Using a covered call strategy can be an effective way to boost your monthly income on your dividend growth stocks. It is a relatively safe way to earn additional income on your investments while protecting potential downside risk. Let’s dig into the best stocks for covered call writing.

Best Stocks for Covered Call Writing (Including Two Dividend Stock Examples)

With the market enjoying a tremendous run since the 2009 bottom, investors would be forgiven for wondering if the good times will continue or if we might be set for a multi-year period of flat or negative returns.

One way to deal with this possibility is by structuring our portfolios to be more focused on income generation rather than growth.

One of the best strategies for generating income is covered call. They are one of the easiest to understand and implement option strategies and they perform very well in flat, slightly up and slightly down markets.

When you combine covered calls with dividend stocks, the results can be very impressive indeed. If you are still thinking about how to invest in dividend growth stocks, review our guide on building a dividend growth stock portfolio.

I love dividends so much that I wrote an entire book on the dividend investing strategy titled Dividend Investing Your Way to Financial Freedom.

Why You Should Sell Covered Calls on Dividends Stocks

Covered calls are a reasonably low-risk way for investors to get started with options. There is a natural progression for an investor who is already accustomed to share ownership to begin to explore the fabulous world of covered calls. The key is to educate yourself, and practice, practice, practice.

Covered calls are not something you learn about in school. In fact, schools don’t really teach you anything about personal finance or investing. This is one of the great failings of our education system. Someday, I hope I can help rectify that.

The best way to really accelerate your portfolio income is by combining the payment of dividend stocks and a covered call strategy. If used correctly, you earn income from your covered calls AND your dividends. This can have a compounding effect on your portfolio.

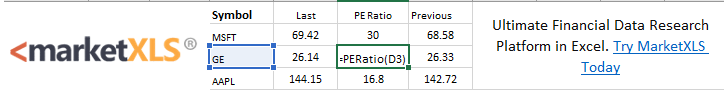

I love using FINVIZ and FINVIZ Futures to make better decisions about my covered call strategy.

Check out how to use FINVIZ futures to understand market trends.

Covered calls are one of the greatest wealth creation tools you can find. A covered call can protect your downside risk on your investment and help you earn additional income. I love investing in dividend growth stocks and deploying a covered call strategy to earn additional monthly income.

In addition, I pair FINVIZ with my commission-free Robinhood dividend growth stock account.

Robinhood offers completely commission-free options trading. I couldn’t believe it when I saw it. That is very rare considering options trading is viewed as a premium product for brokerage accounts. If you sign up for Robinhood, we both get a FREE share of stock!

You can check out our Robinhood app review and how the Robinhood dividends work in our Robinhood app guide.

What are covered calls?

A covered call is a financial transaction in which the seller of call options owns the corresponding amount of the underlying investment, such as shares of common stock. If an investor is invested in a stock, the long position in the shares of common stock provides a “cover” as the shares can be delivered to the buyer if exercised.

Writing (i.e. selling) a call generates income in the form of the premium paid by the option buyer. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no calls were written. The risk of stock ownership is not eliminated. If the stock price declines, then the net position will likely lose money.

The opposite is that you could write puts for income. Here is a guide to selling weekly puts for income.

Example of writing covered calls with dividend growth stocks

Let’s look at an example to help you understand how writing covered calls can help you boost your investment returns.

XYZ stock is trading at $100. You own the stock and don’t think it’s going much higher. You want to increase your income potential so you decide to sell a call option with a strike price of $100.

The buyer of the option takes the other side of your trade and is bullish on the stock. They think it’s going up beyond $100.

For the right to buy the stock for $100, the option buyer pays you a premium of $5.

Let’s look at some scenarios…

Scenario #1: Stock goes to $85

The buyer of the option will walk away and lose 100% of his $5 investment. You will still own the stock, but are sitting on a loss of $10 which is better than the $15 loss you would have if you hadn’t sold the call option.

Scenario #2: Stock stays at $100

The buyer of the option will walk away and lose 100% of his $5 investment. In theory, he could exercise the option if he wants to own the shares, but it is easier to just buy them directly in the market. Note: Most brokers will automatically exercise an option if it is 1 cent in the money. So, if the stock closes at $100.01 the option would be automatically exercised.

You are happy because you have made a $5 return on a stock that has gone sideways thanks to the option premium.

Stock goes to $105

The option buyer will either exercise his option and buy the shares for $100 or sell the option in the open market. If he buys the shares for $100, he can turn around and sell them in the market for a $5 gain. But, he paid $5 for the option, so his profit is zero.

Alternatively, he can sell his option for $5 in the open market. Either way, he has made a breakeven trade.

You are happy because you have made a 5% return, the same as if you had just held the stock..

Stock goes to $115

If the stock goes to $115, both investors are happy, although you are a bit disappointed you didn’t just hold the shares outright. You still make your $5 profit and 5% return, but you have left another $10 on the table.

The option buyer is happy because he can purchase a $115 stock for only $100 (don’t forget he also paid the $5 in premium, so his total cost is $105). Or he can sell the option for $15. That’s a $10 profit on a $5 investment.

The table below shows the outcome for each investor at different stock prices. Remember to multiply these amounts by 100 given that each option contract controls 100 shares.

If you want to learn more about covered calls, check out this free 13-part course.

Best Stocks for Covered Call Writing

Some good stocks for writing covered calls include a few unique features.

Here are some characteristics of the best stocks for writing calls are the following:

- Stocks that pay a dividend

- In addition, write covered calls on stocks that have suppressed valuations that haven’t yet unlocked value

- For example, General Motors was highly undervalued and the stock took significant time before it started to increase in share price. People just did not believe that General Motors was actually growing or generating strong cash flow. During that time, the stock was stuck in a trading pattern of about $36-$40 for a number of years. That’s a lot of covered call writing! The stock eventually increased by about 15-20% after earnings calls.

- Write a covered call on stock in between any significant events. We don’t want increased volatility. In fact, we’d prefer for volatility to be high but expected to decrease. Thus, leading to a decrease in the extrinsic value of the option and you earn more money!

Hope these points helped you identify the best stocks for writing covered calls. With that being said, let’s get into two of the best stocks for writing covered calls.

With dividends, I can compound my income from writing covered calls and receiving dividend income. This can accelerate my dividend income goals.

What are your dividend income goals?

You can create a plan using our free dividend reinvestment calculator. See what it takes to retire off dividend income.

I ran a few case studies on what it takes to live off dividends forever. If you want to ensure success in your covered call strategy, the best stocks for covered calls are definitely dividend stocks.

How to Generate Your Covered Call Stock List

In order to find the best covered calls to sell, you need to generate a list of criteria of stocks that meet you investment objectives. For me, I think it’s most prudent to write covered calls on dividend stocks.

This helps enhance your income while you wait for the valuation to approach market levels. Here is a criteria for screening for your covered call stock list:

- Input stocks that pay a dividend

- Ensure the stock is reasonably valued at less than 15x P/E ratio and less than 10x EV/EBITDA

- Make sure that you understand the business model of the company and how they make money

- Follow the stocks trends for the last few weeks to get a handle on how it trades

- Pair up the valuation of the stock with where volatility is currently priced in the stock; we want to sell high volatility, so look for stocks that have increased volatility embedded in the call option

These are 5 simple criterion for finding best stocks for covered calls. Find the best stocks for covered calls by using stock screeners.

We will get into two different covered call examples that will help you understand how to write covered calls. In my opinion, these stocks feature some of the best characteristics for writing covered calls against.

Two of the best stocks for covered call writing in today’s market

If you want to write covered calls, you must follow your criteria and stick to your plan. Let’s get into my approach on how I set up a covered call on a dividend paying stock.

These are two dividend stock examples that are some of the best stocks to write covered calls against.

XOM – EXXON MOBIL CORPORATION

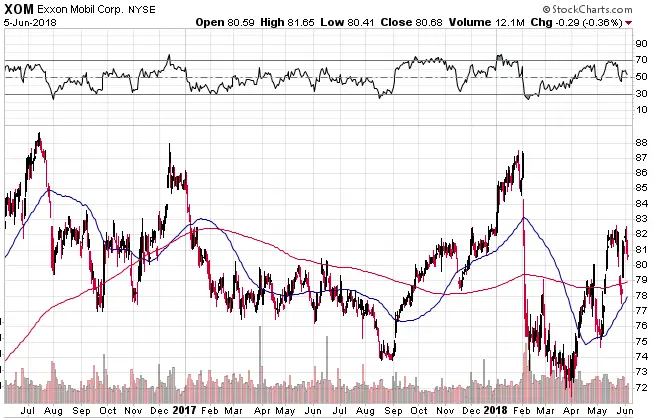

In our first covered call example, XOM has trade between $72 and $88 over the past two years and is currently in the middle of that zone around $80.

The dividend yield on XOM is currently 4.07% which is a healthy income, but investors that want to improve the income potential, can sell covered calls.

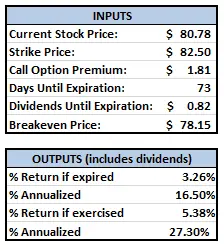

Investors who own 100 shares of the stock could sell an August 17th $82.50 call option for $1.81/share.

If XOM stays below $82.50 at expiry, the call option expires worthless and the investor achieves $2.63 in income, for a return of 3.26% which is 16.50% annualized.

In addition, if XOM rises above $82.50 at expiry the investor gains another $1.72 in capital gains for a total return of 5.38% which is 27.30% annualized. Not a bad return! That makes this one of the best stocks for covered call writing.

If XOM drops, the investors break even price is reduced by the option premium and the dividend received and is, therefore, $78.15.

KHC – THE KRAFT HEINZ COMPANY

Our second covered call example features The Kraft Heinz Company. KHC’s shares have been decimated in the last 12 months falling from $90 to as low as $53.54.

The chart below is certainly not a pretty picture, but some investors may see value there.

One positive of the declining stock price is a very tasty (pardon the pun) dividend yield, which currently sits at 4.32%.

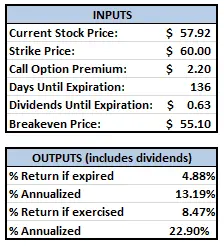

Investors looking to boost the income on this stock could sell a covered call using the October 19th $60 calls which can be sold for $2.20/share.

If KHC stays below $60 at expiry, the call option expires worthless and the investor achieves $2.83 in income, for a return of 4.88% which is 13.19% annualized.

Then, if KHC rises above $60 at expiry the investor gains another $2.08 in capital gains for a total return of 8.47% which is 22.90% annualized. Making Kraft-Heinz stock another one of the best stocks for covered call writing.

If KHC drops, the investors’ break-even price is reduced by the option premium and the dividend received, which is $55.10.

Selling Covered Calls for Income Conclusion

Options trading can be risky (and scary) for newbies, but when used correctly they can be a valuable addition to a portfolio. Investors looking to increase the yield portion of their portfolio would be wise to add covered calls to their stock holdings provided they don’t mind giving up some potential capital gains. Here are other ways to invest in the stock market with limited risk.

However, if you follow your predetermined strategy for writing covered calls for income, you can start accelerating your portfolio income and reinvesting that income at a faster rate. A prudent strategy is key and you must stick to your plan to ensure success in selling covered calls. Consider these other option strategies for income.

Anyone wanting to learn more about covered calls or options, in general, can find me at www.optionstradingiq.com

What are the best stocks for covered call writing in your opinion? I’d love to hear from you in the comments below.

See Related Investing Money Resources:

- SureTrader Review: A Brokerage with No Day Trade Rule

- Capital Stack Guide: How to Do Capital Structure Analysis

- Evaluating the best robo-advisors to use

Millionaire Mob is an early retirement blog focused on passive income, personal finance, dividend growth investing and travel hacking. Stay up to date on all of Millionaire Mob’s latest dividend growth investing ideas by subscribing to our newsletter.

With both a million rewards points and a million dollar net worth you can live a happier lifestyle. Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Join our community of over 3,000 mobsters seeking financial freedom. What are you waiting for?

8 Comments

Thanks for featuring me on such an awesome website. I hope your readers enjoyed this article.

Thanks for the info. I will check out the course. Now that Robinhood offers options for free, I’m going to give options a try using the covered call strategy, which I’ve always been interested in but never had the courage to give it a try. I own a dividend portfolio and dividend growth investing is my main strategy right now, but I want to explore other sources of info so thanks a lot.

Great to hear! Try signinup for Robinhood if you haven’t already. Options + dividends can really take your portfolio to the next level. Good luck!

Great to hear. If you need any help getting started, feel free to reach out.

XOM hit 85 today. RSI is high 70 as well. Do you still have the covered call or did you roll over it? I am just curious. Thank you.

Rolled it. This market is feeling toppy.

How about ETFs that accomplish the same goal?

There aren’t any (that I’m aware of at least)