A dividend growth investing strategy can help you build long-term wealth. Here’s how to invest for passive income and capital appreciation.

Dividend Growth Investing Strategy: Invest for Passive Income

When thinking about how to invest in dividend stocks, always think about quality. To start us off here is one of my favorite quotes from the Oracle of Omaha.

“It’s far better to buy a wonderful business at a fair price than a fair business at a wonderful price.”

-Warren Buffett

Dividend growth investing is one of my favorite forms of passive income. We will give you The Ultimate Guide to Dividend Growth Investing, so you can earn monthly paychecks and fantastic yields for minimal ongoing work (as long as you stick to our disciplined strategy).

Dividend growth investing is a concept where you buy stocks that have a reasonable dividend payout ratio and are likely to increase their dividend into perpetuity. Check out how to use the dividend discount model to build a dividend income portfolio.

Compound interest is your friend. Through dividend growth investing, you can achieve the lucrative benefits of compounding interest. I use Robinhood to build a stable “Dividend Growth Investment Fund”.

Robinhood offers $0 commission trading, so even if my dividend check is only $10. I can use that $10 to buy a $10 stock with no fee. This is the ultimate compound interest vehicle. If you join Robinhood, we will both receive a free share of stock. This is one of the ultimate guides to investing in dividend stocks.

I reinvest all of my dividend proceeds into other dividend paying stocks. You can review updates to my Robinhood portfolio here.

Dividend growth investing is one of the most successful forms of passive income that expands through capital appreciation (stock goes up) and compounded interest (increased dividends) over time.

What are dividend stocks?

Now that you have started understanding what the dividend investing is all about, you know for sure that it requires a lot of effort to hit the bull’s eye.

If you are thinking of going to a dividend growth investment strategy, then you need to study the history of the company along with the future.

The history of the company will help you in understanding the growth rate of the company and how it has evolved over the years. Once you have a fair idea of the backdrop of the company, then you will be able to decide how it is going to evolve in the coming years.

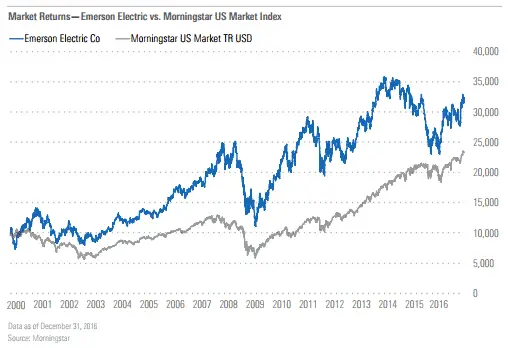

Let’s take a look at a case study. Here is the total return of Emerson Electric compared to the overall US Market for the past 16 years.

Emerson boasts an enviable 60-year history of growing its dividend payment to shareholders. Emerson’s boasts a long-term average of roughly 8% dividend growth per year. This illustrates the dividend investing strategy for long-term outperformance.

Emerson Returns Compared to Total US Market

A high yielding dividend sometimes gains a ton of interest, but some times too high yielding of dividends does not signal financial strength.

Usually, these companies are in distressed situations and their dividend will likely be cut in the near future. You need to make a close assessment of a company’s financial position before investing or making a decision on how they will perform in the future.

Top dividend yield stocks always have a great management team, an amazing product and an enviable balance sheet to boot.

What is a dividend?

A dividend is paid out when the company has enough cash flow from operations (or in hand) after reinvesting in their business. I always love companies that are focused on reinvesting in their company, but also pay a handsome dividend. This gives me comfort that the business will grow in the future (so long as management is making the right decisions!).

So now when the profit margin of a company is increasing, it is likely that the dividend will also have steady growth. This means the company’s wealth compounds and it, in turn, will help your portfolio grow exponentially.

Generally, most investors are happy with their dividend yield, but dividend growth investing is one step beyond. The dividend growth investing considers future potential.

When the inflation rate is less than the rate of dividend you are receiving, then you are investing in a good business.

On the other hand, if you are receiving a high, but equal dividend yield every year, but the inflation rate is eroding the cash value slowly. You are essentially swimming upstream.

What we like is not just a dividend stock, but investing in dividend stocks that increase their dividend over time. I love getting a raise from an investment for doing nothing!

What is a dividend growth investing strategy?

Dividend growth investing is simple math. Every company earns a fair return on the amount of money that they have invested in their own business. Successful companies typically earn generous profits. If they expand their profits over time and maintain a consistent dividend payout ratio (defined below), they will pay a greater dividend over time.

I like to invest in companies that pay a low dividend payout ratio. This is essentially buying low in a company’s dividend trajectory. It protects my downside in case the Company’s earnings do not increase.

A company can pay a greater dividend in the following year even if their earnings do not increase. Building a dividend portfolio is a lot easier than you think.

Important Terms Related to Dividend Growth Investing

There are some terminologies that one should be aware of before venturing into the world of dividend growth investment so that they are in a better position to understand the whole scenario.

- Dividend Growth Rate – Every dividend has a particular rate of growth and it differs from others. While investing, it is important to study the growth rate of a dividend. To get an idea of how much the growth rate can be in the future, you have to go back and take a look at the growth rate of the dividend in the past (past results are not always a prediction of the future, but it’s the best thing we have!). If it has had steady growth for a long period of time, then you can rest assured that the same trend will follow in the near future as well.

- Dividend Payout Ratio – If the company you have invested is earning $1 and paying out a dividend of $0.50, then the payout ratio is 50%.

- Dividend Yield – This is what you earn for every dollar that you have invested. If you have invested in a $100 stock and they pay a $2 dividend, then your dividend yield is 2%. While investing, you will have to keep in mind that the dividend yield you are earning should always be more than the inflation rate.

These are simple terms that every dividend investor should know with the back of their hand. Ensure that you recognize these terms before building a dividend portfolio. There are several ways to invest in the stock market with limited risk.

The Strategy of Investing in Dividend Stocks

The strategy of investing in dividend stocks entails several steps to ensure success.

- First, you need to build up a compilation of some of the great companies that have dividend rates equal to or more than the inflation rate each year.

- You must have enough patience to hold on to the positions for decades in order to take the deferred tax’s advantage. Furthermore, you must hold the stock to realize the benefits of long-term capital appreciation through compound interest. Make sure to reinvest all of your dividends back into your portfolio.

- Take note of how the company is paying out the dividend. The dividend should result not result from the debt that the company is getting into, rather it should come from real, sustainable profit.

- Never invest in one sector or one kind of industry; instead, the investment should be spread out into different industries of the economy.

- Stocks from different countries are also a wise idea of investing, that way you will earn dividend in different currencies and you won’t be relying on one single government.

Here is a list of Dividend Kings, which are stocks that have been increasing their dividends for over 50 consecutive years.

That is pretty impressive and hard to beat!

Growth Potential for Investing in Dividend Stocks

There are few companies that start off paying dividends at their inception. It takes a fantastic track record of success. Additionally, it takes excellent execution to realize companies that are about to pay growing dividends for years to come.

We love Modest Money’s post on why dividend growth investing works.

There are several indexes available that will give you a clear picture of the companies that are paying out a growing dividend for a long period of time.

So before investing, take out some time out and go through the various dividend aristocrat indices to understand the dividend growth rate of companies over a period of time.

While going through the index you shall pay attention to the company’s potential for higher profit and its prospects for growth as well. If you see that the company is performing well for a period of time and the economy is also improving with time, then you can expect the dividend to grow as well.

While considering the idea of investing in dividend stocks, one important thing to take into consideration is the financial state of the company. If the company is borrowing extensively be cautious.

Or, if it is investing in some projects that involve high risks, be cautious. It may not be a good idea to invest in that dividend stock.

Another point of concern is the free cash flow and the cash hoard of the company. The dividend coverage ratio needs to be verified. There should be ample room to sustain or grow the dividends in the absence of earnings growth.

I like to think of any earnings growth as upside or free growth. I’m buying a company at a valuation that I would be comfortable owning even if the stock market closed for 10 years.

Blue-chip stocks are known for their steady growth and pay handsome dividends over the course of their operating history.

We like using FINVIZ Futures to understand stock market trends and buy at the most optimal time. Learn how you can use FINVIZ futures to ensure investment success.

Investing in Healthy but Steady Growth

There are two options, either you can invest in a company that is paying you a large dividend, but the growth is slowing down. Or, in a company that is now paying a small dividend but is enjoying higher profit with each passing year.

Though larger dividend might allure you because of the large quarterly cash payouts. However, think long term, you want a company that has the potential to become an outperforming dividend hero rather than a business that will not be around in 5 years.

Remember, your dividend yield improves as a company and their earnings increase. For example, if you buy a stock at $100 in 2015 that pays a $2 dividend your 2015 dividend yield is 2%.

Fast forward 5 years, it is now 2020 and that stock pays $4 in dividends. Your effective yield is now 4%! Imagine the earnings capability if that company continues that dividend growth rate into perpetuity.

Building an Optimal Portfolio of Dividend Stocks

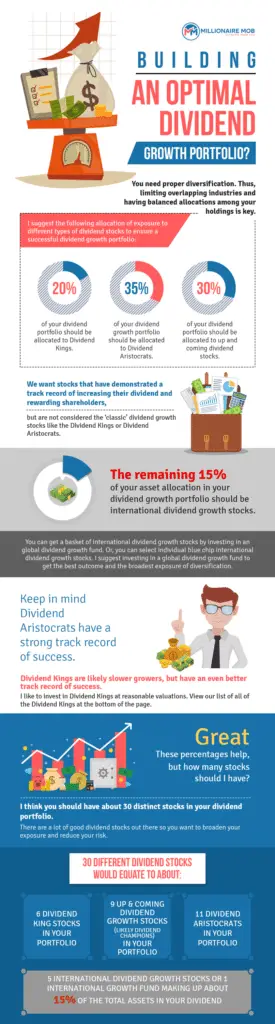

We like investing in an optimal portfolio to ensure success, which typically includes 30 unique dividend stocks. I like to invest in a mix of Dividend Kings, Dividend Aristocrats and Dividend Champions.

In addition, when building a dividend portfolio consider investing in international dividend stocks. This will allow you to broaden your exposure and reduce risk.

Building a dividend portfolio is fun. It allows you to create something from scratch that you get to monitor over time.

Additionally, you can take advantage of compound interest by buying dips during stock market volatility. Think of dividend investing like a compound interest snowball.

We use all of our other forms of passive income or prospective passive income ideas to invest in dividend stocks. Using Robinhood for dividends has been great since I pay no fees for trading stocks.

This will ensure that we are on a path to financial freedom and wealth creation. Think of dividend investing like recycling.

You earn dividend income from your stocks. That income is reinvested into that same stock, which will pay a dividend in the future and you receive more income! Rinse and repeat.

Are you investing in dividend stocks? If not, go out and invest now! You too can live off dividends, you just need to start investing as soon as possible!

Tell us about what you think was missed in our guide on how to invest in dividend stocks. We’d love to hear from you. Subscribe to our newsletter for more fantastic updates like the above (we do not send spam).

Investing in dividend stocks is fun and an easy way to build wealth.

No Comment