Building a dividend growth portfolio through Robinhood is easy. With no commission trading, you don’t feel inclined to invest large sums at once and you can start with a small balance. I like to reinvest my dividend income into other dividend paying stocks. This maximizes my ability to generate compound interest.

Robinhood Dividend Growth Portfolio – February 2018

We are clearly huge fans of building a dividend portfolio. This is evidenced by the number of resources on dividend growth investing we’ve provided to help you learn.

This includes a dividend investing book titled Dividend Investing Your Way to Financial Freedom. I created it to help you learn about the truths of dividend investing.

A couple of stocks in our portfolio include some medalists from our Wall Street Olympics highlighting the best dividend growth stocks.

Dividend Growth Portfolio History

Building a portfolio takes time and doesn’t happen overnight, so follow your steps patiently. You will find success over the long-term.

I’ve been using Robinhood to generate passive dividend income. Robinhood has over 3 million users now and has saved its user over $1 billion in commissions.

The NO-FEE commission structure has allowed me to scale up a generous portfolio of stocks over time with no hassle of buying large chunks of a time. If you use my code we will both get a share of FREE STOCK, so JOIN ROBINHOOD HERE.

I’ve developed a plan to live off dividends forever. I created a free dividend calculator that will allow you to develop your own plan to see what it will take to live off dividends. You can input your own assumptions for dividend yield, growth, contributions and more.

Robinhood Dividend Growth Portfolio Detail

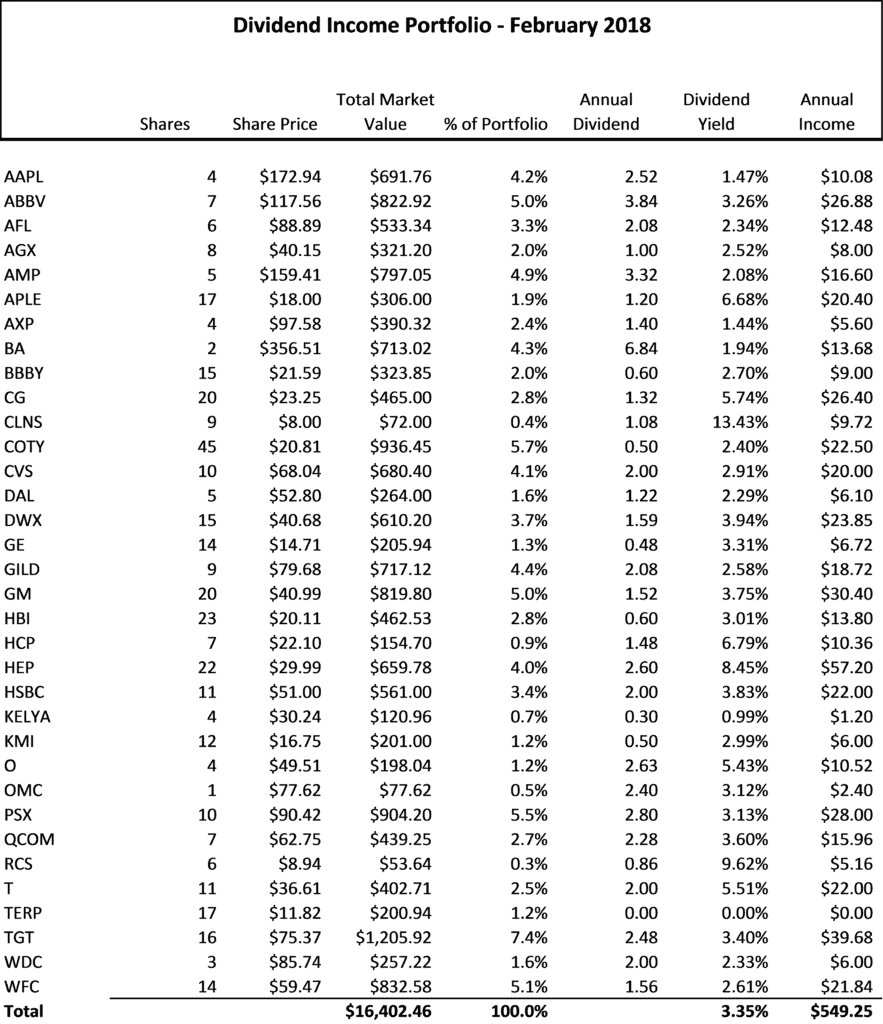

In our dividend portfolio, we own 34 different dividend stocks each with varying dividend yields. We are on track to earn $549.25 of dividend income this year (without consideration to dividend increases).

I have some concentration in Target Corporation that I will plan on selling down. I averaged down during the whole Amazon is going to take over the world crisis, but I am now sitting on a decent 30% gain.

Dividend Growth Portfolio Conclusion – February 2018

Going forward, I will continue to allocate additional income that I receive from other forms of online income to my dividend growth portfolio. One thing that you wills see is that some of these stocks are not your typical dividend growth stock such as dividend achievers or dividend aristocrats.

I consider myself a bit of a value investor and my criteria is that the stock must pay a dividend. In addition, I have about 7% of my portfolio in cash. This will give me flexibility to buy additional shares as needed.

See Related: M1 Finance vs Robinhood: What is Better?

Dividend Portfolio Sells:

- Target Corp (TGT) – Sitting on a good gain and reducing exposure. Will still hold this Dividend Aristocrat

- COTY, Inc. (COTY) – Like Target, this one has been a wild ride. I am sitting on a 25% gain and looking to reduce my exposure just a bit. I like this longer-term.

- Boeing Corp (BA) – This stock has been a high flyer (and so has the dividend). No pun intended. I’m sitting on a 110% gain on this investment so I sold a couple of shares.

Dividend Portfolio Buys:

- Realty Income (O) – Yes, rates are going higher. Yes, this stock could underperform going forward. But, what if it doesn’t? What if rates stay flat? The huge selloff in REITs has peaked my interest to scale into long-term positions. I like being a contrarian.

Using Robinhood, I can grab scale into a stock that is receiving extreme downward pressure. I like this because I don’t feel devastated if the stock continues a downward decline. I can continue to buy more. This works extremely well and is very advantageous for the retail investor. I used my evidence-based research to make portfolio buys and sells.

Check out Robinhood dividends guide and review. We hit on a number of different topics relating to the Robinhood app to provide our best review possible from a dividend investing perspective.

What stocks would you buy or sell in this dividend growth portfolio? Have you build a dividend portfolio to earn passive income? Let me know your thoughts in the comments below. I’d love to hear from you!

Like what you are seeing? Get the latest news and updates in dividend growth investing by subscribing to our newsletter (we do not send spam).

No Comment