When it comes to high-quality dividend growth stocks, there are few companies that shine as much as the Dividend Aristocrats. If you can find undervalued dividend aristocrats, you have to act quickly because these high-quality stocks are rarely ‘on sale.’

The Top 5 Undervalued Dividend Aristocrats Today

There are currently 53 Dividend Aristocrats. To be a Dividend Aristocrat, a company must:

- Be in the S&P 500

- Meet certain minimum size and liquidity requirements

- Have 25+ years of consecutive dividend increases

You can see the full list of Dividend Aristocrats here.

The only problem with buying high-quality businesses like the Dividend Aristocrats is that they often command premium prices. The higher a price you pay, the lower your future returns.

However, it is a market of stocks, not just a stock markets. Even in today’s market, there are still bargains to be had. They are just harder to find. We think you can find undervalued dividend growth stocks in any market. This article will analyze the top 5 undervalued Dividend Aristocrats today, and explain why we believe each stock is a buy at current prices.

I created a book titled Dividend Investing Your Way to Financial Freedom to help you increase your income and build wealth at the same time.

If you want a sample of the book, you can download it here.

I added these stocks to my Personal Capital account (use my link to get a free investment checkup!).

Our List of 5 Undervalued Dividend Aristocrats

These fit my financial ratio formulas and explanations perfectly, which is why I love these dividend aristocrats.

Undervalued Dividend Aristocrat #1: Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance (WBA) – hereafter Walgreens – is a pharmacy and retail company that was founded in Chicago back in 1901. The company has more than 13,200 stores in 11 countries and employs more than 400,000 people.

Walgreens operates in three reporting segments:

- Retail Pharmacy USA ($22.5 billion of sales last quarter)

- Retail Pharmacy International ($3.1 billion)

- Pharmaceutical Wholesale ($5.7 billion)

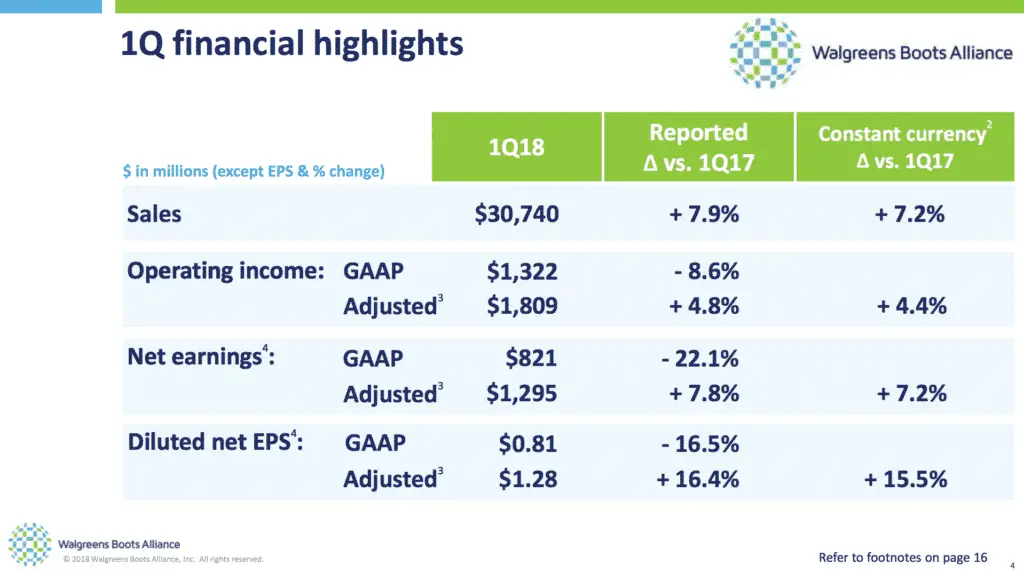

Walgreens’ recent financial performance has been very strong.

The company’s first quarter earnings release saw a 7.2% increase in sales and a 15.5% increase in diluted earnings-per-share.

More information about the company’s financial performance in the most recent quarter can be seen below.

Source: Walgreens First Quarter Earnings Presentation, slide 16

Walgreens’ strong growth combined with its compelling valuation make it an interesting investment right now.

The company is guiding for adjusted earnings-per-share of $5.45 to $5.70 in fiscal 2018, which implies a price-to-earnings ratio of 12.6 using the midpoint ($5.58) of this guidance band. For context, Walgreens has traded at an average price-to-earnings ratio of 16.7 over the past ten years. The company is noticeably undervalued at current prices.

Undervalued Dividend Aristocrat #2: Exxon Mobil

Exxon Mobil is the world’s largest publicly-traded integrated energy company based on its market capitalization of $329 billion. The company operates in four segments:

- Upstream

- Downstream

- Chemical

- Corporate & Financing

Exxon Mobil is undervalued at current prices. With that said, performing a valuation analysis on this energy giant is more difficult than for your ‘typical’ corporation because of the inherent volatility of the energy sector. Because of this, the most common valuation metric that investors use – the price-to-earnings ratio – is not the best metric to assess Exxon’s valuation.

We prefer to use the PE 10 instead, which is calculated by dividing a company’s stock price by its average earnings over the past 10 years. Exxon Mobil’s average earnings over the past 10 years have been $6.34 per share, and the company’s 10-year average PE10 has been 14.0. Multiplying these figures together, our fair value estimate for Exxon Mobil is $89. The company trades for $78 right now.

Exxon Mobil is undervalued, and we believe that today’s investors should be handsomely rewarded when oil prices revert to their historical means.

Undervalued Dividend Aristocrat #3: Cardinal Health

Cardinal Health is one of the “big three” drug distribution companies along with McKesson (MCK) and AmerisourceBergen (ABC). The company serves over 24,000 U.S. pharmacies and more than 85% of U.S. hospitals, and trades on the New York Stock Exchange with a market capitalization of $22 billion.

Cardinal Health is profoundly undervalued at current prices. In the company’s second-quarter earnings release, it revised its 2018 financial guidance. The company now expects adjusted earnings-per-share of $5.25 to $5.50 for the 12-month reporting period.

For context, Cardinal Health shares currently trade hands around $69, which implies a price-to-earnings ratio of 12.9 using the midpoint ($5.375) of the company’s new guidance band. Historically, Cardinal Health’s stock has traded around seventeen times earnings. The company is clearly undervalued right now, providing some opportunity for long-term investors looking to bolster the healthcare exposure within their investment portfolios.

Undervalued Dividend Aristocrat #4: AT&T

AT&T is the largest telecommunications company in the United States based on its $225 billion market capitalization. The company is known among investors for its high dividend yield. AT&T currently yields about 5.5% and is likely the single safest security with a dividend yield above 5%.

The company’s valuation also stands out. AT&T’s fourth quarter earnings release saw the company revise its fiscal 2018 financial guidance. The company now expects to report adjusted earnings-per-share in the $3.50 range, which implies a price-to-earnings ratio of just 10.5 using the company’s current stock price of ~$37.

For context, AT&T’s long-term average price-to-earnings ratio is approximately 14. The company is quite undervalued and its high dividend yield allows investors to get paid to wait for long-term price appreciation.

Undervalued Dividend Aristocrat #5: Medtronic

Medtronic is the world’s largest manufacturer of biomedical devices. The company operates in more than 140 countries, has over 85,000 employees, and has filed more than 53,000 patents.

Medtronic operates in the segments for reporting purposes:

- Cardiac and Vascular Group

- Minimally Invasive Therapies Group (often abbreviated as MITG in Medtronic investor documents)

- Diabetes Group

- Restorative Therapies Group

Medtronic’s presence in the healthcare industry means that it is one of the most recession-resistant Dividend Aristocrats. The company’s earnings-per-share grew steadily during the 2007-2009 Great Recession:

- 2006 adjusted earnings-per-share: $2.41

- 2007 adjusted earnings-per-share: $2.61 (8.3% increase)

- 2008 adjusted earnings-per-share: $2.92 (11.9% increase)

- 2009 adjusted earnings-per-share: $3.22 (10.3% increase)

- 2010 adjusted earnings-per-share: $3.37 (4.7% increase)

Medtronic is trading at an appealing valuation right now. The company is expected to report adjusted earnings-per-share of about $5.50 in fiscal 2018 and currently trades around $80 per share for a price-to-earnings ratio of 14.5.

Medtronic’s current price-to-earnings ratio is roughly equal to its median price-to-earnings ratio over the last 10 years. Still, buying high-quality businesses near fair value and holding them for the long run is an excellent way to build long-term wealth.

Final Thoughts on Undervalued Dividend Aristocrats

The five companies discussed in this article – Walgreens, Exxon Mobil, Cardinal Health, AT&T, and Medtronic – each have long dividend histories, strong growth prospects, and (perhaps most importantly) are trading at sensible prices. You can also invest in a Dividend King, which are stocks that have increased dividends for at least 50 years.

For these reasons, we believe these 5 undervalued Dividend Aristocrats are buys at current prices, particularly for investors that are seeking to generate rising dividend income over time.

What do you think about our dividend growth portfolio? We most likely will invest in one or two of these undervalued dividend aristocrats in the coming months.

Do you think these dividend aristocrats are undervalued? Let us know in the comments below. We’d love to hear from you.

Related Resources:

- Dividend Investing Starts with Profit Growth

- McDonald’s Stock Dividend Analysis

- Free Stock Calculator to Help You Invest Smarter

Get the latest updates in credit card churning, personal finance tips, dividend growth investing and passive income ideas by subscribing to our newsletter (we do not send spam). Escalate your life.

1 Comment