takes time. Go out and enjoy life! Stay motivated by following quotes about financial freedom. Quotes help me stay motivated and inspired to do better.

Related Financial Freedom Resources:

- Best 401(k) Fee Calculators

- Our robo-advisor comparison to help you choose the best robo-advisor

- Why I Started a Retire Early Blog

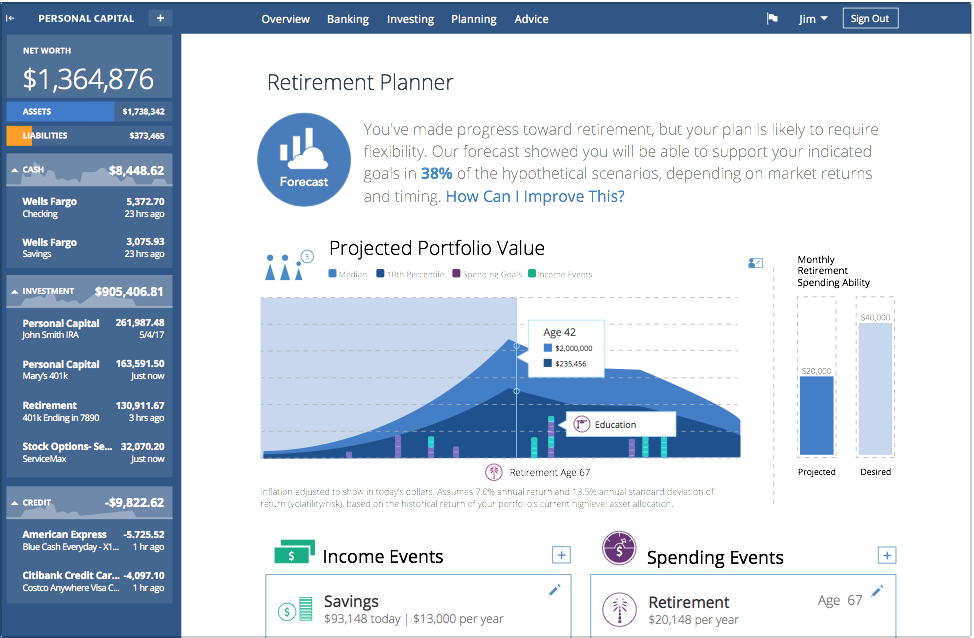

With the Personal Capital Retirement Planner, we’ve been able to manage our money efficiently. I love the intuitive dashboard and tracking. I highly suggest that you sign up for Personal Capital if you’d like to improve your money management skills.

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

Escalate Your Life.

3 Comments

The minimalism part is huge. People have these incorrect ideas that all millionaires drive the fancy cars and have the rolexes. Pop culture has so skewed the sense of true wealth. Warren Buffett is the perfect example of living in the same house he bought years and years ago – not some 15,000 sq ft palace. Don’t let your lifestyle inflate with your income increases. Great read!

Thanks for stopping by Laine! I agree, you must be able to live simple and focus on investing in yourself.