401(k) fees suck. Don’t sacrifice your retirement by overpaying fees. I love the transparency with fees nowadays. These 401(k) fee calculators will help people save money and retire earlier. But what one is best? Blooom vs Personal Capital. Let’s evaluate what 401(k) fee calculator is right for you.

Best 401(k) Fee Calculator: Blooom vs Personal Capital

If you want to invest money effectively. Fees should be at the top of your mind. Especially with your retirement accounts.

I like using a fee calculator to save time and optimize my 401(k) along the way. 401(k) financial advisors are probably having a tough time since these automated calculators have paved the way for people to manage their own money cheaply and effectively.

I have a goal of retiring early. In order to do so, I need to ensure that I’m invested with the lowest cost retirement funds.

I simply don’t like handing away free money. I used these two financial management software programs to eliminate $3,120 in unnecessary fees right away.

If you are a millennial, you may want to think about these retirement strategies. How does Blooom compare to Personal Capital’s retirement fee calculators?

What are 401(k) fee calculators?

401(k) fee calculators will automatically scan your investment accounts for high fee investment options relative to the alternatives. The fee analyzer will then recommend the best way for you to save money and thus invest more efficiently.

By saving on retirement fees, you unlock additional investment value and position yourself for optimal returns in the future. There’s no reason to overpay for something that you would otherwise get by investing in low-cost index funds.

There are two 401(k) fee analyzers that I use nearly daily:

- Blooom: 401(k) (get a free trial using my link)

- Personal Capital (get a free investment consultation after you link your accounts when you sign up using my link)

I’d like to evaluate the pros and cons of using Blooom vs Personal Capital. Both programs are excellent, but should you allocate your time with both of them?

If you are like me, you get overwhelmed with the various options to analyze your retirement fees.

On the same hand, you need to check your 401(k) for fees because some plans offer investment options with ridiculously high fees. The only way to optimize your 401(k) effectively is by using a fee calculator.

Blooom: 401(k)

I covered a lot of this in my Blooom review, but I’d like to provide additional details here in light of Personal Capital’s fee analyzer. Blooom is a top-notch site that offers exceptional online investment management and advisory services.

Blooom robo-advisor focuses on workplace retirement plans that help you manage and fully optimize your 401(k), 403(b), 457s, 401(a), IRA, Roth IRA and thrift savings plan. The retirement fee calculator offers you an automated robo-adviser to assist you with the difficult investments decisions.

How the Blooom 401(k) Fee Calculator Works

In order to use the 401(k) fee calculator, you simply need to sign up. From there, you will be prompted to link all of your retirement accounts including your 401(k), IRA, Roth IRA and more.

You can link to brokerages such as Fidelity, Alerus, Schwab and many more. You shouldn’t have a problem linking on all your accounts.

From there, the Blooom retirement fee analyzer will do what it does best and highlight how you can save more money in all of your retirement accounts. Blooom will advise on where to put your money instead and how to optimize your retirement accounts.

Blooom provides recommendations in a number of different buckets:

- Investment fees

- Risk assessment

- Diversification

From there, they will do a cost assessment of how much you will save by using Blooom.

They will tell you directly how to improve your retirement accounts to ensure success.

The fee checker with Blooom is a great free way to get an analysis of your retirement accounts.

Is Blooom Safe?

Yes. They don’t have security two-factor authentication in place. However, you never can see the login credentials. I am very comfortable in using their platform for analyzing my retirement fees.

Personal Capital 401(k) Fee Analyzer

I owe so much of my personal financial improvement to Personal Capital. I would have never been able to track my net worth so efficiently and effectively. I’m a Personal Capital addict that checks it daily.

Personal Capital is an online financial advisor and personal wealth management company headquartered in San Carlos, California. They have additional offices in San Francisco, CA and Denver, CO.

Personal Capital is a staple in the financial advising industry after blowing away competitors with their intuitive dashboard.

The dashboard is very slick, easy to use and tracks the following:

- Net Worth Tracking

- Personal Cash Flow

- Investment Accounts for Diversification

- Expense Tracking

- Retirement Fee Analyzer

- Home Value Tracking via Zillow

There are additional features to Personal Capital that I’m sure I missed. For all of these reasons, I’ve become better off financially because of Personal Capital.

How the Personal Capital 401(k) Fee Calculator Works

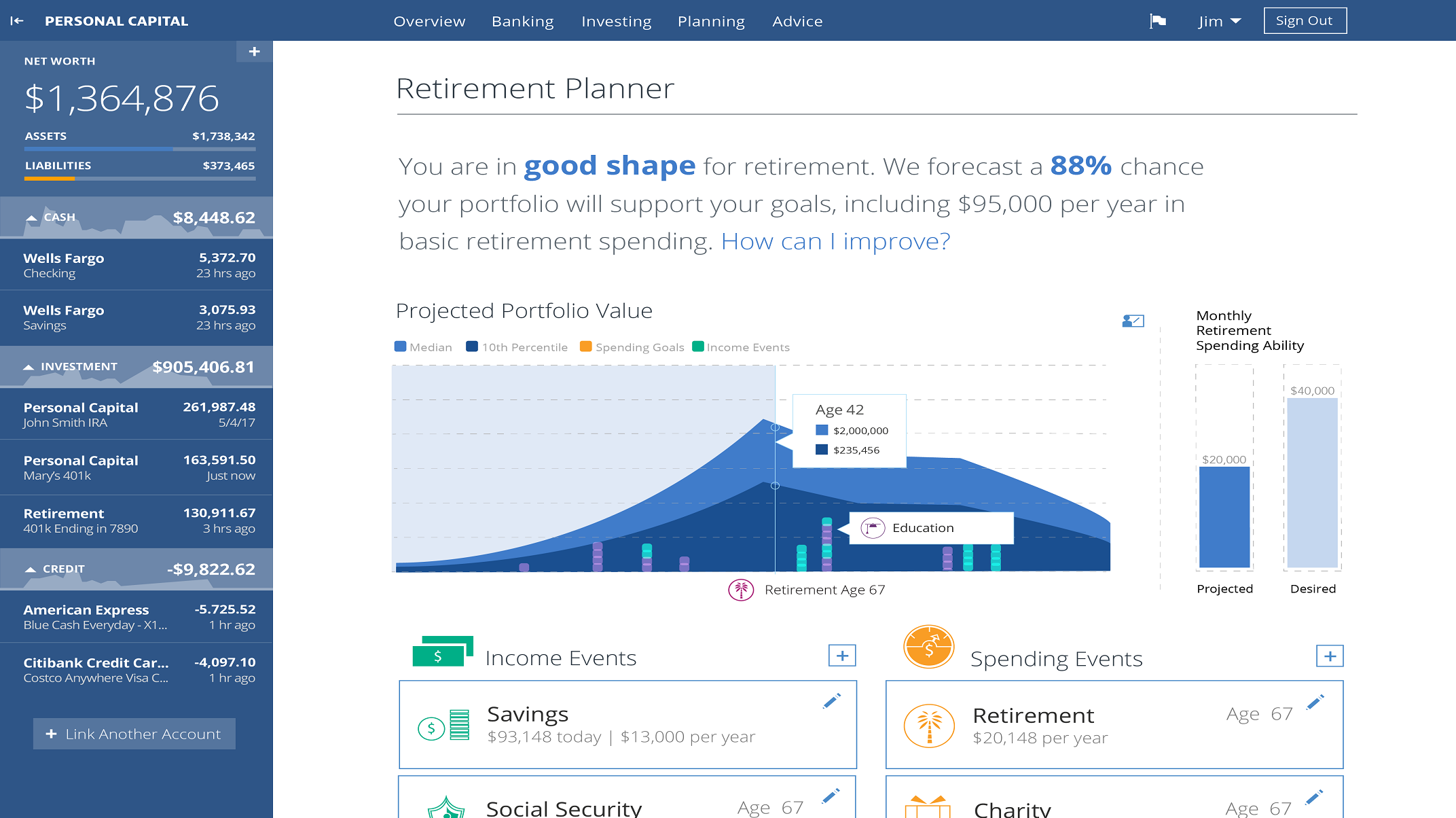

With having Personal Capital, you should already have all your investment accounts linked after signing up. After you have linked all of your retirement accounts, navigate over to the Retirement Planner section of the app or desktop version.

This section is completely free to use and monitor all of the time. Forever. In terms of linking investment accounts, Personal Capital is more robust than Blooom. I have yet to find an investment brokerage account that they don’t have. You should be able to easily link all of your investment accounts.

On the Retirement Planner Section, you will see a full set of your investment directions, including:

- Target Allocation

- Future Projects

- A Recommendation of Meeting Your Retirement Goals

The Retirement Planner dashboard should look like this:

The Personal Capital Retirement Planner is a bit different and less robust as Blooom. However, Blooom comes with monthly fees.

You have to admit that the dashboard is pretty impressive.

Is Personal Capital Safe?

Yes, I feel very comfortable with how safe Personal Capital has become. Every time you login they prompt a text validation to your phone, which is a great sign for your security.

Conclusion on the Best 401(k) Fee Calculator

I think every needs to run a monthly analysis on their 401(k) fees to ensure you are fully optimized. Blooom is completely free to refresh your 401(k) fees, diversification and allocation.

However, if you want an actively managed account you have to add in the $10 per month.

For Personal Capital, their Retirement Planner dashboard is completely free to use. In fact, if you sign up they will give you a free investment consultation.

In addition, Personal Capital offers so much more for you to improve your personal financial plan. If you need an example of what your personal financial plan should look like, review our personal financial plan template.

Conclusion: I’d suggest using both and don’t pay for Blooom premium. Run a 401(k) fee calculation on both Personal Capital and Blooom. Then, apply the overlapping principles.

You simply can’t go wrong with a 401(k) fee calculator. In fact, it’s an absolute must-have for everyone. Now, time to use one of these top investing apps to get started allocating your capital.

What is the best 401(k) fee calculator in your opinion? Please let us know. We’d love to hear from you.

See Also:

- How to Save on Retirement Fees

- Retirement Readiness Checklist: Know When You Can Retire

- Free Dividend Retirement Calculator

At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. Join our community to achieve both. With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle. Financial freedom + travel = pure happiness.

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Join our community of over 3,000 mobsters. What are you waiting for?

Escalate Your Life.