You’re new to the world of Forex trading. You are just starting out in the Forex market. You’re learning new terms and how they relate to buying and selling in the marketplace. And, a new word pops into the picture to further confuse you. The Commodity Channel Index, or CCI. What is it? How are you going to use it as a trader?

These are all questions that beginners ask about. It may seem overwhelming at first, but luckily it’s much easier to understand than you probably think!

What is the Commodity Channel Index

The Commodity Channel Index, or CCI, is an indicator providing technical analysis of trends in the Forex market. This indicator belongs to the oscillator group of Forex indicators. The index oscillates between levels of +/-100, with modifications to +/-200, and has a lookback period of 14-days. When CCI rises or dips below the 100 (or 200) level, this indicates over buying or selling is occurring.

The CCI is a standard indicator for Forex traders, meaning they don’t have to download it on different platforms. It comes standard on different trading platforms. The oscillator measures momentum in the Forex market. In trading, momentum refers to a security’s price. It indicates whether the rising or falling of that price will continue in the same direction. The Commodity Channel Index calculates and depicts the rate at which prices are rising or falling. And, it indicates if that price will continue to rise or fall, for a set period.

How to Use the Commodity Channel Index

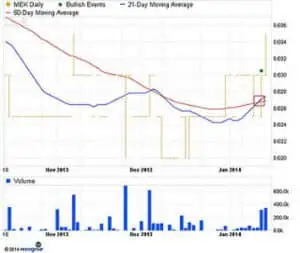

The commodity price index relies on a basic formula, shown in the picture below.

CCI measures relations between prices and Moving Averages (MA), and the deviations in those prices. The first step in using the CCI is to set the time interval for calculating averages.

In most trading platforms, the Commodity Channel Index comes standard. It eliminates the need to calculate the MA manually. Traders can use the tool to help determine deviations in the price of an asset. It can help traders see if prices will fall or rise, given recent trends. The calculations rely on a time interval set. It gives specific parameters traders can use safely. They can use this information to decide if it is time to buy, sell, or wait on an investment decision.

The CCI will provide more buy and sell signals for active traders. Traders can also use the CCI to measure the strength of a market trend. The indicator can also warn traders of extreme market conditions which are taking place in the Forex marketplace.

The Commodity Channel Index isn’t an exact answer to trading questions. It doesn’t provide a 100 percent guide of when assets are overbuying or overselling (OB/OS). Instead, it provides traders with information about trends. These trends circulate depending on the time frame traders choose to input in the indicator formula. The CCI is a tool, not a precise science. It is ideal for traders who want to learn fundamental market trends and to make the right decision moving forward.

Problems with the Commodity Channel Index

There are also problems with the Commodity Channel Index worth noting. Traders who rely solely on CCI charts, and don’t use other indicators, will be at a disadvantage. Some issues with the commodity channel indicator may include:

- False signal readings, since they are predictions, not exact fluctuations

- Buy and sell signals can be too high/low (depending on +/- 100 or 200 settings)

- It can over or underestimate profits and losses

- It utilizes a time frame, set by the trader, rather than exact timing parameters

- Beginner and novice traders might not know how to read indicators, causing false readings and errors properly

Like any indicator, the Commodity Channel Index is just that — an indicator. It is not going to provide 100 percent accuracy and can make incorrect predictions like other trading tools. And, it also varies given external market conditions that the indicator doesn’t account for in Forex. So, as a trader, it’s important to understand there are flaws in the system.

Benefits of the Index, in Spite of Its Flaws

The above section details some of the issues with the Commodity Channel Index. Don’t move so quickly in throwing it aside when choosing indicators and tools to help you as a trader. There are also many benefits to consider, that the CCI presents to traders. In addition to indicating trends, it also allows traders to set the parameters. Doing this can provide a big picture or small picture depiction of market trends in the Forex marketplace.

It is also a great supporting tool. Like other graphs, charts, and calculators, it supports traders in the decision-making process. It helps them visualize buying and selling patterns, for a set period. Traders can also rely on this tool to identify a divergence in the charts. The indicator also helps determine overbuying and overselling that’s occurring with specific assets. It’s also an excellent tool for calculating moving averages and other Forex strategies traders develop.

As long as traders use it wisely, and as a helping tool, they’re going to benefit from the CCI. It can also provide invaluable insight into other trends in the market. And, when traders use it with other indicators, they have a larger picture to help them make wise decisions.

Pivot points also work well with the CCI. The reason for this is because both methods rely on turning points in market trends. Adding moving averages will further enhance the benefits of these three tools. There’s no shortage of ways to use CCI and Forex indicators. As long as traders correctly read them and know their limits, they can benefit from these tools greatly.

Basic Rules of the Commodity Channel Index

When using the CCI, traders must understand the basic rules as it relates to buy and sell indicators. The Commodity Channel Index serves as a baseline of recent fluctuations in the market. So, it will provide current over and under buying or selling of assets. These are some factors to keep in mind when using the buy and sell indicators the CCI presents.

Buy indicators

The Commodity Channel Index provides traders details about buying a specific asset. For example, if the CCI indicator dips below -100, and begins curving upwards, this is a positive indicator. This indication means the price levels are steadying out for a specific asset. If a bullish divergence occurs, this is also a buy indicator. A bullish divergence occurs when an upward movement in CCI occurs. This divergence happens while prices of an asset remain the same or move downward on the indicator graphs.

Again, this information isn’t a 100 percent guarantee that people should jump in and buy an asset. However, the trends indicate that the asset is moving in an upward direction, and may result in positive gains.

Sell indicators

There are also sell indicators a trader should familiarize themselves with when dealing with the Commodity Channel Index The first sell indicator is if the CCI crosses above 100, and begins to take a downward curve. In this case, it may be an indication that the price of the asset is going to continue to drop.

A second sell indicator is when a bearish divergence is visible in the Commodity Channel Index graph. A bearish divergence occurs when the price between the CCI and actual price movement, are on a downward trend. The downward shift in the CCI and the cost of the asset increasing or moving sideways is a contrary indicator. It possibly means a trader should sell the asset, rather than hold onto it.

Benefits of Utilizing the Commodity Channel Index as a Trader

As the name implies, the commodity channel indicator is an indicator. It indicates to traders whether they should buy, sell, or hold onto an asset. It provides traders with details about previous market trends, given a period the trader enters into the CCI formula. The CCI can also produce insightful information about fluctuations in overbuying and overselling in the Forex market. It is, however, an indicator, and shouldn’t be the sole source a trader utilizes, to make their decisions.

Bearing this in mind, traders can significantly benefit from reliance on the commodity channel indicator. It is one of the many tools a trader should keep in their arsenal of trading indicators and calculators. It comes standard on most trading platforms. And, it is a tool investment professional, as well as traders with more experience, rely upon for trend indications. So, as a beginner trader, you can also depend on it as a tool for predicting market trends. This information helps you make insightful decisions, given recent trends for specific assets you’re comparing. As long as traders use it accordingly, the CCI provides invaluable details. It serves as a guide of when and how traders should act when dealing with specific assets.

Understanding the basics of the CCI is the starting point for incorporating it into your trading toolbox. These are a few of the reasons to use the CCI. You can rely on the data points as a guide for buying and selling assets in Forex.

Featured Image: CC by 2.0, by Adam Greene, via Flickr

No Comment