How do you use the dividend discount model to build a dividend portfolio? Well, you need a number of different resources at your disposal and it takes time to learn. However, once you maintain a routine checklist for stocks finding the best dividend growth stocks is easy as pie.

“It’s far better to buy a wonderful business at a fair price than a fair business at a wonderful price.”

-Warren Buffett

How to Use the Dividend Discount Model to Build a Dividend Portfolio

Building a dividend portfolio is paramount to financial freedom and successful investing. Dividend investing allows for you to earn passive income through dividends and receive long-term capital appreciation. We love dividend investing. We created a guide to building a dividend portfolio. Our guide to building a dividend portfolio features both advanced and basic considerations when creating a portfolio.

Why do people care about dividend growth investing the first place?

Dividend growth investing is a concept where you buy stocks that have reasonable dividend payout ratio and and are likely to increase their dividend into perpetuity. Well, if you do it right you receive stable income into perpetuity. You could be on a beach in the Bahamas drinking rum punches while you receive $1,000s of dollars worth of dividend income.

Dividend growth investing is simple mathematics. Every company earns a fair return on the amount of money that they have invested in their own business. Successful companies typically earn generous profits. If they expand their profits over time and maintain a consistent dividend payout ratio, they will pay a greater dividend over time.

We built a guide that will help understand the importance of dividend growth investing. You know the snowball term as it relates to paying down debt? Well, think of dividend growth investing as the investing version of the snowball method.

Compound interest is your friend. For every penny of dividend growth you earn, reinvest that back into a dividend growth stock. You literally get paid to wait…

A person that I frequently follow, Ken Faulkenberry, highlights the 6 Advantages of Dividend Growth Investing:

1. Get Paid to Wait

Dividends allow an investor to get “paid to wait”. Historically dividends have provided 43% of the S&P 500 total return. Dividends provide an ongoing return while waiting for capital appreciation.

2. Dividend Growth Compounding

The benefits of exponential growth are multiplied by growing dividends. This is because both the number of shares (from reinvestment) and the dividends per share are growing.

The exponential power of dividend growth compounding can provide competitive returns regardless of whether the price of the stock increases in value or not.

3. Take Advantage of Bear Markets

Investors savvy enough to reinvest dividends during bear markets purchase more shares with the dividend while the prices are low rather than when the prices are high.

Later, when prices recover, the return is actually enhanced by the temporary fall in the stock price. Reinvesting dividends and accumulating more shares during bear markets greatly boosts dividend growth investing returns. Volatile stocks can actually be a good thing for your portfolio.

4. Capital Preservation

Quality dividend paying companies are more mature and stable than the average company. These stocks usually hold up better in down markets than more speculative stocks. This is especially true when a value approach with margin of safety is used when selecting stocks.

Regular readers of this blog know I put the upmost premium on the concept of preservation of capital and asset allocation investing. Dividend growth investing is a key part of portfolio asset allocation management that emphasizes preserving your investment principal.

5. Create an Income Stream

Dividends provide a regular income stream. Most stocks pay a quarterly dividend, but a well constructed portfolio of dividend stocks can provide a consistent monthly income stream. You want to buy companies that have the ability to increase the dividend. It’s a mistake to focus only on yield.

6. Inflation Hedge

The big disadvantage of fixed income investments is the income stream doesn’t grow. Even a 3% inflation rate will destroy 50% of the buying power of your principal in just 24 years. Dividend growth stocks provide the ability to receive income that increases and maintain the purchasing power of your principal and income.

Compounding Interest Benefits of Dividend Growth Investing

The table below illustrates the benefits of compound interest from an interest savings account compared to the benefits of compound interest in dividend growth stocks while reinvesting. Reinvesting the dividends is only comparable because by in fact you are reinvesting your savings in the interest savings account scenario.

| Interest Compounding | Dividend Growth Compounding | ||||||||

| Year | 4% Interest Rate | Interest Earned Annually | Total Value | Dividends Per Share (increases 3% per year) | Share Price (increases 3% per year) | Dividend Reinvest Adds # of Shares | Total Shares w/ reinvestment of dividends | Total Value of Shares | |

| 0 | 100,000 | 100.00 | 1000 | $100,000 | |||||

| 1 | 4.00% | 4,000 | 104,000 | 4.00 | 103.00 | 39 | 1,039 | $107,000 | |

| 2 | 4.00% | 4,160 | 108,160 | 4.12 | 106.09 | 40 | 1,079 | $114,490 | |

| 3 | 4.00% | 4,326 | 112,486 | 4.24 | 109.27 | 42 | 1,121 | $122,504 | |

| 4 | 4.00% | 4,499 | 116,986 | 4.37 | 112.55 | 44 | 1,165 | $131,080 | |

| 5 | 4.00% | 4,679 | 121,665 | 4.50 | 115.93 | 45 | 1,210 | $140,255 | |

| 10 | 4.00% | 5,693 | 148,024 | 5.22 | 134.39 | 55 | 1,464 | $196,715 | |

| 15 | 4.00% | 6,927 | 180,094 | 6.05 | 155.80 | 66 | 1,771 | $275,903 | |

| 20 | 4.00% | 8,427 | 219,112 | 7.01 | 180.61 | 80 | 2,143 | $386,968 | |

| 25 | 4.00% | 10,253 | 266,584 | 8.13 | 209.38 | 97 | 2,592 | $542,743 | |

| 30 | 4.00% | 12,475 | 324,340 | 9.43 | 242.73 | 117 | 3,136 | $761,226 | |

| 35 | 4.00% | 15,177 | 394,609 | 10.93 | 281.39 | 142 | 3,794 | $1,067,658 | |

| 40 | 4.00% | 18,465 | 480,102 | 12.67 | 326.20 | 172 | 4,591 | $1,497,446 | |

| 45 | 4.00% | 22,466 | 584,118 | 14.69 | 378.16 | 208 | 5,554 | $2,100,245 | |

| 50 | 4.00% | 27,333 | 710,668 | 17.02 | 438.39 | 251 | 6,719 | $2,945,703 | |

In the above example, you can see that the dividend growth portfolio crushes the savings account in ending balance. The dividend growth portfolio results in an ending balance of $2,945,703 compared to a paltry $710,668 for the savings account.

Sensitize the power of compound interest by running your own dividend reinvestment plan through our calculator.

What is the dividend discount model?

The dividend discount model is a method of valuing a company’s stock price based on the theory that its stock is worth the sum of all of its future dividend payments discounted back to their present value. The equation itself is most widely used at the Gordon Growth Model (“GGM”) by name.There are two different types of dividend discount models: the short-form model and the multi-stage model.

I have provided a downloadable version of the short-form dividend discount model for you to use in my resources section.

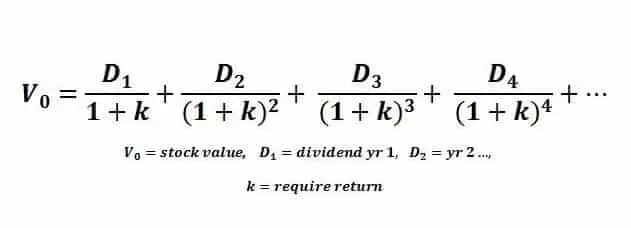

The formula for the dividend discount model is the following:

The formula can look complex but it really is simple to use.

Short-Form Dividend Discount Model

The short-form of the model just takes a multiple of pro forma dividend payments. It certainly has its limitation in practical use. However, it can be used as a decent barometer to tell if you should continue digging into the dividend growth stock further.

For inputting your future growth rate, do not just use 1-year of historical dividend growth rate. I would suggest taking at least a 5-year average at a minimum. Remember, historical results are not representative of future performance. Take it with a grain of salt since it is a bit more of an art than a science.

Multi-Stage Dividend Discount Model

Stock analysts build complex forecast models with many phases of differing growth to better reflect real prospects. For example, a multi-stage DDM may predict that a company will have a dividend that grows at 5% for seven years, 3% for the following three years and then at 2% in perpetuity.

Problems with using the dividend discount model

There are a couple deficiencies with using the short-form dividend discount model (as is the case with virtually every model).

But here are three points to consider when using the model:

- The presumption of a steady and perpetual growth rate less than the cost of capital may not be reasonable. Profit growth is essential to dividend investing.

- If the stock does not currently pay a dividend, like many growth stocks, more general versions of the discounted dividend model must be used to value the stock. One common technique is to assume that the Modigliani-Miller hypothesis of dividend irrelevance is true, and therefore replace the stocks’s dividend D with E earnings per share. However, this requires the use of earnings growth rather than dividend growth, which might be different. This approach is especially useful for computing a residual value of future periods.

- The stock price resulting from the Gordon model is hyper-sensitive to the growth rate chosen

How to build a portfolio using the dividend discount model?

Here is a step-by-step analysis on how to use a dividend discount model to build a portfolio.

Step 1: Uses Stock Screeners to Target High Quality Dividend Stocks

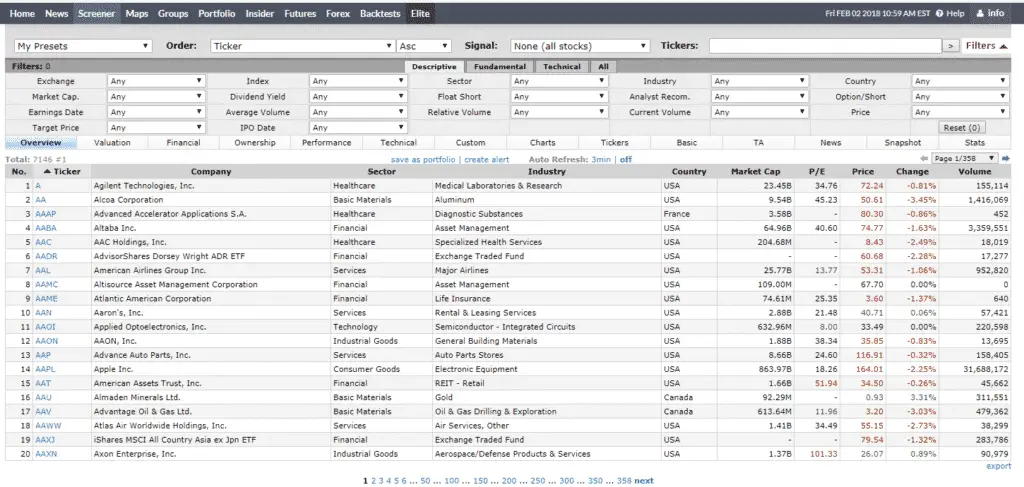

First, you will need to setup a dividend stock screener to find high quality dividend stocks. This will give you a list of 20 stocks that will allow for you to run an initial analysis. I like to use Finviz stock screener in particular. Finviz is a free tool that offers a nice selection of options from a fundamental perspective. I also trust their information and valuations for stocks.

Using their stock screener you can filter for stocks at a certain dividend yield.

Once you navigate to the stock screener on Finviz. Use the following criteria to limit stocks to a finite selection of high-quality stocks:

- Input dividend yield stocks greater than 0%. We only want stocks that pay a dividend.

- Market Capitalization of over $10bln. I only want companies with scale and a size advantage.

- We only want reasonably valued companies, so input P/E ratio less than 20x.

- I like companies that are growing their Earnings Per Share (“EPS”), so input EPS growth next year of greater than 5%.

- I like companies that are growing their EPS over the long-term, so input EPS growth next 5 years of greater than 5%.

- I don’t like to overpay for growth, so input Price / Earnings Growth (“PEG”) of less than 1.

- Finally, I want dividend safety over the long-term. Use a payout ratio of less than 50%. This gives us a margin of safety. If EPS doesn’t grow, there is still sufficient dividend coverage.

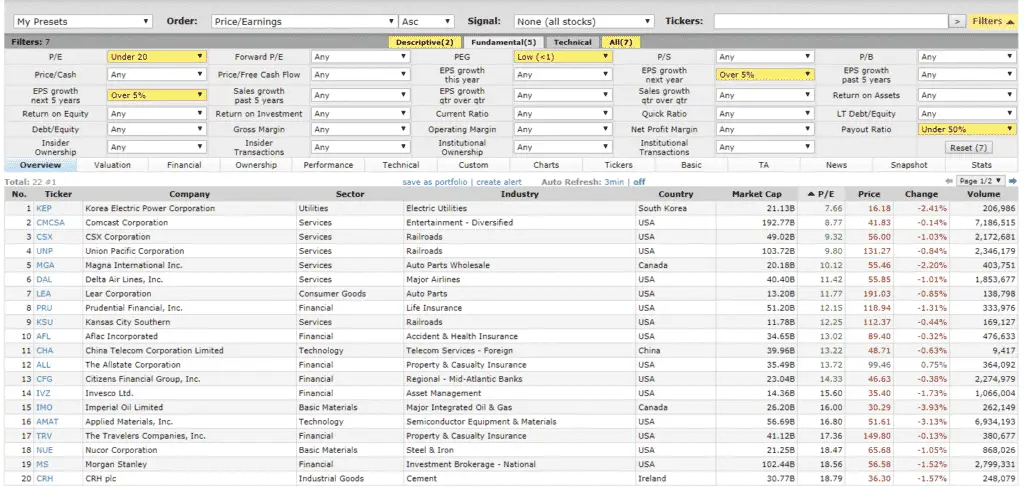

After you input all of the criteria identified above, you should have a list of stocks no more than 50 stocks. As of writing this, I get the following list of stocks to choose from to include in a dividend income portfolio:

You can see the criteria and I have filtered by lowest PE ratio.

I sorted my list of stocks by lowest P/E ratio. Another method is that you can look at the index for dividend aristocrats. Dividend aristocrats are companies that have been increasing their dividend in consecutive years for more than 25 years. SureDividend has the list of dividend aristocrats that you can use to find the companies that attract you.

You cannot use all 50 stocks at the moment, so let’s move on to the next step.

Step 2: Choose Stocks That You Understand The Business Model

For step two, look through the list and choose the stocks that are easy to understand how they make money. Again, we want companies that are easy to understand and we can relate to. This makes it much easier to understand the growth prospects and monitor industry trends relating to that particular company. Keep it simple stupid.

Step 3: Move on Over to the Short-Form Dividend Discount Model

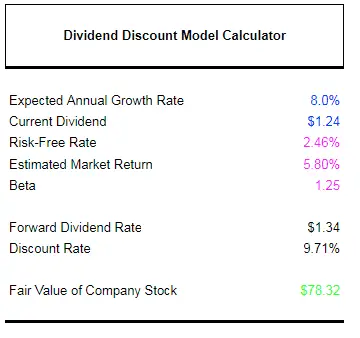

Go over to our short-form dividend discount model to put these dividend growth stocks to practical use and test their sensitivities. For this example, I will do Delta Airlines. Delta Airlines is an interesting dividend growth stock because they have gone through some cyclical turbulence and start paying a dividend again in 2013 of only $0.06 per share. This has skyrocketed to $0.31 per share in 2018.

Using the short-form dividend discount model, I input an expected dividend growth rate of 8%.

Here are the inputs that I used for Delta Airlines in the short-form model.

This implies that Delta Airlines stock is valued at $78.32 per share, which is much higher than the current value (as of writing this). This makes Delta Airlines and intriguing proposition for me because of the following:

- I understand Delta Airlines business model

- Delta Airlines stock is reasonably valued

- There is sufficient dividend coverage with a payout ratio below 50%

However, I don’t think this is the end all be all for Delta Airlines. There certainly are deficiencies with using the short-form dividend discount model. The expected growth rate input is highly sensitive for the valuation.

Conclusion on Dividend Discount Model

The model should be used as a primer to look into a dividend growth stock further. It should not be used as an end all be all for purchasing a dividend growth stock. My next step for this analysis would be to do a discounted cash flow analysis on Delta Airlines to further validate the valuation.

In addition, it would be important to read the latest quarterly earnings call transcripts to ensure the growth prospects are valid in the near-term.

If you are looking for international dividend exposure, look at global dividend growth funds to diversify your portfolio.

Stay tuned for further updates on a potential discounted cash flow analysis and model….

What do you think about the dividend discount model? Are you using it to some degree to build a dividend income portfolio? Leave a comment or question below. I’d love to hear from you!

Subscribe to our mailing list to learn all the best ways to earn dividend income by building a dividend portfolio (we do not send spam).

No Comment